How to Buy Bitcoin and Ethereum on TON Wallet in 2026: A Beginner’s Step-by-Step Guide

How to Buy Bitcoin and Ethereum on TON Wallet is becoming a frequent question in 2026 as TON Wallet expands support for BTC and ETH directly inside Telegram. Users can now store and manage both assets within the TON ecosystem without relying entirely on external exchanges.

Learning How to Buy Bitcoin and Ethereum on TON Wallet involves understanding two main methods: direct on-ramp purchases and the bridge function for cross-chain transfers. Users should also consider custody differences, execution risks, and how TON price volatility can affect liquidity conditions.

For those who prefer broader multi-chain flexibility before moving assets into TON, Bitget Wallet provides secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience, making it easier to manage Bitcoin and Ethereum across networks before bridging them into TON.

Key Takeaways

- How to Buy Bitcoin and Ethereum on TON Wallet involves either using a fiat on-ramp or transferring assets through the bridge function. The method depends on whether you are starting with fiat or already hold BTC or ETH elsewhere.

- TON Wallet integrates BTC and ETH support directly within Telegram. This allows users to manage both assets without leaving the Telegram interface.

- The bridge function enables cross-chain transfers into the TON ecosystem. Users must confirm the correct network and address before completing the transfer.

What Is TON Wallet?

TON Wallet is a Telegram-integrated wallet built on the The Open Network ecosystem. It enables users to store TON, Bitcoin, Ethereum, and other supported assets directly inside Telegram.

Unlike traditional browser wallets, TON Wallet operates within the Telegram interface, making digital asset access more seamless for mainstream users.

What makes TON Wallet different from traditional wallets?

- Integrated environment: Operates directly inside Telegram.

- Multi-asset support: BTC, ETH, and TON available within one interface.

- Bridge compatibility: Users can move assets cross-chain into TON.

Source: X

Is TON Wallet (TON) a scam or just high-risk?

TON Wallet is not automatically a scam—it’s positioned as a self-custodial wallet inside Telegram, meaning users hold the keys and are responsible for security and execution. TON Wallet’s own materials emphasize that the wallet lives on-chain and that only the seed phrase/private key holder can move funds, which aligns with standard non-custodial design.

That said, it can still be high-risk in practice if you see any of these conditions: fake Telegram bots impersonating the wallet, unofficial links, low-liquidity routes when swapping/bridging, copycat token contracts, or sudden “pump” activity around bridged assets. Recent announcements also indicate TON Wallet added Bitcoin (BTC) and Ethereum (ETH) support inside Telegram, which increases utility—but also increases phishing attempts because scammers target popular assets.

What users must do (minimum safety checks):

- Verify the official source: Access TON Wallet via the official Telegram entry points (avoid random bots/DM links).

- Confirm the official contract address (when dealing with tokens/bridged formats): Only use contract/address info from official project channels; don’t trust “contract address” screenshots or forwarded messages.

- Avoid unofficial links: Do not connect your wallet or approve transactions from links shared in groups/comments—phishing is the #1 failure mode in Telegram-based flows.

- Watch liquidity + holder concentration: If you’re bridging into a wrapped/representative asset or swapping inside TON, check liquidity depth and whether supply is concentrated (thin liquidity = high slippage/manipulation risk).

TON Wallet publicly describes itself as self-custodial and explicitly frames user responsibility for key management and safety—this supports “not a scam by default,” while still requiring strong execution discipline.

H2: Where to Buy Bitcoin and Ethereum on TON Wallet?

When users ask “where to buy Bitcoin and Ethereum on TON Wallet,” they usually mean the most secure and efficient way to access BTC and ETH within Telegram. The key distinction is the custody model: fiat providers may involve semi-custodial steps, while bridging or on-chain transfers allow users to retain direct control of their assets.

What’s available depends on regional on-ramp support, listing integrations, and bridge liquidity. In some regions, direct purchase options are available inside TON Wallet, while in others, users may need to bridge Bitcoin or Ethereum from an external wallet depending on network availability and liquidity conditions.

Comparison of Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| Fiat On-Ramp | Semi-custodial | Provider managed | Medium | Beginners | KYC, provider fees |

| Bridge from External Wallet | Non-custodial | User controlled | High | Crypto-native users | Wrong chain risk |

| Swap inside TON | Non-custodial | On-chain | High | TON ecosystem users | Slippage |

Why Many Users Buy Bitcoin or Ethereum With Bitget Wallet?

If users want broader payment options or multi-chain flexibility, they may first buy Bitcoin or Ethereum using Bitget Wallet before transferring assets to TON Wallet via the bridge function. A non-custodial wallet allows users to maintain control of private keys while managing cross-chain transfers more flexibly.

H3: What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

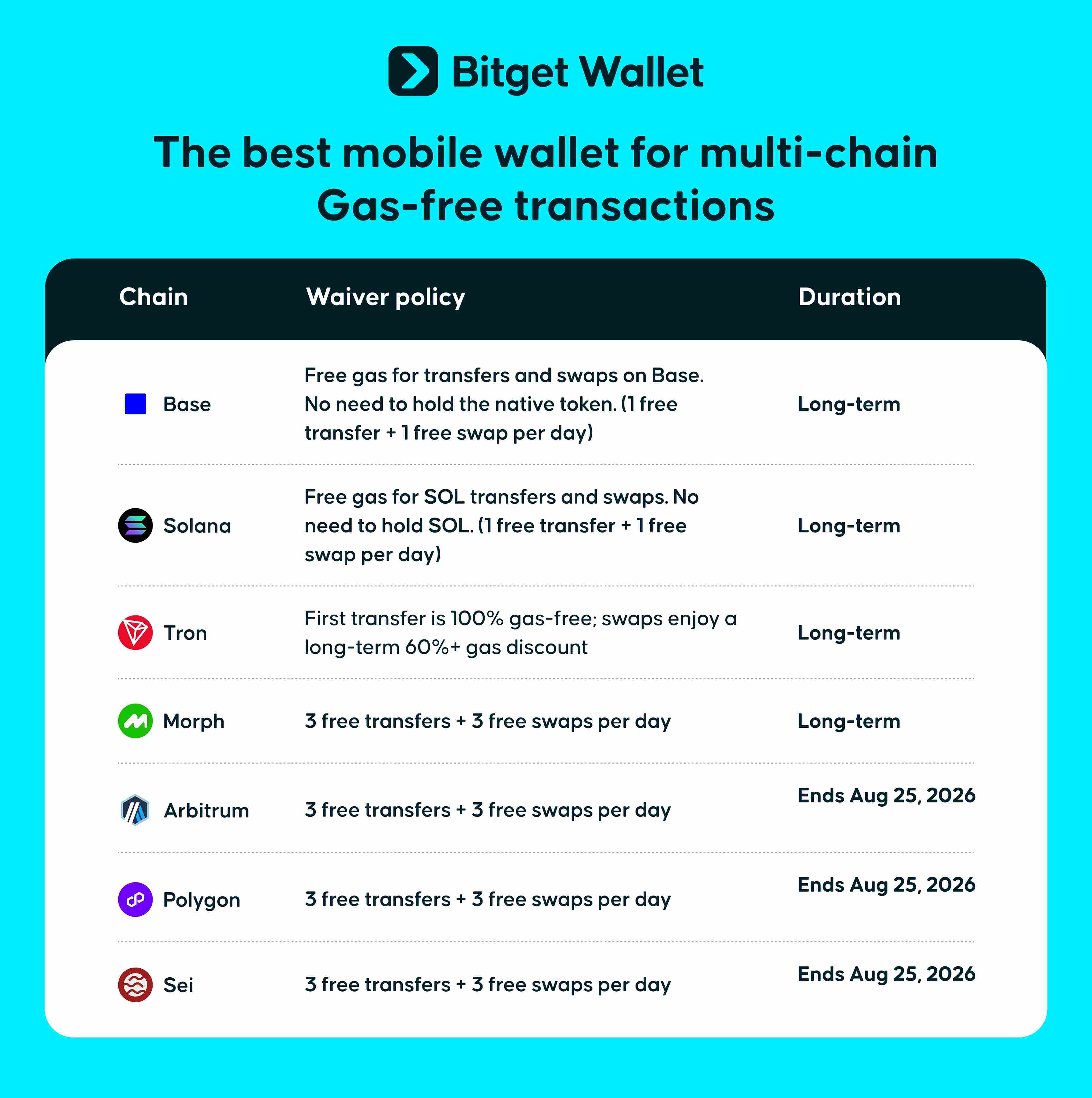

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks allowing users to manage Bitcoin, Ethereum, and other assets across different networks before bridging into TON.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

How to Buy Bitcoin and Ethereum on TON Wallet?

You can buy Bitcoin and Ethereum on TON Wallet either through a direct on-ramp or by purchasing elsewhere and using the bridge function to transfer assets into TON.

Method 1: Buy Directly on TON Wallet

Step 1: Open TON Wallet and ensure it’s activated.

Step 2: Select BTC or ETH, then tap “Buy.”

Step 3: Choose a supported payment provider, enter the amount, and confirm the transaction.

Once processed, Bitcoin or Ethereum will appear in your TON Wallet balance.

Method 2: Steps to Buy and Bridge to TON using Bitget Wallet

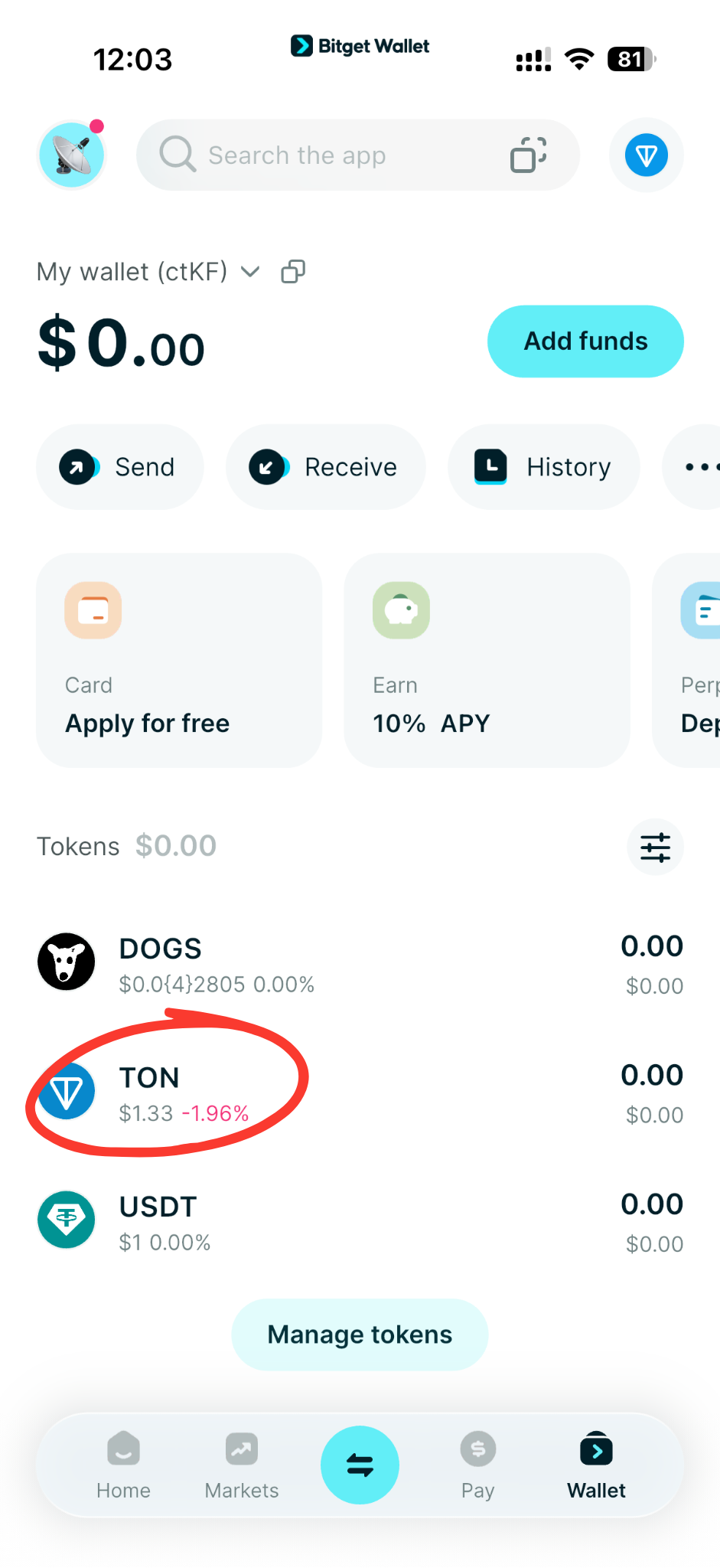

- Download and Set Up: Download the Bitget Wallet app and create or import your wallet.

- Add TON Mainnet: Ensure the TON mainnet is added to your homepage.

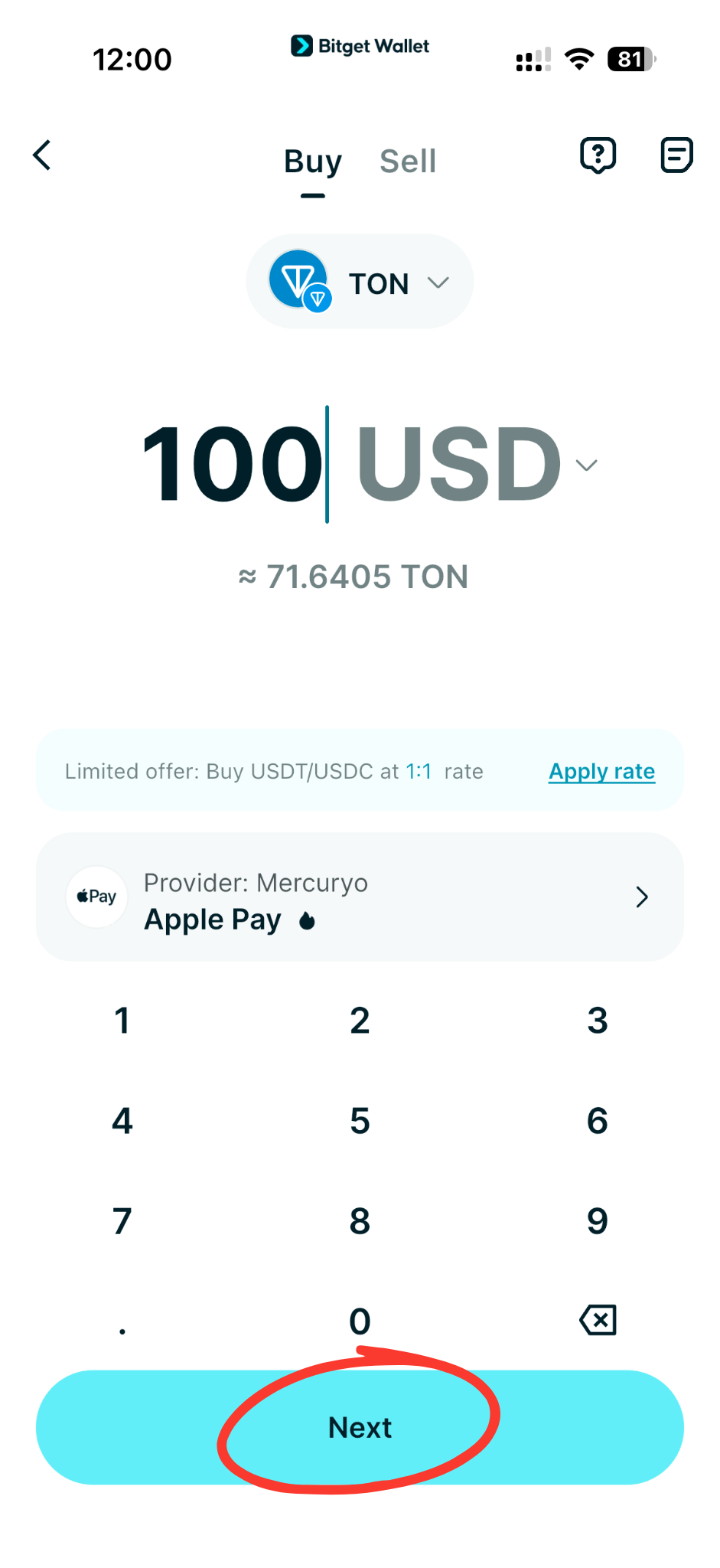

- Buy TON via OTC: Tap "Buy" or "OTC" in the app, select TON, enter the amount, and complete the purchase using your preferred payment method.

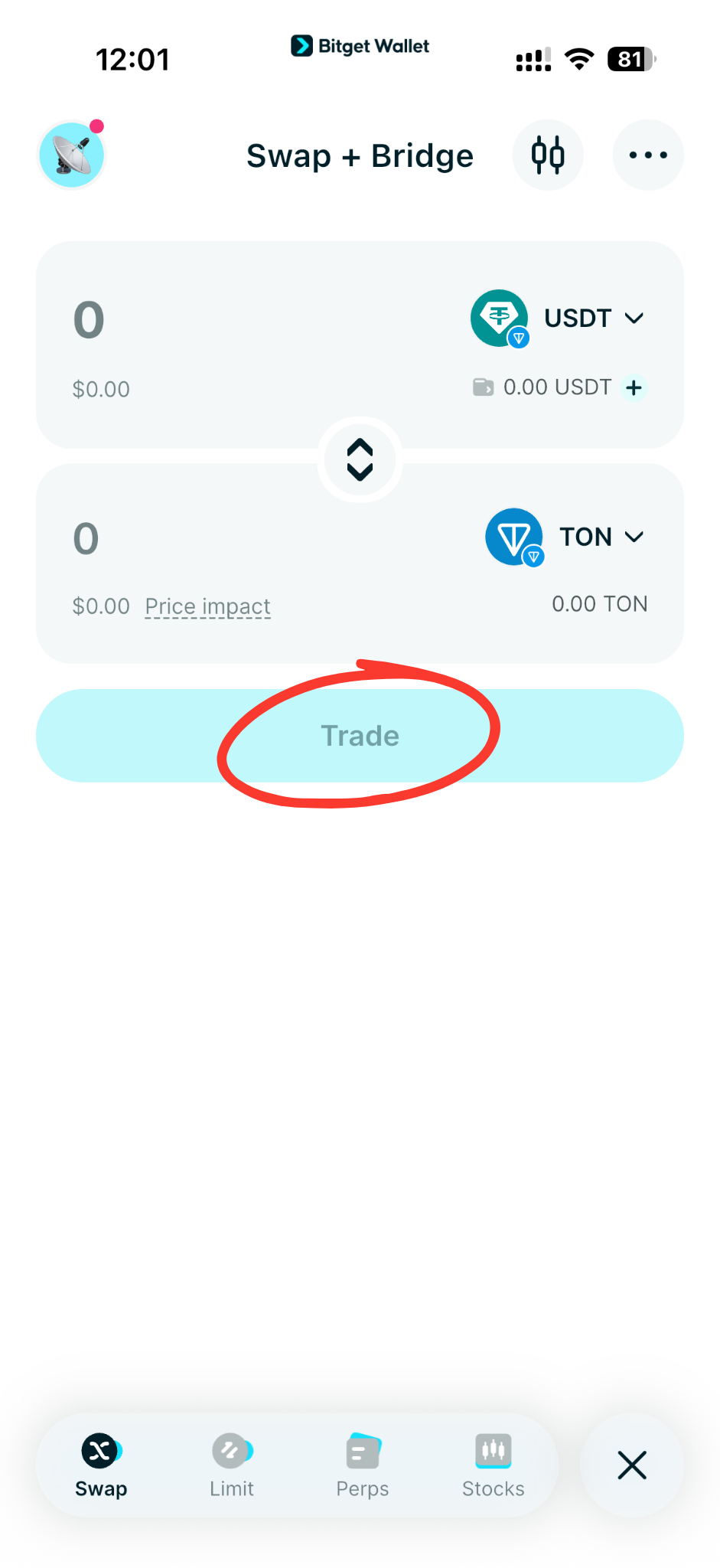

- Alternatively, Swap/Bridge: If you have other assets (e.g., USDT on Ethereum), use the "Swap" feature in Bitget Wallet to bridge them directly to the TON network.

- Confirm Assets: View your acquired TON tokens on the main page of your Bitget Wallet.

What Should You Know About TON Price Volatility?

TON is a Layer-1 network token closely linked to the Telegram ecosystem, and its price volatility is influenced by broader crypto market cycles and ecosystem growth. Movements are primarily driven by market sentiment, liquidity conditions, and overall demand for network usage rather than short-term fundamental changes.

TON can experience sharp fluctuations when trading volume shifts or when attention increases around Telegram integrations and ecosystem updates. Because liquidity depth and capital flows heavily impact price behavior, volatility should be treated as a structural risk factor rather than a guaranteed opportunity.

TON Price Prediction: How High Can TON Go?

TON’s price is influenced by broader crypto market trends, ecosystem development, and adoption within the Telegram-integrated network. As a Layer-1 token, its valuation depends on liquidity conditions, network usage, and overall market sentiment rather than short-term speculation alone.

While TON has shown periods of strong momentum during ecosystem expansion, its price remains sensitive to macro market cycles and capital inflows. Any long-term price movement depends on sustained adoption, developer growth, and consistent network activity.

Factors Influencing the Price of TON

Several crucial aspects contribute to TON’s long-term valuation:

- Market Trends: Broader crypto cycles, Bitcoin performance, and global liquidity conditions strongly influence TON’s price direction.

- Adoption & Real-World Utility: Increased Telegram ecosystem usage, DeFi participation, and transaction demand can support network-driven demand for TON.

- Project Advancements: Infrastructure upgrades, validator growth, and ecosystem partnerships may strengthen network fundamentals over time.

Long-Term Growth Potential

If TON continues expanding within the Telegram ecosystem and attracting developers and users, demand for the token could increase alongside network activity. However, investors should remain aware that regulatory shifts, liquidity cycles, and broader market volatility can significantly affect TON’s price behavior.

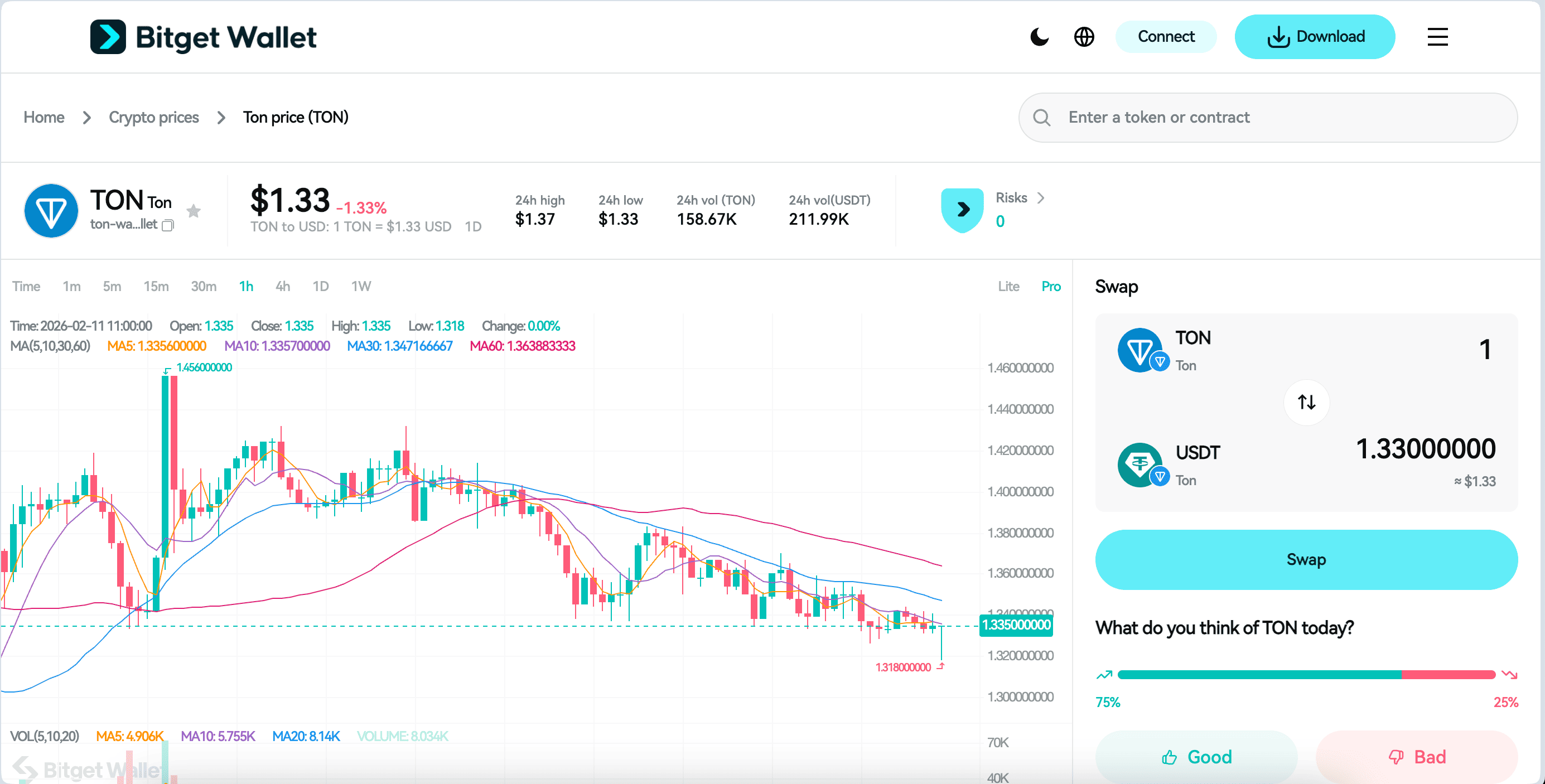

Source: Bitget Wallet

Is TON Crypto Safe to Invest In?

Whether TON is “safe” depends less on the token itself and more on how users manage risk, position size, and execution quality. As a Layer-1 network token, TON carries market and liquidity risks similar to other major crypto assets, meaning safety is shaped by user behavior rather than guarantees from the protocol.

Key Risks to Consider

- Market Volatility: TON’s price can fluctuate sharply due to broader crypto cycles, liquidity shifts, and sentiment changes.

- Liquidity & Execution Risk: Entering or exiting large positions during thin liquidity periods may increase slippage and losses.

- Overexposure: Allocating too much capital to a single asset increases downside risk during market corrections.

- Security & Operational Errors: Sending funds to the wrong network, interacting with fake links, or misusing bridge functions can result in permanent loss.

No speculative crypto asset is risk-free, including TON. Investors should approach exposure with disciplined risk management and a clear understanding of market volatility.

How to Approach TON Volatility With a Smarter Strategy?

Managing TON volatility requires discipline rather than perfect timing. Instead of trying to predict short-term price movements, users should focus on controlled exposure, risk awareness, and consistent execution practices. A structured approach reduces avoidable losses and helps build practical on-chain decision-making skills over time.

Practical Risk-Control Measures

- Observe on-chain liquidity behavior: Monitor trading volume and liquidity depth before entering or exiting positions to avoid excessive slippage.

- Use small position sizes: Limit capital allocation per trade to reduce the impact of sudden price swings.

- Set clear capital limits: Define maximum exposure in advance and avoid increasing position size during emotional market conditions.

- Prioritize secure execution: Double-check network selection, wallet addresses, and bridge confirmations to prevent operational mistakes.

Approaching TON volatility with discipline encourages long-term learning and transferable skills in liquidity analysis, execution control, and risk management—capabilities that remain valuable across any crypto market cycle.

Conclusion

How to Buy Bitcoin and Ethereum on TON Wallet in 2026 involves understanding both direct purchase options and the bridge function that connects external networks to the TON ecosystem. By choosing the right custody method, verifying network details, and managing exposure carefully, users can access BTC and ETH within Telegram while maintaining control over execution risk.

If you want broader multi-chain flexibility before bridging into TON, consider using Bitget Wallet for secure self-custody, cross-chain management, and efficient execution. Explore Bitcoin, Ethereum, and TON with full asset control and seamless transfers — and take advantage of additional features like Stablecoin Earn and cost-efficient swaps directly within the wallet ecosystem.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to Buy Bitcoin and Ethereum on TON Wallet safely as a beginner?

To buy safely, use the official TON Wallet inside Telegram and start with small amounts. Double-check network selection, confirm wallet addresses carefully, and understand whether you are using a direct on-ramp or the bridge function before approving any transaction.

2. Where can I buy Bitcoin and Ethereum on TON Wallet?

You can access BTC and ETH inside TON Wallet either through integrated fiat on-ramp providers or by bridging assets from another wallet. Some users also buy Bitcoin or Ethereum using Bitget Wallet first, then transfer them into TON via the bridge feature.

3. Do I need KYC to buy Bitcoin and Ethereum on TON Wallet?

KYC requirements depend on the method used. If you purchase through a centralized exchange or certain fiat on-ramp providers, identity verification is typically required.

In contrast, buying or managing Bitcoin and Ethereum through on-chain transfers using a non-custodial wallet like Bitget Wallet does not require KYC. However, users are fully responsible for transaction accuracy, security, and proper network selection.

4. Is TON crypto high risk?

Like all crypto assets, TON carries market volatility and liquidity risks. Price fluctuations can occur due to broader market cycles, ecosystem growth, and shifts in trading activity.

5. Can I transfer Bitcoin and Ethereum out of TON Wallet?

Yes. Users can transfer or bridge BTC and ETH out of TON Wallet to other supported networks or external wallets. Always confirm the correct destination network before approving any outbound transaction.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.