Espresso (ESP) Listing Guide: Launch Date! How This Rollup-Native Blockchain Improves Composability?

Espresso (ESP) listing is generating excitement in the crypto world, sparking speculation about its potential to be the next big success. Not long ago, an early investor in Celestia (TIA) turned a modest token sale allocation into tens of thousands post-launch. Now, another potential game-changer is entering the market—Espresso (ESP).

Recently launched via Kaito’s Capital Launchpad, this rollup-native sequencing and composability layer is stirring buzz among investors and modular blockchain enthusiasts. While it’s not yet listed on major centralized exchanges, many are watching closely for its next move. Will this be another success story in the making? In this article, we dive deep into what makes Espresso (ESP) stand out, how to gain exposure, and why investors are keeping a close eye on its next steps.

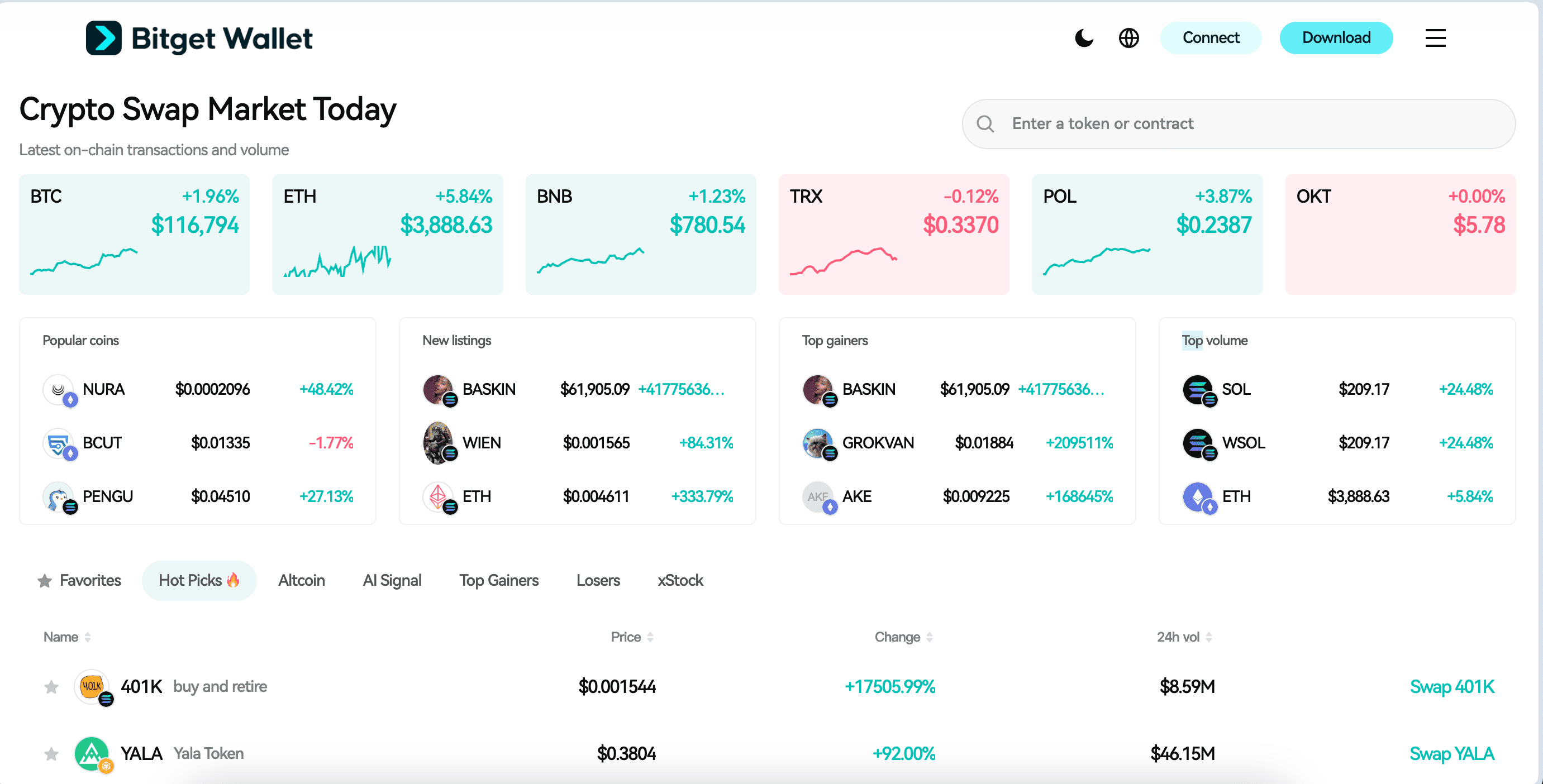

For those preparing ahead of the listing, Bitget Wallet offers secure stablecoin storage, fast cross-chain swaps, and frictionless memecoin trading—making it an ideal tool for managing assets in a modular, multi-chain future.

Espresso (ESP) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Espresso (ESP) listing:

- Exchange: TBA

- Trading Pair: ESP/USDT

- Deposit Available: TBA

- Trading Start: TBA

- Withdrawal Available: TBA

Don’t miss your chance to start trading Espresso (ESP) once it officially launches on an exchange and enters the open market.

- Please refer to the official announcement channels for the most accurate and up-to-date listing schedule.

Espresso (ESP) Price Prediction: Market Maker Impact

The listing of Espresso (ESP) is not just a retail trading event—it’s also a future battleground for market makers. While no official market makers like Wintermute, GSR, or Amber Group have been confirmed yet, the token's similarities to modular infrastructure projects like AltLayer (ALT) make it one to watch closely.

Key Market Maker Indicators

-

Market Maker Roster & Strategy:

No confirmed market maker for ESP yet, but if players like Wintermute or Amber Group enter post-listing, expect short-term aggressive volatility based on prior behavior seen in rollup infrastructure launches.

-

Liquidity Pool Size at Launch:

To be announced. Based on AltLayer’s launch, a moderate-to-high initial liquidity pool is expected, which could help stabilize early trading and reduce manipulation risk.

-

Market Maker Contract Expiry & Options Open Interest:

As of now, no options data or expiry timelines exist for ESP on Deribit or similar platforms. However, AltLayer's early volatility peaked near VC unlock periods and contract milestones—a pattern ESP could follow.

Price Projection Based on Comparable Market Activity

| Time Frame | Predicted Price Range (ESP) | Market Maker Influence |

| Short-term (1–3 months) | $0.15 – $0.28 | High volatility expected if market makers join post-listing |

| Medium-term (3–6 months) | $0.12 – $0.22 | Possible retracement as initial investors take profits |

| Long-term (12+ months) | $0.30 – $0.50+ | Growth tied to project adoption and macro DeFi trends |

Fear & Greed Narrative:

🚨 “The absence of confirmed market makers for $ESP adds uncertainty, but if groups like GSR or Wintermute step in, short-term price swings could mirror AltLayer’s 2x–3x launch trajectory.”

Source: CoinGecko, ICO Analytics, AltLayer market data

Note: The price prediction is sourced from comparative third-party data and is for reference only. It does not represent the official stance of Espresso (ESP) or Bitget Wallet. Always DYOR and verify with official market data before investing.

Source: Bitget Wallet

Explore Espresso (ESP) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

What Is Espresso: (ESP) Explained

Espresso (ESP) is a next-generation modular blockchain infrastructure project designed to power shared sequencing and composability across rollups. Developed by Espresso Systems, it aims to solve critical challenges in Layer 2 ecosystems—such as fragmented execution, MEV (miner extractable value) inefficiencies, and cross-rollup latency.

At its core, Espresso introduces a decentralized sequencing layer that helps rollups coordinate efficiently, ensuring faster finality, better interoperability, and lower costs. The ESP token plays a central role in governance, staking, and potentially paying for sequencing services across the ecosystem.

Launched via Kaito’s Capital Launchpad, ESP has garnered strong community interest and early support from investors focused on modular blockchain evolution.

Why Projector (ESP) Stands Out

- Solves Rollup Fragmentation: By offering a shared sequencer, Espresso enables faster coordination between different Layer 2s—improving throughput and user experience.

- Built for Composability: Unlike isolated rollups, Espresso's infrastructure is designed to make smart contracts and assets more interoperable across chains.

- Backed by Top-Tier VCs: Espresso Systems is supported by investors known for backing Ethereum scaling solutions, boosting credibility and long-term runway.

- Future-Proof Tech Stack: Modular, rollup-native design ensures Espresso aligns with the evolving direction of the Ethereum ecosystem and beyond.

Source: X

Espresso (ESP), the modular infrastructure token from Espresso Systems, recently completed its community sale on Kaito Launchpad. Designed for shared sequencing across rollups, ESP is drawing attention as a potential backbone of Ethereum’s modular future. While its exchange listing is still to be announced, investor buzz is already building.

The Espresso (ESP) Ecosystem: How It Functions

Espresso is a decentralized blockchain project designed to empower users through secure sequencing infrastructure, smart contract automation, and token-based governance.

By leveraging modular blockchain architecture, it enables seamless interactions such as staking, governance participation, and rollup coordination. Below is a step-by-step overview of how the Espresso (ESP) ecosystem works:

| Step | Process | Benefit |

| 1. Blockchain Integration | Espresso operates as a modular PoS-based sequencing layer for rollups. | Enables secure, fast cross-rollup transaction ordering |

| 2. Token Utility | ESP is used for staking, governance, and potentially sequencing fee payments. | Aligns incentives between users, validators, and developers |

| 3. Sequencing Logic Modules | Espresso enables programmable transaction ordering between rollups. | Boosts composability and reduces cross-rollup latency |

| 4. Governance Participation | ESP holders vote on protocol changes and ecosystem rules. | Community-driven decision-making and decentralization |

| 5. Staking | Validators and delegators stake ESP to maintain network integrity. | Earn protocol rewards while supporting ecosystem security |

Meet the Team Behind Espresso (ESP): Leadership and Strategy

Leadership

Espresso Systems is led by a team of researchers, cryptographers, and engineers with deep roots in blockchain scalability, privacy, and cryptographic proofs.

- Ben Fisch (CEO & Co-Founder) – A Yale professor and co-creator of the Filecoin protocol, Ben brings extensive experience in zero-knowledge proofs and distributed systems.

- Benedikt Bünz (Chief Scientist & Co-Founder) – A Stanford PhD and co-creator of Bulletproofs, Bünz is a leading voice in cryptographic research. He’s also involved in the development of other privacy-preserving protocols in the Ethereum ecosystem.

- Charles Lu (CTO & Co-Founder) – Formerly at Google and early contributor to open-source blockchain tooling, Lu oversees technical implementation and infrastructure development.

Their leadership blends academic credibility with real-world engineering chops, shaping Espresso into a serious Layer 2 infrastructure contender.

Strategy

Espresso’s core strategy is to decentralize rollup sequencing—solving fragmentation across Ethereum Layer 2s by offering a shared, modular sequencing layer. This sequencing infrastructure allows different rollups to interoperate more efficiently, reducing latency, enabling composability, and distributing MEV fairly.

Key pillars of Espresso’s strategy include:

- Rollup-Native Focus: Rather than compete with rollups, Espresso empowers them by coordinating transaction sequencing across ecosystems.

- Validator-Staked Security: A Proof-of-Stake model secures the protocol and aligns incentives via the ESP token.

- Governance Through ESP: Token holders will eventually steer protocol upgrades, fee structures, and validator parameters.

- Long-Term Ecosystem Integration: Espresso is positioning itself as a default sequencing layer for modular Ethereum-compatible chains.

This isn’t just a scaling project—it’s a fundamental coordination layer for the future of modular blockchain architecture.

The Role of Espresso (ESP) in Modular Blockchain Infrastructure: Use Cases Explained

Key Use Cases of Espresso (ESP)

-

Shared Sequencing for Rollups

Espresso acts as a decentralized sequencing layer that multiple Layer 2s can plug into. This enables synchronized transaction ordering across different rollups, reducing fragmentation and latency.

-

Cross-Rollup Composability

With a unified sequencer, smart contracts on different rollups can interact seamlessly—opening doors for multi-chain DeFi, gaming, and NFT applications.

-

Fair MEV Distribution

By decentralizing sequencing, Espresso helps ensure that miner extractable value (MEV) is fairly allocated across validators—preventing centralized players from extracting excessive value.

-

Governance and Incentive Alignment

ESP token holders can vote on upgrades, validator incentives, and protocol economics—ensuring decentralized control of key infrastructure.

-

Validator Staking and Security

Validators stake ESP tokens to participate in the sequencing process, reinforcing trust and deterring manipulation.

How Espresso (ESP) Is Transforming Modular Blockchain Infrastructure

Espresso isn’t trying to be the next smart contract platform—it’s aiming to become the backbone of rollup coordination. In a world where rollups are scaling Ethereum, Espresso solves the missing link: who orders the transactions, and how do rollups talk to each other?

By offering a shared, decentralized sequencing layer, Espresso:

- Unifies fragmented rollup environments

- Accelerates transaction finality and cross-chain messaging

- Builds the foundation for multi-rollup DeFi protocols

- Lowers complexity for developers building modular dApps

- Makes rollup ecosystems more interoperable, secure, and fair

This is infrastructure that rolls with the future, not against it.

Espresso (ESP) Roadmap: What to Expect in 2025 and Beyond

The roadmap for Espresso (ESP) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Launch Mainnet 1 featuring permissionless rollup integration for Arbitrum Orbit chains, alongside a cross-chain composability MVP. |

| Q2 2025 | Roll out Mainnet 2, adding OP Stack support and transitioning the network to full Proof‑of‑Stake. |

| Q3 2025 and Beyond | Scale to thousands of nodes, accelerate integrations with additional rollup stacks, and continue rollout of advanced composability tools and research outputs like CIRC and shared sequencing marketplace. |

These milestones underscore how ESP is building the foundational infrastructure for seamless composability across rollups—think fast confirmations, decentralized sequencing, and modular scaling.

How to Buy Espresso (ESP) on Bitget Wallet?

Trading Espresso (ESP) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Espresso (ESP).

Step 3: Find Espresso (ESP)

On the Bitget Wallet platform, go to the market area. Search for Espresso (ESP) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, ESP/USDT. By doing this, you will be able to exchange Espresso (ESP) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Espresso (ESP) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Espresso (ESP).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Espresso (ESP) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

The listing of Espresso (ESP) isn’t just about short-term profit—it marks a major step toward building a decentralized, modular future. Espresso aims to empower users and developers through secure sequencing, seamless rollup coordination, and composability across the Web3 infrastructure stack.

As Espresso gains traction, getting involved—whether through staking, governance, or community engagement—will be key to staying ahead in this rapidly evolving ecosystem.

To manage your assets securely and prepare for ESP’s future listing, Bitget Wallet offers a reliable, user-friendly platform to store and trade digital assets with confidence.

Step into the future of Web3 infrastructure. Download Bitget Wallet for faster cross-chain trending trades, perfect for beginners. Sign up now and grab your $2 bonus!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Espresso (ESP)?

Espresso (ESP) is the native token of Espresso Systems, a modular blockchain infrastructure project designed to provide a decentralized, shared sequencing layer for rollups. It enables faster transaction ordering, cross-rollup composability, and decentralized coordination across Layer 2 chains.

2. Is Espresso (ESP) listed on any exchanges yet?

No. As of now, ESP is not listed on centralized or decentralized exchanges. It recently completed its community sale on Kaito’s Capital Launchpad, and listing details are expected to be announced soon via official channels.

3. What can the ESP token be used for?

ESP is used for staking by validators, participating in governance decisions, and potentially paying sequencing fees within the network. It plays a critical role in securing the shared sequencing infrastructure and aligning incentives across the ecosystem.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins