What is Doppler Protocol? Uniswap v4-Powered Next-Gen Token Launches

What is Doppler Protocol is redefining how tokens launch in decentralized finance. By leveraging the Doppler liquidity bootstrapping protocol built on Doppler Uniswap v4, it optimizes price discovery while delivering capital‑efficient liquidity management. With innovative features such as Doppler bonding curves, the Doppler EVM launchpad, and research support from Whetstone Research Doppler, this protocol is pushing token launches into a new era of fairness and automation.

In this article, you’ll discover how Doppler Protocol works, its significance for token launches, and how it compares to other liquidity bootstrapping models—alongside how Bitget Wallet supports secure stablecoin custody, dynamic memecoin trading, and seamless cross‑chain asset management.

Key Takeaways

- Doppler liquidity bootstrapping protocol uses Doppler bonding curves to create fair and capital‑efficient token launches. These bonding curves automatically adjust token prices during the launch, ensuring balanced market entry and preventing early price manipulation.

- Doppler Uniswap v4 hooks enable modular liquidity management and automated price adjustments. This integration allows projects to fine‑tune liquidity parameters dynamically, resulting in smoother trading and reduced volatility throughout the launch phase.

- Doppler EVM launchpad supports multi‑chain token distribution with transparent analytics. It provides real‑time data and insights to teams and investors, making token launches more accountable, auditable, and accessible across multiple blockchain networks.

What is Doppler Protocol?

The Doppler Protocol is a next‑generation liquidity bootstrapping protocol designed for fair and efficient token launches. Built by Whetstone Research Doppler, it leverages Uniswap v4 hooks and modular smart contracts to automate price discovery and liquidity deployment.

At its core, it acts as a Doppler EVM launchpad, enabling token projects to launch across multiple chains with transparent analytics and automated liquidity mechanisms.

Why Does Doppler Protocol Matter for DeFi?

Token launches in DeFi have long struggled with fairness and price volatility. Doppler Protocol solves these issues by combining automated price discovery with bot‑resistant mechanisms and community‑driven participation.

By using programmable bonding curves and transparent on‑chain execution, Doppler fosters investor confidence, reduces manipulation risk, and encourages decentralized governance.

Read more: What Is a dApp? Complete Guide to Decentralized Applications

How Doppler Protocol Works?

The Doppler Protocol is engineered for price stability, fair distribution, and automated liquidity management. It ensures new tokens are introduced to the market without the wild volatility often seen in traditional token launches.

Doppler Bonding Curves and Doppler Price Discovery Mechanism

The bonding curve is central to Doppler’s design. It dynamically adjusts price during token sales, preventing market shocks and unfair early advantages.

Key Features:

- Dynamic price discovery: Automatically adjusts pricing throughout the launch to reduce volatility and improve market stability.

- Bonding curve protection: Limits whale accumulation and bot sniping, ensuring fairer token distribution for all participants.

- On‑chain transparency: Uses Uniswap v4 hooks for verifiable, secure, and tamper‑resistant execution.

Core Technical Features of Doppler Protocol

Built with modular and interoperable architecture, Doppler is ready for multi‑chain deployments and flexible integrations.

Technical Highlights:

- EVM launchpad optimization: Built for seamless deployment across multiple EVM‑compatible blockchains.

- Modular smart contract architecture: Designed by Whetstone Research Doppler for flexibility and scalability.

- Integrated analytics dashboards: Offers real‑time liquidity and performance tracking for transparent decision‑making.

- Capital‑efficient design: Reduces gas costs while maintaining robust security and functionality.

Read more: Bitget Wallet DApp Guide: How to Use DApps Securely?

What Are the Benefits of Using Doppler Protocol for Token Launches?

Doppler Protocol provides a comprehensive framework for token distribution that emphasizes fairness, efficiency, and transparency.

Here are the key benefits projects and investors can expect when using Doppler Protocol:

Benefits:

- Fair token distribution: Doppler’s bonding curve design reduces the risk of front‑running and automated bot sniping. This ensures that community members and genuine investors have a fair opportunity to participate without price manipulation.

- Capital efficiency: The protocol requires significantly less liquidity to be locked compared to traditional launch models. This allows projects to allocate resources more effectively, improving early‑stage flexibility and growth potential.

- Transparent price discovery: All price adjustments and transactions are fully auditable and verifiable on‑chain. This transparency fosters investor confidence and strengthens trust in the launch process.

- Multi‑chain capability: Doppler functions as an integrated Doppler EVM launchpad, enabling seamless token launches across multiple blockchains. Projects can reach wider audiences and tap into diverse liquidity pools without additional technical overhead.

Tip: Looking for a smoother post‑launch experience? Manage your tokens with confidence using Bitget Wallet —a trusted solution for secure stablecoin custody, dynamic memecoin trading, and seamless cross‑chain transfers.

How Does Doppler Compare to Other Liquidity Bootstrapping Protocols?

Compared to legacy solutions, Doppler focuses on automation, analytics, and cross‑chain support. Here is how Doppler Protocol stands out from legacy liquidity bootstrapping solutions, with a focus on automation, analytics, and cross‑chain support:

| Protocol | Industry Position | Doppler Advantage |

| Balancer LBPs | Established liquidity bootstrapping model | Lower slippage, customizable bonding curves, tighter Uniswap v4 integration |

| Copper Launch | Retail‑oriented token distribution platform | Automated analytics and adaptive bonding curve management |

| Legacy LBPs | First‑generation bonding curve frameworks | Simpler deployment, cross‑chain readiness, modular design |

Who Should Use Doppler Protocol?

Doppler Protocol is designed to meet the needs of diverse participants in the decentralized finance ecosystem. Here are the types of users who benefit most from its fair, efficient, and transparent launch model:

Ideal Users:

- DeFi projects seeking fair and efficient token launches: Projects can leverage Doppler’s automated price discovery and bonding curves to reduce volatility and encourage equitable participation from early investors.

- DAOs and community‑based token initiatives: Decentralized organizations can launch governance tokens in a transparent manner, strengthening trust and aligning community incentives without complex liquidity management.

- Startups needing fast, capital‑efficient liquidity solutions: Early‑stage teams can focus on growth and development instead of locking up excessive capital for liquidity, thanks to Doppler’s efficiency‑oriented design.

- Investors looking for transparent, bot‑resistant participation models: Retail and institutional investors alike gain access to fairer entry points and verifiable on‑chain price discovery, mitigating risks from whales and automated bots.

How to Launch a Token with Doppler Protocol via Bitget Wallet DApp?

Launching a token using Doppler Protocol inside Bitget Wallet DApp browser is a secure way to leverage automated liquidity bootstrapping and bonding curve distribution while keeping control of your assets. Although Doppler isn’t natively integrated like PancakeSwap or Uniswap, Bitget Wallet’s built‑in DApp browser allows direct access to Doppler and other issuance platforms on supported networks.

What Is Doppler Protocol?

Doppler Protocol is a decentralized liquidity and price discovery system built on Uniswap v4. It uses specialized hooks to automate token launches through bonding curves, dynamically adjusting price based on demand. This approach ensures fair distribution and mitigates early volatility often seen in manual token launches.

Key features of Doppler include:

- Uniswap v4 hook integration for automated liquidity management

- Dynamic bonding curves that respond to buy pressure

- Analytics dashboard for real-time monitoring

- Cross‑chain EVM support (Ethereum, Arbitrum, Base)

Why Use Bitget Wallet for Doppler Launches?

Bitget Wallet provides a secure, non-custodial environment to interact with DApps like Doppler:

- Built-in DApp browser for quick access to verified DApps

- 130+ blockchain support including Doppler-compatible chains (Ethereum, Arbitrum, Base)

- Integrated risk alerts and network auto-switching for safer on-chain interactions

How to Launch Your Token on Doppler via Bitget Wallet?

Launching a token with Doppler Protocol via Bitget Wallet combines the simplicity of a secure multi-chain wallet with the power of automated bonding curve distribution. While Doppler is not a native Bitget integration, you can easily access its DApp and run a full token launch directly from your wallet. Follow these steps:

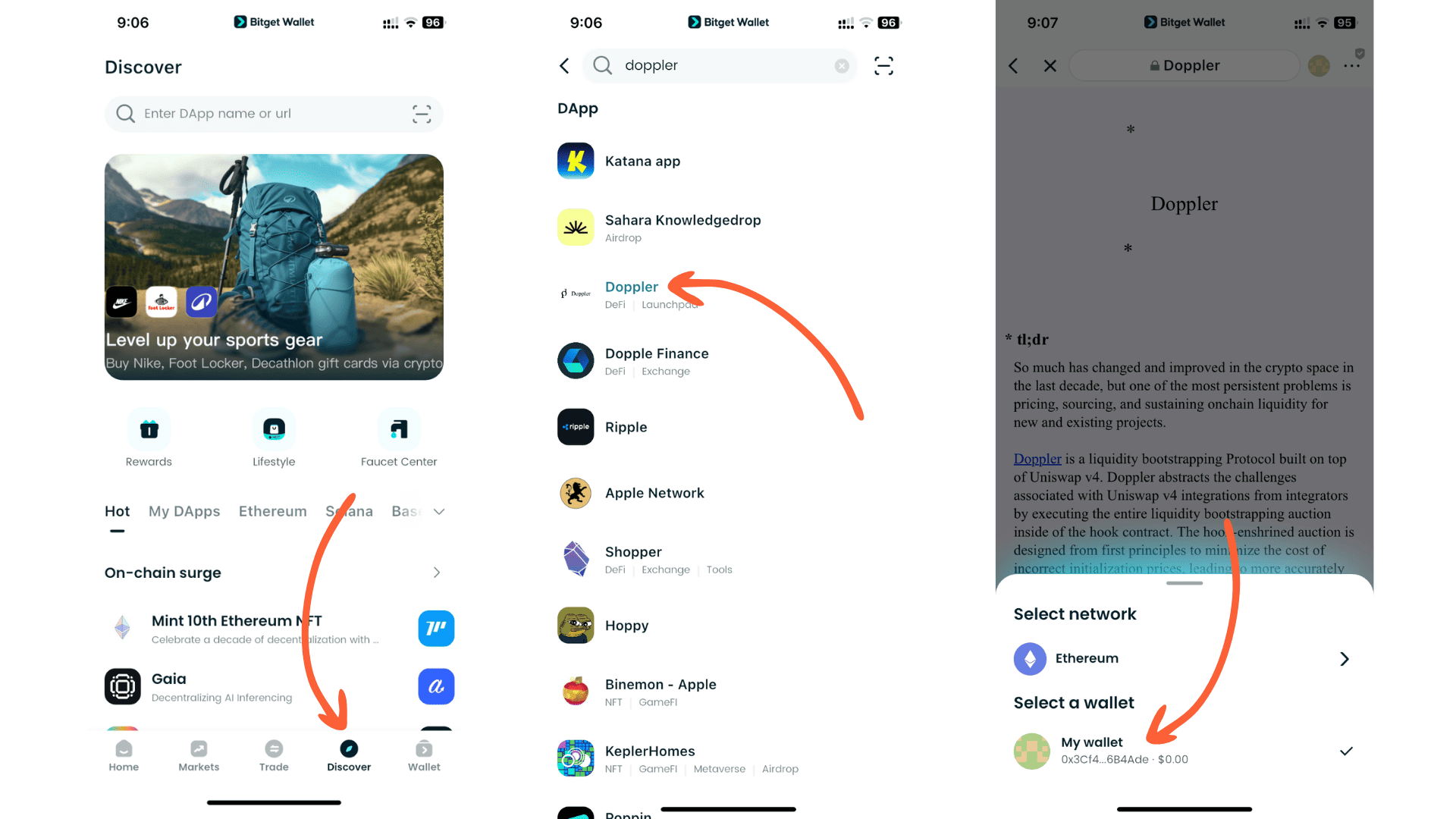

Step 1: Access Doppler Protocol Through Bitget Wallet

- Open Bitget Wallet (mobile or browser extension).

- Go to Discover → use the search bar or paste the official Doppler DApp URL.

- Allow the wallet to automatically switch to the correct network or switch manually (Ethereum, Arbitrum, Base).

- Tap Connect Wallet and approve the connection.

Step 2: Deploy Your Token and Enable Doppler Hook

- Deploy your token smart contract on the target EVM chain.

- Connect it to Uniswap v4 and activate Doppler’s hook module, enabling automated liquidity bootstrapping.

Step 3: Configure Bonding Curve Parameters

From within Doppler’s launch interface:

- Set initial token price

- Select supply allocated for sale

- Choose bonding curve slope (static or dynamic) and optional time gates

These settings determine price movement during distribution.

Step 4: Activate Dynamic Price Discovery

Enable Doppler’s pricing engine to automatically adjust based on demand, ensuring fair entry for buyers and reducing early volatility.

Step 5: Monitor Your Launch in Real Time

Use Doppler’s analytics dashboard (accessible through Bitget Wallet’s browser) to view:

- Liquidity pool depth

- Price action along the bonding curve

- Participant transaction activity

Step 6: Post‑Launch Liquidity and Ecosystem Strategy

After your bonding curve sale is complete, you can:

- Move liquidity into a permanent pool

- Launch staking or governance programs

- Integrate with additional DeFi protocols to expand your ecosystem

Conclusion

Doppler Protocol is redefining token launches with bonding curves, automated price discovery, and multi‑chain deployment—enabling fairer distribution, better capital efficiency, and greater transparency. Accessing it via the Bitget Wallet DApp browser lets projects securely launch tokens, manage liquidity, and monitor analytics directly from a non‑custodial Web3 wallet.

Ready to manage your digital assets with ease? Sign up for Bitget Wallet now – grab your $2 bonus! Experience secure stablecoin storage, hot memecoin trading, and seamless cross‑chain transfers—all in one platform.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How does Doppler prevent price manipulation?

Doppler uses programmable bonding curves and automated price discovery mechanisms to dynamically adjust token prices during launches. This approach minimizes the ability of bots and whales to exploit early price inefficiencies, resulting in a fairer market for all participants.

2. Is Doppler only for Ethereum?

No, Doppler is built as an EVM launchpad, meaning it can operate on any chain compatible with the Ethereum Virtual Machine. This multi‑chain capability gives projects flexibility to launch tokens across diverse ecosystems without additional custom infrastructure.

3. How is Doppler different from Balancer LBPs?

Doppler integrates directly with Uniswap v4 hooks, offering lower slippage and adaptive bonding curve mechanics for more precise price control. It also includes automated analytics, simplifying liquidity management and providing real‑time performance insights throughout the launch process.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins