What Is Evaa Protocol (EVAA): A TON-Based DeFi Lending Platform With Leveraged Liquid Staking

What is Evaa Protocol (EVAA)? Evaa Protocol (EVAA) carries the value of financial openness and accessibility, blending decentralized finance with innovation in the TON blockchain ecosystem. Evaa Protocol uses blockchain technology to expand lending, borrowing, and yield strategies within digital assets. By merging DeFi principles with TON’s infrastructure, it unlocks new possibilities in the digital asset space. It both upholds the ethos of permissionless finance and modernizes lending applications for today’s markets.

Backed by TON Ventures, Animoca Brands, Polymorphic Capital, WAGMI Ventures, and CMT Digital, Evaa Protocol (EVAA) is shaping DeFi on TON with incentives, leveraged liquid staking, and platform utility. Paired with Bitget Wallet — offering secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience — $EVAA is positioned for lasting impact in the DeFi industry.

This article breaks down Evaa Protocol (EVAA), covering its mission, key features, and potential expansion. If you're looking to understand its role in blockchain, evaluate its investment value, or stay informed about its market influence, this guide has you covered.

Key Takeaways

- Evaa Protocol (EVAA) is a TON-based DeFi lending platform that supports lending, borrowing, and yield generation.

- It features leveraged liquid staking, letting users maximize staking rewards while maintaining liquidity.

- Backed by TON Ventures, Animoca Brands, and other major investors, EVAA is positioned as a key player in TON’s DeFi ecosystem.

What Is Evaa Protocol (EVAA): Overview and Key Features

Evaa Protocol (EVAA) is a decentralized lending protocol on the TON (The Open Network) blockchain. It allows users to put digital assets into staking, borrow against collateral, and earn yield through creative mechanisms. Through blended lending and leveraged liquid staking, Evaa allows users to earn maximum returns while remaining in the TON ecosystem. Backed by leading investors including TON Ventures and Animoca Brands, Evaa aims to become a cornerstone of TON’s growing DeFi infrastructure.

Key Features

- TON-Based Lending & Borrowing – Users can supply and borrow assets natively on the TON blockchain.

- Leveraged Liquid Staking – Borrow against staked assets to amplify staking rewards while maintaining liquidity.

- $EVAA Token Utility – The native token powers incentives, staking, and protocol functions.

- Strong Ecosystem Backing – Supported by notable investors such as TON Ventures, Animoca Brands, and CMT Digital.

- User-Friendly Integration – Built with TON’s Telegram mini-app ecosystem for seamless access and adoption.

Source: X

Evaa Protocol has confirmed its Token Generation Event (TGE) for October 3, 2025— a date now echoed across TON ecosystem announcements. Meanwhile, the protocol closed a $2.5 million private funding round led by investors including TON Ventures, Animoca Brands, Polymorphic Capital, CMT Digital, and WAGMI Ventures to fuel its DeFi expansion on TON.

Evaa Protocol (EVAA) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the Evaa Protocol (EVAA) listing:

- Exchange: To be announced

- Trading Pair: EVAA/USDT

- Deposit Available: 3 Oct 2025

- Trading Start: 3 Oct 2025

- Withdrawal Available: 4 Oct 2025

Stay tuned for the official announcement with the confirmed listing schedule for Evaa Protocol (EVAA).

- Please refer to Evaa’s official channels for the most accurate and up-to-date information.

Evaa Protocol (EVAA) Future Price Outlook: 2025 and Beyond

Market movements, project sustainability, and community participation influence a cryptocurrency’s price. With its established investor backing and integration in the TON ecosystem, Evaa Protocol (EVAA) may trade within a speculative range of $0.05 – $0.15 in 2025. If it sustains growth and further integrates into TON-based DeFi applications, it has the potential to rise to $0.30 or higher in the long term.

What Affects Evaa Protocol (EVAA) Price?

Several factors influence the potential price trajectory of Evaa Protocol (EVAA):

- Investor Sentiment: Confidence from major backers like TON Ventures and Animoca Brands strengthens trust in EVAA’s long-term potential. Positive community momentum in TON can also drive speculative demand.

- Adoption & Demand: As the first major DeFi lending platform on TON, wider adoption of lending, borrowing, and leveraged liquid staking directly boosts demand for EVAA tokens.

- Regulatory Influence: As with all DeFi tokens, regulatory frameworks for staking, lending, and TON ecosystem projects will shape EVAA’s accessibility and liquidity in global markets.

Future Price Prospects

If Evaa Protocol (EVAA) continues its expansion within the TON DeFi ecosystem, increased adoption may lead to a surge in demand. As EVAA cements its role as a cornerstone of TON-based lending, projections suggest its value could climb to $0.30–$0.50 over the long term. However, investors should adopt a cautious approach, considering the volatility of financial markets, regulatory policy shifts, and global economic conditions.

Source: TheBlock, DeFiLlama, Messari, TON

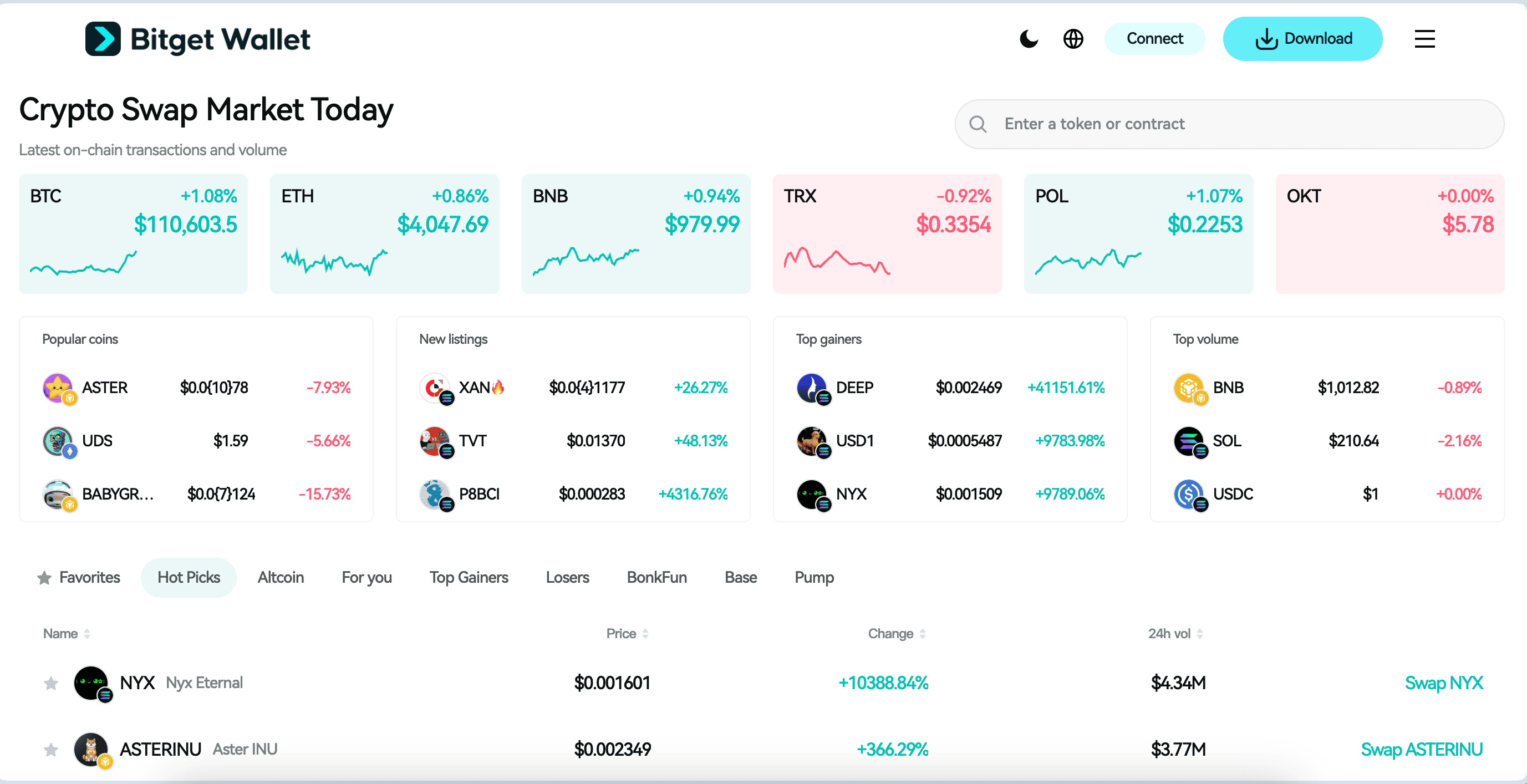

Source: Bitget Wallet

Explore Evaa Protocol (EVAA) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

Core Features of Evaa Protocol (EVAA) and Why They Matter?

The standout features of Evaa Protocol (EVAA) include:

-

TON-Based Lending and Borrowing

Evaa is the first decentralized lending platform on The Open Network (TON). Users can deposit digital assets to earn interest or borrow against collateral directly within the TON ecosystem. This expands TON’s DeFi landscape and makes lending/borrowing accessible to millions of Telegram users through seamless integration.

-

Leveraged Liquid Staking

Unlike standard staking, Evaa introduces leveraged liquid staking strategies, allowing users to borrow against staked assets and amplify their rewards. This feature provides both liquidity and higher yield potential, giving users more flexibility compared to traditional staking platforms.

-

Strong Backing and Ecosystem Integration

Evaa is supported by TON Ventures, Animoca Brands, CMT Digital, and other major investors, ensuring strong financial and strategic backing. Its deep integration with TON and Telegram mini-apps positions it as a cornerstone protocol for TON-based DeFi, driving adoption and community trust.

How Evaa Protocol (EVAA) Operates and What Benefits It Delivers?

How Evaa Protocol Works?

- Built on The Open Network (TON), enabling fast, low-cost, and secure transactions directly within the TON ecosystem.

- Uses TON’s consensus mechanism (Proof-of-Stake) to validate transactions efficiently and maintain network security.

- Supports DeFi lending, borrowing, and leveraged liquid staking, creating new opportunities for yield generation and liquidity management.

Key Benefits

- Seamless DeFi on TON – Evaa brings core DeFi functions like lending and borrowing to TON, making it the first mover in TON’s growing decentralized economy.

- Enhanced Yield with Leveraged Liquid Staking – Users can borrow against staked assets to maximize returns, combining the benefits of staking rewards with additional liquidity.

- Ecosystem Backing and Adoption – Supported by leading investors like TON Ventures and Animoca Brands, Evaa has strong strategic backing and integration potential within Telegram’s vast user base.

The Companies and Organizations Supporting Evaa Protocol (EVAA)

The Companies

Evaa Protocol is backed by leading venture firms and Web3 investors that strengthen its credibility and growth potential:

- TON Ventures – official investment fund supporting projects within The Open Network ecosystem.

- Animoca Brands – a global leader in Web3, blockchain gaming, and digital property rights.

- CMT Digital – a firm specializing in blockchain investments and digital asset markets.

- Polymorphic Capital and WAGMI Ventures – additional investors providing early-stage capital and strategic support.

The Organization’s Partnerships

Instead of traditional partnerships, Evaa has strong ecosystem alignments within TON:

- The Open Network (TON): providing the blockchain infrastructure on which Evaa is built.

- Telegram mini-app ecosystem: enabling simple access for millions of users directly through Telegram.

- Other TON DeFi projects: complementary protocols expanding liquidity, yield opportunities, and cross-platform synergies.

How They Work Together?

These companies and ecosystem connections strengthen Evaa by combining:

- Capital and strategic backing from investors.

- Infrastructure from TON’s scalable blockchain.

- User access and adoption via Telegram’s vast community.

Together, they position Evaa Protocol as a foundational DeFi platform on TON, built for both growth and long-term sustainability.

How Evaa Protocol (EVAA) is Used: Practical Benefits

Evaa Protocol (EVAA) is the native token of the first lending platform on The Open Network (TON). It is primarily used within the protocol to support lending and borrowing markets, incentivize liquidity providers, and power yield-generating activities. Users can deposit assets to earn interest, borrow against collateral, or engage in leveraged liquid staking — where EVAA plays a role in distributing rewards and maintaining the system’s incentives. In this way, EVAA ensures active participation and alignment between users and the protocol.

Evaa Protocol (EVAA)’s Benefits

- Liquidity Incentives: EVAA is distributed as rewards to users who supply assets, ensuring deep liquidity for lending and borrowing.

- Enhanced Yield Strategies: Through leveraged liquid staking, EVAA helps amplify returns while keeping capital flexible within the TON ecosystem.

- Ecosystem Growth: As TON’s first major DeFi lending token, EVAA strengthens the foundation of TON’s financial layer, supported by backers like TON Ventures and Animoca Brands.

Evaa Protocol (EVAA) Roadmap 2025: Key Milestones and Expansion Plans

The roadmap for Evaa Protocol (EVAA) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Expand supported assets on the Evaa lending platform, including more TON ecosystem tokens and cross-chain wrapped assets. |

| Q2 2025 | Launch enhanced leveraged liquid staking strategies to maximize yield opportunities for users and integrate with more TON-based DeFi protocols. |

| Q3 2025 | Introduce community-driven utility for $EVAA, such as incentive adjustments, staking pools, and potential governance features. |

| Q4 2025 | Scale adoption through Telegram mini-app integration, targeting mainstream TON users and expanding liquidity partnerships. |

These milestones highlight the practical value of $EVAA in the DeFi and TON ecosystem, reinforcing its role as a cornerstone protocol for lending, borrowing, and yield generation.

How to Buy Evaa Protocol (EVAA) on Bitget Wallet?

Trading Evaa Protocol (EVAA) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Evaa Protocol (EVAA).

Step 3: Find Evaa Protocol (EVAA)

On the Bitget Wallet platform, go to the market area. Search for Evaa Protocol (EVAA) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, EVAA/USDT. By doing this, you will be able to exchange Evaa Protocol (EVAA) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Evaa Protocol (EVAA) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Evaa Protocol (EVAA).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Evaa Protocol (EVAA) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

What is Evaa Protocol (EVAA)? Evaa Protocol (EVAA) is the first lending and borrowing platform on The Open Network (TON), offering users access to lending, borrowing, and leveraged liquid staking. Backed by investors like TON Ventures and Animoca Brands, it stands out as a key DeFi project driving TON’s ecosystem growth.

Buying $EVAA through Bitget Wallet makes the process simple and secure. With support for 130+ blockchains, over 1 million tokens, MPC security, and low-cost swaps, Bitget Wallet ensures users can trade, stake, and manage EVAA with ease while benefiting from one of the most trusted wallets in Web3.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Evaa Protocol (EVAA)?

Evaa Protocol is the first lending and borrowing platform on The Open Network (TON). It allows users to supply assets, earn interest, borrow against collateral, and use leveraged liquid staking to maximize yields.

2. What role does the $EVAA token play?

The $EVAA token is used to incentivize liquidity providers, power yield strategies, and align users with the protocol. It rewards participation and strengthens the DeFi ecosystem on TON.

3. How can I buy and use EVAA?

You can buy $EVAA through trusted platforms like Bitget Wallet, which supports 130+ blockchains and over 1 million tokens. Once purchased, EVAA can be used within the protocol for lending, borrowing, and staking activities.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.