How to Travel with Crypto and Crypto Card: Save Money on Hotels and Spend Smarter Abroad

How to Travel with Crypto and Crypto Card is revolutionizing the way tourists purchase plane tickets, pay for accommodations, and keep track of expenses while traveling. With borderless payments, low fees, and the added benefit of prepaid crypto cards, it's an intelligent substitute for a bank. The Bitget Wallet Card provides a secure, easy-to-use method of storing and spending crypto on the go.

With tools such as the Bitget Wallet Card, travelers have more than mere payment convenience—convenience plus discounts on accommodations, reduced fees, and the ability to always be in control of their assets via a non-custodial wallet. As a frequent flyer, digital nomad, or even the new crypto user, this new travel experience combines security, cost savings, and worldwide accessibility all under one streamlined experience.

Key Takeaways

- Crypto cards allow you to spend Bitcoin, stablecoins, and other assets abroad with reduced fees and instant conversions.

- Platforms like Bitget Wallet integrate travel booking (hotels, flights, excursions) with direct crypto payments, offering discounts.

- Stablecoins provide reliable budgeting, protecting travelers from currency volatility and conversion losses.

How to Travel with Crypto and Crypto Card?

How to Travel with Crypto and Crypto Card is not just a concept for tech enthusiasts anymore—it’s becoming mainstream. Today, travelers have two powerful ways to use crypto on the road:

- Direct payments: You can now pay for flights, hotels, restaurants, or excursions with Bitcoin, Ethereum, or stablecoins on platforms that support crypto transactions. Major travel sites, boutique hotels, and even some airlines have started integrating crypto checkouts.

- Indirect spending via crypto debit or prepaid cards: These cards instantly convert your digital assets into local currency at the point of sale. That means you can use your favorite coins anywhere Mastercard or Visa is accepted—whether you’re booking a last-minute hotel room in Paris or buying street food in Bangkok.

The Bitget Wallet Card sits neatly in the middle, bridging the gap between your on-chain assets and real-world payments. Unlike traditional exchange cards, it’s linked to a non-custodial wallet, meaning you hold the keys while still enjoying all the perks of instant crypto-to-fiat conversion.

What are the main benefits of crypto travel payments?

Traveling with crypto brings a set of advantages that traditional banking can’t match:

- Borderless convenience – Say goodbye to carrying multiple cards or juggling bank accounts in different countries.

- Reduced fees – No more losing 3–5% on exchange rates or ATM withdrawals.

- Instant settlement – No waiting days for your payment to “clear.” Crypto payments finalize in seconds.

- Direct bookings – Many platforms now offer crypto-only discounts, sometimes cutting up to 40% off hotel stays.

- Self-custody – You’re not depending on banks that might freeze cards, block payments, or hit you with hidden charges.

In short: crypto travel payments free you from middlemen, reduce costs, and put you back in control.

How does a crypto card improve your travel experience?

A crypto debit or prepaid card is your all-in-one tool for global spending. Here’s how it levels up your trips:

- Universal acceptance – Use your card wherever Mastercard or Visa works. That means millions of merchants worldwide.

- Seamless conversions – Spend stablecoins, Bitcoin, or Ethereum without ever thinking about currency conversions—your card does the math instantly.

- Stability & flexibility – Load stablecoins for predictable daily expenses while keeping Bitcoin or ETH for long-term holding.

- Stress-free budgeting – Top up your card only with what you plan to spend. It’s like a prepaid travel wallet, but smarter.

- Rewards & cashback – Some crypto cards, like the Bitget Wallet Card, offer unique incentives—lower fees, discounts on hotel bookings, or even cashback in stablecoins.

- Mobile wallet sync – Instant top-ups from your phone let you manage funds on the go without ever stepping into a bank.

- Security first – With non-custodial cards, you avoid the risk of centralized exchanges holding your funds hostage.

With these features, a crypto card doesn’t just replace your traditional card—it improves it by giving you lower costs, more freedom, and perks designed for digital-first travelers.

Read more: Crypto Cards for Travelers: A Complete Guide for International Users

Why More People Are Using Cryptocurrency for Travel?

More travelers now choose to travel with Bitcoin and other cryptocurrencies thanks to lower costs, easier access, and the growing acceptance of crypto-backed cards. Forbes highlights that crypto offers speed, transparency, and self-custody, making it more than just another payment method—it’s a smarter way to manage money abroad with hotel bookings, prepaid stablecoin cards, and exclusive crypto-only discounts.

The key reasons behind this growing adoption include:

- Freedom from banks – Avoid blocked cards, ATM issues, and hidden FX fees.

- Reduced conversion costs – Skip inflated exchange rates at currency desks.

- Faster settlements – Payments clear within seconds, perfect for urgent bookings.

- Blockchain transparency – Every transaction is verifiable, reducing fraud risks.

- Self-custody and security – Keep full control of your funds without intermediaries.

Put simply, crypto payments fit the lifestyle of the modern traveler—fast, borderless, and cost-efficient.

What are the benefits of paying for travel with cryptocurrency?

When you pay for travel with cryptocurrency, you’re not just saving money—you’re gaining flexibility and access:

- Lower fees – Crypto transactions typically bypass the 2–3% credit card surcharge.

- Instant settlement – Unlike bank transfers that take days, crypto clears almost instantly.

- Borderless convenience – Spend Bitcoin or stablecoins anywhere without currency conversion.

- Crypto-only deals – Travel sites and hotel platforms now offer exclusive discounts for paying in crypto.

- Direct use in bookings – Airlines, hotels, and even excursions increasingly accept Bitcoin directly.

This means you don’t just save on fees—you also unlock deals and access not available to traditional payment users.

Why do stablecoins make budgeting easier during travel?

While Bitcoin and Ethereum are fantastic for payments, their prices can swing significantly during your trip. This is where stablecoins step in as the ideal travel currency.

- Stable value – Pegged to the dollar or euro, stablecoins like USDT or USDC avoid volatility.

- Widespread acceptance – More booking platforms and payment processors now accept stablecoins as default travel payment.

- No surprise losses – Avoid losing money on sudden exchange rate changes when moving between currencies.

- Budget control – Preload a fixed amount of stablecoins onto a card, keeping your travel spend predictable and stress-free.

By combining Bitcoin for direct use and stablecoins for daily expenses, travelers can enjoy both upside potential and financial stability abroad.

How Do Crypto Debit Cards and Prepaid Cards Work?

A crypto debit card works much like a regular bank card, but instead of being linked to your checking account, it connects directly to your crypto wallet, automatically converting Bitcoin, stablecoins, or altcoins into local currency with every swipe, tap, or online purchase. This makes it possible to spend crypto at millions of merchants worldwide—even those that don’t directly accept digital assets—with BitPay and Bitsacard highlighting these cards as the missing link between digital money and everyday spending, while Forbes notes they are rapidly gaining mainstream recognition among frequent travelers.

For anyone searching for the best crypto card for international travel, the key features to look for are:

- Ease of top-up – Can you load Bitcoin, Ethereum, and stablecoins directly from your wallet?

- Global acceptance – Is it backed by Mastercard or Visa, usable at millions of POS systems worldwide?

- Transparent fees – No hidden charges, just clear FX and transaction costs.

- Security & control – Non-custodial design ensures you keep the keys to your funds.

- Multi-chain support – Access to cross-chain swaps, stablecoins for budgeting, and even memecoins for fun spending.

The Bitget Wallet Card ticks all these boxes, standing out for its ability to handle not just mainstream assets like Bitcoin and USDT but also stablecoins and trending memecoins—all under one roof.

How can prepaid crypto cards help manage your travel budget?

One of the strongest advantages of a prepaid crypto card is spending control. Instead of tying your travel money to a bank account that may be subject to fraud or overspending, you can load only what you plan to use:

- Top-up flexibility – Add crypto on demand, whether in BTC, ETH, or stablecoins.

- Predictable budgeting – Stablecoins keep your travel fund steady against volatility.

- Spending control – Prepaid limits help you stick to your travel budget, just like a digital travel wallet.

- Hedging options – Hold your savings in BTC or ETH but preload stablecoins for predictable day-to-day expenses.

For frequent travelers, this system provides a stress-free way to balance security with flexibility.

What are the differences between Bitget Wallet Card and exchange cards?

While many exchanges now issue their own crypto cards, there’s a fundamental difference between custodial and non-custodial models:

- Exchange cards (custodial)

- Funds are held by the exchange.

- Risk of freezes, hacks, or withdrawal restrictions.

- Limited cross-chain support—usually just the main coins.

- Bitget Wallet Card (non-custodial)

- You hold the keys—funds stay in your wallet, not in a centralized exchange.

- Cross-chain advantage: spend stablecoins, swap between 90+ chains, or even use memecoins.

- Lower fees: Bitget Wallet Card charges only 1.7% compared to 2–3% industry averages.

- Exclusive perks: cashback rewards, stablecoin APY, and discounts on hotel bookings through Entravel.

If you’re a traveler who values freedom, security, and lower costs, the Bitget Wallet Card isn’t just another crypto card—it’s designed to be the best crypto card for international travel.

Read more: What Is a Crypto Debit Card and How Does It Work?

How Can You Book Flights and Hotels with Crypto?

One of the most exciting ways to use digital assets today is crypto for flights and hotels. With Entravel, Bitget Wallet’s built-in hotel booking platform, you can bypass traditional travel agencies and book directly with crypto—often at a much lower price than major platforms like Expedia or Booking.com.

How to book flights and hotels directly with Bitget Wallet?

Entravel is a white-label hotel booking platform within the Bitget Wallet app which allows users to book premium hotels with crypto and enjoy prices up to 40% lower than mainstream platforms such as Expedia and Booking.com

For the price comparison of Entravel hotel versus competitors, please refer to:

https://docs.google.com/spreadsheets/d/1GZBB3UvqfMauGJK7JpsqFha0C8C3cEHAasIRLMrP6BU/edit?gid=0#gid=0

User Flow

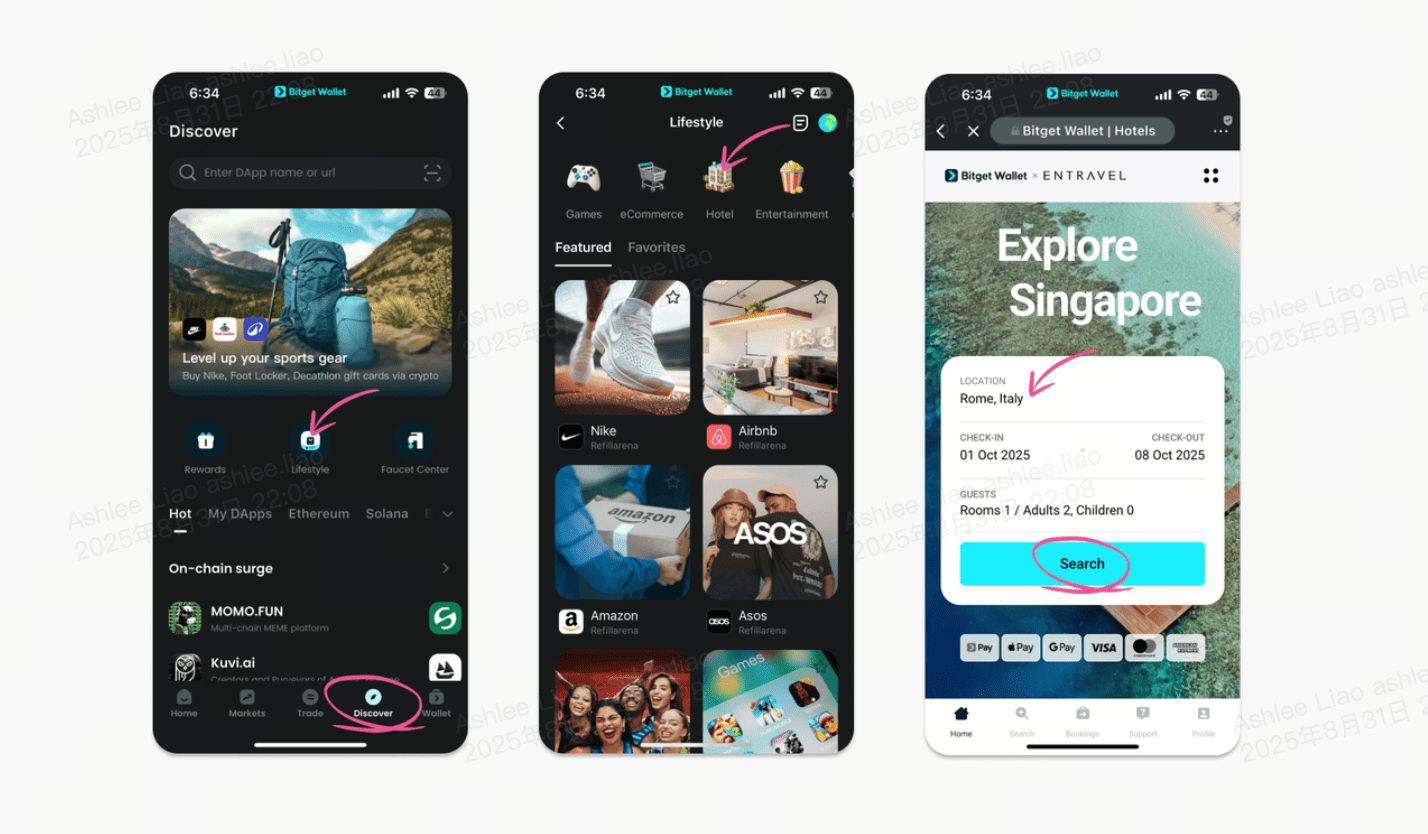

Booking hotels via Lifestyle page

Users are able to discover Entravel via Discover -> Lifestyle - > Hotels

Select travel destination and dates

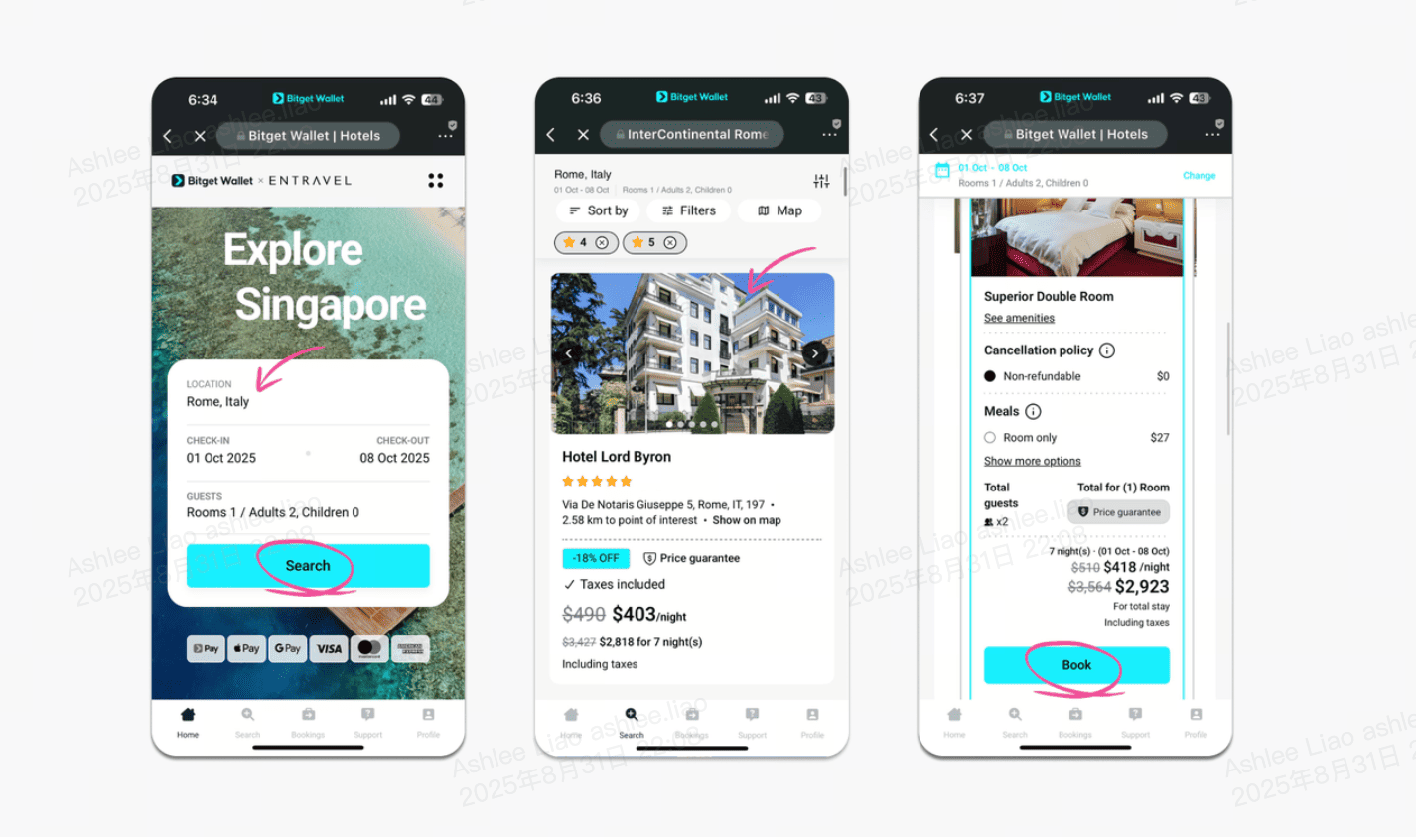

Similar to any other booking website, simply choose your destination, dates and your desired hotel and room type

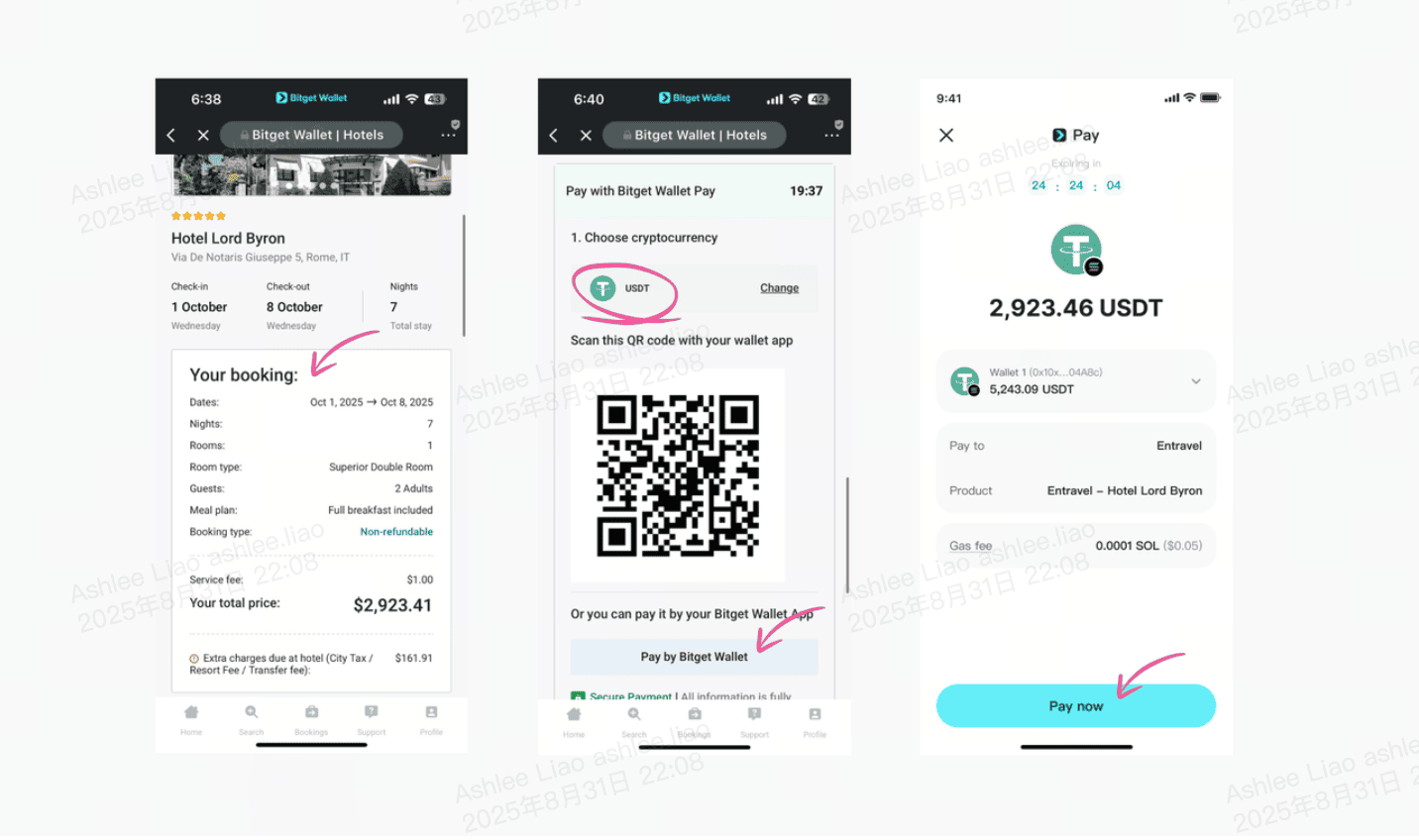

View booking summary and make payment

After selecting the hotel, users are able to pay directly with Bitget Wallet and enjoy an additional 4% discount. The funds are also directly deducted from their wallet.

Can you really save money by booking hotels with crypto?

Absolutely. Entravel is specifically designed to beat the pricing of mainstream platforms:

- Up to 40% lower hotel prices compared to sites like Expedia and Booking.com.

- Extra 4% discount when paying directly with Bitget Wallet.

- Transparent, no-hidden-fee structure—what you see is what you pay.

For frequent travelers, that means hundreds (if not thousands) of dollars saved every year, simply by switching from traditional booking platforms to crypto-based ones.

What makes Bitget Wallet Card the best choice for international travel?

Using Bitget Wallet Card alongside Entravel makes the experience even smoother:

- Global acceptance – Spend at millions of merchants, not just on hotels.

- Cross-chain support – Pay with Bitcoin, stablecoins, or even trending memecoins.

- Lower fees – Just 1.7%, compared to the 2–3% typical of exchange cards.

- Security & self-custody – Funds stay in your control, not on a centralized exchange.

- Exclusive perks – From cashback bonuses to stablecoin APY, the card adds value beyond travel.

Together, Entravel + Bitget Wallet Card create a powerful ecosystem: book your trip with crypto for flights and hotels, then use the same card to cover meals, transport, and experiences abroad.

What Are the Risks and Regulations of Traveling with Crypto?

Before you pay for travel with cryptocurrency, it’s important to know that laws vary dramatically across the globe. Some countries, like El Salvador or Malta, actively encourage crypto use for hotels and dining, while others, including China and Algeria, restrict or ban it entirely. On top of that, compliance frameworks such as the FATF Travel Rule are expanding, requiring greater transparency from platforms and travelers alike. Understanding these differences helps you avoid unexpected issues and ensures your crypto payments remain smooth, legal, and stress-free.

Which countries are most crypto-friendly for travelers in 2025?

Several destinations have embraced crypto as a legitimate tool for commerce and tourism:

- El Salvador – Bitcoin is legal tender, accepted everywhere from hotels to coffee shops.

- Malta – A pioneer in blockchain regulation, with broad merchant support.

- Prague – Known as one of Europe’s most crypto-active cities, with cafés and hotels accepting Bitcoin.

- Bangkok – A hub for digital asset payments, especially in tourism districts.

These destinations make it simple to book hotels, dine, and even take excursions using Bitcoin or stablecoins. For adventurous travelers, they provide a glimpse of what mainstream crypto adoption looks like.

Where is crypto restricted or banned for travel payments?

At the other end of the spectrum are countries that heavily regulate or outright ban crypto transactions:

- Algeria – Crypto use is prohibited under financial law.

- China – Bans crypto payments, with only state-backed digital yuan permitted.

- Egypt – Religious and financial authorities restrict crypto transactions.

- Vietnam – Digital assets are not recognized as legal payment instruments.

In these regions, travelers can still use crypto debit cards (which settle in fiat at point-of-sale) but should avoid direct peer-to-peer crypto payments.

How to stay compliant with local tax and reporting rules?

Even in crypto-friendly destinations, compliance remains critical:

- Keep transaction records – Maintain a digital trail of your payments for tax reporting.

- Consult professionals – Cross-border taxation can be complex, especially if your home country requires crypto disclosures.

- Use transparent platforms – Wallets like Bitget provide built-in reporting features and compliance integrations.

By being proactive, travelers can enjoy the freedom of paying with crypto without worrying about legal or financial consequences down the road.

How Can You Keep Your Crypto Safe While Traveling?

Convenience is great, but traveling with digital assets also brings unique risks. Using public Wi-Fi, logging into exchanges on shared devices, or carrying all your crypto on a hot wallet can expose you to phishing attacks, malware, and hacks. That’s why smart travelers use a layered approach—combining secure storage, cautious online behavior, and stablecoin budgeting. Learning how to use stablecoins for travel budget planning is just one piece of the puzzle; keeping those funds safe is equally critical.

Why is a hardware wallet essential for travel security?

A hardware wallet (cold wallet) is the gold standard for securing digital assets while abroad. Unlike hot wallets connected to the internet, hardware wallets store your private keys offline, minimizing the risk of remote attacks.

- Offline storage – Eliminates exposure to hacks over Wi-Fi or mobile networks.

- Reduced hack risk – Even if your phone or laptop is compromised, your main crypto reserves remain safe.

- Travel strategy – Keep the bulk of your portfolio in a hardware wallet, and transfer only what you need to a hot wallet or prepaid card for daily spending.

Brands like OneKey are designed with portability in mind, making them especially practical for frequent travelers.

What security practices should travelers follow with crypto?

Even the best card or wallet can’t protect you if your digital habits are sloppy. To stay secure while traveling:

- Use a VPN – Prevent snooping on public Wi-Fi at airports, cafés, and hotels.

- Enable 2FA – Add an extra layer of authentication to your wallets and exchange accounts.

- Keep secure backups – Store seed phrases and recovery keys offline in a safe location, never in your phone’s notes app.

- Avoid custodial wallets – Stick with non-custodial solutions like Bitget Wallet, where you control your keys and funds.

- Spend from hot wallets only – Treat your prepaid or hot wallet like a travel purse: carry enough for convenience, but never everything.

By combining hardware wallets with strong digital hygiene, travelers can enjoy the freedom of crypto payments without compromising security.

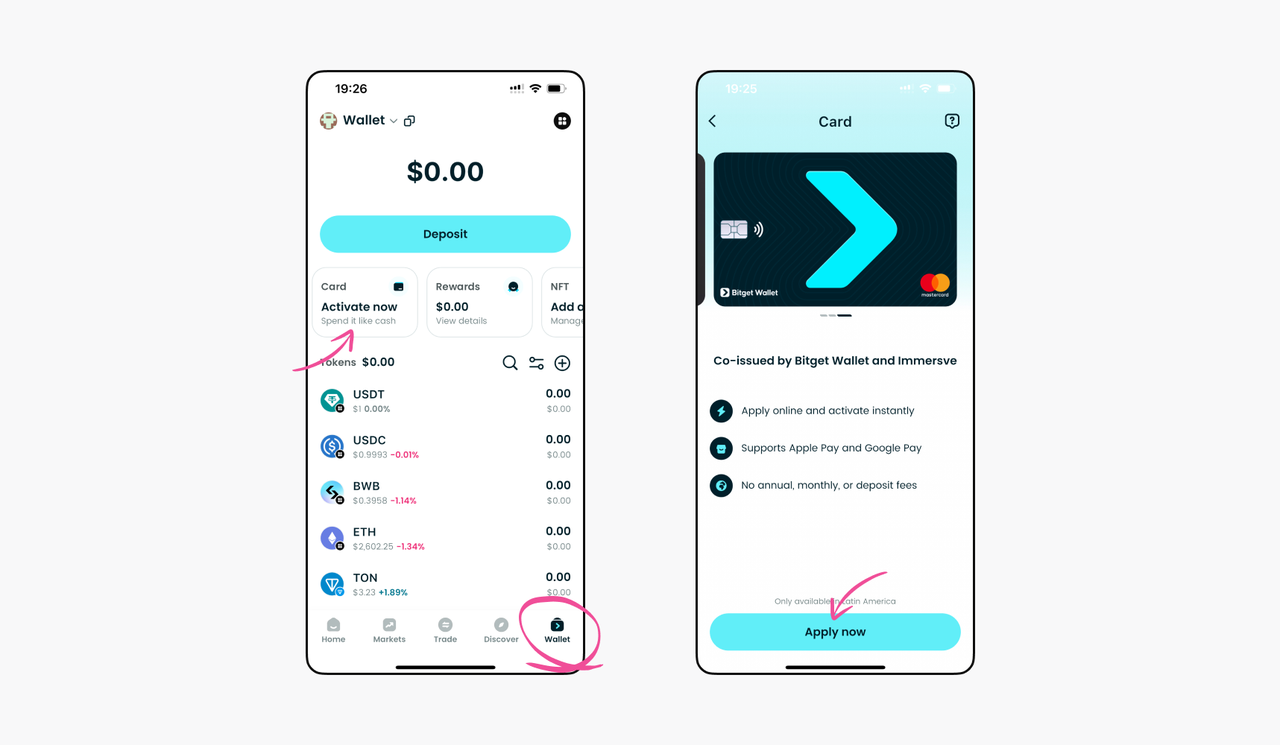

How to Apply for Bitget Wallet Card?

Applying for the Bitget Wallet Card takes only minutes and unlocks worldwide crypto spending.

What are the steps to get your Bitget Wallet Card?

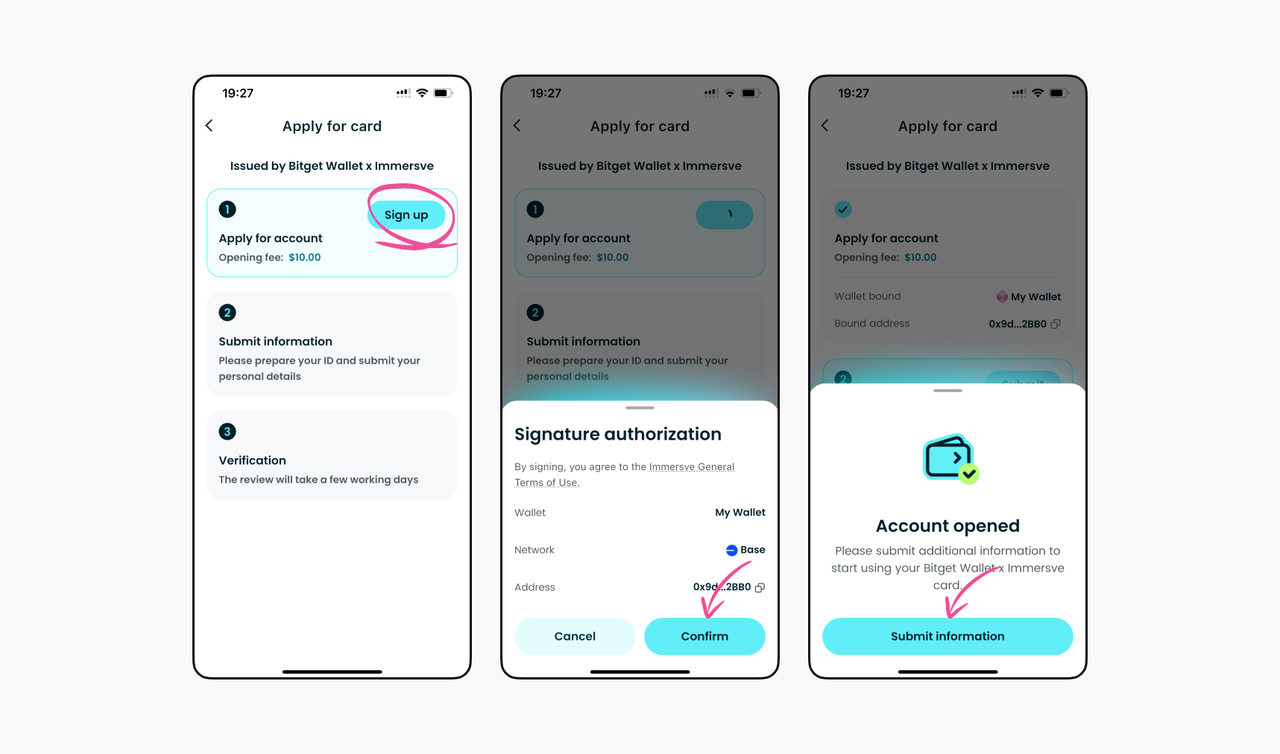

Getting started takes just a few simple steps:

1. Download Bitget Wallet to Apply

[Download the Bitget Wallet app](https://web3.bitget.com/en/wallet-download?) and head to Wallet > Card > Apply now.

2. Sign up for an account

Click Sign up and sign the transaction to create your card account. An opening fee of 10 USDC applies.

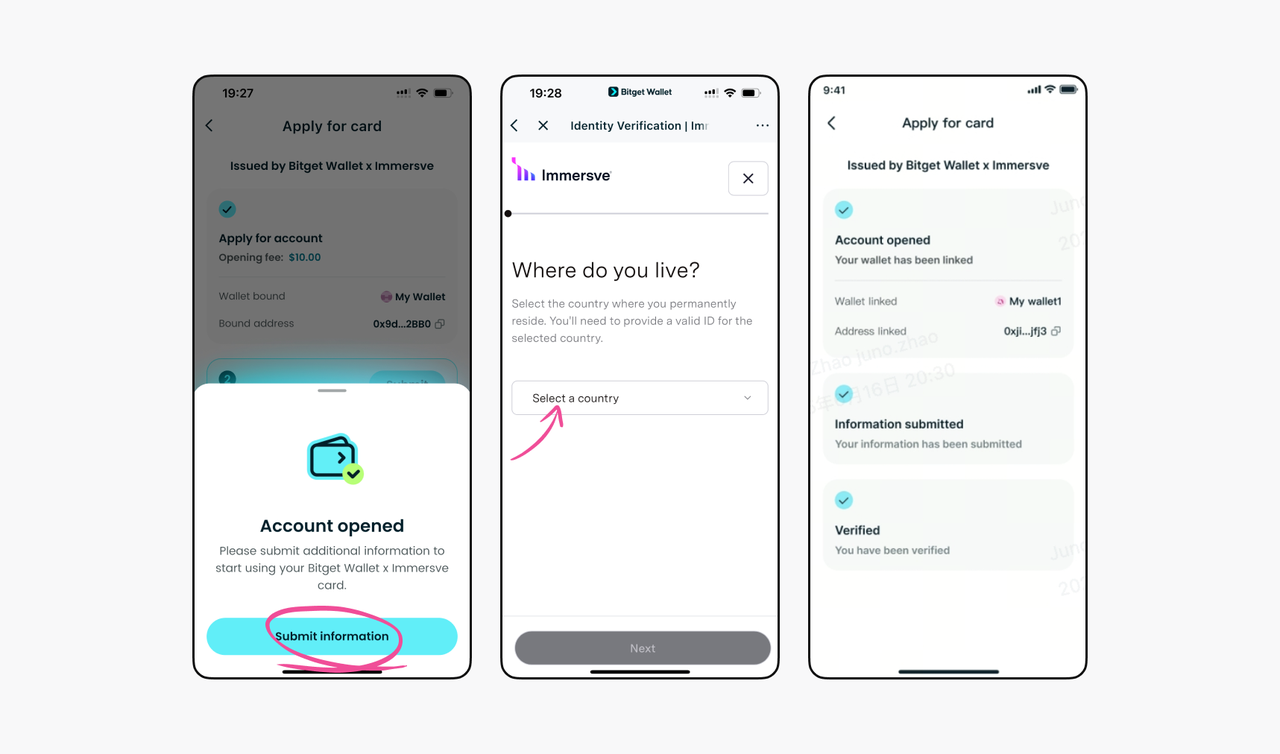

3. Submit your personal information

Once your account is opened, you'll be redirected to submit personal information such as your country, address, contact details, and estimated monthly spend.

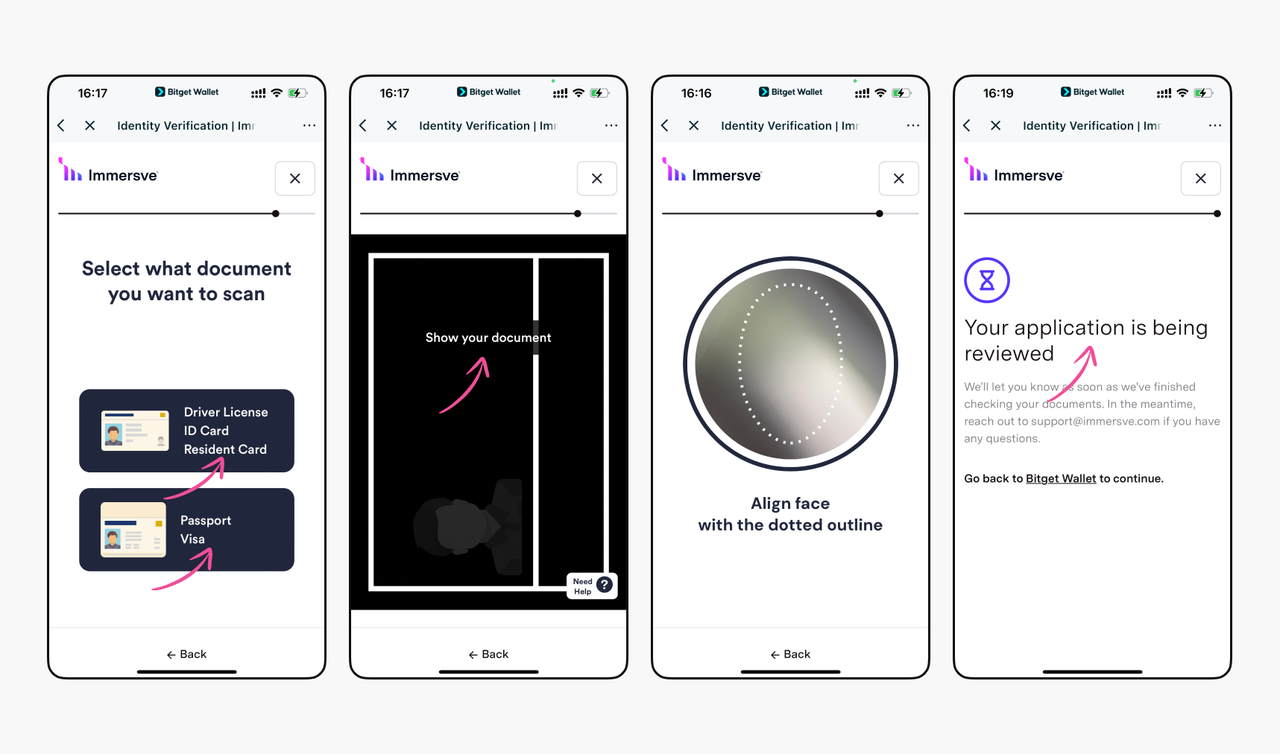

4. Verify your identity

You'll then need to verify your identity by uploading a valid ID (passport, driver's license, or national ID) and completing a quick face verification. Most applications are approved within 3 minutes.

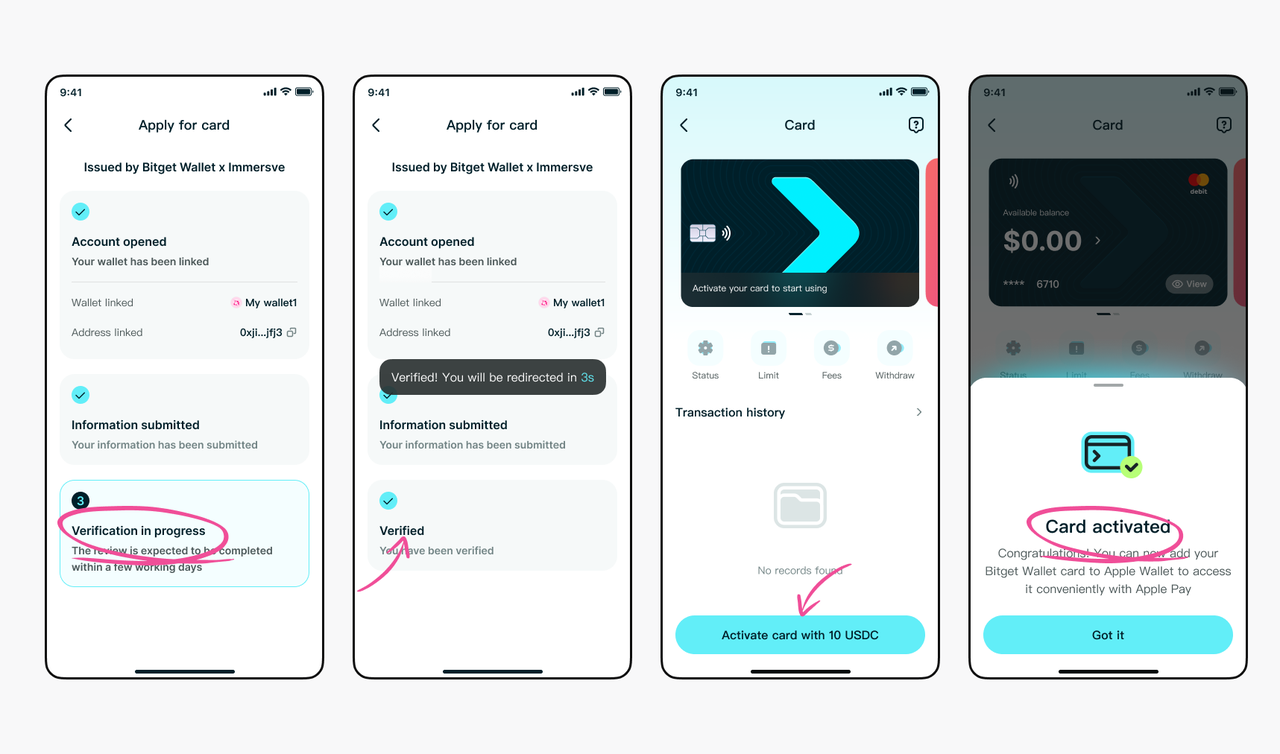

5. Activate your card

After verification is complete, you can activate your card by paying the 10 USDC issuance fee. Once done, you can view your digital card details and add it to Apple Pay or Google Pay.

Why is the Bitget Wallet Card different from other crypto cards?

Not all crypto cards are created equal. Many exchange-issued cards come with higher fees, custodial risks, or limited perks. The Bitget Wallet Card stands out by combining global acceptance with traveler-friendly benefits, giving you more value for every transaction:

- Legally issued: Mastercard in EU, Visa in Asia.

- Lower fees: 1.7% vs 2–3% average.

- Cashback: $5 bonus after KYC + extra rewards.

- High-yield perks: up to 8% APY on stablecoins.

- Seamless conversion from crypto to fiat in seconds.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Conclusion

How to Travel with Crypto and Crypto Card is quickly becoming the smarter way to see the world. From saving money on hotels with Entravel to managing a stablecoin travel budget and spending securely with prepaid cards, crypto offers lower costs, faster payments, and greater freedom than traditional banking ever could. The Bitget Wallet Card pulls it all together—global acceptance, lower fees, and self-custody control—making it the perfect travel companion.

Ready to experience borderless payments? Pay globally with your crypto using Bitget Wallet Card – perfect for beginners.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs About Traveling with Crypto and Crypto Cards

1. What coins can I use for travel payments?

You can use Bitcoin, Ethereum, USDT, USDC, and other stablecoins for travel bookings and expenses. Platforms like Bitget Wallet support multiple assets, giving you flexibility in how you pay.

2. Can I use Bitget Wallet Card worldwide?

Yes, it’s accepted anywhere Mastercard (EU) or Visa (Asia) is valid. This makes it usable at millions of merchants and online platforms globally.

3. How do stablecoins help with travel expenses?

Stablecoins keep your budget steady by avoiding the volatility of assets like Bitcoin or Ethereum. They also help you avoid unexpected foreign exchange conversion losses.

4. Are there discounts for paying in crypto?

Yes, Entravel offers up to 40% lower hotel rates compared to mainstream booking sites. On top of that, Bitget Wallet users get an extra 4% discount when paying directly in crypto.

5. How to choose the best crypto card for travel?

Look for a card with global acceptance, low fees, and non-custodial storage for better security. The Bitget Wallet Card offers all of these plus travel perks like cashback and stablecoin rewards.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins