What Is the Halloween Effect in Crypto and Why It Spooks Investors Every Year?

Halloween effect in crypto refers to a curious seasonal pattern where digital assets — much like traditional stocks — often perform better between November and May than during the rest of the year. The idea stems from decades-old financial wisdom known as “Sell in May and Go Away,” suggesting investors tend to retreat during summer and return near Halloween, reigniting markets.

In traditional finance, this phenomenon has been documented across equity markets since the early 20th century. Now, crypto traders are asking whether this historical uptrend applies to Bitcoin and other digital assets.

In short: the Halloween effect captures investor attention every year because it sits at the crossroads of market data and trading superstition — a mix of strategy, sentiment, and seasonal psychology that continues to spook investors into believing history might repeat itself.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Key Takeaways

- The Halloween effect suggests stronger performance between November and May.

- It originated from the old “Sell in May and Go Away” stock market adage.

- Bitcoin has followed the pattern in roughly 6 of the past 10 years.

- The theory combines liquidity, investor psychology, and media cycles.

- It remains unproven — a tradition more than a law of finance.

What Is the Halloween Effect and Where Did It Come From?

The Halloween effect first appeared in financial studies over a century ago. British and later American researchers noticed that stock market returns from November through April consistently outperformed those from May through October. This gave rise to the expression “Sell in May and Go Away.”

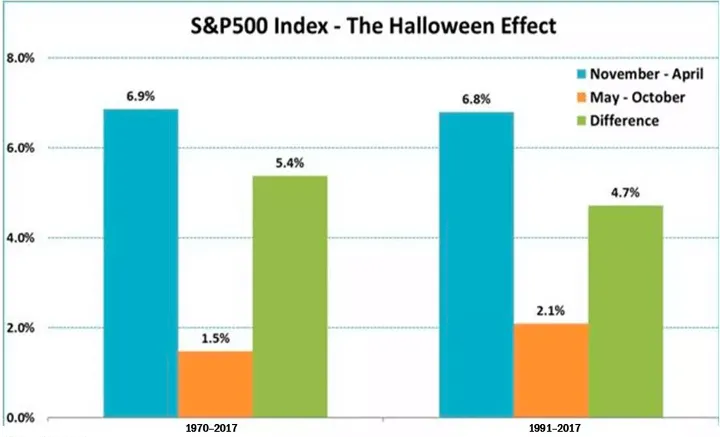

The logic was straightforward: investors, particularly in Europe, took summer breaks, reducing liquidity and trading activity. When they returned in autumn, renewed market participation drove prices upward — a cycle that held for decades in the S&P 500, the FTSE 100, and other indices. Between 1970 and 2017, the S&P 500 averaged 6.5% returns from November–April, compared with just 2% from May–October.

As blockchain markets matured, traders began wondering whether this seasonal rhythm extended to digital assets. After all, crypto never sleeps — but investors still behave like humans, prone to cycles of optimism and fear.

How Does the “Sell in May and Go Away” Strategy Work?

The idea is deceptively simple: sell your holdings in May, hold cash during the quieter summer months, and buy back near Halloween to catch the winter upswing. This Halloween trading strategy thrived in equities because institutional cycles, earnings seasons, and retail sentiment all clustered in the final quarter.

When applied to crypto, the same logic loosely fits. Retail participation often peaks during the year’s end, media coverage spikes, and Bitcoin historically enjoys Q4 rallies. Yet, in a 24/7 market with no “off-season,” the strategy’s reliability is far less certain.

Does the Halloween Effect Really Apply to Crypto Markets?

So far, evidence is mixed — but intriguing.

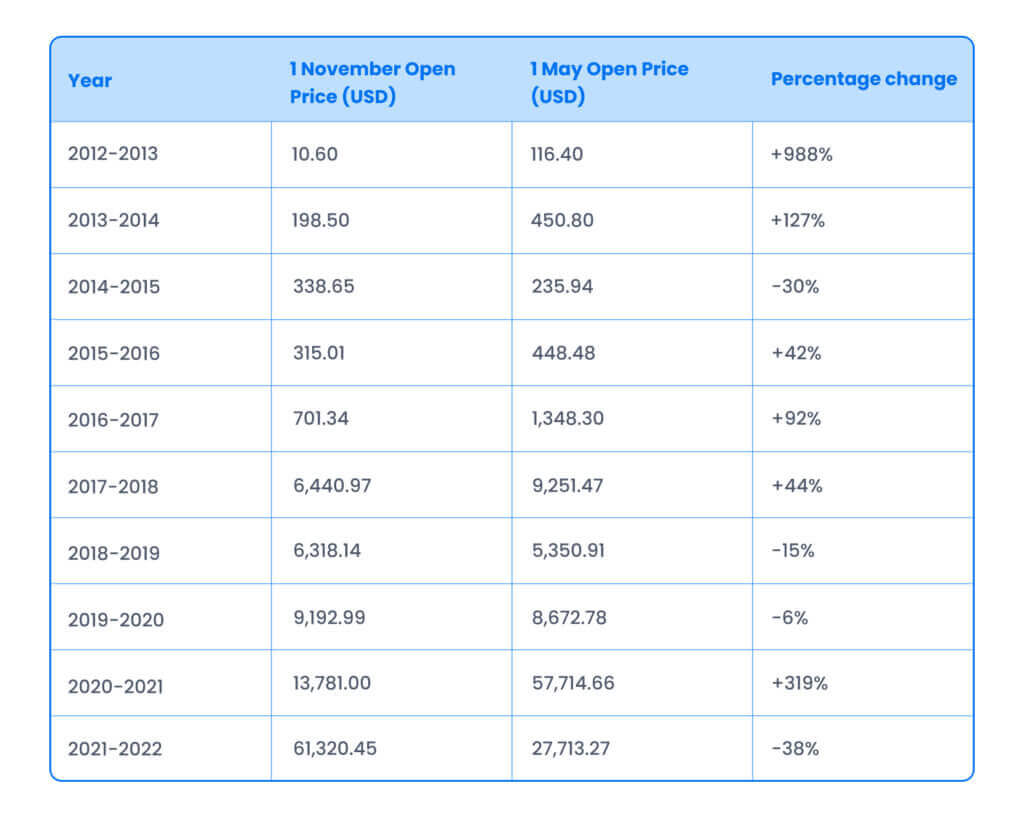

Between 2015 and 2017, Bitcoin rose 41%, 87%, and 117% respectively in the November–May window. During the 2020–2021 bull run, the pattern returned spectacularly, with Bitcoin up 457% from Halloween to the following May.

However, it’s not foolproof. The 2018–2019 period saw a decline of roughly 13% over the same months, while 2022’s macro headwinds flattened the trend entirely.

Data from multiple exchanges indicate that in six of the past ten years, Bitcoin and Ethereum posted gains after Halloween, suggesting partial validity — yet still far from a dependable rule.

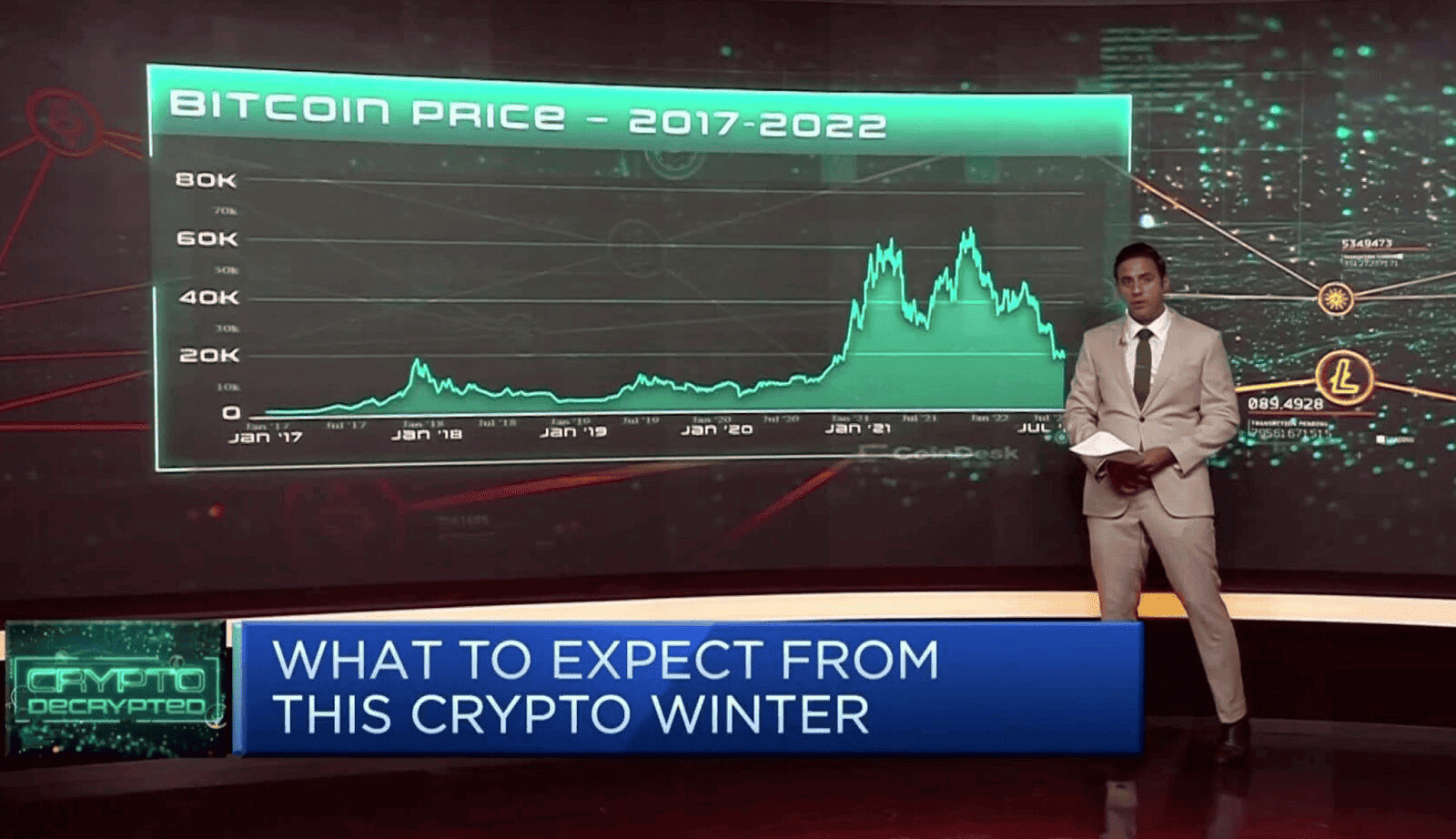

Source: CNBC

What Factors Drive the Halloween Effect in Crypto?

Three major drivers explain why this pattern persists:

-

Winter News Coverage & Media Buzz

From November onward, crypto media cycles intensify. New token listings, exchange updates, and year-end projections generate renewed retail attention, boosting liquidity.

-

Liquidity & Trading Volume

Traders often reduce exposure during summer’s low-volatility stretch, then re-enter markets around October as liquidity and institutional participation increase.

-

Investor Psychology & Fear-Greed Cycles

The fear and greed index crypto often tilts toward “greed” near year-end, reflecting optimism fueled by holiday spending, media momentum, and macro recovery narratives.

Together, these forces explain why crypto seasonal trends mimic the old stock market pattern — but with higher volatility and fewer guarantees.

Source: Bloomberg

Why Do Investors Get Spooked by the Halloween Effect?

Despite its appeal, the Halloween effect unsettles many traders. Its reputation for triggering rallies and corrections makes it a psychological minefield. Some fear missing out (FOMO) on seasonal gains; others dread becoming victims of sudden downturns.

Crypto’s notorious unpredictability amplifies the drama. In late 2021, Bitcoin surged past $60,000 right after Halloween — only to tumble below $40,000 months later. These whiplash movements have cemented the effect’s “spooky” allure.

Source: Swyftx

How Fear and Greed Influence Crypto Behavior

Emotions dominate every bull run and crash. When the market rallies post-Halloween, greed inflates expectations; when corrections strike, fear drives liquidation. Studying these extremes reveals why sentiment oscillates faster in digital markets.

So, is the Halloween effect real? In part, yes — but not for the mystical reasons traders imagine. It reflects recurring behavior patterns rather than calendar magic.

What Are the Myths and Criticisms Behind the Halloween Effect?

Skeptics argue that the Halloween effect is little more than data slicing. They claim analysts retrofitted statistics to match a narrative. Supporters counter that decades of empirical evidence — across markets and geographies — suggest persistent seasonality.

The Efficient Market Hypothesis (EMH) dismisses such anomalies, asserting that markets already price in seasonal expectations. Yet, investor psychology routinely defies theory.

In crypto circles, the so-called “Satoshi’s Ghost” myth humorously credits Bitcoin’s founder for returning from digital hibernation each Halloween to “bless the bull run.” Folklore aside, the more rational view is that macro trends — not spirits — drive these cycles.

Is the Halloween Effect Just a Seasonal Coincidence?

Probably. Correlation rarely equals causation. When analysts isolate returns between November and May, they ignore other catalysts: monetary policy shifts, halving cycles, regulatory news, or tech breakthroughs.

Still, why crypto performs better after Halloween often comes down to timing. It’s when risk appetite increases, liquidity improves, and speculative energy surges — not because ghosts haunt exchanges.

How Can Investors Use the Halloween Effect Wisely in 2025?

Traders should treat the Halloween effect as a reference point, not a rulebook. Seasonality can hint at sentiment shifts, but overreliance invites losses. Smart investors use it as one of many inputs — alongside on-chain data, macro trends, and technical analysis.

Back-testing can help: compare Bitcoin’s past Halloween-to-May performance against other six-month cycles. Use sentiment tools, track whale activity, and diversify portfolios to reduce risk.

Practical Tips for Seasonal Crypto Traders

- Track Bitcoin dominance and altcoin rotations closely between October and May — this is when capital flows reveal where sentiment truly lies.

- Blend macro signals with technical tools like RSI and MACD to confirm strength before entering trades.

- Watch exchange inflows and outflows — they’re early indicators of whale behavior and shifting market confidence.

- Always DYOR (Do Your Own Research) — never follow a crowd just because it’s wearing a Halloween mask.

- Remember: not every ghost story is a signal. Sometimes, sitting out is the smartest move you can make.

How to Trade During the Halloween Effect with Bitget Wallet

While theory meets superstition, execution requires reliability. Bitget Wallet gives traders a secure, cross-chain environment to act on seasonal opportunities. It supports Ethereum, Solana, Base, BNB Chain, and Polygon, enabling seamless swaps, portfolio monitoring, and yield options.

Features like Zero-Fee Memecoin Trading and Stablecoin Earn Plus (up to 10% APY) help users navigate the crypto Halloween effect with less friction. Built-in approval checkers and real-time market alerts add a safety layer for those exploring short-term Halloween trading patterns.

Trade safely during the Halloween effect using Bitget Wallet — your all-in-one app for stablecoin storage, cross-chain swaps, and market alerts.

Step-by-Step — How to Participate in the Halloween Rally On-Chain

- Connect Bitget Wallet to your preferred blockchain — whether it’s Ethereum, Solana, Base, or Polygon. Security and cross-chain speed matter most when volatility rises.

- Swap or stake assets strategically when markets dip between October and November — this is where disciplined traders catch the upside, not the noise.

- Track yields and plan your exit before May, guided by technical and macro signals. The key: keep emotion out of the trade and let data lead the way.

The crypto Halloween rally isn’t about chasing superstition — it rewards those who blend insight with execution, patience with precision. Trade smart, stay grounded, and treat every “seasonal effect” as data, not destiny.

Conclusion

The Halloween effect in crypto continues to fascinate traders because it blurs the line between statistical tendency and superstition. Historical data shows it can work — sometimes spectacularly — yet volatility, sentiment, and macro forces always play spoiler.

Rational investors see it as one more seasonal indicator, not a prophecy. Whether you’re testing patterns or managing long-term holdings, consistency beats calendar luck.

Experience the Halloween effect with confidence — manage, trade, and earn across chains using Bitget Wallet, the most secure way to navigate spooky markets.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

FAQs

Does the Halloween effect apply to crypto?

Yes — the Halloween effect in crypto mirrors the traditional “Sell in May” theory, showing stronger performance from November to May. However, its reliability fades in bear markets, and extreme volatility can distort seasonal gains.

Is the Halloween effect real or just market folklore?

It’s partly real and partly behavioral. Bitcoin’s Halloween effect performance has been positive in six of the past ten years, but experts argue it’s more about investor behavior than statistical destiny.

Why does crypto perform better after Halloween?

Liquidity increases, sentiment improves, and the fear and greed index crypto usually trends toward optimism in Q4. These conditions make post-Halloween months more favorable for speculative growth.

What causes investors to get spooked by the Halloween effect?

Because market sentiment can flip quickly. Traders chasing the crypto Halloween rally may encounter sharp corrections if sentiment turns, reminding everyone that no seasonal trend guarantees profit.

How can traders use the Halloween trading strategy safely?

Apply the Halloween trading strategy cautiously: use stop-losses, confirm signals with technical data, and avoid emotional trades. Always secure assets with tools like Bitget Wallet to minimize risk during seasonal swings.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins