How to Trade WLFI Tokens Safely (2026): Listings, Unlocks, and Security Tips

This guide explains where to buy WLFI, how to avoid scams, and what to know about the unlock schedule. WLFI is high-risk; trade only what you can afford to lose.

How to Trade WLFI Tokens has become a leading query following the launch of World Liberty Financial (WLFI). This beginner-friendly guide explains where WLFI is listed, how to trade it securely, and how to store assets in a non-custodial wallet such as Bitget Wallet. Launched in 2025 with prominent political and financial associations, WLFI is both high-profile and controversial; this guide prioritizes practical steps and risk controls over hype.

What Is World Liberty Financial the WLFI Token?

World Liberty Financial (WLFI) is a governance-focused crypto built on Ethereum’s Layer 2. Launched with Trump family backing and over $550M raised, it gives holders capped voting rights but leaves core control with the WLF corporation. Initially non-transferable, WLFI becomes tradable from September 1, 2025, with a 20% token unlock and a speculative valuation near $40B FDV.

WLFI vs Other Tokens

| Feature | WLFI | Governance Tokens (e.g., UNI, COMP) | Memecoins (e.g., DOGE, PEPE) |

| Primary Purpose | Governance + DeFi payments | Protocol governance | Pure speculation & community |

| Backers | $550M presale, Trump-aligned investors | VCs / Foundations | Grassroots / social media |

| Supply Release | 20% unlock at TGE, rest via Lockbox votes | Usually liquid at launch | Often 100% circulating |

| Regulatory Exposure | High (political + SEC scrutiny) | Moderate | Low |

| Utility | Payments, DeFi roadmap, voting | Governance rights | None (mostly) |

| Volatility Risk | High (unlock + politics) | Medium | Extreme but short-lived |

| Security Audits | Cyfrin audit on Lockbox (2025) | Varies by protocol | Rare |

How Was WLFI Launched and Funded?

WLFI’s path to market was anything but ordinary. Backed by high-profile political ties and massive presale demand, the token’s launch drew both mainstream headlines and regulatory scrutiny. From its record-breaking raise to its integration with the USD1 stablecoin system, WLFI quickly positioned itself as a politically branded DeFi experiment with global investor interest.

- WLFI’s launch was headline-making: a presale that raised over $550M in commitments.

- Strict SEC oversight limited U.S. investors, while offshore buyers gained larger access.

- WLFI is structured as an ERC-20 token on Ethereum L2, with cross-chain expansion in development.

- It connects to the USD1 stablecoin ecosystem, intended to back WLFI’s payment and DeFi features.

- Media attention skyrocketed due to its association with Trump family allies and branding as a “political DeFi experiment.”

How Does WLFI Differ From Other Crypto Tokens?

While most new tokens fight for attention through hype alone, WLFI sets itself apart by tying governance, payments, and DeFi use cases to a highly visible political brand. This mix of utility, financial ambition, and political narrative gives WLFI a different trajectory than standard memecoins, positioning it as both a speculative asset and an experiment in tokenized influence.

- Utility: Unlike pure memecoins, WLFI positions itself as a payment and DeFi token.

- DeFi Integration: Future roadmaps highlight lending, staking, and liquidity programs.

- Narrative: WLFI blends financial ambition with political branding—something not seen since meme coins like MAGA but with more serious backing.

- Comparison: Memecoins thrive on hype. WLFI leans on futures trading, listing exchanges, and stablecoin connections for longevity.

How to Trade WLFI Tokens on Secure Exchanges?

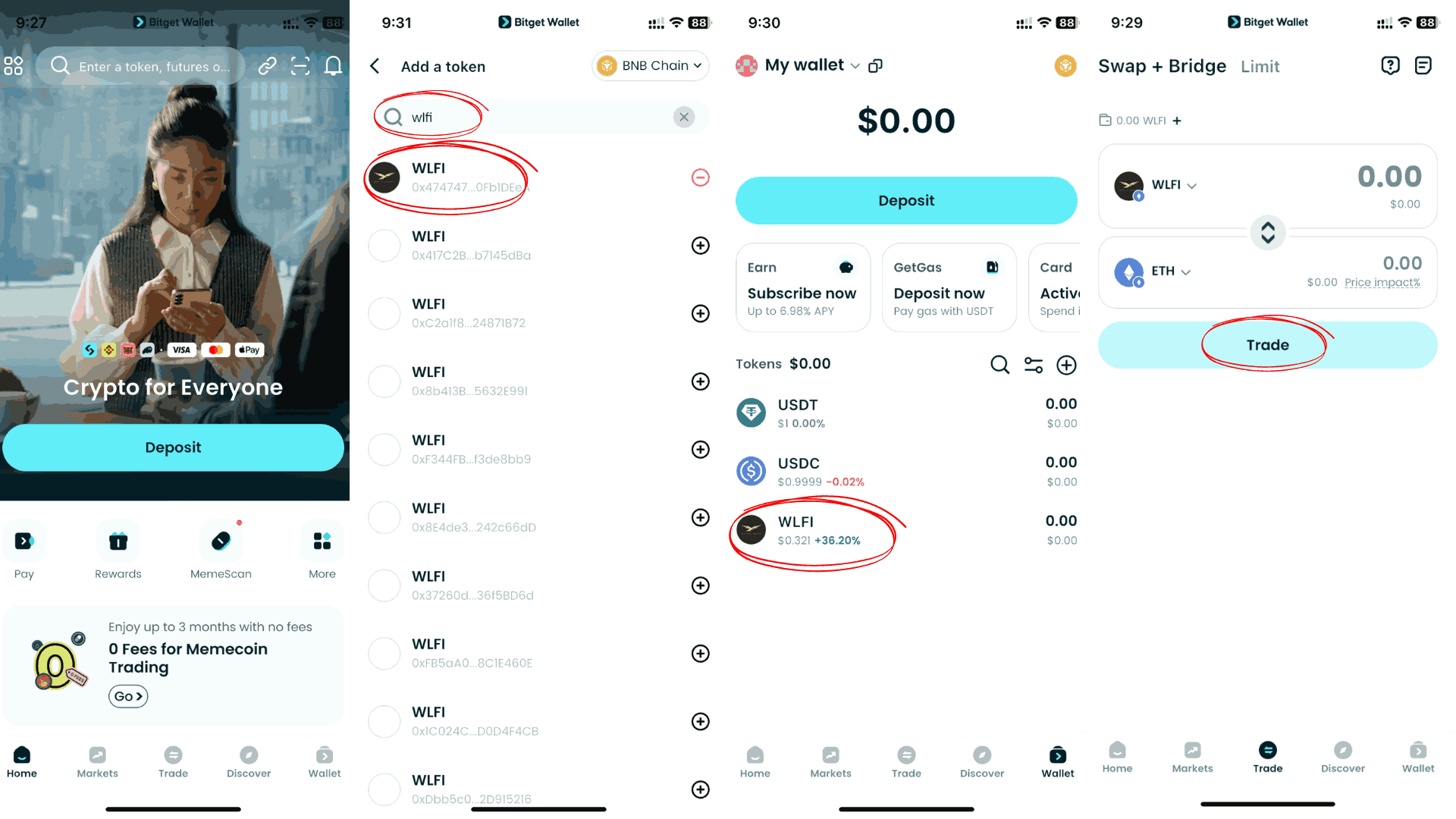

To trade WLFI safely, follow these best-practice steps:

- Install Bitget Wallet on your mobile device (iOS or Android) and ensure it’s the latest version.

- Create or import a wallet and back up the recovery/seed phrase offline — never store screenshots or cloud copies.

- Deposit USDT or ETH into the wallet and keep a small amount of ETH available for gas fees.

- Verify and add the official WLFI contract address using a reliable block explorer (e.g., Etherscan) to avoid counterfeit tokens.

- Open the Swap feature inside Bitget Wallet and choose USDT or ETH as the asset you’re exchanging.

- Select WLFI as the token to receive, set a conservative slippage tolerance, and confirm the trade.

- After settlement, check your WLFI balance in the wallet.

- Use the wallet’s approval manager to revoke any unnecessary permissions created during the swap.

- Store your tokens in Bitget Wallet’s non-custodial storage, and keep an eye on WLFI’s unlock schedule before deciding when to sell or stake.

Which Exchanges List WLFI Tokens?

WLFI is now available on both decentralized and centralized platforms, giving traders multiple access points depending on their preferences.

- Decentralized: Bitget Wallet supports direct swaps with USDT and other stablecoins in a non-custodial setup.

- Centralized:

- Bitget Exchange – one of the earliest and most liquid WLFI listings.

- Binance – broad global liquidity.

- OKX – popular for futures and derivatives.

- Uniswap – decentralized ERC-20 swap option.

- Hyperliquid – smaller but active futures market.

👉 Why Bitget Wallet? It combines ease of use with security: beginner-friendly design, 130+ chains supported, and full self-custody, making it the fastest and safest entry point for WLFI trading.

How Do You Create and Verify Your Exchange Account?

For centralized platforms like Bitget Exchange or Binance:

- Complete KYC (ID verification).

- Enable 2FA (Google Authenticator, SMS, or Email codes).

- Secure account recovery options.

For decentralized trading on Bitget Wallet:

- Download app (iOS/Android).

- Create a new wallet or import an existing one.

- Backup seed phrase securely.

- No KYC required, but always safeguard recovery details.

What Trading Pairs Are Available for WLFI?

WLFI is already live on several major exchanges, and like most new tokens its liquidity is concentrated around a few key pairs. Traders can choose between stablecoin pairings for stability, or crypto pairings for more volatility and speculation.

- WLFI/USDT (most common).

- WLFI/BTC (higher volatility).

- WLFI/ETH (ERC-20 pairing).

- Some localized pairs like WLFI/TRY (Turkey).

What Fees and Costs Should Traders Expect?

Trading WLFI isn’t free—different platforms apply their own charges, and costs can shift depending on whether you use a centralized exchange or Bitget Wallet. Beyond fees, hidden expenses like slippage and gas can eat into profits if you’re not careful.

- Spot trading fees: 0.1% typical.

- Futures fees: maker/taker discounts apply.

- Wallet swaps: minimal DEX fees on Bitget Wallet.

- Security tips:

- Use limit orders to avoid slippage.

- Always check gas fees on Ethereum.

- Avoid trading WLFI during unlock spikes (volatility risk).

How to Secure WLFI Tokens After Trading?

After buying WLFI, move it to Bitget Wallet, add the official contract, and secure your seed phrase offline. Use the wallet’s approval manager to clear unused permissions, and note that WLFI’s Lockbox unlocks only 20% at launch with the rest released later by governance. Turn on notifications to stay ahead of unlock events and volatility.

Understand the WLFI Lockbox (Read This First)

Before moving your tokens anywhere, know how WLFI’s Lockbox works:

- Only 20% of supply unlocked at TGE (Sept 1, 2025).

- Remaining 80% released gradually based on governance votes.

- Smart contract audited by Cyfrin (2025).

- View the live contract on Etherscan WLFI.

Why it matters: the unlock schedule affects liquidity and price swings — check it before you decide to stake, swap, or sell.

What Is the WLFI Lockbox and How Does It Work?

To manage supply and reduce early sell pressure, WLFI introduced a smart contract system known as the Lockbox, which controls how and when tokens become available to holders.

- Lockbox System: WLFI tokens are partially locked.

- 20% unlock available to retail traders at TGE.

- 80% unlock depends on governance votes.

- Audited by Cyfrin for smart contract security.

- Intended to prevent immediate dump but adds compliance complexity.

How Do You Store WLFI Safely in Bitget Wallet?

Once you’ve traded WLFI, the safest move is to shift it into Bitget Wallet, where you retain full control instead of leaving tokens on an exchange. The wallet combines security features with ease of use, making it ideal for both beginners and experienced traders.

Bitget Wallet offers:

- Non-custodial design: private keys are yours.

- Multi-Party Computation (MPC): advanced protection.

- Cross-chain storage: trade WLFI, store memecoins, stablecoins, and Bitcoin together.

- User-friendly interface: easy swaps, staking, and DApp integration.

What Common Issues Have Users Faced With WLFI Unlocks?

Like many new tokens with staged releases, WLFI’s unlock process hasn’t been perfectly smooth. Early users reported a mix of technical hiccups and market risks that are worth noting.

- Coinbase Wallet glitch: unlock timing issues led to delays.

- Compliance KYC delays: some users reported frozen transfers while documents verified.

- Liquidity spikes: initial futures listings created sudden liquidation cascades.

What Are the Best Practices for WLFI Trading in 2025?

Trading WLFI requires careful preparation. Given its political associations, staged unlocks, and evolving use cases, adopting a disciplined approach can help traders mitigate risk while staying positioned for potential opportunities.

How Do You Analyze WLFI Market Trends Before Trading?

Market analysis should go beyond price charts. Reliable indicators provide a clearer view of adoption and liquidity:

- On-chain tools such as Glassnode, Dune, and Nansen reveal wallet activity and token flows.

- Active address growth reflects whether user participation is expanding or stagnating.

- Futures open interest (OI) highlights the level of leveraged speculation.

- Liquidity depth on exchanges like Bitget and Binance indicates whether trades can be executed without excessive slippage.

Taken together, these signals offer a stronger foundation for decision-making than relying on price action alone.

What Tips Should Beginners Follow When Trading WLFI?

For new traders, simplicity and security should take priority. Key practices include:

- Conduct independent research (DYOR) before entering trades.

- Start with small positions, as WLFI is volatile.

- Enable two-factor authentication (2FA) on exchange accounts.

- Withdraw WLFI into Bitget Wallet immediately after trading, ensuring full custody of assets.

- Verify the official WLFI contract to avoid interacting with fraudulent tokens.

Adhering to these steps reduces exposure to common pitfalls faced by inexperienced traders.

Can You Stake or Use WLFI in DeFi Protocols?

WLFI’s role within DeFi is still evolving. Early signals suggest it may be integrated into lending markets and, in time, offer staking opportunities, although no official pools have launched yet. In addition, WLFI is expected to support payments within the USD1 stablecoin ecosystem, providing utility beyond speculative trading. Until these features are formally implemented, traders should exercise caution and avoid engaging with unofficial or unverified staking programs.

What Risks Should You Consider Before Trading WLFI?

Like any emerging token, WLFI carries notable risks that traders should weigh before entering the market. These risks span ownership concentration, regulatory exposure, and technical vulnerabilities.

How Concentrated Is WLFI Ownership?

WLFI’s supply is heavily tilted toward a small group of early backers, making ownership far from evenly distributed. A substantial share is reported to be held by Trump family allies and affiliated insiders, which means a limited number of wallets control a disproportionate amount of the circulating supply. This type of whale concentration raises the risk of market manipulation—large holders can move prices significantly with relatively small trades, leaving retail traders exposed to sudden volatility. For a token already tied to politics and speculation, such concentration adds an additional layer of uncertainty that every trader should factor into their strategy.

Could WLFI Face Regulatory or Political Challenges?

WLFI’s political ties add risks that go beyond normal market volatility. The SEC could classify WLFI as a security, bringing heavier compliance requirements. At the same time, its branding around U.S. politics means prices may swing sharply around election news, campaign events, or policy debates—creating headline-driven volatility that traders can’t ignore.

What Are the Technical and Smart Contract Risks?

Beyond ownership and regulation, WLFI also carries technical risks tied to its infrastructure and market design. These factors can directly impact both security and trading stability.

- The Lockbox unlock system has yet to be fully tested under stress.

- Futures markets with high leverage could trigger sudden liquidations.

- As an ERC-20 token, WLFI remains exposed to contract exploits or bugs.

FAQs About How to Trade WLFI Tokens

Can I stake WLFI after buying it on an exchange?

Limited staking opportunities exist through certain DeFi platforms, but official staking pools backed by the project have not yet been launched. Traders should be cautious with third-party programs that promise unusually high returns, as these may carry additional risks.

What networks support WLFI tokens?

WLFI currently operates on Ethereum Layer 2, offering faster transactions and lower gas fees than Ethereum mainnet. The project has indicated plans for cross-chain expansion, which may increase accessibility over time.

What is the minimum WLFI needed to trade?

There is no fixed minimum for WLFI trades—most exchanges allow positions starting at less than $10. However, network fees and exchange costs can make very small trades less practical.

Is WLFI safe compared to other DeFi tokens?

WLFI carries higher political and regulatory risks than most DeFi tokens due to its branding and ownership concentration. That said, storing WLFI in Bitget Wallet provides a non-custodial layer of protection, giving users more security than leaving tokens on exchanges.

How do I avoid fake WLFI staking pools?

Only interact with pools or contracts published on WLFI’s official channels or verified through reputable block explorers. Double-check contract addresses on Etherscan before approving any transaction, and avoid offers promising unrealistically high annual yields.

Is WLFI legal to trade in the US/EU?

WLFI’s regulatory status is still evolving. U.S. residents face tighter restrictions due to potential securities classifications, while most EU countries allow WLFI trading under existing virtual-asset rules. Always confirm local regulations or consult a qualified advisor before investing.

What are gas fees when swapping WLFI?

Because WLFI runs on Ethereum Layer 2, gas fees are generally lower than on mainnet. Costs vary with network congestion and the platform used (e.g., Bitget Wallet vs Uniswap). Check the estimated fee in your wallet before confirming a swap.

Sign up Bitget Wallet now - grab your $2 bonus!

Conclusion

How to Trade WLFI Tokens safely and profitably depends on choosing the right exchange and wallet. Start by learning WLFI’s unique tokenomics, trade only on secure platforms like Bitget Exchange, and always store assets in a non-custodial option such as Bitget Wallet. By following best practices—small trades, strong security, and awareness of unlock mechanics—you can navigate WLFI’s volatile but promising ecosystem.

Download Bitget Wallet today to trade WLFI across chains, store stablecoins, and explore the latest DeFi opportunities with maximum security.

Sign up Bitget Wallet now - grab your $2 bonus!

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins