What Is Real Estate Tokenization? GATES and Oasys Partner to Bring RWAs to Japan’s Property Market

Real estate tokenization is picking up the pace in the world, driven by changing regulations and increasing interest from foreign investors. The method converts conventional property ownership to blockchain-based digital tokens. In the recent past, Japanese real estate company GATES partnered with blockchain platform Oasys to introduce tokenized real-world assets (RWAs) to Japan's property market.

This article covers the basics of real estate tokenization, the partnership behind it, the project’s scale, relevant regulations, and what it means for investors globally.

Key Takeaways

- Real estate tokenization offers fractional ownership through blockchain tokens for increased liquidity and access.

- GATES and Oasys tokenize over $75 million of Tokyo real estate, with further expansion.

- International investors have increased access to Japanese real estate markets through compliant legal structures and blockchain transparency.

What Is Real Estate Tokenization?

Real Estate Tokenization involves digitalizing the right to ownership of physical assets on a blockchain. A single token represents a proportion of ownership of the property, allowing investors to buy, sell, or trade pieces of the property without having to own the asset in whole.

Source from Primior

How Does Tokenization Differ from Traditional Real Estate Investment?

Conventional property investment typically entails the acquisition of entire properties or major stakes through conventional finance networks. This often requires substantial amounts of funds, takes a long time, and leads to illiquid assets.

| Aspect | Traditional Real Estate Investment | Real Estate Tokenization |

| Ownership Type | Entire property or large shares | Fractional ownership via digital tokens |

| Capital Requirement | High entry cost, large sums needed | Lower entry barriers, buy small portions |

| Liquidity | Low liquidity, hard to sell quickly | Higher liquidity, tokens trade easily on blockchain |

| Transaction Speed | Lengthy legal processes and paperwork | Fast transactions via blockchain |

| Accessibility | Mostly institutional or wealthy investors | Accessible to retail and institutional investors |

| Management & Record-Keeping | Managed offline, requires intermediaries and agents | Managed via blockchain with transparent smart contracts |

How Are Properties Recorded and Managed on the Blockchain?

Real Estate Tokenization are inscribed on a blockchain—a decentralized ledger that permanently records ownership and transaction data. Smart contracts, or self-executing contracts, automate processes like disbursing rental income or managing voting rights.

The system offers transparency, which allows investors to track ownership and transactions in real time without middlemen. It also reduces administrative work and the risks of errors or fraud.

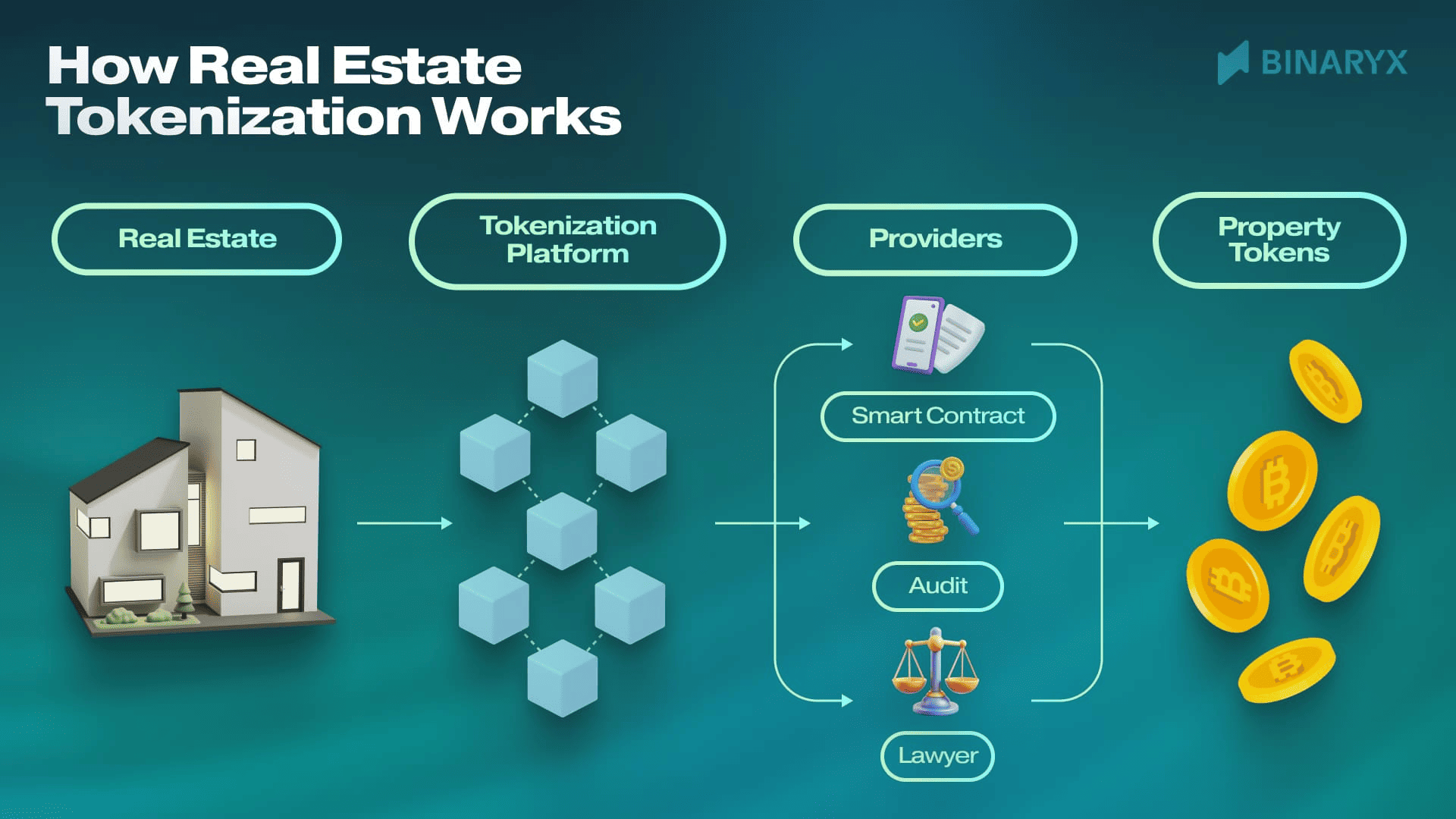

Source from Binaryx

Why Did GATES and Oasys Form a Partnership?

The partnership of GATES and Oasys pairs real estate expertise and blockchain technology to lead Japan towards property tokenization on an expansive level.

What Are the Strengths and Business Models of Each Company?

GATES was founded in 2012 and is a big Japanese real estate investment company with operations including acquisitions, asset management, and sales. The company generated about $145 million in 2024 and is preparing to list on Nasdaq in order to expand globally.

Source from LT

Oasys was originally a gaming blockchain platform that has now its eyes on real-world assets (RWAs). It runs a scalable, energy-efficient Layer 1 blockchain with Ethereum compatibility and institutional-grade tokenized asset optimization.

What Can This Partnership Enable in the RWA Space?

By integrating GATES's real-estate expertise and Oasys's blockchain, they will tokenise large Japanese real estate assets. This brings GATES's portfolio into reach of investors worldwide, making transactions safe, clear, and affordable.

Their alliance also presents a model for scaling beyond Japan's real-world asset tokenization to the global real estate markets.

What Does This Real Estate Tokenization Project Involve?

The project focuses on converting valuable Tokyo properties into blockchain-based digital tokens. It initially targets income-generating buildings valued at over $75 million in prime locations.

These properties provide steady rental income, attracting investors seeking reliable returns.

What Are the Properties Being Tokenized in Tokyo Worth $75M+?

The first phase includes income-producing buildings in top Tokyo areas, valued at $75 million+. These assets offer solid rental yields and strong market fundamentals, making them suitable for fractional investment.

This approach ensures token holders own stakes in tangible, high-quality properties rather than riskier development projects, balancing risk and return.

What Does the Roadmap Look Like, and How Big Will the Tokenized Asset Pool Grow?

After launching the $75 million Tokyo project, GATES and Oasys aim to scale up to $200 billion in tokenized assets—about 1% of Japan’s real estate market.

Plans also include expanding to other global hubs like the U.S., Europe, and Southeast Asia. Near-term goals focus on initial token sales and onboarding international investors using Oasys’s blockchain, with longer-term plans to diversify beyond real estate into other asset classes.

How Can Foreign Investors Buy Tokenized Real Estate in Japan?

Foreign investors can join Japan’s tokenized property market through a legal and technical framework designed for smooth cross-border investment and regulatory compliance.

A key feature is the Special Purpose Vehicle (SPV), a legal entity set up overseas that owns the properties. Investors buy tokens representing fractional shares in the SPV, isolating financial risk and simplifying legal ownership.

On the tech side, tokenized real estate runs on the Oasys blockchain, a secure, scalable Layer 1 platform. Investors can buy, hold, and trade tokens easily using Web3 wallets like Bitget Wallet, which offers a secure and user-friendly way to manage tokenized assets and cross-chain transactions.

What Is an SPV, and How Does It Ensure Regulatory Compliance?

The SPV is an overseas legal entity created to hold the real estate assets and manage investor relations. This setup isolates risk and complies with Japanese and international regulations.

Investors own tokens that represent their share of the SPV’s assets, simplifying legal complexities related to cross-border ownership.

What Advantages Does Tokenized Real Estate Offer to International Investors?

- Simplified Access: Web3 wallets connected to Oasys blockchain enable easy token purchases without traditional real estate hurdles.

- Better Liquidity: Tokens can be traded on secondary markets for faster exit options.

- Transparency & Security: Blockchain’s immutable ledger ensures clear ownership and transaction history.

- Fractional Ownership: Lower investment amounts let investors diversify across assets.

This opens Japan’s real estate market to a global audience like never before.

Could Japan’s Gaming and Cultural IP Be Tokenized Next?

Japan’s vibrant gaming and cultural IP, such as anime and game franchises, are promising candidates for future tokenization. These assets generate steady revenues and enjoy worldwide popularity.

Tokenization would allow investors to own fractional shares and benefit from transparent royalty management via blockchain, expanding tokenized real-world assets beyond physical property.

What Kinds of Assets Will Be Tokenized in Future Phases?

GATES and Oasys plan to expand beyond real estate by tokenizing high-value intangible assets rooted in Japanese culture. These include:

-

Gaming Franchises

Popular IPs from Japan’s renowned video game industry, offering global fan engagement and recurring revenue streams.

-

Anime and Manga IP

Iconic anime and manga titles with strong merchandising and licensing income potential.

-

Other Cultural Intellectual Property

Broader IP assets such as character brands, virtual idols, and multimedia content.

Tokenizing these assets unlocks new forms of fractional investment and global access to Japan’s soft power economy.

How Does Japanese IP Fit Into RWA Use Cases?

Tokenizing Japanese intellectual property (IP) is a natural next step in the Real World Asset (RWA) revolution. Here's why it aligns so well with global investor demand and blockchain capabilities:

-

Consistent, Predictable Revenue Streams

Iconic Japanese IPs—such as anime, manga, and video game franchises—generate stable income through licensing, streaming, merchandising, and international syndication. This predictability makes them ideal for fractional ownership and tokenized yield models.

-

Global Fanbase and Brand Equity

Japan's cultural IP commands passionate global followings. Tokenized IP allows fans to become stakeholders, creating strong community-driven value and long-term investment potential.

-

High Barriers to Entry and Limited Supply

These assets are rare, tightly held, and protected by legal frameworks. Tokenization provides controlled access to a traditionally illiquid and exclusive market.

-

Blockchain Enhances Transparency and Trust

Smart contracts enable real-time royalty tracking and automated revenue sharing, reducing disputes and administrative costs for both creators and rights holders.

What Are Japan’s Latest Regulatory Developments for RWAs?

Japan is advancing regulations to support real-world asset tokenization:

- The Financial Instruments and Exchange Act (FIEA) now recognizes tokenized real estate interests as securities, enhancing investor safeguards.

- Japan’s first security token trading platform launched by Osaka Digital Exchange boosts secondary market liquidity.

- New licensing rules will require token sellers to register as financial instruments business operators for compliance.

- Tax reforms aim to reduce crypto taxes and offer breaks to startups issuing tokens, encouraging investment.

What Legal Updates Are Expected After 2025?

The Japan Crypto Asset Business Association (JCBA) is drafting guidelines for token issuance, custody, and trading, with the Financial Services Agency (FSA) expected to formalize regulations post-2025.

How Are Financial Institutions and Government Bodies Involved?

Financial firms increasingly partner with blockchain companies to offer RWA products, while government agencies engage in consultations to balance innovation with investor protection.

This cooperative approach aims to make Japan a leader in blockchain asset management.

Conclusion

Real estate tokenization is transforming property investing by combining traditional assets with blockchain technology. The GATES and Oasys partnership is a pioneering effort to make Japan’s real estate market more accessible and transparent, especially for international investors.

With regulations evolving and blockchain infrastructure maturing, tokenized real estate in Japan holds great promise. Investors can explore and manage these assets securely using Bitget Wallet, a trusted platform for digital asset management.

FAQs

What is real estate tokenization?

It is the process of converting physical property ownership into blockchain-based digital tokens representing fractional shares, making investing more accessible and liquid.

How does tokenization benefit investors?

It lowers entry barriers, improves liquidity, increases transparency, and simplifies transactions by cutting out intermediaries.

How does the GATES-Oasys partnership impact Japan’s real estate market?

It leads large-scale tokenization projects, opening Tokyo real estate to global investors via compliant blockchain platforms.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.