How to Buy ENTEROMIX in 2026: A Beginner’s Step-by-Step Guide to The Cure To Cancer

How to buy ENTEROMIX is a question more investors are asking in 2026 as narrative-driven tokens tied to bold themes such as The Cure To Cancer gain attention across on-chain markets. Before buying, it’s essential to understand liquidity conditions, verify the official ENTEROMIX contract address, and assess ENTEROMIX price volatility, since this token’s movements are largely driven by sentiment and trading depth rather than traditional fundamentals.

This guide explains how to buy ENTEROMIX step by step, where to buy ENTEROMIX, and how to manage execution risk responsibly. Many users choose Bitget Wallet = Secure Stablecoin Storage + Hot Memecoin Trading + Seamless Cross-chain Experience when accessing on-chain liquidity, helping them maintain self-custody while navigating volatile narrative tokens.

Key Takeaways

- How to buy ENTEROMIX depends on whether it is listed on a centralized exchange or primarily available through on-chain liquidity pools. Before executing any trade, always confirm the trading venue and liquidity depth to reduce slippage and execution risk.

- The safest execution method involves verifying the official ENTEROMIX contract address before any swap. This step helps prevent interacting with impersonation tokens and ensures you are trading the correct asset shown on price tracking platforms.

- ENTEROMIX price volatility is driven primarily by sentiment, liquidity conditions, and market attention rather than guaranteed fundamentals. As a narrative-focused token, price movements can shift rapidly depending on trading volume and community activity.

What Is The Cure To Cancer (ENTEROMIX)?

The Cure To Cancer (ENTEROMIX) is a narrative-driven crypto token positioned around a high-impact global theme. It trades primarily through decentralized liquidity pools and is not inherently backed by clinical research, pharmaceutical patents, or regulated medical products unless officially verified by its documentation.

ENTEROMIX functions as a speculative digital asset whose price behavior depends on market sentiment, community growth, and exchange liquidity rather than measurable medical outcomes.

What makes The Cure To Cancer ENTEROMIX different from utility tokens?

- Narrative vs utility: ENTEROMIX appears to be narrative-driven rather than a traditional utility token. It does not necessarily provide protocol governance or revenue-sharing unless explicitly documented.

- Price driver: Price movements are typically influenced by social attention, liquidity inflows, listings, and community-driven momentum.

- Where it trades: ENTEROMIX trading pair availability depends on its deployed chain (e.g., Solana, Ethereum, or Base). Liquidity is usually concentrated on DEX platforms.

Source: Bitget

Is The Cure To Cancer ENTEROMIX a scam or just high-risk?

The Cure To Cancer (ENTEROMIX) is not automatically a scam, but it should be treated as high-risk when transparency is limited, liquidity is low, copycats exist, or sudden price pumps occur. In speculative crypto spaces, tokens without established fundamentals or regulated backing often exhibit behavior that amplifies risk.

What users must do before deciding how to buy ENTEROMIX:

- Verify the official contract address on a trusted blockchain explorer to ensure you interact with the correct token and avoid impersonation.

- Avoid unofficial links from social media or random Telegram/Discord channels that could redirect to fake liquidity pools.

- Watch liquidity and holders concentration; low liquidity paired with high holder dominance often results in outsized price swings and execution slippage.

ENTEROMIX’s narrative nature and on-chain behavior mean news cycles and sentiment can move prices quickly, so staying updated through reliable sources and monitoring on-chain metrics is essential.

Where to Buy ENTEROMIX?

When users ask where to buy ENTEROMIX, they typically want the best balance between convenience, custody control, and execution quality. The key decision is custody: custodial platforms hold assets for you, while on-chain swaps allow direct wallet control.

Availability depends entirely on listings and liquidity. If ENTEROMIX is not listed on major centralized exchanges, users must buy ENTEROMIX on-chain through decentralized swaps.

Comparison of ENTEROMIX Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled | High | Self-custody users | Contract impersonation, slippage, gas fees |

| On-chain UEX | Custodial | Platform-managed | Medium | Hybrid users | Custodial exposure, withdrawal limits |

| Centralized Exchange (CEX) | Custodial | Platform-managed | Low | Beginners | Custodial risk, regulatory limits |

Why Many Users Buy ENTEROMIX With Bitget Wallet?

If The Cure To Cancer (ENTEROMIX) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control

Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution

Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution

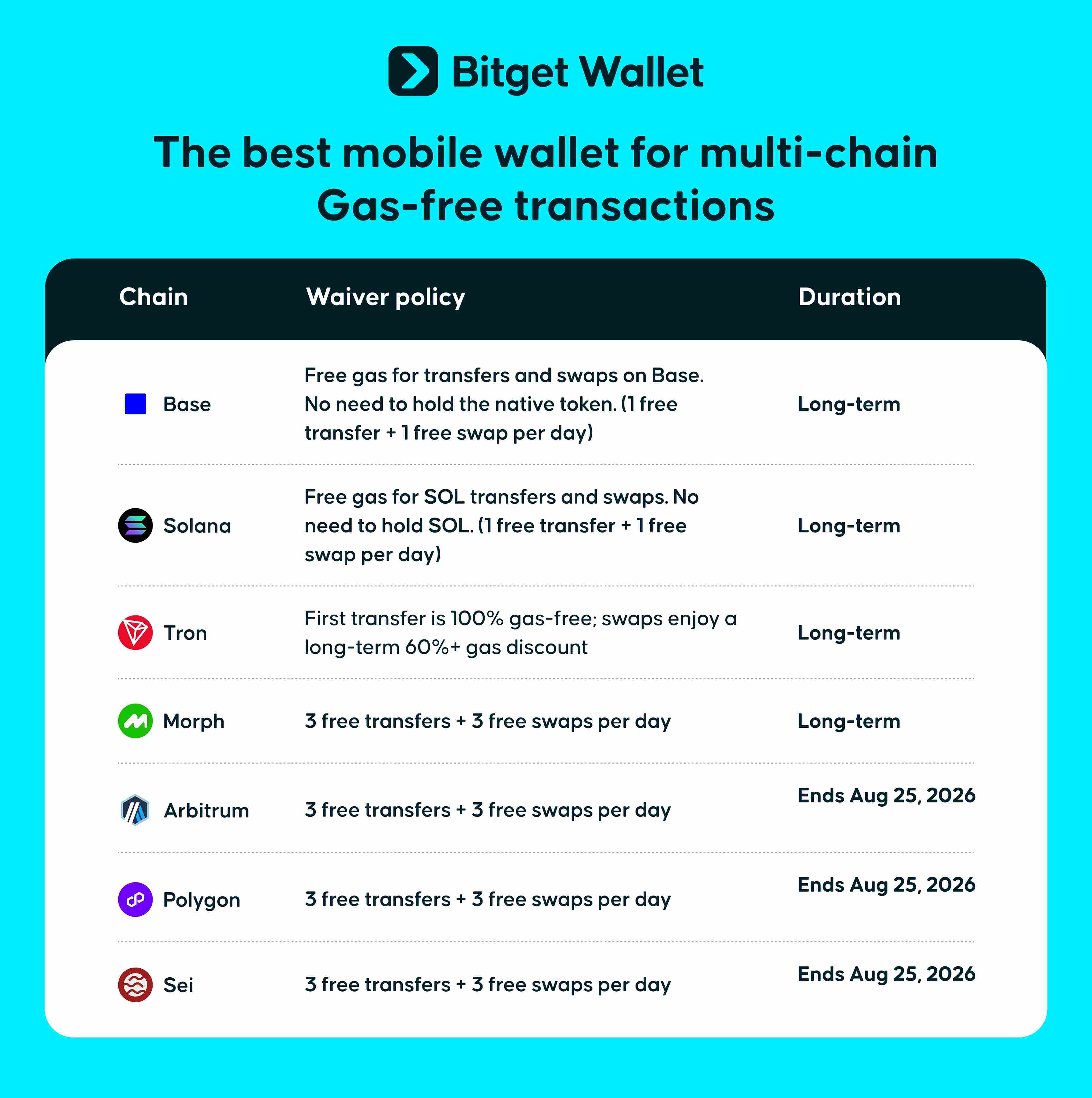

Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage ENTEROMIX across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management

After buying ENTEROMIX, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

How to Buy ENTEROMIX on Bitget Wallet?

Trading The Cure To Cancer (ENTEROMIX) is easy on Bitget Wallet. Follow these simple steps to get started:

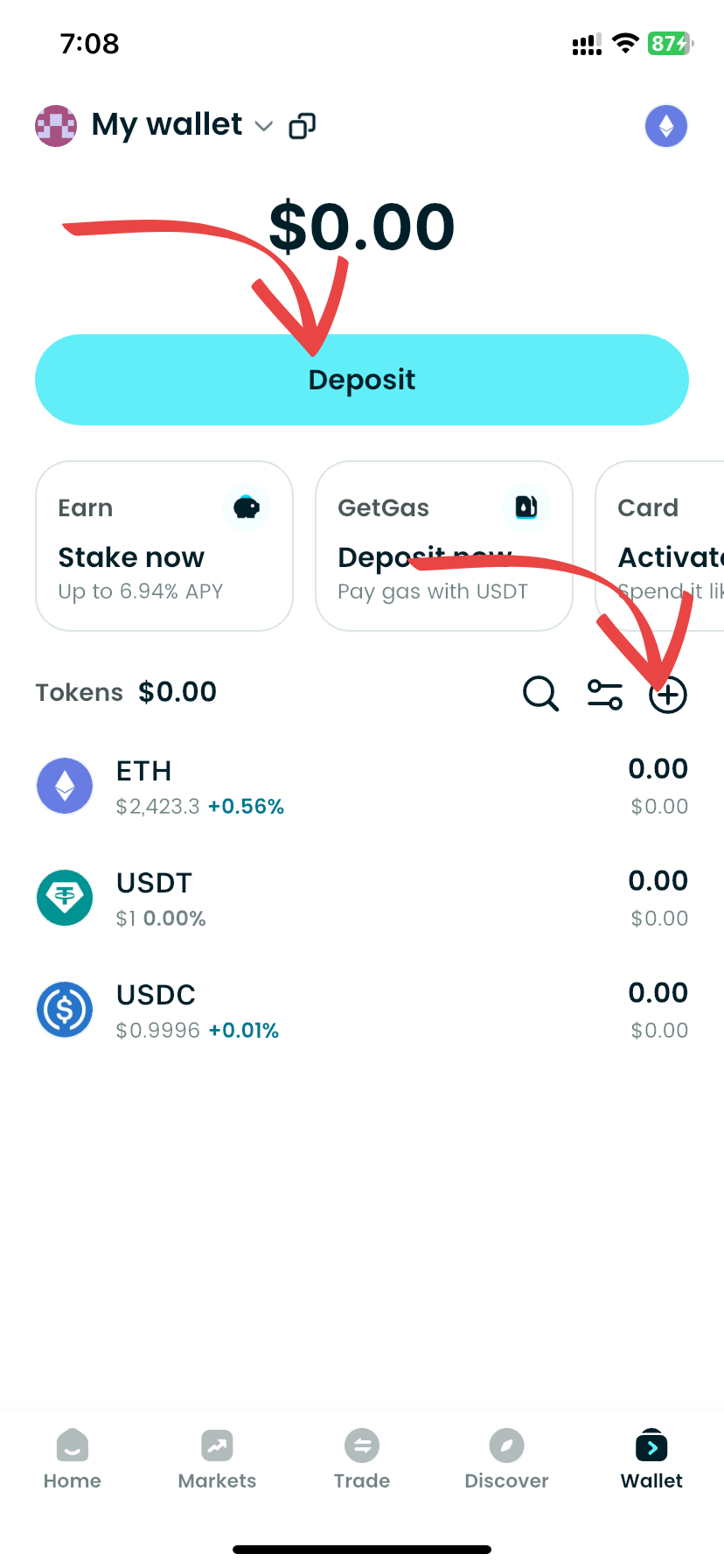

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading The Cure To Cancer (ENTEROMIX).

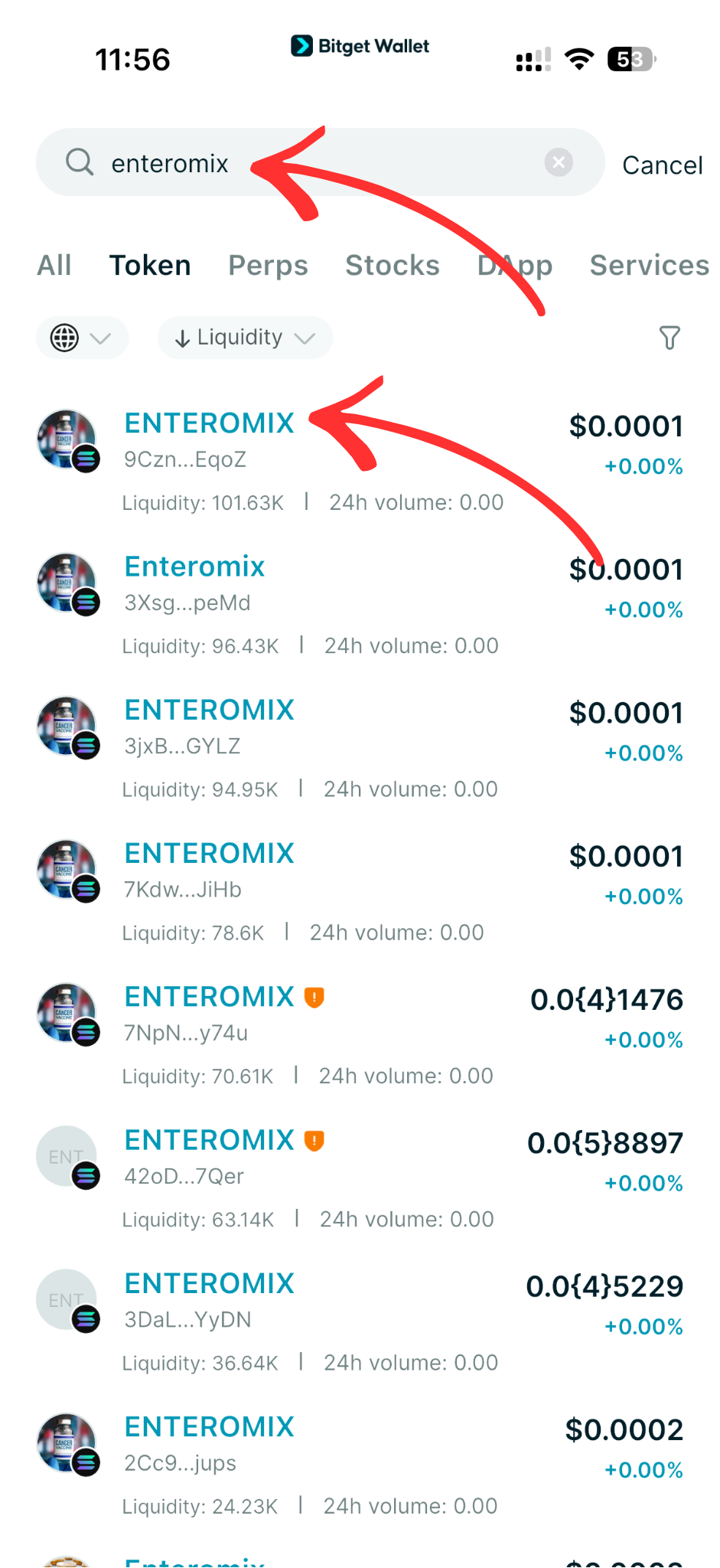

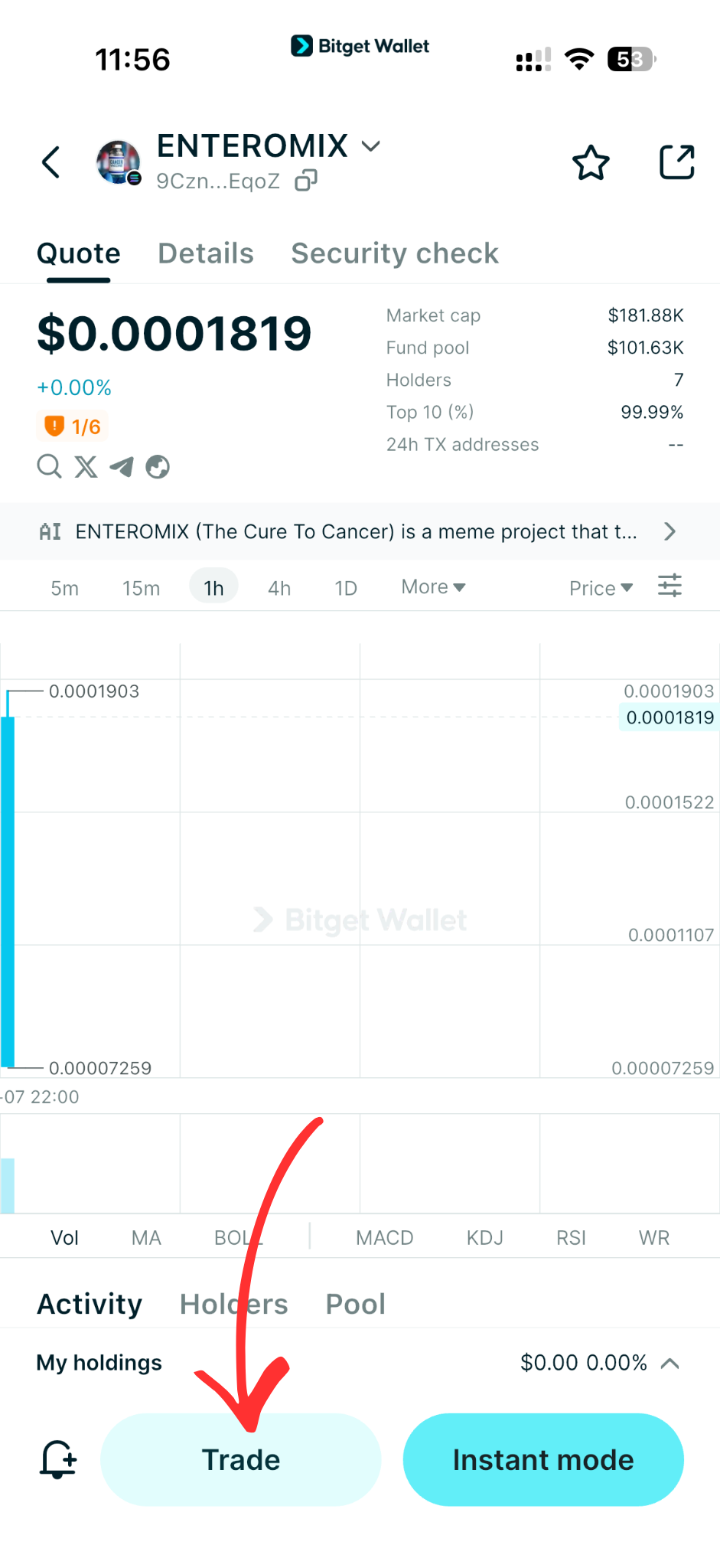

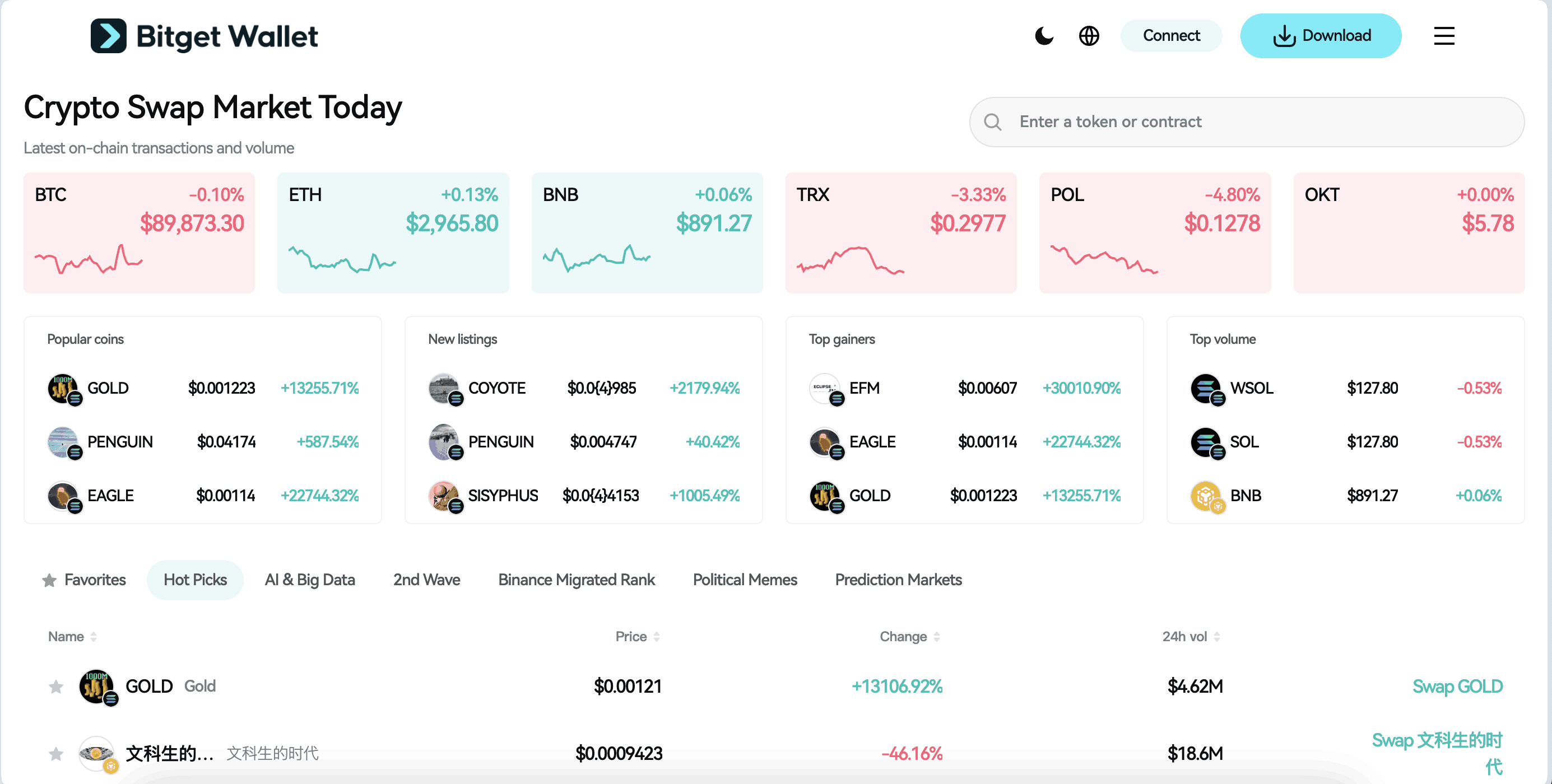

Step 3: Find The Cure To Cancer (ENTEROMIX)

On the Bitget Wallet platform, go to the market area. Search for The Cure To Cancer (ENTEROMIX) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, ENTEROMIX/USDT.

By doing this, you will be able to exchange The Cure To Cancer (ENTEROMIX) for USDT or any other cryptocurrency.

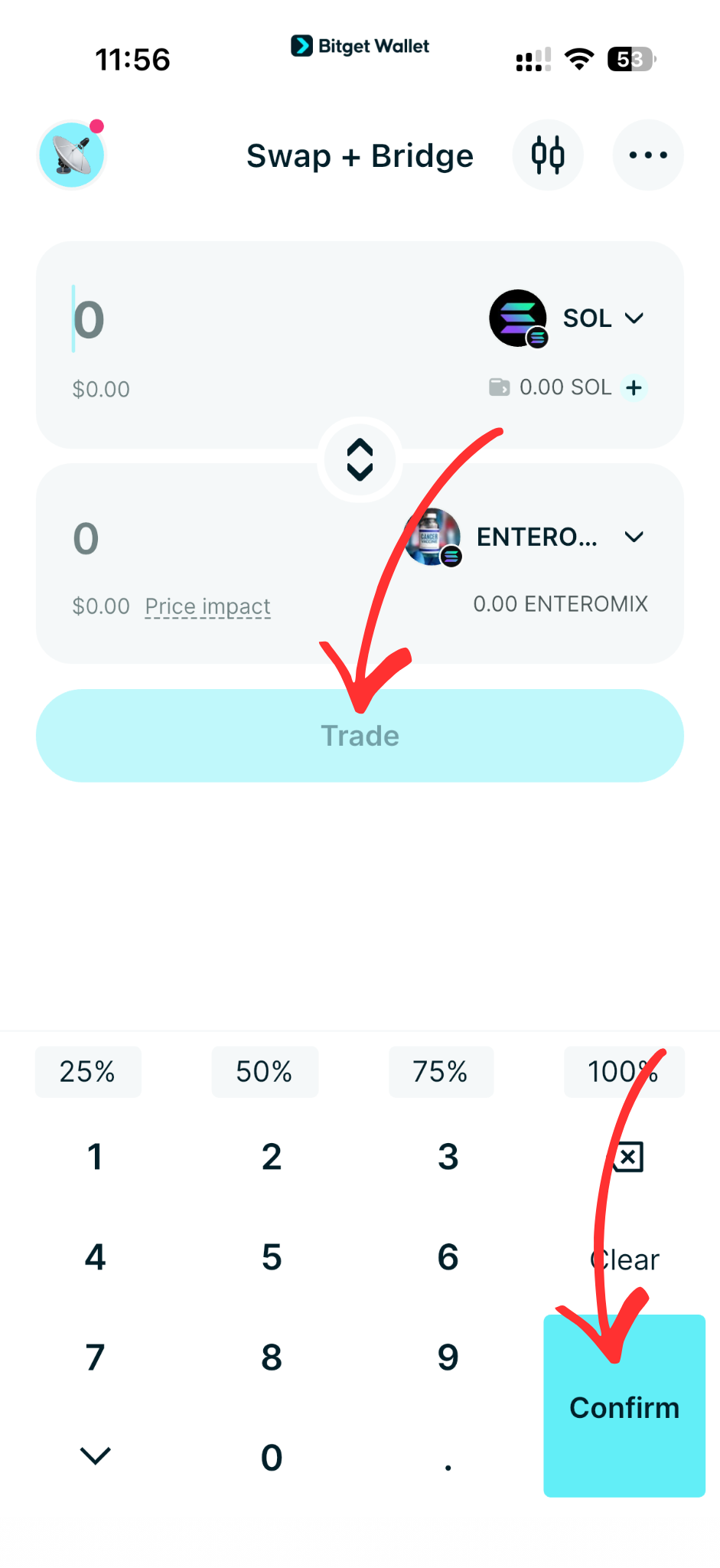

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of The Cure To Cancer (ENTEROMIX) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased The Cure To Cancer (ENTEROMIX).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your The Cure To Cancer (ENTEROMIX) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

What Should You Know About ENTEROMIX Price Volatility?

ENTEROMIX is a narrative-driven token rather than a regulated biotech or revenue-generating utility asset. ENTEROMIX price volatility is primarily driven by liquidity depth and market sentiment, meaning price movements tend to reflect trading activity and attention cycles instead of measurable fundamentals.

ENTEROMIX can experience sharp price fluctuations because low trading volume and concentrated liquidity make the market sensitive to relatively small buy or sell orders. On-chain liquidity conditions, holder concentration, and shifts in community attention can rapidly amplify price swings, which is why ENTEROMIX price volatility should be treated as a structural risk factor rather than an opportunity.

ENTEROMIX Price Prediction: How High Can The Cure To Cancer Go?

Forecasting ENTEROMIX requires caution because it is a narrative-driven token rather than a revenue-generating protocol with transparent cash flows. Factors such as overall crypto market conditions, liquidity sustainability, exchange exposure, and community participation influence valuation more than traditional fundamentals.

Because ENTEROMIX price volatility is heavily sentiment-based, any valuation range remains speculative and dependent on trading activity rather than measurable medical or technological milestones. Investors should treat projections as scenario analysis, not guaranteed outcomes.

Key Drivers of ENTEROMIX Price Movement

Several variables shape the potential value of The Cure To Cancer (ENTEROMIX):

- Market Dynamics: Broader crypto market cycles, Bitcoin momentum, and overall risk appetite directly affect speculative tokens like ENTEROMIX. During bullish phases, narrative tokens often experience amplified inflows; during risk-off periods, liquidity can contract rapidly.

- Adoption & Community Attention: ENTEROMIX appears to rely primarily on community growth, social engagement, and attention cycles rather than protocol-generated revenue. Increased visibility can temporarily expand liquidity, while declining attention can reduce trading depth.

- Liquidity & Exchange Access: The availability of trading pairs, depth of liquidity pools, and potential exchange listings significantly influence execution quality and price stability. Thin liquidity can magnify both upward and downward price movements.

Future Growth Prospects

If ENTEROMIX maintains community engagement and sustains liquidity across trading venues, short-term price stability may improve relative to extremely low-volume conditions. However, because its valuation is sentiment-sensitive and liquidity-dependent, future growth remains highly speculative and vulnerable to rapid market shifts.

Source: Bitget Wallet

Is ENTEROMIX Crypto Safe to Invest In?

Whether ENTEROMIX is “safe” depends less on the token itself and more on how users manage execution, exposure, and verification. As a narrative-driven asset with liquidity-sensitive price behavior, the primary risks come from volatility, contract confusion, and trading discipline rather than guaranteed structural security.

Safety in crypto is largely determined by user behavior—how carefully you verify the ENTEROMIX contract address, assess liquidity depth, and control position size. Execution quality, custody choice, and risk management matter more than the narrative surrounding the token.

Key Risks to Consider:

- Fake or impersonation tokens: Copycat contracts using similar names can mislead buyers who do not verify the official ENTEROMIX contract address.

- Low liquidity risk: Thin liquidity pools can cause extreme slippage, making it difficult to enter or exit positions without significant price impact.

- Holder concentration: If a small number of wallets control a large portion of supply, coordinated selling can trigger sharp downturns.

- Overexposure to volatility: Allocating too much capital to a high-volatility narrative token increases portfolio risk.

No speculative crypto asset is risk-free, and ENTEROMIX is no exception. Investors should approach participation with disciplined capital management and independent research rather than assuming inherent safety.

How to Approach ENTEROMIX Volatility With a Smarter Strategy?

Summary Block

When dealing with ENTEROMIX price volatility, discipline matters more than trying to time short-term market swings. Users can reduce avoidable losses by focusing on controlled exposure, liquidity awareness, and structured execution rather than reacting emotionally to price spikes. This approach also builds transferable on-chain skills that apply to any speculative crypto asset.

Practical Risk-Control Steps:

- Observe on-chain liquidity behavior: Monitor pool depth, trading volume, and holder concentration before entering a position to understand execution risk.

- Use small position sizes: Start with limited capital exposure so that unexpected swings do not significantly impact your overall portfolio.

- Set clear capital limits: Define maximum allocation and acceptable loss thresholds before trading ENTEROMIX to prevent emotional decisions.

- Prioritize secure execution: Always verify the official contract address and double-check swap details to avoid interacting with fake tokens.

Developing disciplined habits while navigating ENTEROMIX volatility strengthens long-term decision-making and builds skills that remain valuable across different market cycles and token types.

Conclusion

How to buy ENTEROMIX starts with understanding where it trades, verifying the official ENTEROMIX contract address, and assessing liquidity before executing any swap. Because ENTEROMIX price volatility is heavily influenced by sentiment and trading depth rather than traditional fundamentals, disciplined execution and risk management are essential for anyone considering exposure.

Trade narrative-driven tokens with full self-custody control using Bitget Wallet. Beyond secure on-chain swaps and multi-chain access, Bitget Wallet also supports Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on memecoins / selected RWA U.S. stock tokens—giving users flexible capital management options within a single secure ecosystem.

Unlock cross-chain DeFi and stablecoin savings easily in Bitget Wallet.

FAQs

1. How to buy ENTEROMIX safely as a beginner?

To understand how to buy ENTEROMIX safely, beginners should first verify the official ENTEROMIX contract address on a trusted blockchain explorer and confirm where liquidity exists. Start with a small test transaction, check slippage settings, and avoid unofficial links before increasing position size.

2. Where can I buy ENTEROMIX?

Where to buy ENTEROMIX depends on its listing status and available liquidity. If ENTEROMIX is not actively listed on major centralized exchanges, users typically buy ENTEROMIX on-chain through decentralized swaps using a supported wallet.

3. Do I need KYC to buy ENTEROMIX?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying ENTEROMIX through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is ENTEROMIX crypto high risk?

Yes, ENTEROMIX should be considered high risk due to its narrative-driven positioning, liquidity sensitivity, and price volatility. Thin trading volume and concentrated holder distribution can amplify sudden price swings.

5. How to avoid fake ENTEROMIX tokens?

Always double-check the official ENTEROMIX contract address using a reputable blockchain explorer before executing any swap. Avoid links from unknown social accounts and confirm liquidity pools match the verified contract to reduce impersonation risk.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy 404 Coin in 2026: A Beginner’s Step-by-Step Guide to 404 Coin2026-02-20 | 5mins