Chainlink ETF Timeline: Key Dates, Approval Status, and What Comes Next for LINK

Chainlink ETF Timeline has become a focal point for institutional crypto investors as Wall Street gains its first regulated exposure to Chainlink (LINK) through a U.S.-listed spot ETF. Unlike speculative altcoin narratives, this timeline reflects how capital allocators position ahead of regulatory approval, fund inflows, and post-launch price behavior.

For retail investors tracking LINK, the ETF timeline offers more than headlines — it explains why LINK moved before listing, how institutional inflows shaped early trading, and what risks remain after launch. Tools like Bitget Wallet also allow investors to monitor LINK across chains and manage exposure securely during ETF-driven volatility.

In this article, we’ll walk through the full Chainlink ETF filing and launch timeline, analyze institutional inflows and LINK price reactions, compare LINK’s ETF path with Bitcoin and Ethereum, and explain how investors can participate safely as volatility evolves.

Key Takeaways

- Chainlink ETF Timeline shows how LINK experienced pre-launch accumulation, followed by confirmed institutional inflows after listing.

- Grayscale’s conversion of its Chainlink Trust into a spot ETF marked a major step toward institutional adoption of LINK.

- ETF-driven demand strengthens Chainlink’s long-term narrative, but short-term technical risks still require careful risk management.

What Is the Chainlink ETF?

Chainlink ETF provides regulated market access to LINK for institutional and traditional investors, making the Chainlink ETF Timeline critical for understanding how capital enters the asset before and after approval.

A Chainlink ETF allows investors to gain exposure to LINK through brokerage accounts without directly holding or managing the token themselves. This structure mirrors the evolution seen with Bitcoin and Ethereum ETFs, where regulatory approval often reshaped demand dynamics long before launch day.

How does a Chainlink spot ETF work?

A spot Chainlink ETF directly tracks the market price of LINK rather than using futures contracts. Key structural features include:

- Custody: LINK is held by a regulated custodian on behalf of the fund

- Creation & redemption: Shares are created and redeemed in cash, following the BTC and ETH ETF model

- Market exposure: Investors gain price exposure without self-custody requirements

This structure is designed to appeal to pension funds, asset managers, and institutions restricted from holding crypto assets directly.

Why do ETF timelines affect institutional behavior?

Institutional investors rarely wait for launch day. Instead, they position capital based on regulatory signals and approval probability. Along the Chainlink ETF Timeline, this behavior typically includes:

- Early accumulation ahead of expected approval windows

- Gradual exposure increases during listing anticipation

- Post-launch allocation adjustments based on ETF inflows

This explains why LINK showed strength before its ETF debut, aligning with patterns previously observed in Bitcoin and Ethereum ETF cycles.

What Is the Full Chainlink ETF Timeline So Far?

Chainlink ETF Timeline can be divided into three clear phases: regulatory filing, public launch, and market reaction. Each stage triggered a distinct response from institutions and LINK traders.

Rather than unfolding overnight, Chainlink’s ETF journey followed a familiar institutional playbook seen previously with Bitcoin and Ethereum ETFs—anticipation first, confirmation later.

Source: cryptoslate.com

When did Grayscale file for the Chainlink ETF?

Grayscale formally initiated the Chainlink ETF process by submitting an S-1 registration statement to the U.S. SEC. Instead of launching a brand-new product, Grayscale proposed converting its existing Grayscale Chainlink Trust—which already managed roughly $29 million in assets—into a spot ETF.

Key filing details that defined this stage of the Chainlink ETF Timeline include:

- Proposed ticker: GLNK

- Listing venue: NYSE Arca

- Custodian: Coinbase Custody Trust Company

- Creation/redemption: Cash-based, consistent with BTC and ETH spot ETFs

- Optional feature: Staking yield, pending regulatory approval

This filing positioned Chainlink as one of the first oracle-focused assets to pursue regulated ETF exposure in the U.S., expanding beyond Layer-1 narratives.

When did the Chainlink ETF officially launch?

Chainlink ETF officially debuted when GLNK began trading on NYSE Arca, marking the first time U.S. investors could access LINK through a spot ETF vehicle.

On launch day, several signals confirmed institutional participation:

- $37 million in net inflows recorded on the first trading session

- Conversion from a closed-end trust to an ETF structure completed successfully

- Immediate integration into traditional brokerage platforms

This phase of the Chainlink ETF Timeline represents the transition from speculation to measurable capital commitment—an inflection point that validates earlier positioning.

What happened to LINK price before and after launch?

LINK’s price behavior followed a classic ETF-driven pattern:

Before launch

- Gradual accumulation ahead of listing

- Breakout from descending resistance

- Higher-low price structure formed

After launch

- LINK surged roughly 7–8%, briefly testing resistance near $14.63

- Trading volume expanded 183% above the 24-hour average

- Price consolidated while holding key support above $14.28

This sequence reinforces why the Chainlink ETF Timeline matters more than the launch date alone—the market often prices ETF outcomes before approval becomes official.

How Did Institutional Inflows Impact LINK After the ETF Launch?

ETF inflows differ from speculative trading because they represent deliberate asset allocation decisions. The early inflow data following the Chainlink ETF launch offers insight into LINK’s evolving role as an institutional asset.

Source: pintu.co.id

How much capital flowed into the Chainlink ETF on day one?

On its first trading day, the Grayscale Chainlink ETF recorded $37 million in net inflows, a notable figure for an altcoin-focused ETF.

Why this matters in the broader Chainlink ETF Timeline:

- Confirms immediate institutional demand rather than delayed adoption

- Places LINK among a small group of altcoins with verified ETF inflows

- Signals portfolio-level exposure rather than short-term trading interest

While smaller than Bitcoin ETF launches, the inflow size aligns with LINK’s market capitalization and niche positioning as infrastructure rather than a base layer.

What technical signals confirmed institutional participation?

Market structure following the ETF launch showed characteristics typically associated with institutional execution:

- Volume spike: 183% above average during resistance testing

- Price behavior: Consecutive higher lows throughout the session

- Support defense: Buyers consistently held above the $14.28 zone

These signals suggest accumulation rather than distribution, reinforcing the interpretation that ETF inflows were not immediately flipped for short-term profit.

What Are the Short-Term and Long-Term Risks Around the Chainlink ETF Timeline?

Despite strong ETF-related demand, the Chainlink ETF Timeline also highlights periods where risk increases—particularly as post-launch volatility sets in.

Could LINK face short-term pullbacks after the ETF launch?

From a technical perspective, LINK remains vulnerable to corrective moves:

- Price is trading inside an ascending parallel channel, often associated with consolidation phases

- MACD bearish crossover has appeared on lower timeframes

- A breakdown could push LINK back toward the $11.80 support zone

These risks do not invalidate the ETF narrative, but they emphasize the importance of timing and position management.

Why could the Chainlink ETF strengthen long-term adoption?

Longer-term implications of the Chainlink ETF Timeline extend beyond price action:

- Chainlink underpins tokenization pilots across traditional finance

- CCIP adoption has surged, with reported usage growth between 40% and 120%

- ETF access introduces LINK to pension funds and corporate treasuries previously unable to hold tokens directly

Together, these factors position LINK as infrastructure exposure rather than a speculative altcoin—a distinction that may matter as tokenization markets expand.

How Does the Chainlink ETF Timeline Compare With Bitcoin and Ethereum ETFs?

Comparing ETF rollouts helps contextualize LINK’s trajectory within broader crypto market cycles.

What similarities exist between LINK, BTC, and ETH ETF rollouts?

Across all three assets, ETF timelines followed a recognizable pattern:

| Phase | BTC / ETH | LINK |

| Filing | Regulatory anticipation | Grayscale S-1 filing |

| Pre-launch | Price front-running | LINK accumulation |

| Launch | High volatility | $37M inflows |

| Post-launch | Consolidation | Range-bound behavior |

This similarity strengthens confidence in the Chainlink ETF Timeline as a repeatable institutional process.

What makes the Chainlink ETF structurally different?

Chainlink’s ETF differs in several meaningful ways:

- Exposure to oracle infrastructure, not a settlement layer

- Potential staking yield component (pending approval)

- Direct relevance to tokenization and cross-chain data flows

These structural differences could attract a distinct class of investors focused on financial infrastructure rather than monetary assets.

How Can Investors Safely Prepare for LINK Volatility Around the ETF Timeline?

Chainlink ETF Timeline doesn’t end at launch day. Volatility often increases once ETF flows meet short-term trading behavior, making preparation as important as participation.

Source: cryptoslate.com

How should investors manage LINK during ETF-driven volatility?

Instead of reacting to price swings, investors can use a structured approach:

- Scale entries and exits: Avoid single-point buys during ETF headlines

- Define exposure size: Treat LINK as infrastructure exposure, not a momentum trade

- Separate trading from holding: Short-term trades and long-term holdings should not share the same risk rules

This approach reduces emotional decisions while allowing participation across multiple phases of the ETF cycle.

How Can You Track and Trade LINK Safely Using Bitget Wallet?

Chainlink ETF Timeline is entering a phase where institutional inflows and short-term volatility overlap, making execution, visibility, and asset control more critical than speed alone. As ETF-driven price swings intensify, relying solely on centralized exchanges can expose investors to custody risk, withdrawal delays, and fragmented liquidity.

Bitget Wallet provides a practical on-chain solution—allowing users to track LINK in real time, manage exposure across multiple chains, and retain full control of their assets as markets react to ETF milestones.

With Bitget Wallet, you can:

- Hold LINK non-custodially — you control your private keys and retain full ownership of your assets.

- Swap and trade LINK directly using aggregated liquidity from multiple DEXs, with support for 130+ blockchains, enabling faster execution and better pricing.

- Track and manage LINK across chains — interact seamlessly with Ethereum, Solana, Base, and other major networks from a single wallet.

- Reduce counterparty risk during ETF-driven volatility by keeping assets under self-custody rather than on centralized exchanges.

- Access real-time market data and analytics, helping you monitor smart-money signals and underlying market shifts as they happen.

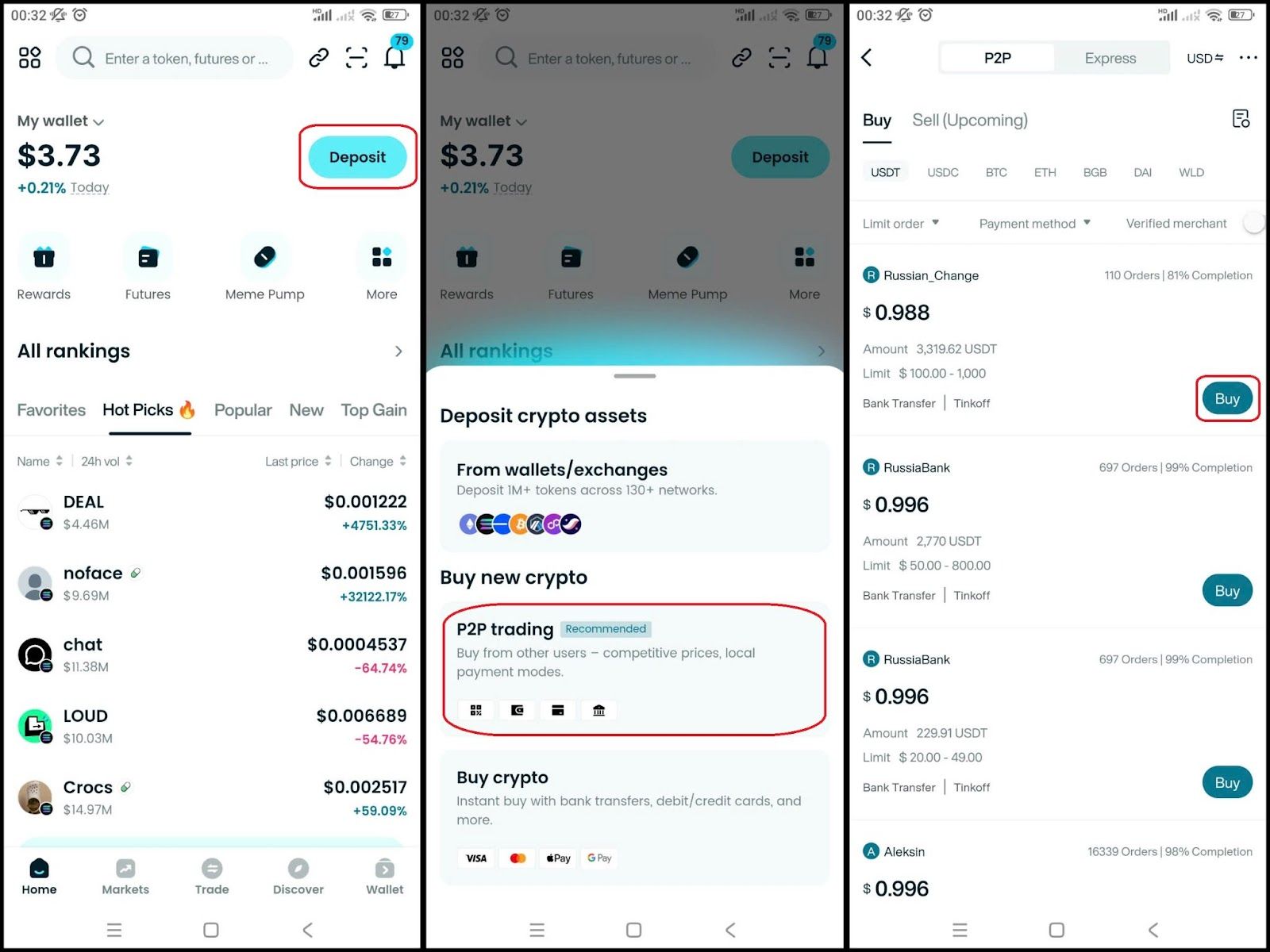

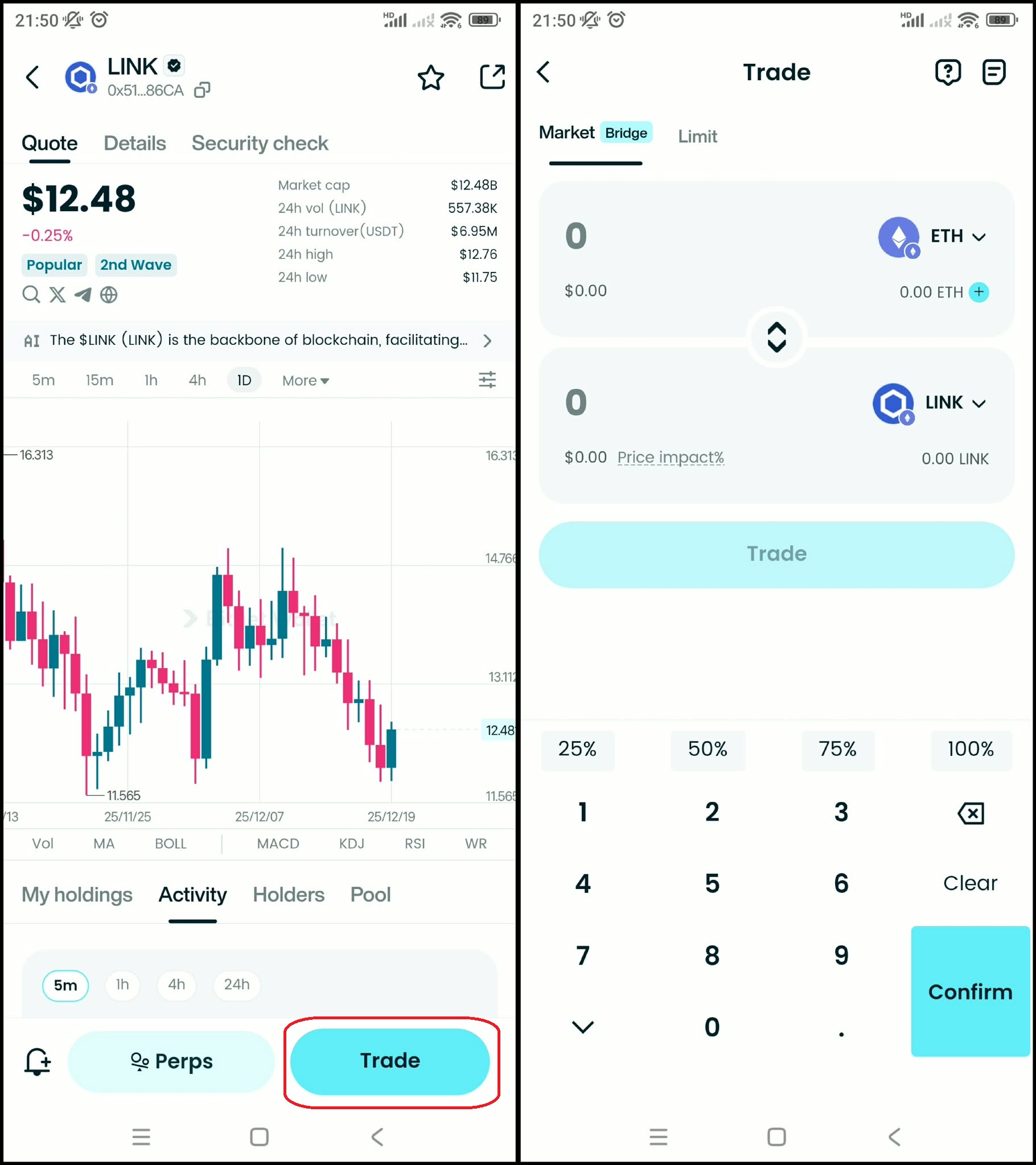

How to Buy Chainlink (LINK) on Bitget Wallet?

Buying Chainlink (LINK) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

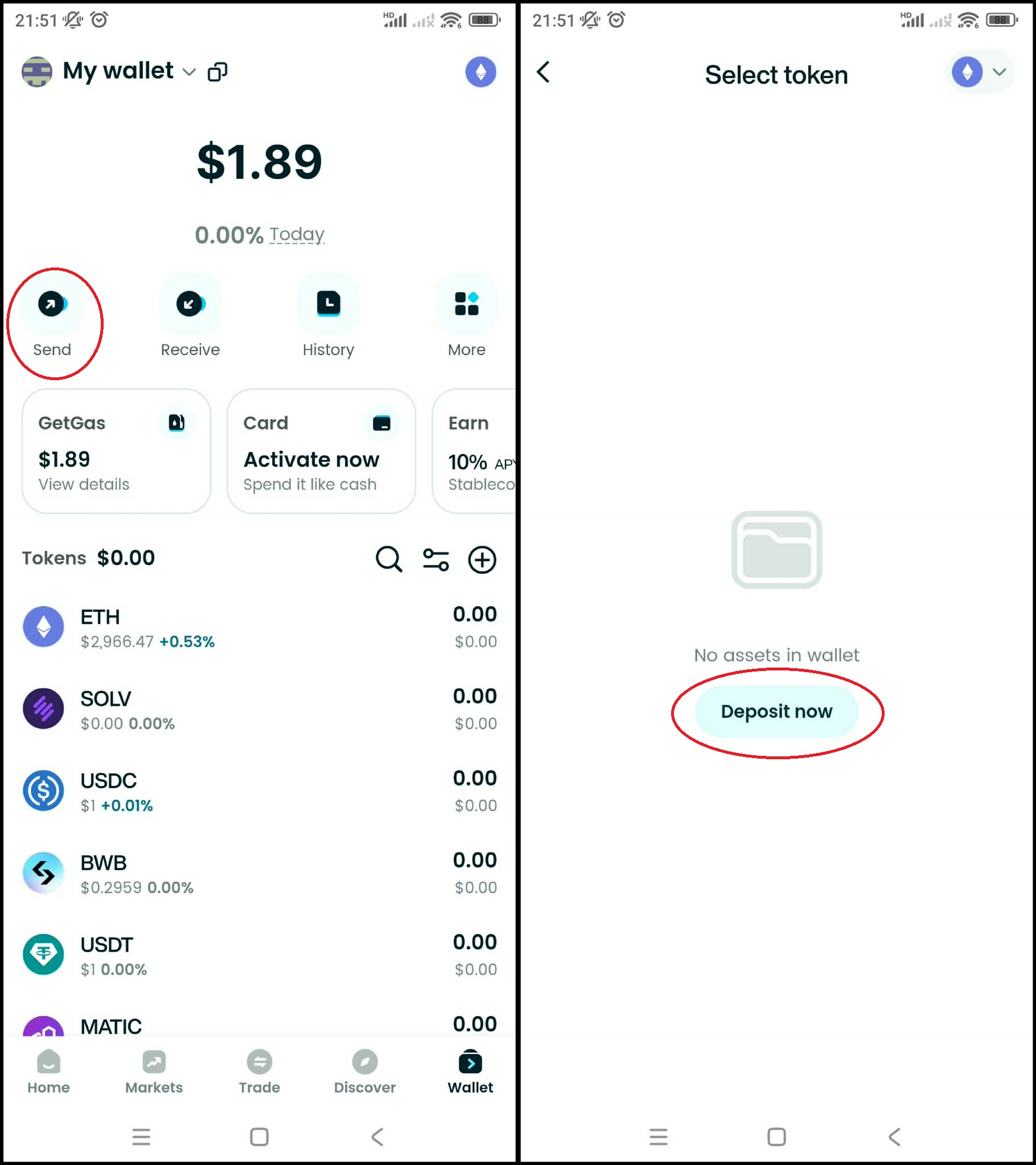

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

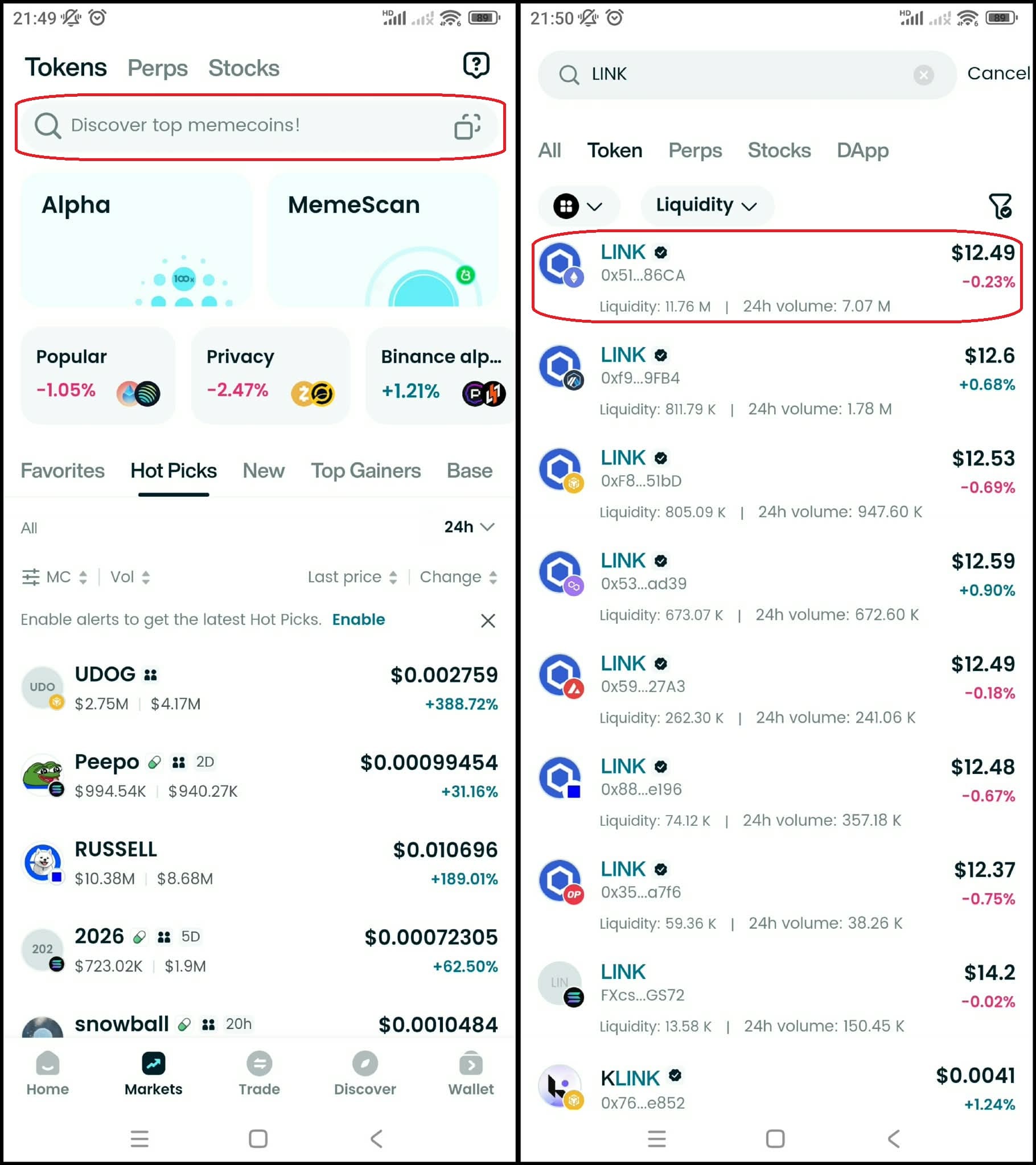

Step 3: Find Chainlink (LINK)

- In the main interface of the wallet, go to Market, type "LINK" in the search bar.

- Select Chainlink (LINK) to see the trading page.

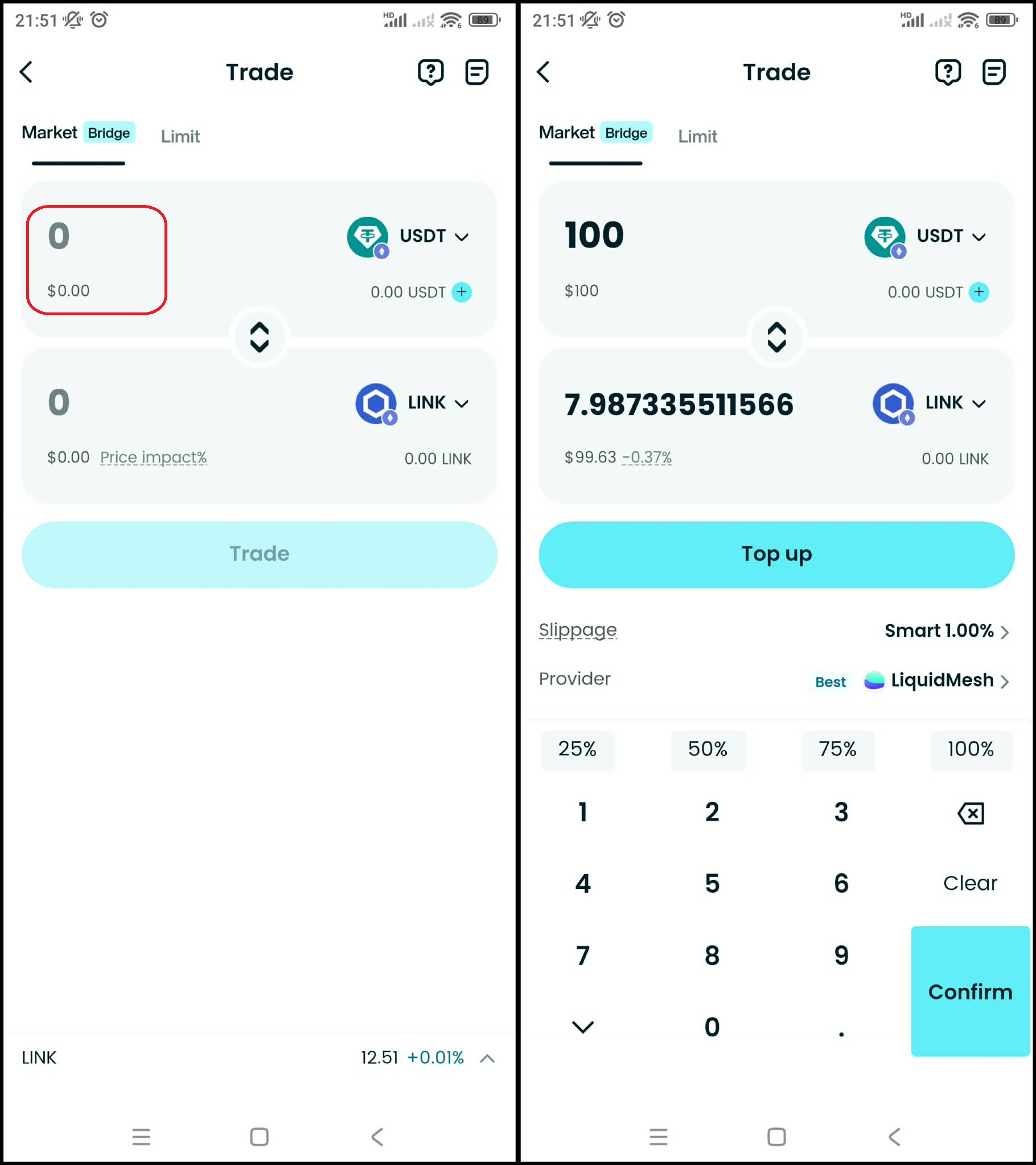

Step 4: Select the trading pair

Select the pair you want to trade, for example LINK/USDT. So you can use USDT to buy Chainlink (LINK), or vice versa.

Step 5: Place an order

Enter the amount of Chainlink (LINK) you want to buy, check carefully and confirm the order.

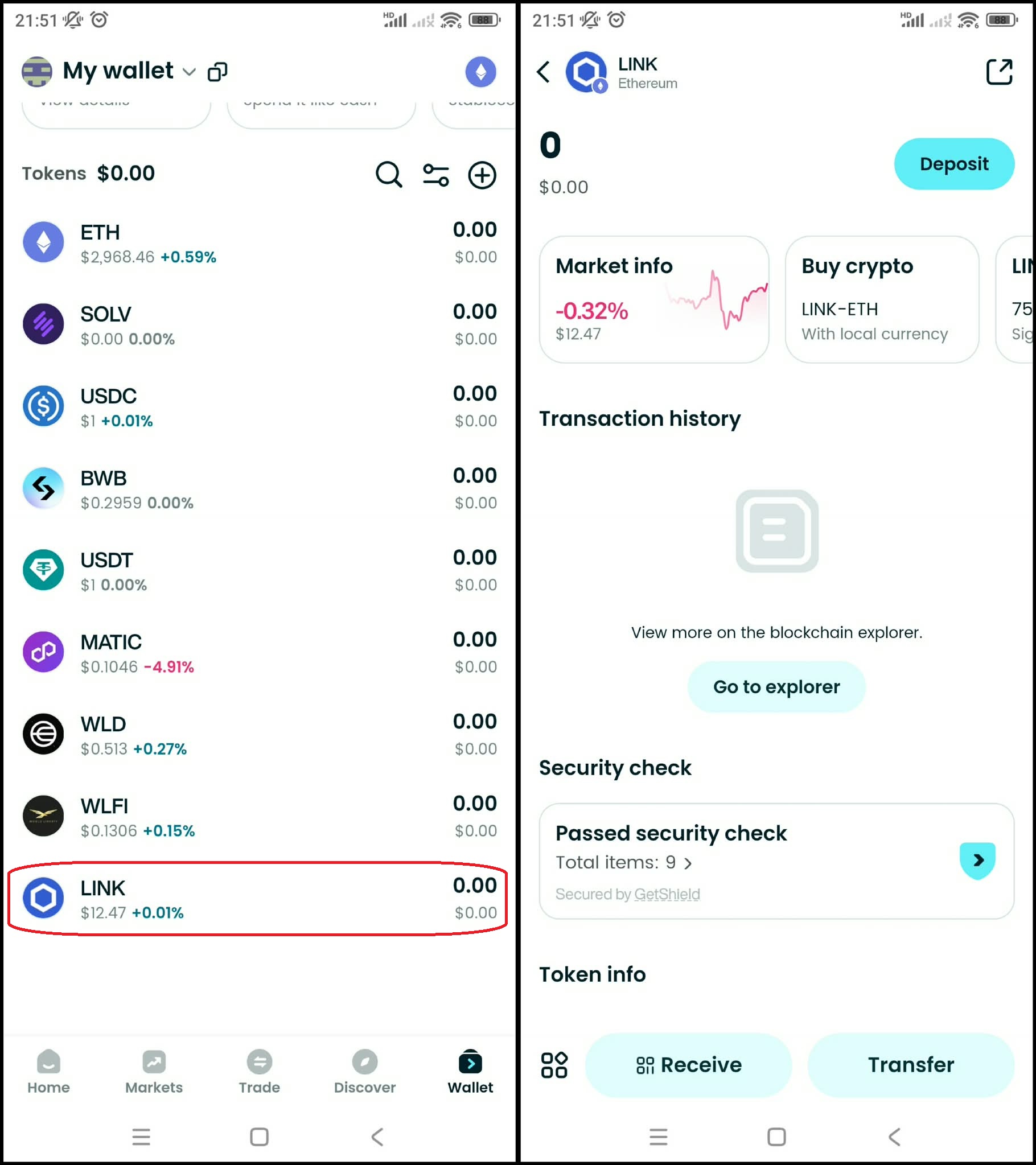

Step 6: Check the order

After buying, you can check your LINK in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Chainlink (LINK), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Chainlink (LINK):

- What is Chainlink (LINK)?

- Chainlink (LINK) Airdrop Guide

- Chainlink (LINK) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

With just a few simple steps, Bitget Wallet gives you more than a place to buy LINK—it provides a secure starting point for navigating the next phase of the Chainlink ETF Timeline. As institutional participation reshapes liquidity and volatility patterns, having full control over your assets becomes a strategic advantage rather than a technical detail.

By combining non-custodial security, cross-chain flexibility, and real-time market access, Bitget Wallet helps investors move beyond short-term headlines and participate in LINK’s long-term institutional narrative with confidence.

Trade, store, and manage LINK securely across chains with Bitget Wallet — beginner-ready and built for long-term investors.

Conclusion

Chainlink ETF Timeline shows how LINK transitioned from a regulatory filing into an asset gaining real institutional traction—explaining why price discovery often happens before ETF approvals, not after. From Grayscale’s S-1 submission to verified first-day inflows, the timeline reveals a repeatable cycle of early positioning, launch-driven volatility, and post-listing consolidation.

As institutional exposure to LINK continues to grow, investors who focus on discipline, security, and execution—not headlines—are best equipped to navigate ETF-driven market shifts. Bitget Wallet helps bridge this gap by giving users self-custodial control, seamless cross-chain access, and real-time on-chain flexibility.

Download Bitget Wallet now to follow the Chainlink ETF Timeline as it unfolds, trade LINK across chains with confidence, and stay fully in control as institutional adoption accelerates.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the Chainlink ETF Timeline?

Chainlink ETF Timeline refers to the sequence of regulatory filing, ETF approval, market launch, institutional inflows, and LINK price reactions associated with the first U.S. spot Chainlink ETF.

2. When did the Grayscale Chainlink ETF launch?

The Grayscale Chainlink ETF (GLNK) officially launched on NYSE Arca after converting from the Grayscale Chainlink Trust, recording $37 million in first-day inflows.

3. Is Bitget Wallet safe for holding LINK?

Yes. Bitget Wallet is a non-custodial wallet that allows users to store, trade, and manage LINK securely while maintaining full control of their private keys.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins