Kyros Listing Airdrop Guide: $KYROS Launch Date! Inside the Solana-Based Yield Aggregation and Restaking Protocol

The upcoming Kyros (KYROS) listing has quickly become one of the most talked-about events on Solana this quarter. Following its successful WARCHEST restaking campaign, where early users minted kySOL and deposited liquidity into Kamino and Sandglass, excitement is mounting over potential airdrop rewards and the project’s launch valuation.

Kyros positions itself as a yield aggregation and restaking protocol built to maximize rewards on Solana. By transforming SOL and JitoSOL into liquid restaked assets (kySOL, kyJTO), it enables investors to earn boosted APY while maintaining liquidity — a model reminiscent of early LST success stories like Lido’s stETH or JitoSOL’s surge.

With the KYROS token listing imminent, traders are speculating on price performance and how airdrop participants might gain an early edge. Will Kyros become the next major yield powerhouse on Solana — or even the next 100x opportunity? This article delves into the confirmed launch schedule, exchange listing details, airdrop qualifications, price predictions, and how to buy and store $KYROS safely using Bitget Wallet

Kyros (KYROS) Listing: Key Dates, Airdrops & Participation Guide

1. Key Listing Information

Here are the important details about the Kyros (KYROS) listing:

- Exchange: To be announced

- Trading Pair: KYROS/USDT

- Deposit Available: October 9, 2025

- Trading Start: October 9, 2025

- Withdrawal Available: October 10, 2025

Don’t miss your chance to start trading Kyros (KYROS) on exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

2. Kyros Airdrop: How to Claim $KYROS Rewards?

Kyros (KYROS) is a liquid restaking protocol built on Solana, designed to maximize staking efficiency and reward early contributors. The project launched the WARCHEST airdrop campaign, during which the Kyros team distributed early rewards and points to users who restaked SOL and JitoSOL tokens into kySOL. Participants can complete simple social and registration tasks to qualify for their share of the airdrop.

$KYROS Timeline

- Airdrop Period: September 30, 2025 – NA

- Winners Announced: NA

Tokenomics of $KYROS

- Total Token Supply: 50,000,000 $KYROS

- Airdrop Value (USD): $NA

- Number of Winners: NA

How to Participate $KYROS Airdrop?

Step 1: Visit the Airdrop Page

Go to the official airdrop page (https://app.kyros.fi/) — you can also find it under the “Discover” section in your Bitget Wallet.

Step 2: Connect Bitget Wallet

Connect your Bitget Wallet to securely receive and manage your Solana-based assets.

Step 3: Restake SOL or JitoSOL

Restake your SOL or JitoSOL tokens — the system will automatically mint kySOL, the liquid restaked token of Kyros.

Step 4: Deposit kySOL into Partner Pools

Add your kySOL liquidity to:

- Sandglass Finance

- Kamino Finance

→ This increases your liquidity contribution and boosts your WARCHEST points.

Step 5: Complete Quests & Earn Points

Perform swaps, LP farming, or social engagement tasks to accumulate WARCHEST points, which determine your airdrop tier on the Kyros leaderboard.

Step 6: Claim Your $KYROS Tokens

- Your WARCHEST points will later convert into $KYROS tokens after the official token listing.

- Rewards will be distributed directly to your Bitget Wallet once claiming opens.

▶ Read more: Airdrop Claim Tutorial: How to Claim Airdrop to Your Wallet

Kyros (KYROS) Price Prediction: Market Maker Impact

The listing of Kyros (KYROS) on exchanges is more than just a trading debut — it marks an important milestone in building liquidity and establishing fair market dynamics for early participants. As liquidity providers engage, this phase is expected to support smooth price discovery, stable order books, and a healthier trading environment for $KYROS holders.

Key Market Maker Indicators

- Market Maker Roster & Strategy: While no official details have been disclosed, early liquidity activity is expected to focus on gradual liquidity deployment and balanced spread management, helping to limit sharp volatility after listing.

- Liquidity Pool Size at Launch: A well-structured initial liquidity pool would indicate strong trading depth and reduced price manipulation risk, creating a more sustainable market for new participants.

- Market Maker Contract Expiry & Options Open Interest: No derivative data or contract expiries have been reported at this stage, suggesting that $KYROS is still in its early market formation phase. As trading volume grows, additional liquidity tools and structured market support are likely to emerge, further enhancing stability.

Price Projection Based on Market Maker Activity

| Time Frame | Predicted Price Range | Market Maker Influence |

| Short-term (1-3 months) | NA | High volatility expected due to liquidity constraints |

| Medium-term (3-6 months) | NA | Potential stabilization as market makers adjust positions |

| Long-term (1 year or more) | NA | Macroeconomic trends & project fundamentals take over |

What Is Kyros? KYROS Token Explained

Kyros (KYROS) is a Solana-based yield and liquid restaking protocol designed to maximize returns from staked assets while maintaining liquidity across DeFi. It transforms traditional staking into a more flexible, composable, and efficient system where users can restake assets like SOL and JitoSOL to earn enhanced rewards through kySOL and kyJTO tokens.

The project aims to build Solana’s leading yield layer, helping users seamlessly manage staking, MEV rewards, and DeFi yield strategies — all in one unified ecosystem.

Key Features

- Liquid Restaking: Converts staked SOL and JitoSOL into liquid restaked tokens (kySOL, kyJTO), allowing users to earn rewards while using their assets across DeFi.

- Boosted Yield Layer: Integrates staking, MEV, and restaking rewards to achieve superior APY (up to +8% over standard staking).

- Composable DeFi Integration: Fully compatible with leading Solana DeFi protocols like Kamino, Sandglass, and Raydium to enhance liquidity and capital efficiency.

Source: Kyros on X

Kyros (KYROS) TGE Goes Live: Future of Yield and On-Chain Capital Efficiency

Kyros (KYROS) Token Generation Event (TGE) — one of the most anticipated liquid (re)staking protocols on Solana — is officially set to launch on October 9. With a $50K raise target and a $5M FDV, Kyros aims to unlock uncapped yield opportunities for SOL and JitoSOL holders.

Backed by a network of strategic partners and built on advanced yield-layer infrastructure, Kyros is designed to maximize on-chain capital efficiency while introducing a new decentralized profit layer for the Solana ecosystem. Powered by Solana’s high-performance blockchain, Kyros is positioning itself as one of the most innovative and high-potential DeFi protocols to watch in 2025.

Kyros (KYROS) Ecosystem: How It Functions?

How Kyros Works

- Built on the Solana blockchain, enabling high-speed, low-cost transactions ideal for restaking and DeFi operations.

- Utilizes liquid staking derivatives (LSDs) and MEV-based yield optimization to enhance efficiency and transparency.

- Supports DeFi integrations, enabling users to supply, borrow, and trade their kySOL or kyJTO across multiple partner platforms.

Key Benefits

- Enhanced Yield Potential – By combining staking, MEV rewards, and restaking, Kyros delivers higher returns than standard staking solutions.

- Composability Across Solana DeFi – kySOL and kyJTO can be used as collateral or liquidity in various Solana protocols, maximizing capital efficiency.

- User-Centric Simplicity – The interface allows one-click restaking and integration with top wallets like Bitget Wallet.

- Security & Transparency – Partnered with reputable validators such as Kiln, Everstake, and Staking Facilities, ensuring secure and decentralized restaking operations.

Meet the Team Behind Kyros (KYROS): Leadership and Strategy

Leadership

| Section | Details |

| The Team | Kyros (KYROS) is built by a collective of DeFi-native builders and Solana infrastructure partners. The team’s mission is to make Kyros a benchmark for yield innovation in the Solana ecosystem. |

| The Vision | Focused on becoming Solana’s “yield layer,” Kyros aims to develop a sustainable ecosystem that connects staking, liquidity, and restaking rewards seamlessly. |

| Partnerships | Kyros collaborates with Jito, SwissBorg, Kamino, Sandglass, Raydium, Kiln, Everstake, BorgPad, and Helius, forming a robust network of DeFi, validator, and liquidity partners. |

Strategy

Kyros’s strategy centers on three pillars:

- Yield Aggregation: Combine multiple yield sources (staking + MEV + DeFi) into one interface.

- Liquidity Expansion: Encourage integration of kySOL and kyJTO across major DeFi protocols.

- Institutional & Retail Access: Partner with platforms like SwissBorg to bridge DeFi yield opportunities for both retail and institutional users.

Kyros (KYROS): Practical Applications & Use Cases

1. Why Utility Matters for Kyros (KYROS)

The KYROS token is the core of the ecosystem, empowering governance, incentivizing participation, and fueling liquidity for all restaking operations.

2. Key Use Cases of KYROS

Kyros (KYROS) serves multiple practical purposes, including:

- Governance: Token holders can vote on validator selection, yield strategies, and protocol upgrades.

- Staking & Restaking Incentives: Used to reward users who restake SOL, JitoSOL, or participate in liquidity pools.

- Fee Sharing: A portion of network fees and MEV yield is redistributed to KYROS stakers.

- Ecosystem Utility: Used as collateral or liquidity in Solana DeFi protocols integrating Kyros assets.

These applications highlight the practical value of $KYROS in building a sustainable, yield-focused infrastructure within Solana’s DeFi landscape.

3. What’s Next for Kyros (KYROS)?

Kyros is expanding beyond restaking to create a modular yield hub that supports multiple LSD assets, automated DeFi vaults, and cross-protocol liquidity pools.

Future plans include:

- Launching DeFi Vaults with estimated APY up to 15%.

- Integrating with more Solana-native DeFi protocols.

- Enabling institutional-grade staking infrastructure through strategic validator partnerships.

Kyros (KYROS) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for Kyros (KYROS) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | NA |

| Q2 2025 | NA |

| Q3 2025 | NA |

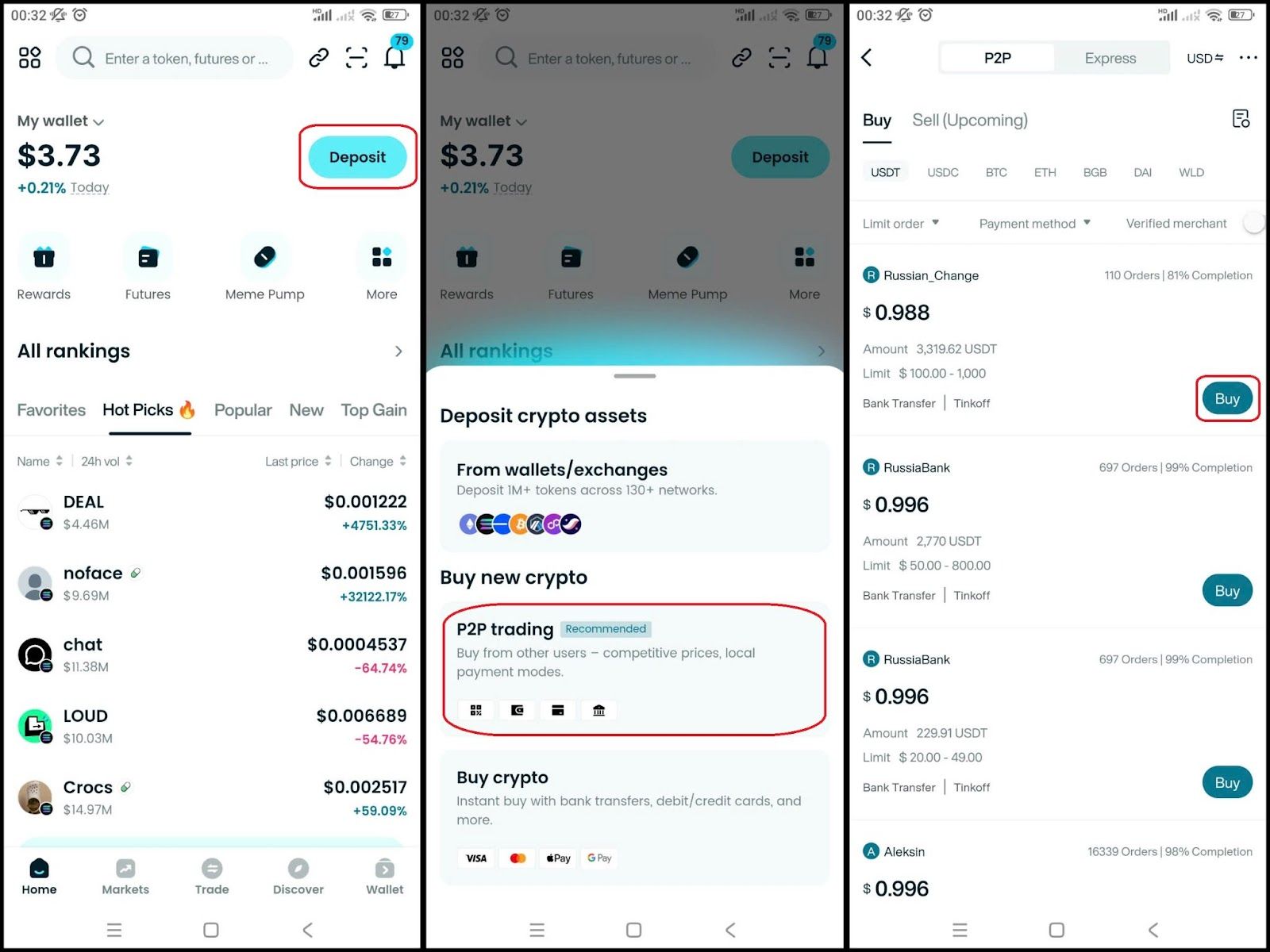

How to Buy Kyros (KYROS) on Bitget Wallet?

Buying Kyros (KYROS) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find Kyros (KYROS)

- In the main interface of the wallet, go to Market, type "KYROS" in the search bar.

- Select Kyros (KYROS) to see the trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Select the trading pair

Select the pair you want to trade, for example KYROS/USDT. So you can use USDT to buy Kyros (KYROS), or vice versa.

Step 5: Place an order

Enter the amount of Kyros (KYROS) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your KYROS in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Kyros (KYROS), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Kyros (KYROS):

- What is Kyros (KYROS)?

- Kyros (KYROS) Airdrop Guide

- Kyros (KYROS) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

The Kyros (KYROS) listing on major exchanges represents more than a short-term price catalyst — it marks a strategic step toward a decentralized and yield-driven future on Solana. With its mission to simplify access, enhance on-chain security, and reward active participation in the Web3 ecosystem, Kyros is poised to attract growing investor attention.

As adoption expands, early participants — whether through trading, restaking, or contributing to liquidity pools — stand to benefit from the project’s long-term vision and community growth.

For secure and seamless asset management, Bitget Wallet remains the go-to choice. Offering self-custody protection, cross-chain functionality, and an intuitive interface, it empowers users to trade, stake, and store their digital assets with confidence.

👉 Step into the future of decentralized finance — download Bitget Wallet today and unlock your gateway to Web3 opportunities.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Kyros (KYROS)?

Kyros (KYROS) is a Solana-based yield protocol enabling liquid restaking for assets like SOL and JitoSOL. It maximizes staking rewards through MEV optimization and integrated DeFi strategies.

2. When Will Kyros (KYROS) be listed?

Kyros (KYROS) is scheduled for listing on October 9, 2025, marking its transition from restaking protocol to full ecosystem token with trading and governance functions.

3. What is the best KYROS Wallet?

The best wallet to store and manage Kyros (KYROS) is Bitget Wallet, offering secure Solana integration, staking support, and easy access to Kyros DeFi features.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins