Altcoin Season Coming: How to Spot the Next Altcoin Bull Market?

The altcoin season coming in 2025 is capturing global investor attention. As Bitcoin dominance declines and Ethereum surges, sentiment is shifting toward a new altcoin bull market. Capital rotation into smaller tokens is accelerating, with both retail and institutional players positioning early for potential upside.

From increased DeFi activity to the rise of meme coins, we’re seeing clear signs of altcoin season emerge. In this article, we’ll explore the key indicators driving this trend, what it means for market participants, and how tools like Bitget Wallet can help you track, swap, and manage altcoins effectively across multiple chains.

Key Takeaways

- Altcoin season coming is marked by declining Bitcoin dominance and rising Ethereum and altcoin performances in 2025.

- Key indicators include Altcoin Season Index (ASI) surges, meme coin rallies, and growing institutional inflows fueling the altcoin bull market.

- Bitget Wallet offers a secure, multi-chain platform to manage altcoin portfolios, enabling timely swaps and risk management during volatile market cycles, essential in navigating altcoin capital rotation.

What is Altcoin Season?

Altcoin season is a period when altcoins (any crypto other than Bitcoin) significantly outperform BTC in terms of price action and volume. This phase is often driven by increased risk appetite, innovation narratives, and capital rotation from large caps to smaller, high-beta tokens.

-

Altcoins generate faster and higher returns than Bitcoin.

-

Capital rotates from BTC/ETH into mid- and low-cap altcoins in a clear pattern of altcoin capital rotation.

-

Social media and on-chain activity spike around trending altcoins, serving as signs of altcoin season.

-

Bitcoin Dominance Index (BTCD) dips below 50%, signaling altcoin strength and momentum.

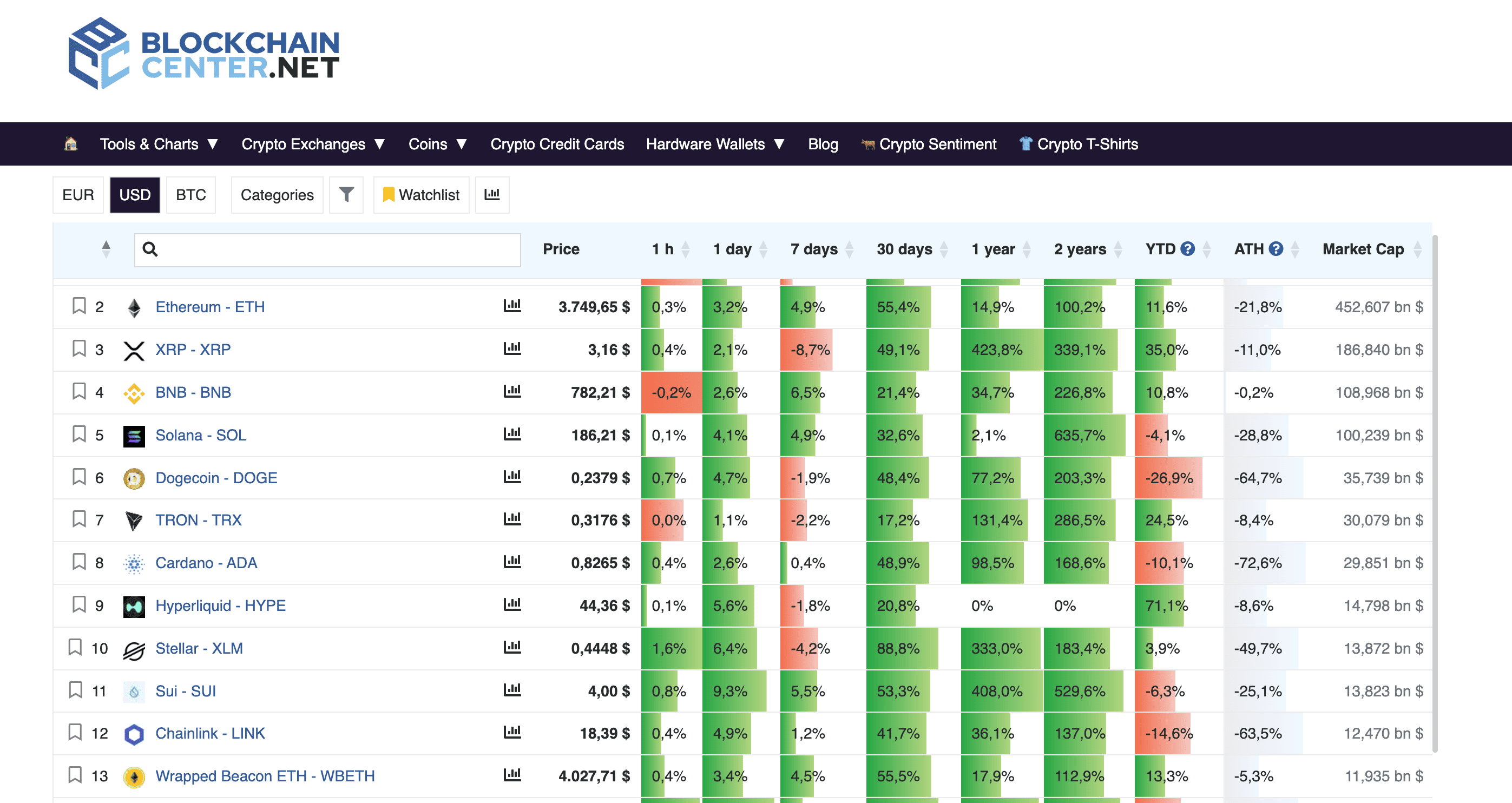

Source from Blockchaincenter.net

Using Bitget Wallet, users can monitor these trends and act quickly by accessing altcoin data, trading tools, and cross-chain token management in one app.

✅ Read More: Altcoin Season 2025: What It Is, When It Starts, and How to Profit?

How Does Altcoin Season Differ from Bitcoin Bull Markets?

While both market phases show rising prices, altcoin seasons are generally more explosive and risk-heavy compared to Bitcoin-led bull runs. The core difference lies in capital flow and volatility, important signs of altcoin season investors should understand.

| Aspect | Bitcoin Bull Market | Altcoin Season |

| Lead Asset | Bitcoin (BTC) | Altcoins (ETH, SOL, meme coins) |

| Risk Level | Moderate | High |

| Speed of Gains | Gradual | Explosive |

| Common Triggers | Macro trends, ETF approval | BTC consolidation, ETH rally, altcoin capital rotation |

| Social Buzz | Medium | High (Telegram, X, Reddit) |

💡 Tip: Use Bitget Wallet to monitor and diversify your portfolio as trends shift from Bitcoin to high-growth altcoins during the current altcoin bull market.

What Are the Key Indicators of Altcoin Season Arrival?

Identifying the arrival of altcoin season requires careful observation of several market and on-chain indicators that reflect shifting investor sentiment and capital flows—clear signs of altcoin season.

The Altcoin Season Index (ASI) is a crucial metric that measures the percentage of altcoins outperforming Bitcoin, with values above 50 signaling growing momentum and levels above 75 indicating a strong altcoin bull market phase. Alongside ASI, institutional buying, Ethereum’s price surge, and vibrant memecoin activity serve as clear signs that altcoin season is underway.

- Altcoin Season Index (ASI) above 75 marks strong altcoin outperformance compared to Bitcoin, signaling a mature altcoin season.

- Bitcoin dominance falling below 50% reflects significant capital rotation into altcoins—an essential element of altcoin capital rotation.

- Ethereum surging past key levels, such as surpassing $3,700, demonstrating robust Layer-1 demand and fueling the altcoin bull market.

- Memecoin and small-cap rallies indicating retail and speculative investor enthusiasm, classic signs of altcoin season.

- Notable price records, including XRP reaching all-time highs and Solana crossing $200.

- Increasing decentralized exchange (DEX) volumes and DeFi total value locked (TVL) on networks like Solana and Arbitrum, signaling growing ecosystem activity.

- Growing institutional participation via ETF interest and venture capital inflows enhances market stability and momentum.

How Does the Drop in Bitcoin Dominance Signal Capital Rotation?

Bitcoin dominance has recently fallen below 60%, marking a significant shift in market dynamics. This decline indicates that capital is moving away from Bitcoin and into altcoins, signaling the onset of altcoin season coming.

Bitcoin dominance dipped to approximately 59.2%, down from 63.34% on July 16. This marks the first time since March that Bitcoin's share of the total cryptocurrency market capitalization has fallen below 60%.

This drop is often associated with increased capital inflows into altcoins, as investors seek higher returns in smaller, more volatile assets. Notably, Ethereum (ETH), Solana (SOL), and XRP have seen significant price increases during this period.

The rotation typically follows a pattern: from Bitcoin to Ethereum, and then to other altcoins—a classic example of altcoin capital rotation reflecting shifting investor sentiment.

To monitor these shifts effectively, tools like TradingView or CoinGecko can be utilized to track Bitcoin dominance trends. Additionally, Bitget Wallet offers integrated features to help users manage their portfolios and respond to market changes promptly.

- BTC.D < 48–50% aligns with historical altcoin rallies.

- Early movers include ETH, SOL, AVAX, and meme tokens.

- Rotation typically follows a predictable pattern, from BTC to ETH to alts.

Why Are Meme Coins and Small‑Cap Tokens Important Signals?

Meme coins and low-cap tokens often act as the early shockwave in altcoin season coming due to their viral nature and low liquidity, making them sensitive to social sentiment and speculative capital.

- DOGE, PEPE, and BONK often trigger the first wave of altcoin hype.

- Retail investors fuel meme coin momentum via X, Telegram, and TikTok.

- Strong on-chain activity signals rising risk appetite.

- Historically, these tokens surge 10x–100x faster than BTC or ETH.

✅ Read more: What is Meme Coin? How to Buy Solana Meme Coin on Bitget Wallet?

Which Altcoins Are Leading the Market Rally in 2025?

In 2025, the altcoin rally is gaining momentum, driven by strong narratives around Layer-1 blockchains, meme coins, and emerging AI projects. Both retail and institutional investors are fueling growth, creating diverse opportunities across different segments of the crypto market.

Understanding which altcoins are leading helps investors position their portfolios strategically during this phase of altcoin capital rotation and the broader altcoin bull market.

- *Ethereum (ETH): Staking demand and Layer-2 ecosystem expansion boost network usage and price.

- *XRP:Growing institutional adoption and favorable regulatory developments support cross-border payments and investor confidence.

- *Solana (SOL): DeFi, NFTs, and consumer app development fuel a strong resurgence.

- Pepe (PEPE): The viral meme coin is driving speculative rallies and attracting new retail investors.

- Pudgy Penguins (PENGU): Community-driven NFT project with increasing ecosystem utility.

- BONK (BONK): Solana-based meme coin gaining traction through community engagement and token burns.

How Are Institutional Investors Driving Altcoin Momentum?

Institutional money entering altcoins via venture funding, ETFs, and custody solutions adds both legitimacy and liquidity to the space, reinforcing the current altcoin bull market.

- VC-backed projects (e.g., LayerZero, EigenLayer) show institutional inflows.

- ETH and SOL see rising balances among fund-linked wallets.

- Spot ETH ETFs are under review in the U.S. and Asia.

- WhaleStats and Bitget Research reveal growing altcoin allocations.

✅ Read more What Is the GENIUS Act? U.S. Stablecoin Regulation Explained (2025 Guide)

Are Meme Coins Signaling Overheating or Further Growth?

Memecoin rallies often represent the late stages of an altcoin season coming, fueled by heightened retail enthusiasm and speculative trading. While they can generate explosive short-term gains, memecoins also carry significant volatility and risk, often signaling a market nearing its peak. Understanding their role in the cycle helps investors make informed decisions about entry and exit timing.

- Memecoin surges typically occur after major Layer-1 and Layer-2 rallies.

- They attract a wave of retail investors chasing quick profits.

- High volatility means memecoin gains can reverse rapidly.

- Memecoin rallies may precede market corrections or signal profit-taking phases.

- Smart investors use tools like Bitget Wallet to monitor, trade, and manage risk efficiently during these periods.

Source X.

What Risks Should Investors Watch During Altcoin Season?

Despite massive upside, altcoin season coming carries serious risks. Sudden corrections, scams, and emotional FOMO can wipe out gains quickly.

- Meme coin pumps often lead to -90% crashes.

- Over-trading and leverage increase liquidation risks.

- Buying late in the cycle amplifies downside.

🛡️. **Bitget Wallet features built-in swap, bridge, and cold-storage options, giving you total control and protection without centralized exchange exposure.**

How to Identify the Right Time to Take Profits?

Identifying the optimal exit point during altcoin season coming is just as critical as timing the entry. Profit-taking signals emerge when metrics like the Altcoin Season Index (ASI) peak, total alt market capitalization nears structural highs, and capital rotation shifts back toward safety. These cues, combined with chart patterns and market psychology, help you preserve gains before broader corrections set in. With Bitget Wallet, you can act quickly—swapping to stablecoins, bridging between chains, or exiting positions in one secure platform.

- ASI above 70–75 signals overheating; when more than 75% of altcoins outperform BTC over 90 days, consider reducing exposure into stablecoins.

- TOTAL3 market cap approaching $2 trillion—especially if forming a bullish cup-and-handle pattern—often precedes a cooling down phase in broader altcoin markets.

- Ethereum outperforming Bitcoin, especially with a stagnating ETH/BTC ratio, typically marks a mid-cycle shift where profits begin rotating into smaller caps.

- BTC dominance begins to rise again after a drop below ~60%, a historical cue for capital rotation away from altcoins.

- Meme-coin mania peaks, when memecoins and small-caps rally sharply, often they mark the late distribution phase and increased risk of rapid reversals.

How to Prepare for and Navigate Altcoin Season Effectively?

Navigating an altcoin season coming requires a strategic approach to portfolio management, diversification, and risk mitigation. Rather than chasing hype, successful investors design a balanced allocation, track market signals, and use tools that streamline operations across multiple blockchains. Here’s how to get started:

- Allocate a solid foundation in blue-chip assets like Bitcoin and Ethereum—typically 40–60% of your holdings, to anchor your strategy.

- Allocate 20–30% to growth altcoins (e.g., SOL, ARB, XRP) participating in DeFi, AI, or L2 narratives.

- Reserve 5–10% for speculative exposure in meme coins or small-cap tokens—with clearly defined exit rules.

How to Prepare for and Navigate Altcoin Season Effectively

Preparing for an altcoin season coming requires disciplined diversification, risk control, and tools that support cross-chain actions. Smart use of portfolios and Web3 wallets ensures you can participate actively while minimizing exposure.

- Allocate core holdings to BTC and ETH (40–60%) for stability.

- Reserve 20–30% for growth altcoins like SOL, ARB, XRP.

- Set aside 5–10% for speculative picks including memecoins (BONK, PEPE) with strict exit plans.

- Keep stablecoins as liquidity buffers (USDC, USDT) to seize dips quickly.

- Rebalance frequently, every 1–3 months, or when allocations drift significantly.

Should You Use Dollar‑Cost Averaging or Lump‑Sum Entry?

Choosing between dollar-cost averaging (DCA) and lump-sum entry depends on your investment style, risk tolerance, and market conditions. Both approaches have pros and cons, and the best results often come from combining them.

- Dollar-cost averaging smooths out volatility by spreading buys over time, reducing risk during unpredictable market swings.

- Lump-sum entry can maximize gains if timed early in a confirmed altcoin uptrend.

- Scheduled buys and recurring purchases in Bitget Wallet make DCA effortless and automated.

- Bitget Wallet’s instant swaps and cross-chain bridges support quick lump-sum entries when momentum picks up.

How to Track Altcoin Season with Tools and Data?

To catch altcoin season coming early, use reliable indicators and track real-time trends. The right tools help confirm momentum and guide smart decisions.

- CoinMarketCap ASI: Measures altcoin strength vs. Bitcoin; above 75 signals alt season.

- Glassnode: Tracks capital flow into altcoins using on-chain data.

- TradingView: Watch BTC dominance and ETH/BTC ratio for rotation cues.

- DeFiLlama: Monitors DeFi TVL and DEX volumes.

- Bitget Wallet: Offers real-time alerts, portfolio tracking, and access to DApps.

✅ Unlock multi-chain DeFi and stablecoin savings easily in Bitget Wallet.

Conclusion: Altcoin Season Coming—Get Ready with Bitget Wallet

The altcoin season coming is becoming clearer in 2025: Ethereum surges, Bitcoin dominance declines, and niche altcoins rally strongly. This altcoin bull market offers exciting opportunities but requires careful preparation and risk management.

Bitget Wallet provides a secure, multi-chain environment to manage assets, swap tokens instantly, and access DeFi applications.

Download Bitget Wallet today to confidently navigate this altcoin season—maximize gains, minimize risks, and stay in control.

FAQs

What is altcoin season?

Altcoin season refers to a period when altcoins significantly outperform Bitcoin in terms of price growth. It usually happens after Bitcoin has had a strong run and investors begin rotating profits into smaller, higher-risk tokens in search of higher returns.

How do I know if altcoin season is coming?

Signs that altcoin season is coming include:

- Bitcoin dominance declining steadily

- Ethereum and other altcoins outperforming Bitcoin

- Meme coins and small caps rallying quickly

- The Altcoin Season Index rising above 75

Tools like TradingView and Bitget Wallet can help you monitor these trends.

What is Bitcoin dominance and why does it matter?

Bitcoin dominance measures Bitcoin’s market share compared to the total crypto market cap. When it drops, it often signals a shift toward altcoin capital rotation. A decline in dominance is one of the clearest indicators that altcoin season may be starting.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins