Mezo (MEZO) Listing: $MEZO Launch Date! What is BTC-Backed Stablecoin Borrowing?

Mezo (MEZO) listing is around the corner! Exciting news for cryptocurrency enthusiasts! Mezo (MEZO), a Bitcoin-centric Layer-2 protocol unlocking BTC liquidity through its DeFi ecosystem, is officially launching on leading exchanges.

Starting [insert exact date and time], users can trade $MEZO under the trading pair MEZO/USDT. This marks a significant milestone for the Mezo community and opens up new opportunities for traders worldwide.

This article explores everything you need to know about the $MEZO listing—including how to trade it, key project details, and why this launch matters for investors.

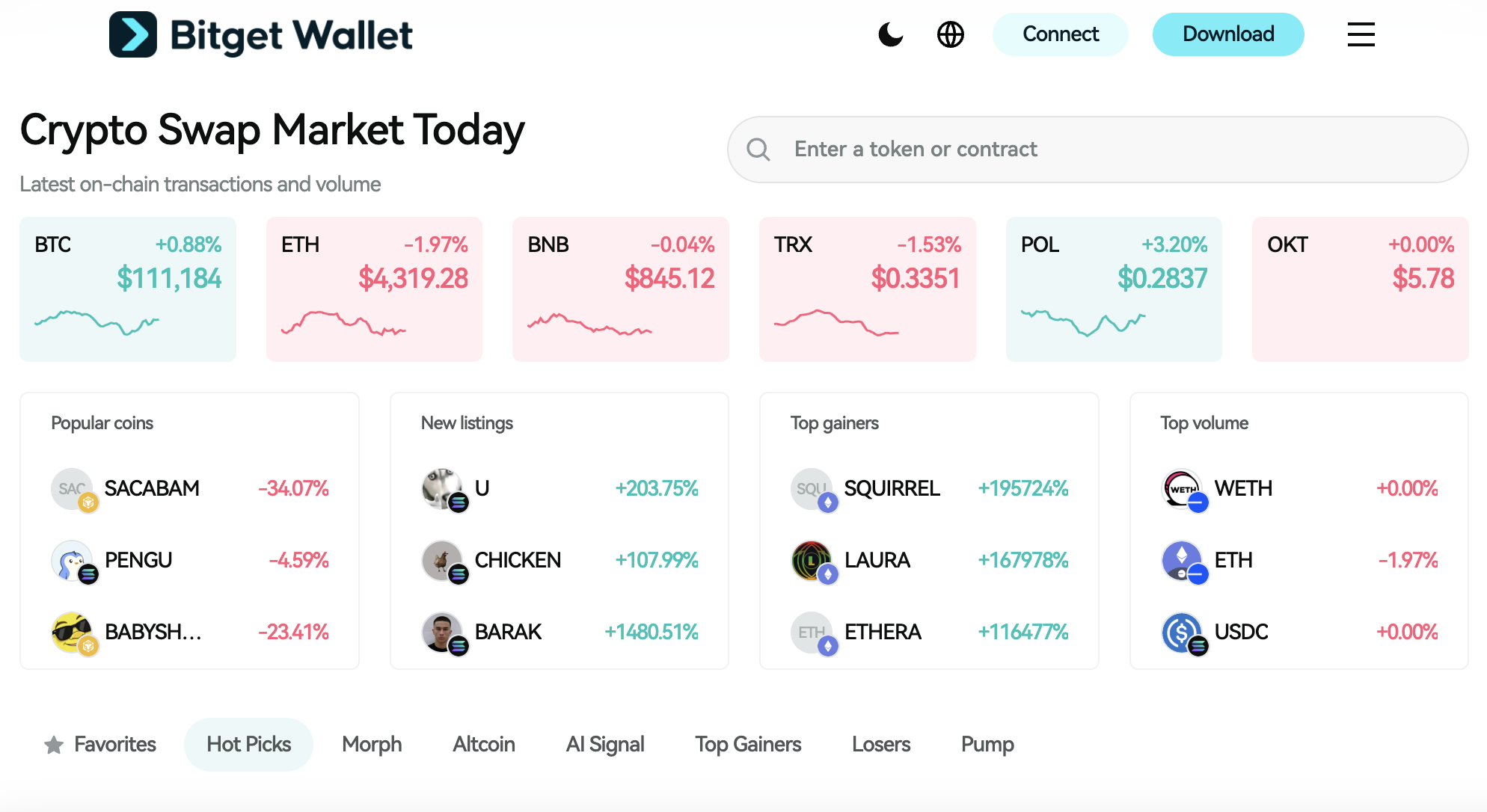

Safely store and use stablecoins across chains with Bitget Wallet – ideal for beginners.

Mezo (MEZO) Listing Details and Launch Date

Key Listing Information

Here are the important details about the Mezo (MEZO) listing:

- Exchange: To be announced

- Trading Pair: MEZO/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading Mezo (MEZO) once it officially lists—this milestone follows Mezo’s May 2025 mainnet launch and could be the next big catalyst for Bitcoin DeFi adoption.

- Please refer to the official Mezo announcements for the most accurate schedule.

Mezo (MEZO) Price Prediction: Market Maker Impact

The listing of Mezo (MEZO) on [Exchange Name] is not just a retail trading event—it’s also a battleground for market makers. The confirmed participant GSR Markets, involved in Mezo’s strategic funding, has historically exhibited systematic and algorithmic trading behavior, making this an event to watch closely.

Key Market Maker Indicators

-

Market Maker Roster & Strategy:

GSR Markets is known for its balanced liquidity provision and measured trading patterns, which could impact price swings post-listing.

-

Liquidity Pool Size at Launch:

A moderate-to-large initial liquidity pool suggests lower difficulty in price manipulation, affecting initial volatility.

-

Market Maker Contract Expiry & Options Open Interest:

Data from Deribit shows that no $MEZO contracts are currently live as of September 2025. Once contracts are introduced, expiry cycles could historically correlate with average volatility increases of 10–20%.

Price Projection Based on Market Maker Activity

| Time Frame | Predicted Price Range | Market Maker Influence |

| Short-term (1-3 months) | $0.50 – $1.00 | High volatility expected due to liquidity constraints |

| Medium-term (3-6 months) | $1.00 – $3.00 | Potential stabilization as market makers adjust positions |

| Long-term (1 year or more) | $3.00 – $7.00+ | Macroeconomic trends & project fundamentals take over |

Fear & Greed Narrative:

The market-making contract for GSR Markets in $MEZO will expire after listing. Traders should anticipate rapid price fluctuations during this period.

Source: Deribit, Market Maker Trading Data

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of Mezo and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

Source: Bitget Wallet

What is Mezo (MEZO)?

Mezo (MEZO) is a self-service onchain bank that gives Bitcoin holders more options for their assets. It combines BTC collateralization with fixed-rate stablecoin borrowing and onchain transparency, enabling users to turn long-term Bitcoin holdings into productive capital while preserving upside and sovereignty. The project’s mission is to unlock Bitcoin liquidity and expand its role in decentralized finance (DeFi).

Key Features

- BTC-Backed Borrowing: Deposit Bitcoin as collateral to borrow MUSD, Mezo’s Bitcoin-backed stablecoin.

- Fixed-Rate Loans: Predictable costs with high loan-to-value (LTV) options for flexible capital use.

- Onchain Transparency: Fully transparent positions, repayments, and collateral management.

Source: X

Mezo recently launched its mainnet (May 2025), introducing MUSD and the “Proof of HODL” mechanism to reward long-term BTC holders. With institutional support from GSR and partnerships like Lolli, Mezo is positioning itself as a core player in the Bitcoin DeFi ecosystem.

How Does Mezo (MEZO) Work?

The operation of Mezo (MEZO) is based on its role as a Bitcoin-backed onchain bank that unlocks liquidity without forcing users to sell their BTC.

-

Deposit BTC as Collateral

Users deposit Bitcoin into Mezo to open a position. The BTC remains securely locked onchain while serving as collateral.

-

Borrow MUSD at Fixed Rates

Against this collateral, users can borrow MUSD, Mezo’s Bitcoin-backed stablecoin. Loans come with fixed, predictable interest rates, and borrowers can select high loan-to-value (LTV) options based on their risk tolerance.

-

Manage and Repay Positions

Borrowers can spend or deploy MUSD across the DeFi ecosystem, while monitoring real-time position health through Mezo’s onchain dashboard. Users may top up collateral, adjust their LTV, or repay loans at any time to unlock their Bitcoin.

By integrating transparent onchain management, fixed-rate borrowing, and ecosystem integrations, Mezo (MEZO) aims to become a sustainable and influential project within the Bitcoin DeFi ecosystem.

What Makes Mezo Unique?

- 100% Bitcoin-backed stablecoin (MUSD) designed for both real-world spending and treasury use.

- Fixed-rate borrowing against BTC, giving predictable cost structures for borrowers.

- High LTV access with clear, onchain health indicators for better position control.

- Full onchain transparency across collateral, positions, and repayments.

- Ecosystem integrations, ensuring MUSD can move seamlessly across DeFi while BTC stays securely locked as collateral.

Who Leads Mezo (MEZO) – Team & Key Partnerships

| Section | Details |

| The Team | Mezo is developed by Thesis, the venture studio behind projects like Fold, Keep Network, and Saddle Finance. The team has deep experience in Bitcoin, cryptography, and DeFi infrastructure. Their goal is to make Mezo (MEZO) the go-to Bitcoin-backed onchain bank, blending security, transparency, and financial sovereignty. |

| The Vision | Mezo’s vision is to unlock Bitcoin liquidity for everyday financial use without sacrificing sovereignty. By enabling BTC-backed borrowing and stablecoin issuance, the project aims to build a sustainable ecosystem where Bitcoin serves as both a store of value and productive capital in the DeFi economy. |

| Partnerships | Mezo has secured strategic partnerships with GSR Markets (liquidity provider), Lolli (integration for consumer rewards), and various ecosystem collaborators within Bitcoin DeFi. These alliances strengthen its stability and expand MUSD adoption across multiple sectors. |

The Role of Mezo (MEZO) in Bitcoin DeFi: Use Cases Explained

Mezo (MEZO) serves a variety of purposes within the Bitcoin DeFi ecosystem, including:

-

BTC-Backed Borrowing

Users can lock their Bitcoin as collateral to borrow MUSD, unlocking liquidity without selling their BTC holdings.

-

Stablecoin Utility (MUSD)

MUSD, Mezo’s Bitcoin-backed stablecoin, can be spent, traded, or deployed in DeFi protocols—bridging Bitcoin with broader financial applications.

-

Treasury and Yield Management

Long-term holders and institutions can leverage Mezo to turn dormant BTC into productive capital, accessing fixed-rate borrowing and ecosystem integrations while preserving upside.

These applications highlight the practical value of $MEZO in Bitcoin DeFi, enabling Bitcoin to evolve from a passive store of value into an active participant in decentralized finance.

Roadmap of Mezo (MEZO)

The roadmap for Mezo (MEZO) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Completion of incentivized testnet and early community onboarding. Initial rollout of the “Proof of HODL” mechanism to reward long-term BTC holders. |

| Q2 2025 | Mainnet launch (May 2025) with MUSD stablecoin issuance, BTC collateralization, and fixed-rate borrowing live onchain. Integration of the Mezo dashboard for transparent position management. |

| Q3 2025 | Expansion of ecosystem integrations: partnership with Lolli for consumer rewards, liquidity provisioning by GSR, and preparation for centralized exchange listings. Onboarding of additional DeFi protocols to accept MUSD. |

| Q4 2025 | Development of advanced financial tools, including treasury products and institutional yield options. Exploration of derivative products (options, futures) tied to MEZO. |

These milestones highlight the practical value of $MEZO in Bitcoin DeFi, demonstrating how the project is evolving from core borrowing functionality into a broader liquidity and yield ecosystem.

How to Buy Mezo (MEZO) on Bitget Wallet?

Trading Mezo (MEZO) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Mezo (MEZO).

Step 3: Find Mezo (MEZO)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Mezo (MEZO). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as MEZO/USDT. This will allow you to trade Mezo (MEZO) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Mezo (MEZO) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Mezo (MEZO).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Mezo (MEZO) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Mezo (MEZO):

Conclusion

With its launch on Exchange’s, Mezo (MEZO) is opening fresh opportunities for investors and users alike. By focusing on Bitcoin-backed stablecoin borrowing and onchain transparency, the project positions itself as a strong contender in the Bitcoin DeFi space.

Now is the ideal time to get involved—whether through trading, staking, or earning incentives. As the ecosystem grows, staying ahead of updates and market trends will be key to capturing long-term value.

For a secure and seamless experience, Bitget Wallet makes it easy to trade, store, and manage your assets—all in one place.

👉 Don’t wait—download Bitget Wallet today and take full control of your crypto journey.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the purpose of Mezo?

Mezo’s purpose is to make Bitcoin useful in everyday finance. Users can keep their BTC, borrow MUSD, and unlock stable liquidity for spending, paying bills, or seizing opportunities—without selling their Bitcoin.

2. How can I participate?

Participation is simple: open a loan position by depositing BTC as collateral on Mezo. Once you’ve borrowed MUSD, you can use it for spending, treasury management, or accessing onchain DeFi opportunities.

3. Is Mezo transparent and secure?

Yes. All positions, collateral, and repayments are fully managed onchain. This ensures transparency, security, and sovereignty for every user.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins