Best Crypto Card Rewards of 2026: Which Crypto Credit & Debit Cards Offer the Top Cashback and Perks?

Best Crypto Card Rewards of 2026 are changing the game for crypto fans. We're talking about turning everyday spending – your morning coffee, weekly groceries, even that dream vacation – into BTC, ETH, stablecoins, or altcoins dropped straight into your wallet. Forget the idea that these cards are just for tech whizzes; they’ve gone mainstream, becoming a smart money move for everyone, whether you're just starting out or you've been trading for years.

Pick the right card, and suddenly, every swipe earns you crypto. But it's not just about cashback (though that’s generous, often 1%–5% or more!). Many cards sweeten the deal with staking bonuses, free airport lounge access, and zero foreign transaction fees – all while working seamlessly worldwide thanks to Visa or Mastercard. Your choice boils down to two main types: a crypto credit card (spend now, pay later) or a crypto debit card (spend directly from your crypto or fiat balance). Just remember to factor in things like how reward values might swing with the market, any staking requirements, and potential fees to truly maximize what you get back.

Whether you’re new to digital assets or a seasoned holder, choosing the right card — and storing your rewards securely in Bitget Wallet — is essential to maximizing value and keeping your crypto safe.

What Are Crypto Card Rewards and How Do They Work?

Think of crypto rewards cards – whether credit or debit – like your regular cashback cards, but cooler. Instead of dollars or points, you get paid directly in BTC, ETH, USDC, or other altcoins. Those cashback rates usually sit between 1%–5%, sometimes spiking higher with special promotions. Because they run on Visa or Mastercard networks, you can use them pretty much anywhere in the world. Some cards even offer bonus categories (like dining, travel, or extra staking rewards) that boost your earnings, especially if you agree to lock up a certain amount of crypto with them for a while.

- **Crypto debit cards:** These work instantly. When you buy something, your stablecoins convert to cash right at the checkout, and your rewards flow back into your crypto wallet.

- **Crypto credit cards:** These feel familiar – you get a spending limit and a bill each month. The difference? Your rewards are paid out in crypto at the end of your billing cycle.

With more options popping up all the time, the best card for you depends on how you like to pay (your preferred crypto payment method), how comfortable you are with crypto's ups and downs, and whether perks like zero foreign transaction fees, no annual fee, or those airport lounge passes matter most.

🔥 Brazil Exclusive: Get 20% Cashback + 5 USDC Rewards with Bitget Wallet Card! 🔥

Make your first purchases smarter with the Bitget Wallet Card, now available exclusively for users in Brazil! Enjoy 20% cashback—capped at 10 USDC per user—and get your rewards in USDC at the end of the campaign.

✨ Campaign Highlights (Brazil Only):

- 🇧🇷 20% Cashback on eligible spending (max 10 USDC)

- Rewards distributed in USDC after the campaign

- Refer friends in Brazil & earn 5 USDC for each successful activation

- Friend must complete KYC + activate their Bitget Wallet Card

- Referral rewards paid out weekly

CTA Button: Brazil Users – Get Your Bitget Wallet Card Today and Earn 10 USDC!

Which Crypto Debit Cards Offer the Best Crypto Rewards?

Among the many contenders in 2026 , several Best Crypto Debit Cards stand out for low fees, high cashback, and global accessibility. One of the most competitive is the Bitget Wallet Card, followed by strong options from Crypto.com, Coinbase, Fold, Gnosis Pay, Wirex, and Bybit.

Bitget Wallet Card

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn:

Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks:

Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market:

Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued:

Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience:

Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion:

Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

**Crypto.com Visa Debit**

- Rewards: 0%–8% CRO depending on staking tier (Ruby 2% with $500 stake; higher tiers require larger stakes).

- Perks: Netflix/Spotify rebates (tier-based), lounge access from mid-tiers.

- Fees/Notes: $0 annual; caps on monthly rewards at lower tiers; global availability.

- Best for: Users willing to lock CRO to chase higher rates.

Coinbase Visa Debit

- Rewards: Typically 1% BTC or up to 4% in select altcoins (offer-based).

- Fees/Notes: $0 annual; US-only (excl. HI); simple app controls; better to spend USDC to avoid conversion costs.

- Best for: U.S. beginners wanting straightforward everyday spend + easy reward selection.

Fold Debit Card

- Rewards: Bitcoin sats via gamified “Spins”; Spin+ (paid) unlocks flat 0.5% base and 1.5%–5% rotating boosts.

- Fees/Notes: Activation or Spin+ membership; U.S. only.

- Best for: New users who like gamified BTC accrual and don’t mind memberships.

Gnosis Pay Debit Card

- Model: Self-custodial Visa card; spend from your Gnosis Safe with EURe/GBPe.

- Rewards: Up to 5% GNO (based on holdings; +1% with OG NFT).

- Fees/Notes: ~$35 issuance; zero operational fees; Apple/Google Pay; EEA & UK.

- Best for: DeFi natives prioritizing self-custody and no-fee spending flows.

Wirex Card (Visa/Mastercard)

- Rewards: Up to 8% WXT (elite tiers); typical 1%–3%.

- Fees/Notes: No annual; FX friendly; free ATM up to ~$200/mo; 130+ countries.

- Best for: Frequent travelers needing multi-currency flexibility.

Bybit Mastercard Debit

- Rewards: Up to 10% cashback (VIP/tier-based) + ~8% APR on idle balances; rotating bonus categories; Netflix/Spotify/Prime rebates.

- Fees/Notes: No annual; EEA & CH, Australia, Argentina, Brazil, AIFC, APAC; higher tiers need volume/balances.

- Best for: Active exchange users chasing high rates through VIP tiers.

Which Crypto Credit Cards Offer the Best Cashback?

While debit cards dominate the Best Crypto Card Rewards of 2026 discussion, several credit cards also offer competitive cashback—paid in crypto instead of traditional points. For users who prefer revolving credit and the ability to build a credit history, these options can be compelling.

Gemini Credit Card

- Rewards: Up to 3% back in Bitcoin, Ethereum, or 60+ other cryptos.

- Fees: No annual fee; foreign transaction fees apply.

- APR: Variable, ~18–25% depending on credit profile.

- Availability: U.S. only.

- Pros: Instant reward settlement, no transfer delays, wide crypto selection.

- Cons: High APR for carried balances, limited to U.S. users.

Venmo Credit Card

- Rewards: 3% back in your top spending category, convertible to BTC, ETH, LTC, or BCH.

- Fees: No annual fee; FX fees apply.

- APR: Variable, ~20–28%.

- Availability: U.S. only.

- Pros: Seamless integration with Venmo app, auto-purchase of crypto with rewards.

- Cons: Limited crypto choices, higher FX fees for travel.

Coinbase One Card (Pending Release)

- Rewards: Expected 1%–4% back in crypto, no conversion fees for members.

- Fees: Likely no annual fee; further details pending.

- APR: TBD.

- Availability: Anticipated in U.S., EU, UK first.

- Pros: Direct integration with Coinbase ecosystem, possibly enhanced perks for Coinbase One subscribers.

- Cons: Not yet available, unclear bonus categories.

| Card Name | Max Rewards | Annual Fee | APR Range | Availability | Best For |

| Gemini Credit Card | 3% | $0 | 18–25% | U.S. | Variety of crypto choices |

| Venmo Credit Card | 3% | $0 | 20–28% | U.S. | Everyday spenders who use Venmo |

| Coinbase One Card* | 4% (est.) | $0 | TBD | U.S./EU/UK | Coinbase users with subscription perks |

How Do the Top Crypto Cards Compare?

With dozens of cards offering different perks, fees, and reward structures, choosing the Best Crypto Credit Cards or Best Crypto Debit Cards requires a clear side-by-side look. In 2026 , some cards stand out for maximum cashback, while others dominate on low fees or travel perks.

Which Crypto Card Has the Highest Cashback in 2026 ?

In pure reward percentage, the leaders are KAST Solana (15%), Bybit (10%), Crypto.com (8%), Gemini (4%), and the Bitget Wallet Card (up to 8% APY on staked stablecoins plus first-month bonuses). While high rates are attractive, they often come with staking requirements, geographic limits, or high annual fees.

| Card Name | Type | Max Rewards | Fees | Availability | Best For |

| Bitget Wallet Card | Debit | 8% APY* | 1.7% spend fee | EU, LATAM, UK, Asia | Beginners & travelers seeking ease |

| KAST Solana | Debit | 15% | Staking required | Limited | High-volume Solana ecosystem users |

| Bybit Card | Debit | 10% | Tiered staking | Global | Traders using Bybit exchange |

| Crypto.com Visa | Debit | 8% | Staking required | Global | CRO token holders, frequent spenders |

| Gemini Credit Card | Credit | 4% | $0 annual fee | U.S. | Variety of crypto redemption options |

- APY applies to staked stablecoins, not direct cashback.

Which Cards Have the Lowest Fees and Best Perks?

For those seeking the Best Crypto Card with No Fees, the Bitget Wallet Card is hard to beat: no annual fee, no top-up fees, and ultra-low spending fee of just 1.7%. The Gemini Credit Card and Venmo Credit Card also skip annual fees, though foreign transaction fees still apply.

Other factors worth considering include ATM withdrawal limits (some cards allow none), FX fees for international travel, and whether lounge access or travel insurance is bundled.

Highly Recommendation: Bitget Wallet Card

Lowest total fees, ideal for global travelers, with both Mastercard & Visa support. It combines no annual fee, zero FX fees, generous cashback rates, and compatibility with 1,000,000+ crypto assets. Rewards can be spent instantly or stored securely in Bitget Wallet with cross-chain support and DeFi integration—making it perfect for both beginners and experienced users.

Other cards:

-

Gemini Credit Card:

No annual fee, strong crypto selection, instant reward settlement.

-

**Crypto.com Visa (Mid Tiers):**

Zero FX fees, lounge access with staking, but high CRO lock-up.

What Should You Consider Before Choosing a Crypto Rewards Card?

Before picking a card from our Best Crypto Cards 2026 list, it’s not just about the highest cashback rate. The right choice depends on your lifestyle, financial goals, and comfort with crypto’s volatility.

Key factors to evaluate:

- Spending habits: Choose a card with rewards that match where you spend most (e.g., dining, travel, online shopping).

- Staking requirements: Some cards offer higher rates if you lock up crypto — great for committed holders, less so for casual users.

- Fees & limits: Check annual fees, foreign transaction fees, ATM withdrawal limits, and top-up costs.

- Reward volatility: Crypto rewards can change in value quickly; decide if you’ll hold or cash out.

- Travel perks: For frequent flyers, look for Visa/Mastercard acceptance, zero FX fees, and lounge access.

How Do Staking Requirements Impact Rewards?

Many leading crypto rewards cards, like the Crypto.com Visa and KAST Solana, use tiered systems that require staking large amounts of their native token to unlock top rates — for example, up to 8% CRO cashback but with a 180-day lock-up. This can tie your funds to volatile assets and reduce flexibility.

The Bitget Wallet Card takes a smarter approach:

- Earn high rewards without mandatory staking — competitive base rate from day one.

- Boost APYs up to 8% by staking stablecoins or supported tokens (minimizing volatility risk).

- Instant QR code payments for seamless online and offline transactions.

- Global Visa & Mastercard support with no annual fee and just 1.7% spending fee.

This flexibility means you can scale your rewards when you want — without being locked into risky token holdings.

Read more: How to Stake Crypto on Bitget Wallet

What Are the Risks of Earning Rewards in Crypto?

While crypto rewards can outpace traditional cashback, they come with unique risks:

-

Volatility:

The value of your rewards can drop significantly in a bear market.

-

Regulatory uncertainty:

Changes in crypto laws could affect card availability or reward redemption.

-

Tax implications:

In many jurisdictions, crypto rewards are taxable as income.

-

Fee erosion:

High annual fees, foreign transaction fees, or hidden charges can offset reward gains.

Understanding these risks—and factoring them into your decision—will help you pick a card that delivers net positive value.

Which Crypto Card Is Best for Your Needs?

Not every crypto payment card is right for everyone. Some are designed for high-volume traders willing to stake tokens, while others focus on simplicity and global usability. Our list of the Best Crypto Rewards Cards 2026 includes both high-yield options and easy-to-use options, so your decision should be based on your financial goals, travel plans, and personal risk tolerance.

If you’re new to digital assets, you’ll probably want a card that doesn’t require staking and has an intuitive, easy-to-understand interface. On the other hand, frequent travelers may prioritize features like no FX fees, widespread acceptance (Visa/Mastercard), and multi-currency support.

What’s the Best Crypto Card for Beginners?

For beginners, the Bitget Wallet Card stands out thanks to:

- No staking requirement for solid baseline rewards.

- Straightforward onboarding process linked to Bitget Wallet.

- Global acceptance with both Visa and Mastercard options.

It allows new users to enjoy crypto cashback without being locked into token volatility, making it a low-risk entry point into crypto payments.

Read more: How to Buy Crypto with Visa Card: A Complete 2025 Guide for Beginners

What’s the Best Crypto Card for Travel and International Use?

For frequent flyers and remote workers, the Bitget Wallet Card again takes the lead:

- No FX fees for international purchases.

- Multi-currency support across crypto and fiat.

- Global merchant acceptance via Visa and Mastercard.

- Secure storage for rewards directly in the Bitget Wallet app.

Other strong contenders include the Crypto.com Visa for its lounge access perks (with staking) and Wirex for its multi-currency wallet integration.

Read more: Crypto Cards for Travelers – A Complete Guide for International Users

How to Maximize Your Crypto Card Rewards?

Having a crypto rewards card is just the beginning – to get the most value from it, you need a smart strategy. From choosing the highest cashback card for your biggest spends, to combining benefits from multiple issuers, how you use it can make or break your rewards or save big.

Timing is also crucial, as the ever-changing crypto market can turn a 5% cashback into a 10% profit – or a loss – depending on how the market plays out. Don’t forget to keep an eye on reward expiry dates, staking opportunities, and special partner promotions to push your profits even higher!

Should You Redeem Rewards Immediately or Hold Crypto?

Redeeming immediately converts your rewards into stable value, shielding them from volatility. Holding, on the other hand, can amplify gains if the market rises—but it also exposes you to downside risk.

A balanced approach is often best:

- Short-term needs: Redeem to stablecoins or fiat.

- Long-term bets: Hold a portion in BTC or ETH.

Read more: How to Use a Crypto Card for Daily Transactions

How to Buy Crypto with Crypto Rewards Card: Step-by-Step Guide

Buying crypto with a Crypto Rewards Card is fast and simple with Bitget Wallet. Whether paying directly or using a Crypto Rewards Card, here’s the full process — including how to apply for a Bitget Wallet Card for seamless purchases.

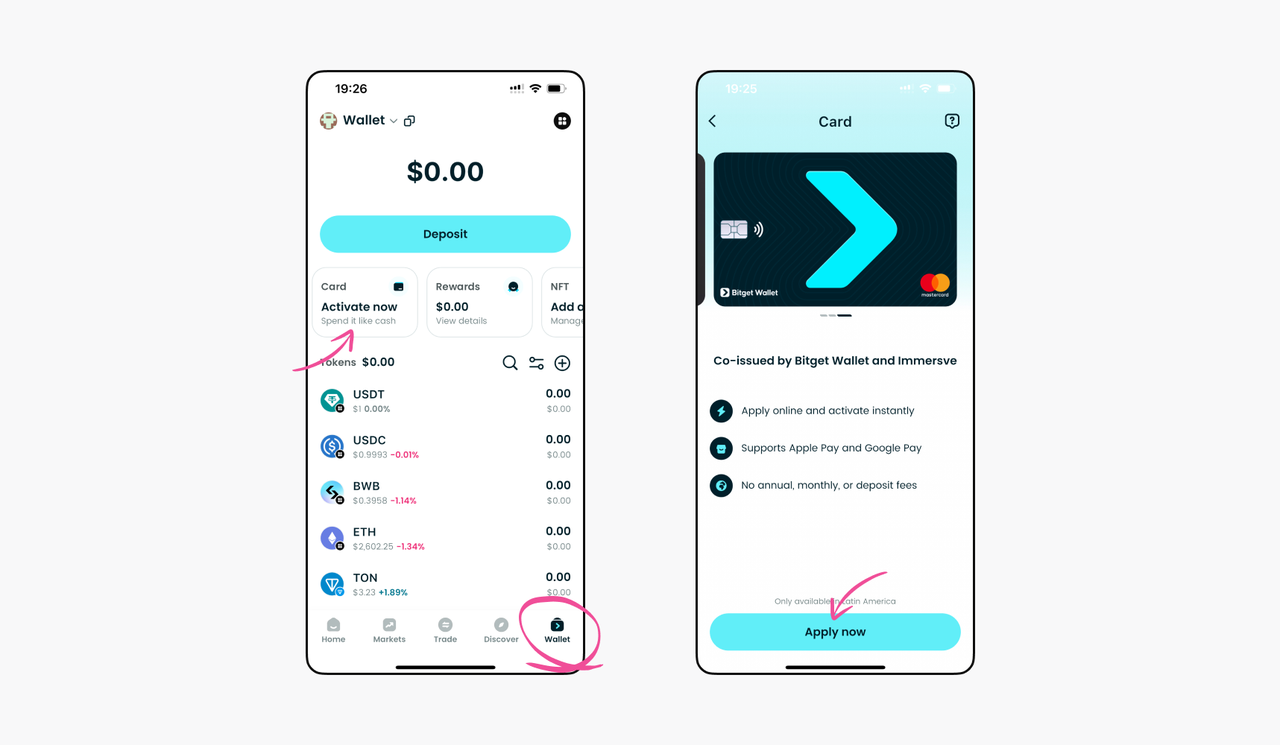

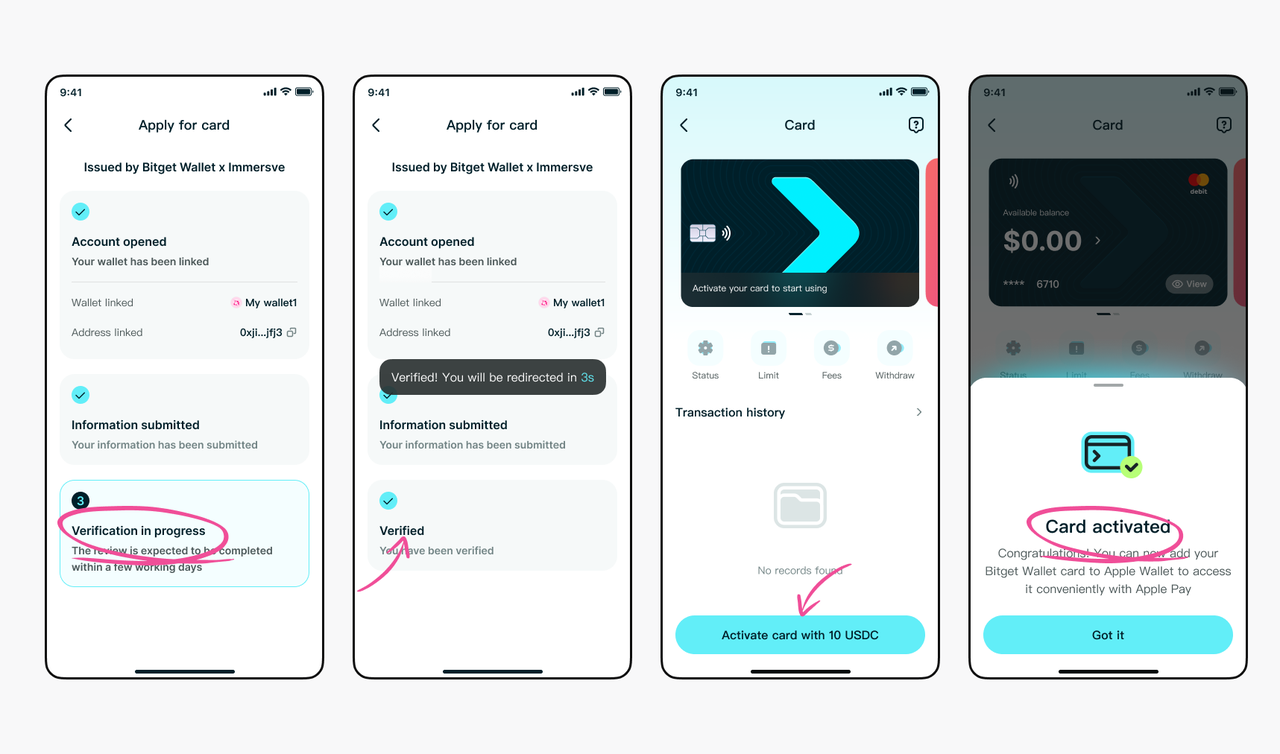

Step: 1 Download Bitget Wallet and Apply for the Card

Install the Bitget Wallet app, go to Wallet > Card > Apply Now, and start your application.

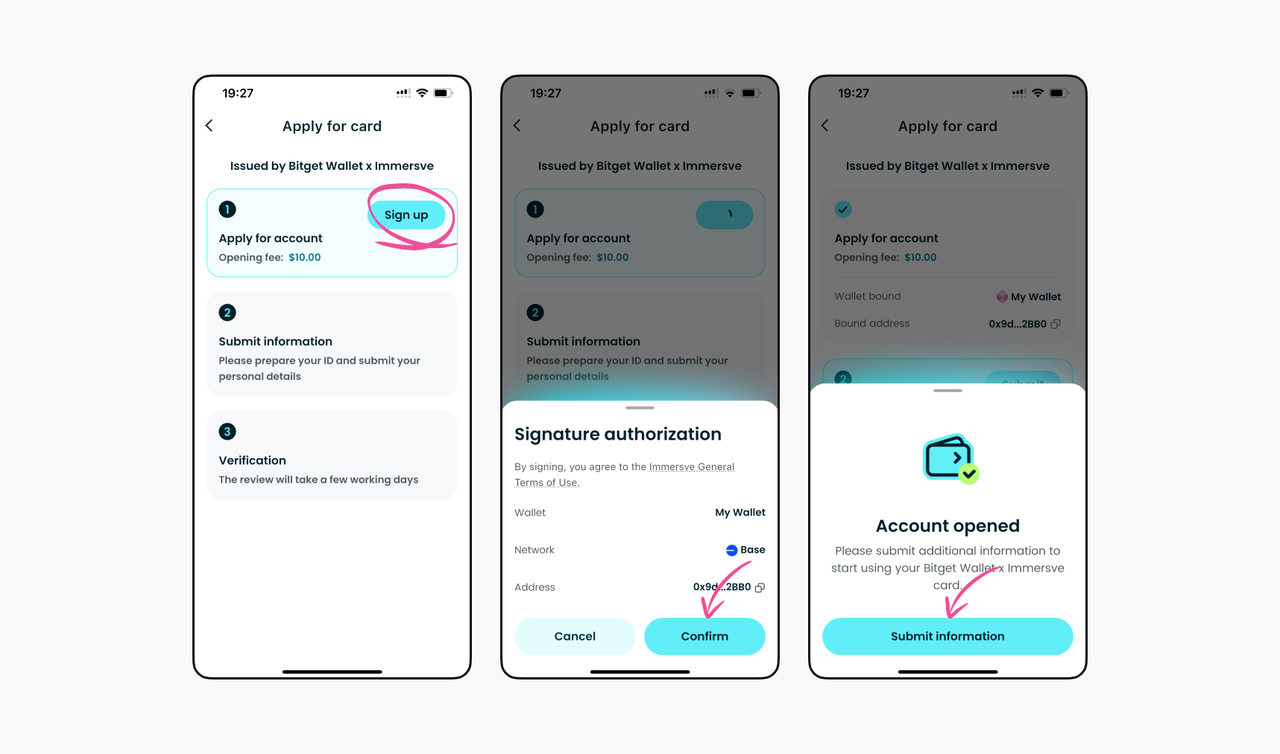

Step 2: Sign Up for an Account

Tap Sign Up and sign the on-screen transaction to create your card account. A one-time opening fee of 10 USDC applies.

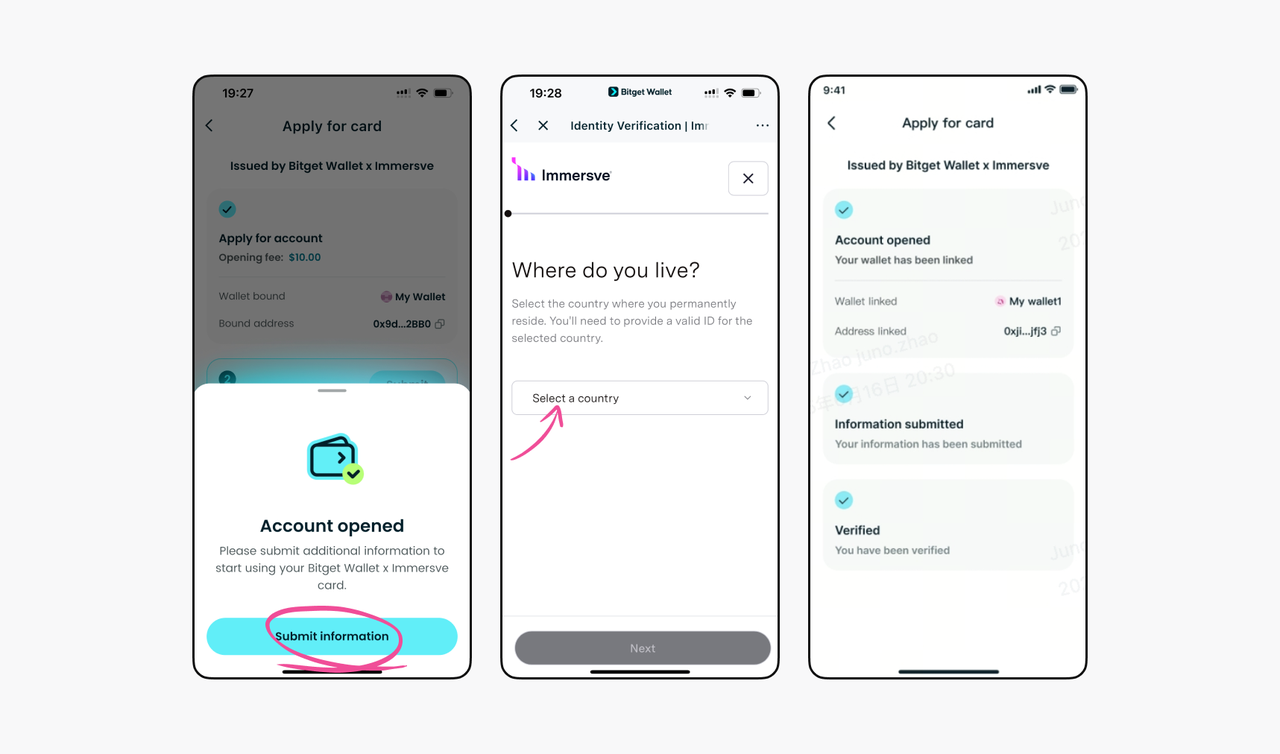

Step 3: Submit Personal Information

Provide your country, address, contact details, and estimated monthly spend.

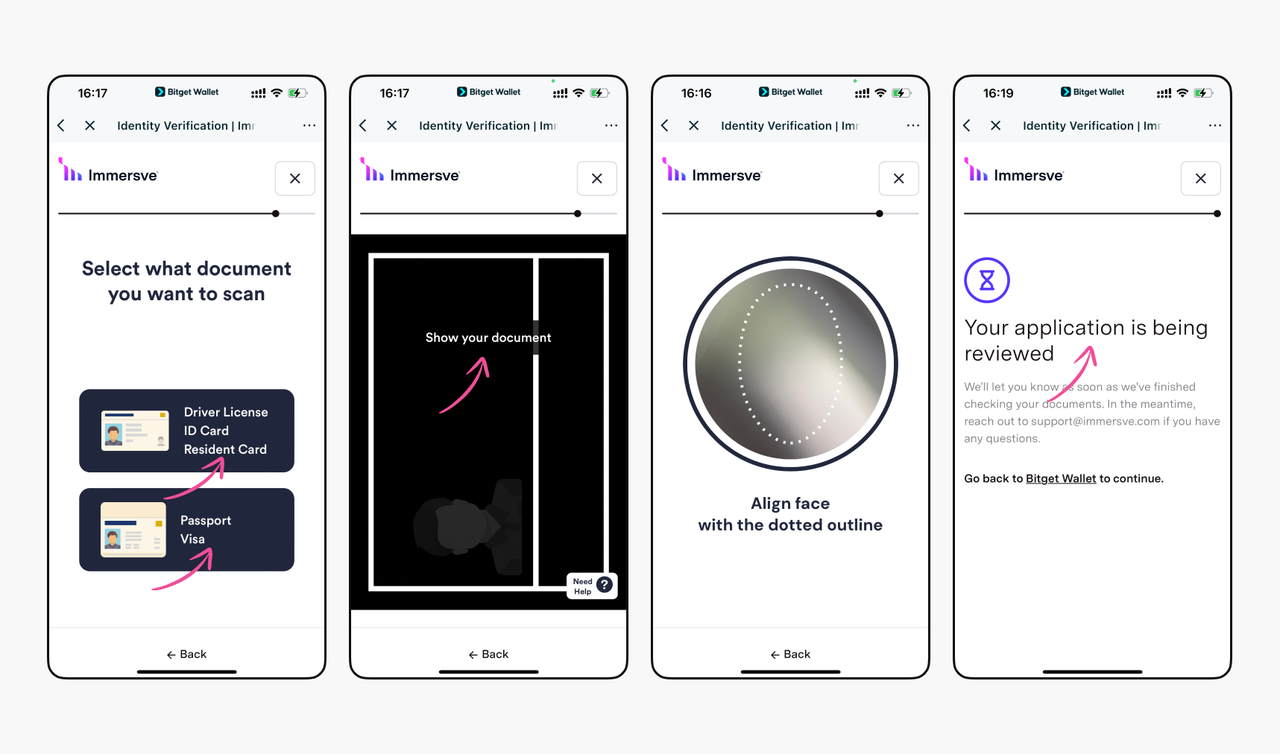

Step 4: Verify Your Identity

Upload a valid ID (passport, driver’s license, or national ID) and complete a quick face verification. Most applications are approved in under 3 minutes.

Step 5: Activate Your Card

Pay the 10 USDC issuance fee to activate your Bitget Wallet Card. Once activated, you can view your digital card details and add it to Apple Pay or Google Pay for instant use.

Why Use Bitget Wallet for Your Crypto Purchases?

Bitget Wallet offers a secure, beginner-friendly platform with cross-chain support, advanced memecoin trading, and stablecoin integration. Compared to MetaMask, Phantom, or Trust Wallet, Bitget Wallet’s Rewards Card support in Asia, direct gift card redemption, and built-in DEX aggregator make it stand out.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Conclusion

Best Crypto Card Rewards of 2026 are redefining how digital asset holders shop, travel, and earn. Whether you choose a debit card like the Bitget Wallet Card for its no-staking accessibility, or a high-yield credit option for maximum cashback, the right choice depends on your lifestyle, spending habits, and risk tolerance.

From 15% category bonuses to no-fee international purchases, the top cards this year prove that crypto payments are no longer a niche experiment—they’re a mainstream financial tool. But rewards only have value if they’re stored securely and managed smartly.

Download the Bitget Wallet today to keep your earned crypto rewards safe. With cross-chain support, memecoin trading, and stablecoin storage, it’s the ultimate companion for turning everyday purchases into long-term digital wealth. Take control of your crypto rewards now—because the best perks go to those who act early.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Are crypto rewards cards safe to use?

Yes, if issued by trusted banks or networks like Visa/Mastercard. Store rewards in secure wallets such as Bitget Wallet for added protection.

2. How do I get the highest cashback from a crypto card?

Pick cards with top rates in your spend categories, low fees, and staking perks. Combining Bitget Wallet Card with others can boost total rewards.

3. Do I have to pay taxes on crypto card rewards?

In many regions, crypto rewards are taxable when received. Later gains or losses on sales may incur capital gains tax—keep records.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins