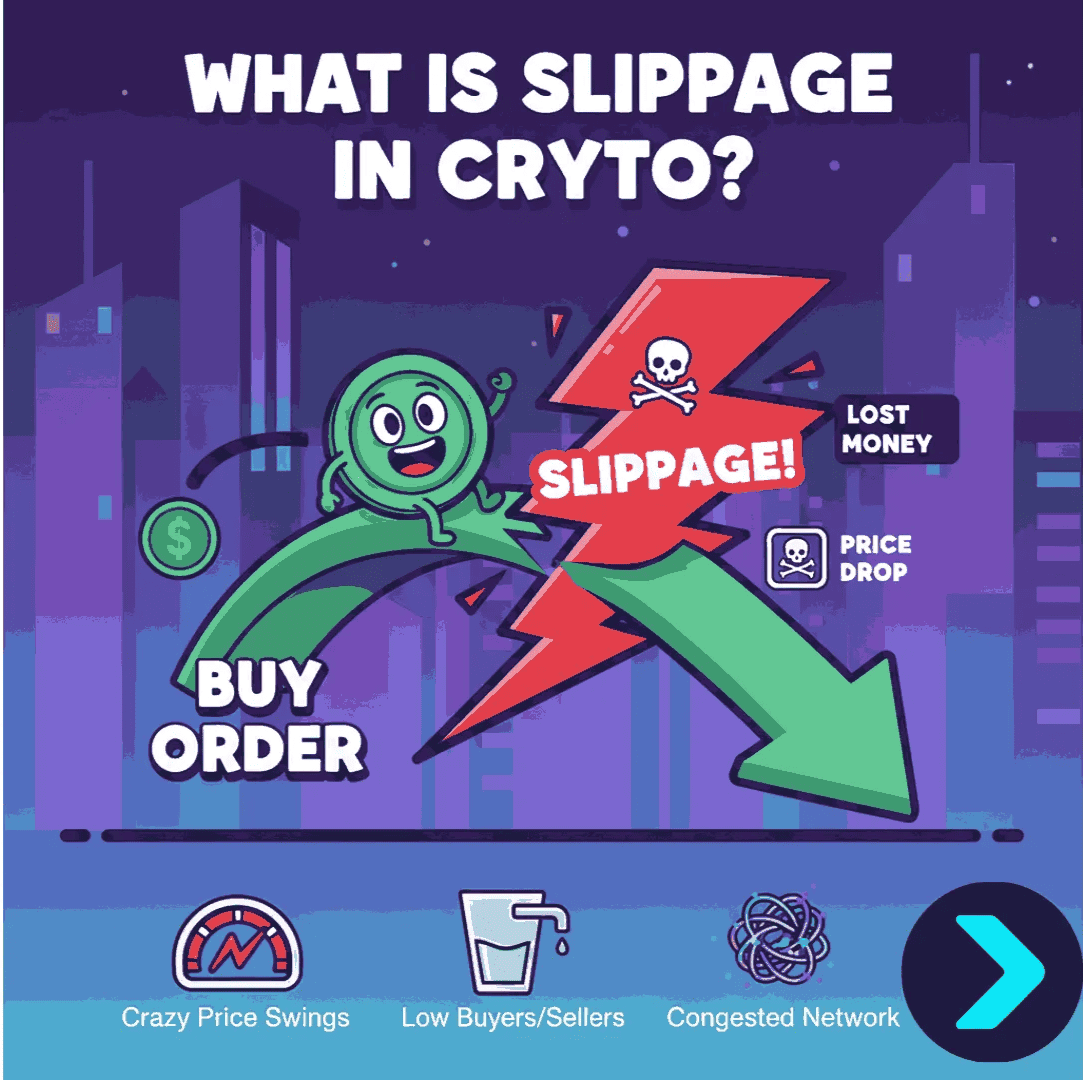

What is slippage in crypto?

What is slippage in crypto is the gap between the price you expect to pay for a trade and the price you actually get when it’s executed. Markets move quickly, so your order may fill at a less favorable level than quoted. Slippage can be positive—you get a better deal—or negative, meaning you pay more or receive less. It’s an everyday reality on centralized exchanges (CEXs) such as Kraken or Coinbase and decentralized exchanges (DEXs) like Bitget Wallet, 1inch, or CoW Swap.

To trade confidently, you need to understand why slippage happens and how to keep it under control. Key causes include market volatility, thin liquidity, large order sizes, and blockchain delays. This guide explains the causes, gives examples, and shows how to use slippage tolerance settings to safeguard your trades. You’ll also see platform-specific tips—from Bitget Wallet’s swap percentage slider to Kraken’s limit orders—and learn strategies such as splitting big orders or trading in high-liquidity pairs. Mastering these basics helps you optimize execution, reduce costs, and avoid hidden losses.

Bitget Wallet: The beginner-friendly gateway for stablecoins, memecoins, and cross-chain trading.

What is Slippage in Crypto Trading?

Slippage in crypto trading is the difference between the price you expect when placing an order and the price at which it actually executes. It happens because digital asset markets move fast, and liquidity can vary dramatically across trading pairs and platforms. Compared with traditional finance, crypto often faces higher volatility, thinner order books on smaller tokens, and network delays on blockchains — all of which make slippage more common. Understanding why it happens helps traders plan entries and exits more precisely and avoid hidden costs.

What Are the Types of Slippage in Crypto?

Slippage comes in two main forms:

| Type | Meaning | When It Helps | When It Hurts |

| Positive Slippage | Trade executes at a better price than expected. | You buy lower or sell higher than quoted. | Rare downside — usually a bonus. |

| Negative Slippage | Trade executes at a worse price than expected. | — | You pay more or receive less than intended. |

Examples:

- Buying ETH quoted at $2,000 but filled at $1,995 → positive slippage

- Selling BTC quoted at $40,000 but executed at $39,850 → negative slippage

- Swapping a new altcoin at $1.10 but filling at $1.15 due to thin liquidity

How Do Traders Experience Slippage in Real Life

Suppose you place a market order to buy ETH at $2,000:

- If it executes at $2,020, that’s $20 higher than quoted.

- Slippage is calculated as:

$$ \text{Slippage (\%)} = \frac{\text{Executed Price} - \text{Expected Price}}{\text{Expected Price}} \times 100 $$

Using the example: (2020 - 2000) / 2000 × 100 = 1% negative slippage.

Likewise, an order to sell ETH at $2,000 that fills at $2,015 represents a 0.75% positive slippage. Real trades often include small gaps like these — sometimes helpful, sometimes costly — which is why setting a proper slippage tolerance is essential, especially on volatile pairs or low-liquidity DEX pools.

What Causes Slippage in Crypto Trading?

Slippage happens for several reasons, and understanding them helps traders choose better times, tools, and strategies. The main culprits are volatility, liquidity, trade size, and network speed. Each factor can make the gap between an order price and its execution wider — sometimes by a fraction, other times by several percent.

Why Market Volatility Leads to Slippage?

Crypto markets react quickly to news, influencer posts, exchange listings, or big funding announcements. Sudden spikes in price — especially with hype tokens — mean that by the time your order hits the book or pool, the quote may already have shifted. For example, a token priced at $1.20 might surge to $1.35 within seconds after a major tweet, leaving market orders filled at the higher price.

How Liquidity Affects Slippage?

Pairs with deep liquidity, like BTC/USDT or ETH/USDT, have thick order books and large liquidity pools, so trades clear near the quoted price. Thin pairs or new memecoins often have shallow books; even small orders can “walk” through worse prices, causing significant slippage.

Do Large Orders Increase Slippage Risk?

Big trades consume available liquidity at the best price levels. On centralized exchanges, they chew through the order book; on DEXs, they drain liquidity pools. For instance, a $100,000 buy on a small-cap token may push the average fill price several percent above the initial quote.

How Do Network Delays or Execution Speed Cause Slippage?

Slippage also creeps in when network traffic or execution time slows a transaction. High gas fees, blockchain congestion, or long block confirmation times give the market room to move before your order settles. During peak usage — such as NFT drops or token launches — prices can shift noticeably while a trade waits in the mempool.

How is Slippage Different on CEXs vs DEXs?

Slippage behaves differently depending on whether you trade on a centralized exchange (CEX) or a decentralized exchange (DEX). The execution engines, liquidity models, and available settings all shape how much prices can drift between order placement and completion.

What Causes Slippage on Centralized Exchanges (CEXs)?

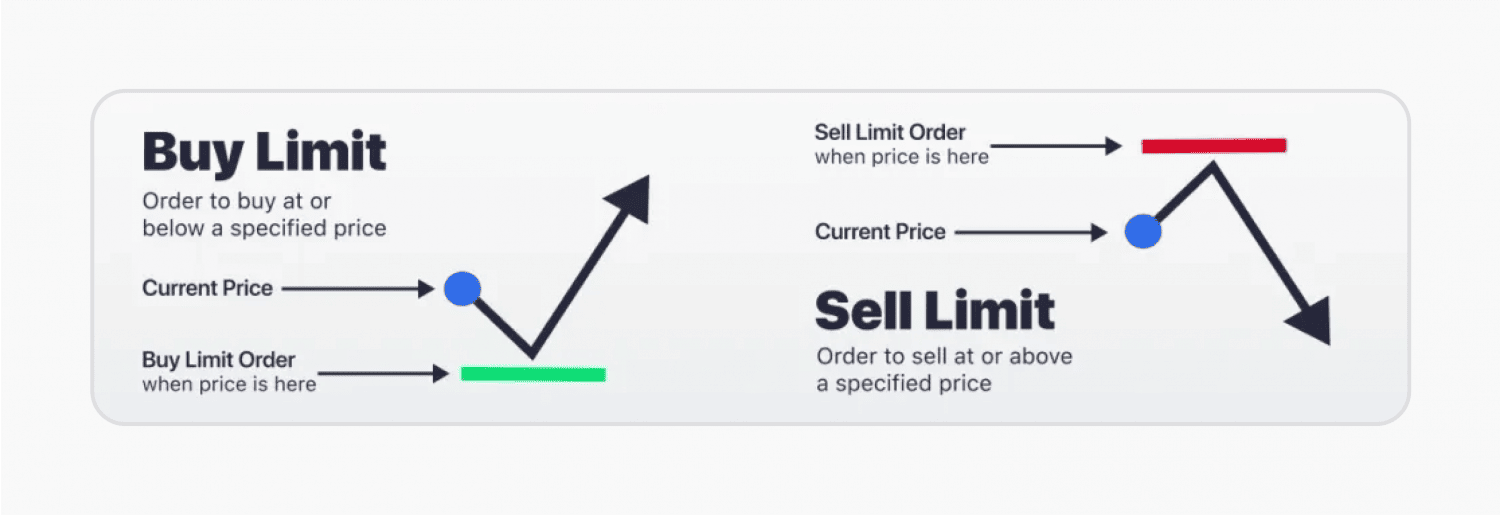

On CEXs like Coinbase, Kraken, or Binance, trades are matched through an order book. The key factor is depth: how many buy and sell orders sit at each price level. Market orders fill against the best available prices, but if the book is thin or your trade is large, execution moves down the book, creating slippage. Limit orders can help by locking in a maximum price, but they may remain unfilled in fast-moving markets.

How Slippage Works on Decentralized Exchanges (DEXs)?

DEXs such as Uniswap, 1inch, or Bitget Wallet use automated market makers (AMMs) and liquidity pools instead of order books. Prices adjust dynamically based on pool balances. Large trades move the price along the curve, and blockchain confirmation speed introduces an extra delay — prices may change between submitting a transaction and when it settles on-chain.

What is Slippage Tolerance and How Should You Set It?

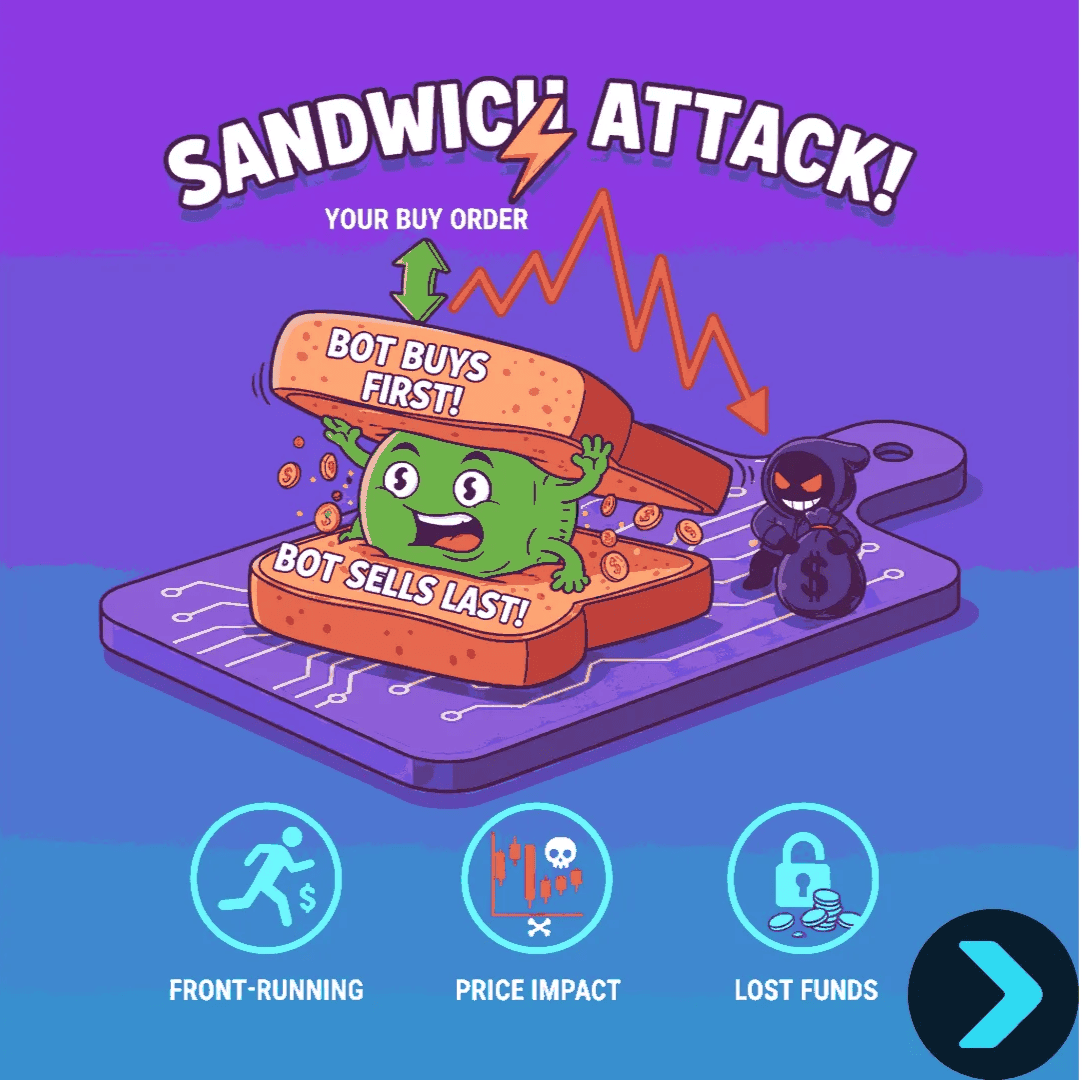

Slippage tolerance is the percentage range you allow between the expected and executed price on a DEX swap. Many platforms default to around 0.5%–1% for stable assets, but you can adjust this. Too low, and your transaction may fail (you still pay gas); too high, and you risk overpaying or falling prey to sandwich attacks or other MEV exploits. Adjust tolerance based on the asset’s volatility, liquidity, and urgency.

CEX vs DEX Slippage at a Glance

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

| Price source | Order book | AMM formula / liquidity pool |

| Speed | Fast (internal engine) | Dependent on blockchain confirmations |

| Main driver | Order book depth & order size | Pool size, trade size, network congestion |

| Control | Use limit orders | Set slippage tolerance % |

| Risks | Partial fills, thin books | Failed trades, MEV / sandwich attacks |

How to Calculate Slippage in Crypto?

Knowing how to measure slippage helps you see the real cost of a trade. Whether on a CEX or a DEX, the math is simple: compare what you expected to pay (or receive) with what you actually got, then express the difference as a percentage.

Source: b2binpay

What is the Formula for Slippage Percentage?

The basic equation is:

Slippage (%) = (Executed Price – Expected Price) ÷ Expected Price × 100

Examples

-

Buy ETH expected at $2,000, executed at $2,020

→ (2020 – 2000) ÷ 2000 × 100 = 1% negative slippage

-

Sell BTC expected at $40,000, executed at $40,200

→ (40200 – 40000) ÷ 40000 × 100 = 0.5% positive slippage

Positive slippage means you gained (paid less or sold for more). Negative slippage means you lost value versus your quote.

Do DEXs Calculate Slippage Differently?

On decentralized exchanges, slippage is often shown as the difference between the amount of tokens you expect and the amount you actually receive after a swap. AMMs adjust prices along a curve, so large trades or small pools shift the ratio more.

Example: You expect 100 USDT for 0.05 ETH, but the pool fills at 98 USDT because of size and liquidity — a 2% negative slippage.

By checking this percentage before confirming, you know if the trade risk fits your tolerance.

How to Minimize Slippage in Crypto?

Reducing slippage is about planning trades and using the right tools. By combining smart order types, good timing, and platform choice, you can keep execution close to your target price.

Should You Use Market or Limit Orders?

Market orders guarantee execution but not price — they fill at the best available levels, which may drift if liquidity is thin. Limit orders let you set the maximum you’ll pay (or the minimum you’ll accept). They protect you from bad fills, although they might not execute if the market moves too far.

When is the Best Time to Trade to Avoid Slippage?

Trade during periods of strong liquidity and lower volatility. For major coins, that often means overlapping U.S. and European sessions. Avoid placing big orders right after breaking news, during exchange outages, or at the start of token listings, when spreads and volatility spike.

How Can Splitting Large Orders Reduce Slippage?

Breaking big trades into smaller chunks — often called scaling in or out — prevents you from sweeping the entire order book or liquidity pool at once. This keeps the average fill price closer to your target, especially for thinly traded tokens.

Why Choose High-Liquidity Platforms?

Platforms with deep books or large liquidity pools help keep prices steady during execution. Well-established venues — for example, tools offered by Bitget Wallet — often provide better protection against sudden price jumps or thin spreads.

How to Sell With High Slippage?

If market conditions are unstable and you must exit quickly, set a realistic slippage tolerance and use a limit or stop-limit order rather than a blind market sell. For very illiquid assets, consider selling in stages or waiting for calmer trading conditions to avoid giving up too much value.

What Happens if Slippage is Too High?

Excessive slippage can turn a simple trade into an expensive mistake. If you allow too much deviation between quoted and executed prices, you risk giving up more value than expected or exposing yourself to blockchain exploits.

Can You Lose Money Because of Slippage?

Yes — when slippage tolerance is set too wide or the market moves sharply, your order may fill far from your intended price. For example, a buy at $2,000 with a 5% tolerance could execute anywhere up to $2,100. That extra cost may wipe out expected gains or even create an immediate loss.

What are the Dangers of High Slippage (MEV, Sandwich Attacks)?

On decentralized exchanges, bots monitor pending transactions. If your slippage tolerance is generous, they can front-run your order, push the price up (or down), let you fill at the worst point, and then reverse their trade — a tactic known as a sandwich attack. This type of MEV (maximal extractable value) is why setting reasonable limits is crucial.

Is 99% Slippage Good or Acceptable?

A 99% tolerance is almost never acceptable. It means you’re willing to execute even if the price nearly doubles or halves while your transaction is pending. Such a setting only makes sense for testing with tiny amounts or when you’re intentionally taking any price for an urgent exit — but for normal trades, it’s reckless and usually guarantees poor fills or losses.

What Slippage Tolerance Should You Use for Different Assets?

Setting the right slippage tolerance depends on the asset’s liquidity, volatility, and how urgently you need to trade. A careful balance keeps your order from failing without exposing you to unnecessary losses or on-chain exploits.

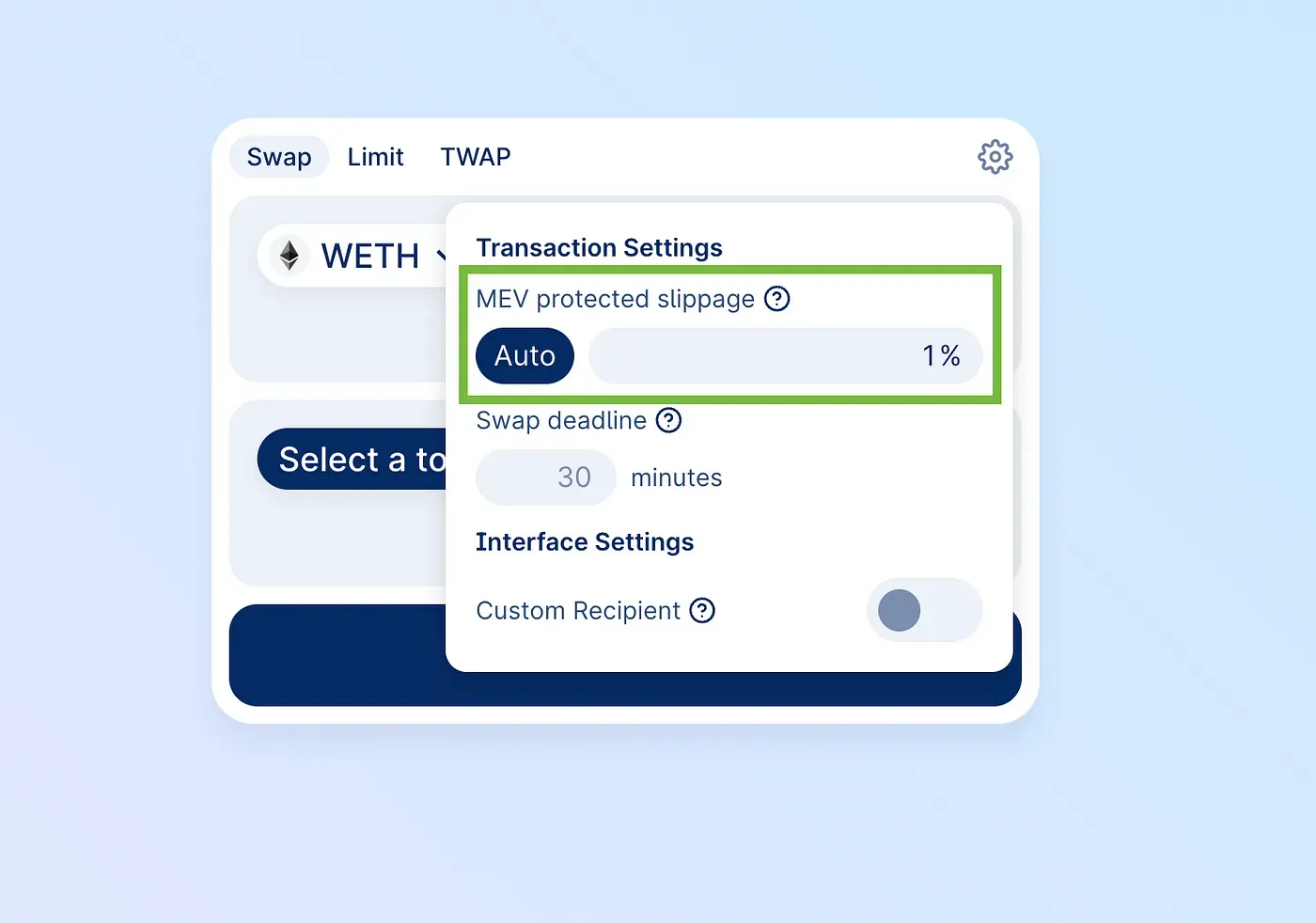

Source: Cow.fi

Recommended Slippage Ranges

| Asset Type | Suggested Slippage Tolerance | Notes & Risks |

| Stablecoins (USDT, USDC, DAI) | 0.25% – 0.5% | Spreads are usually tight; wider ranges rarely needed unless the network is congested. |

| Standard Assets (BTC, ETH) | 0.5% – 2% | Large liquidity cushions, but prices can still move fast in volatile sessions. |

| Volatile Assets (memecoins, new launches) | 2% – 5% (sometimes higher) | Only accept big tolerances if you’re prepared for heavy swings or failed trades. |

Key Warnings

- Even at modest tolerances, decentralized exchanges can expose you to MEV and sandwich attacks if your transaction is spotted in the mempool.

- Use reasonable settings and avoid trading thin pairs during hype events if you can.

- For very risky tokens, size down your order instead of blindly raising tolerance — this limits potential losses if price jumps while the swap is pending.

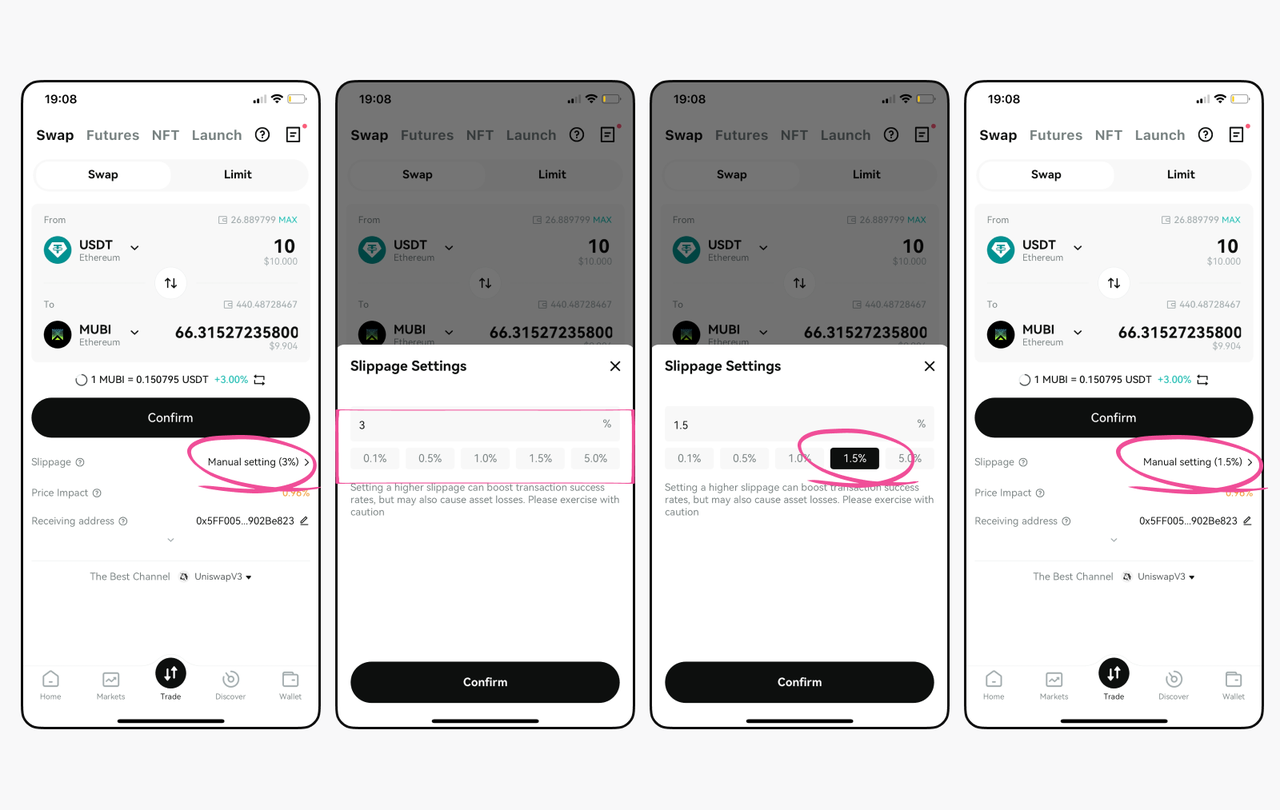

How to Adjust Slippage in Bitget Wallet

Managing slippage tolerance inside Bitget Wallet is simple and beginner-friendly. The platform lets you choose a preset or set your own percentage so trades stay within your comfort zone — helping you avoid failed transactions or paying more than planned.

Step-by-step:

- Open Bitget Wallet and go to the Swap page.

- Look for the current slippage value at the bottom right of the swap panel.

- Click the value to open the settings window.

- Pick one of the preset percentages (e.g., 0.5%, 1%, 2%) or type in a custom number.

- Press Confirm to save your choice and return to the swap screen.

By keeping slippage within a sensible range, you protect your trades from unnecessary losses and keep gas fees from being wasted on failed swaps. This makes Bitget Wallet a practical choice for anyone who wants a clear, risk-managed trading experience.

Manage your slippage tolerance easily inside Bitget Wallet for safer swaps.

Frequently Asked Questions (FAQ)

What is slippage in crypto trading?

Slippage is the difference between the quoted price and the actual price at which a trade executes. It can be positive (better price) or negative (worse price). Slippage happens on both centralized and decentralized exchanges, especially during volatile markets, thin liquidity, or when trades are unusually large.

What is a good slippage for crypto?

For stablecoins, 0.25%–0.5% is usually enough. BTC and ETH often work well with 0.5%–2%. Volatile tokens or new launches may need 2%–5%, but higher levels increase risk. Start small, match tolerance to liquidity, and avoid pushing above a few percent unless you accept the chance of bad fills or failed trades.

What happens if slippage is too high?

High slippage lets your order fill far from your intended price, wiping out profits or creating instant losses. On DEXs, a wide tolerance also makes you a target for sandwich attacks or other MEV bots. Only use wide ranges for urgent exits with very small amounts.

What slippage should I set?

Match tolerance to the asset and market: stablecoins ≈0.5%, BTC/ETH up to 2%, volatile pairs 2%–5%. For thin liquidity, consider smaller trades instead of raising tolerance. A balanced range prevents failures without inviting huge losses or front-running.

What is the purpose of slippage?

Slippage settings give your trade breathing room while protecting you from paying far more than quoted. On DEXs, a tolerance tells the contract how much deviation you’ll accept before the swap reverts. It’s a risk-management tool, not just an arbitrary number.

What is 100% slippage in crypto?

A 100% tolerance means you’re allowing the price to double or halve before the transaction cancels. It’s extremely risky and only useful for testing tiny amounts or emergency exits — never for normal trades.

Is 10 percent slippage bad?

Ten percent is high for most assets and usually only needed for illiquid tokens or chaotic launches. Use it only if you’re comfortable losing a big chunk of value, and reduce your order size instead of stretching tolerance when markets are thin.

Can you lose money because of slippage?

Yes. Negative slippage means paying more or receiving less than expected. Large orders, thin books, or volatile conditions can move the fill price away from your quote. Even a small percentage difference can erase profits, especially when fees and gas costs are added.

How much slippage is acceptable?

For major coins, under 1% is typical. Stablecoin trades often work with 0.25%–0.5%. Thin or hype markets may need up to 5%, but any higher invites unnecessary losses or MEV attacks. If tolerance must exceed 5%, consider splitting the order or skipping the trade.

How to get rid of slippage?

You can’t eliminate slippage completely, but you can minimize it: use limit orders, trade in deep markets, avoid announcements or token launches, and break large orders into smaller parts. On DEXs, set a sensible tolerance and monitor pool depth before confirming.

How to sell with high slippage?

If you must exit illiquid assets, set tolerance just wide enough to execute and consider splitting the sale into stages. Use stop-limit or limit orders if supported. Large “market sells” on thin pairs often push prices down fast, so patience helps preserve value.

Which slippage is best for trading?

There’s no single “best” level — it depends on liquidity, volatility, and urgency. Lower is safer for big coins or calm markets. Wider ranges suit fast-moving or low-cap tokens but demand caution. Adjust for each trade and prefer small size over reckless tolerance.

Is 99% slippage good?

A 99% setting is almost never reasonable. It tells the platform you’re willing to accept nearly any price. Use only for experiments with trivial amounts or emergency exits; otherwise, it guarantees disastrous fills.

What is an example of slippage in crypto?

You expect to buy ETH at $2,000, but by the time your trade executes it’s $2,020 — a 1% negative slippage. Conversely, selling at $2,000 but filling at $2,015 gives 0.75% positive slippage. Both show how prices can shift between order placement and execution.

Conclusion

What is slippage in crypto reminds us that even small price changes can impact every trade. Slippage stems from market volatility, thin liquidity, large order sizes, and execution delays — all factors that can move prices before an order settles. Learning how it works helps traders protect their capital and avoid unpleasant surprises.

Smart tactics make a difference: use limit orders to control entry prices, set sensible slippage tolerance, trade on high-liquidity platforms, and split large positions to reduce impact on books or pools. Always remember slippage can be positive or negative, so managing risk is as important as chasing opportunity.

Download Bitget Wallet to trade securely, manage your slippage tolerance across chains, and explore crypto with beginner-friendly tools.

Bitget Wallet Key Advantages

✅ Stablecoin Earn Plus: Earn up to 18% APY on your holdings

✅ Zero-fee trading on memecoins and RWA U.S. stock tokens

✅ Crypto card with Mastercard & Visa: Spend globally with zero fees

Sign up Bitget Wallet now - grab your $2 bonus!

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins