What Is Perpetual DEXs and What Traders Should Know About Perpetual Trading

What is Perpetual DEXs? It refers to a decentralized trading system that enables users to trade on-chain perpetual futures directly through smart contracts — with no intermediaries, no centralized custody, and no expiry dates. In perpetual trading, positions remain open indefinitely as long as margin requirements are met, allowing traders to use leverage while maintaining full transparency and control.

By 2025, Perp DEXs have evolved into one of DeFi’s fastest-growing sectors, surpassing $1.5 trillion in cumulative trading volume, driven by institutional participation, better liquidity, and deep wallet integration. These platforms embody the principles of decentralization — automation, self-custody, and verifiable transparency.

In this article, you’ll learn how Perpetual DEXs work, what makes them unique, the opportunities and risks of perpetual trading, and how Bitget Wallet connects users seamlessly to this next-generation decentralized derivatives ecosystem.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

What Is a Perpetual DEX and How Does It Work?

A Perpetual DEX (Decentralized Perpetual Exchange) is an on-chain derivatives platform where traders buy and sell perpetual contracts — futures with no expiry date. These contracts mirror the price of an underlying asset (like Bitcoin or Ethereum) through funding rates, ensuring that perpetual prices remain close to spot values.

Instead of a centralized intermediary, smart contracts automatically manage order execution, margin, funding, and liquidation. Traders connect wallets, such as Bitget Wallet, to open leveraged positions directly from their accounts. Every perpetual trade is executed transparently on-chain, with cryptographic proofs ensuring fairness and visibility.

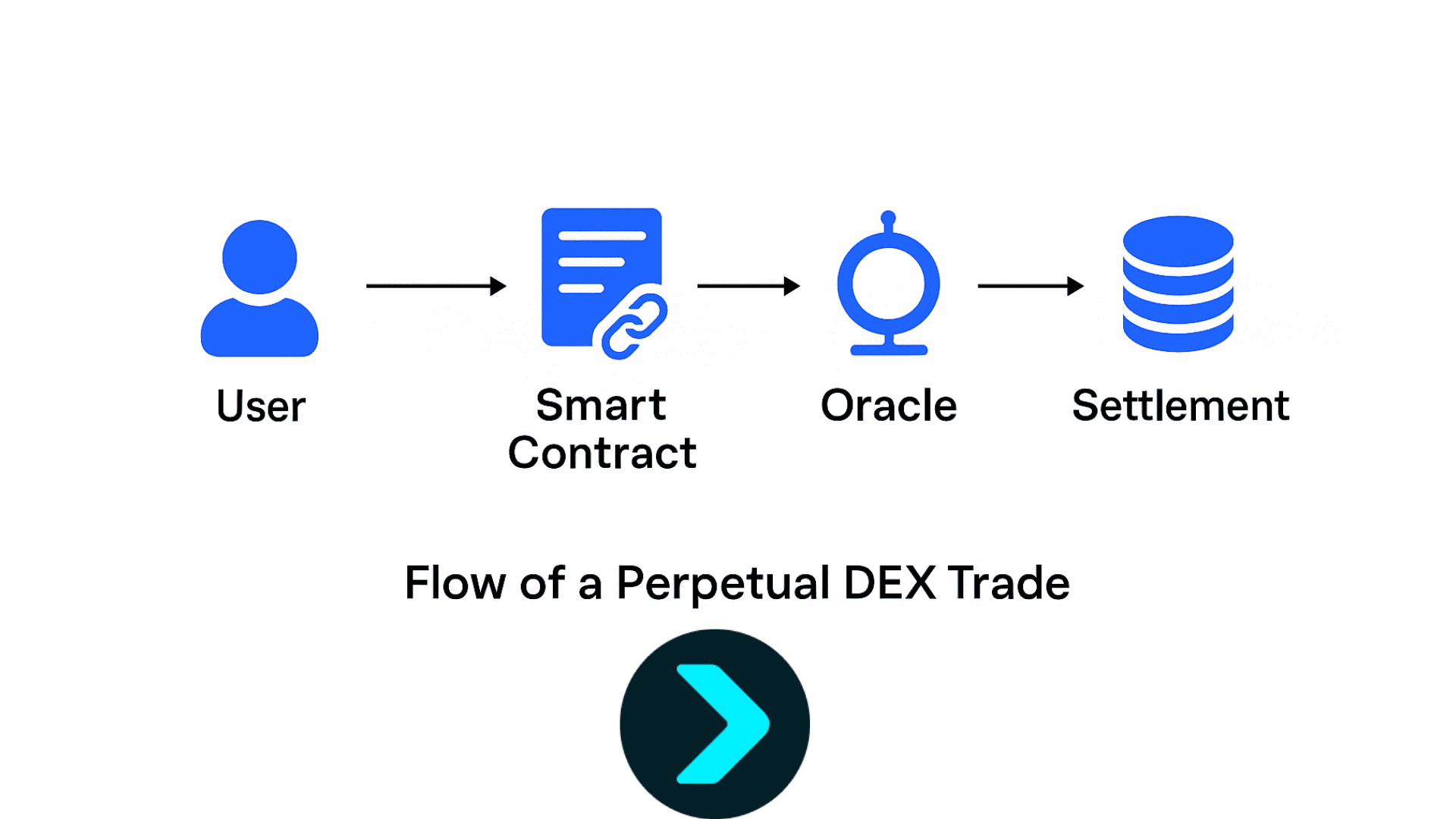

📊 Perpetual DEX Transaction Flow

| Step | Description |

| 1. Trader | Connects via Bitget Wallet and selects the perpetual market. |

| 2. Smart Contract | Holds collateral, manages leverage, and executes trades automatically. |

| 3. Oracle | Provides real-time price data to adjust funding rates and settle contracts. |

| 4. Settlement | Profits/losses and funding payments are distributed on-chain. |

What is On-chain Structure?

The on-chain structure of a Perpetual DEX replaces brokers and clearing houses with autonomous smart contracts. These handle every stage — margin accounting, funding adjustments, and liquidation logic — removing any need for manual oversight.

There are two dominant infrastructure models:

| Model | Example Platforms | Mechanism | Performance Insight |

| AMM / vAMM (Automated Market Maker) | GMX, dYdX (v3) | Liquidity providers back trading pools; pricing is algorithmic. | High transparency but limited depth and slippage at scale. |

| On-Chain Order Book | Hyperliquid, Aster | Uses on-chain limit orders for precise pricing and speed. | Deeper liquidity and near-CEX execution quality. |

Because all Bitget Wallet perpetual contracts are Perp DEX-based, users retain full transparency and control, ensuring every trade is visible, auditable, and managed through code, not intermediaries.

How Do Perpetual Contracts Differ From Traditional Futures?

Unlike traditional futures, which expire on a set date and require periodic rollover, perpetual contracts stay open indefinitely. They maintain price alignment with the spot market via funding rate payments — a mechanism where longs pay shorts when the perpetual price trades above spot, and shorts pay longs when below.

This structure creates continuous settlement and enables 24/7 trading — a defining feature of Decentralized Perpetual Exchanges.

| Feature | Traditional Futures | Perpetual Contracts (Perp DEX) |

| Expiry Date | Fixed (weekly/monthly) | None — trades roll indefinitely |

| Settlement | On expiry | Continuous funding payments |

| Execution Venue | Centralized exchange (CME, Binance Futures) | On-chain via smart contracts |

| Transparency | Limited | Full on-chain visibility |

| Custody | Centralized broker | User-controlled via Bitget Wallet |

Why Are Perpetual DEXs Growing So Fast in 2025?

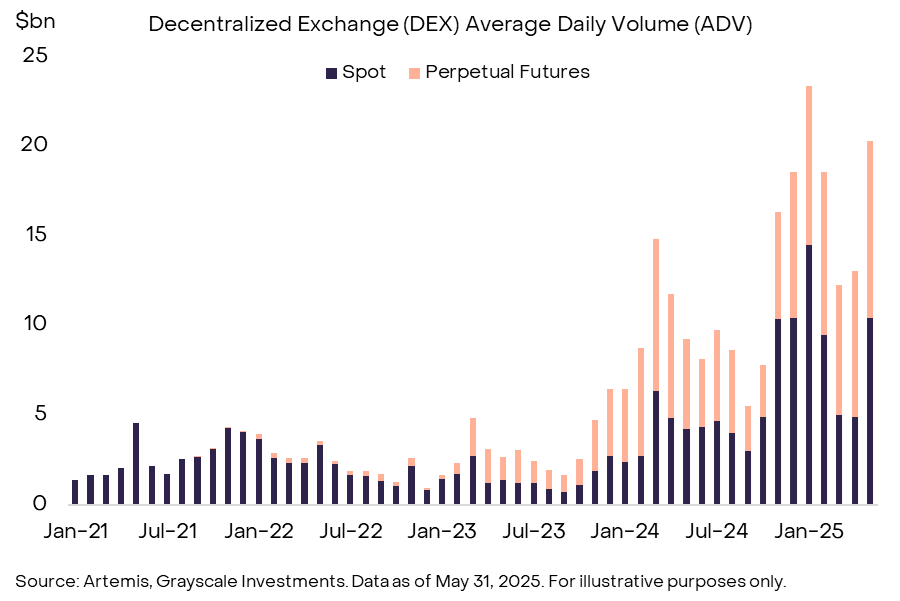

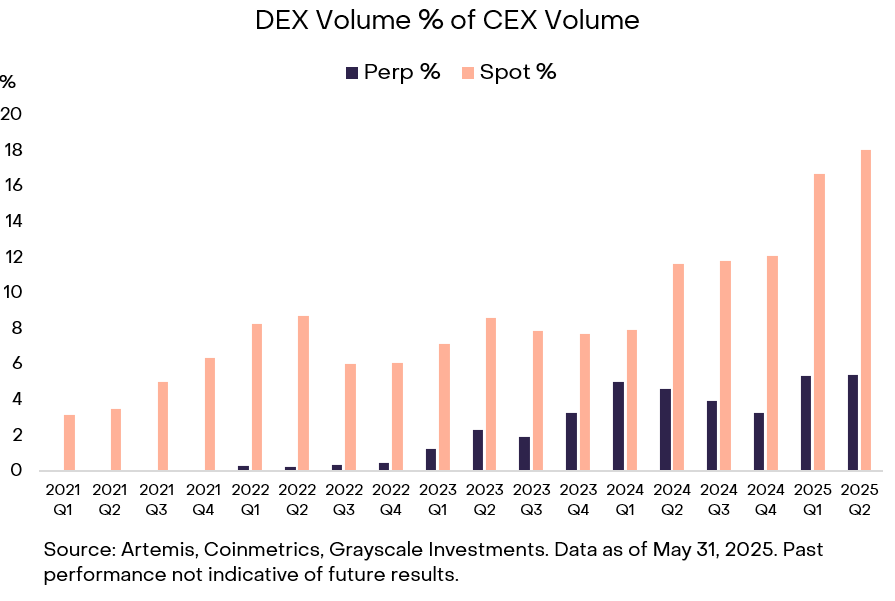

According to DefiLlama, total Perpetual DEX trading volume surpassed $1.5 trillion in 2025, representing over 26% of all perpetual futures trading globally. This explosive rise marks a fundamental shift in trader preference: from custodial platforms to on-chain transparency and control.

After the collapse of major CEXs like FTX, users demanded self-custody, verifiable reserves, and composable trading environments. Perpetual DEXs answered that call. They integrate seamlessly with DeFi primitives — lending markets, yield vaults, and even Real-World Asset (RWA) protocols such as Avantis on Base, letting traders loop collateral into multiple yield sources.

Layer 1 and Layer 2 scaling solutions have also made high-frequency on-chain trading viable, while institutional investors are entering through whitelisted wallets and on-chain liquidity programs.

Source: Artemis

Perpetual DEXs now handle over $1.5 trillion in 2025 trading volume, capturing 26% of the global derivatives market as traders shift toward self-custody and transparency.

How Do Hyperliquid and Aster Lead the Market?

Two giants dominate this new era: Hyperliquid and Aster.

- Hyperliquid runs on a custom Layer 1 blockchain built specifically for high-speed on-chain order matching. It offers an on-chain order book, ~73% market share, and leverage up to 50×, with institutional-grade latency and transparent fees.

- Aster, on the other hand, focuses on cross-chain design and yield-bearing collateral. Its users can deposit stablecoins, earn passive yield, and trade perps with up to 1000× leverage — though with higher liquidation risk.

| Platform | Chain Model | Leverage | Collateral Type | Liquidity Depth | Core Strength |

| Hyperliquid | Custom L1 | 50× | USDC / USDT | Deep | Speed + Transparency |

| Aster | Multi-chain | 1000× | Yield-bearing stablecoins | Broad | Cross-chain + Yield |

| GMX | Arbitrum / Avalanche | 50× | Pool-based liquidity | Moderate | Simplicity + Proven UX |

Both platforms set new standards in liquidity depth, execution speed, and composability, showing how decentralized infrastructure can rival — and often outperform — centralized systems.

What Should Traders Know Before Trading on Perpetual DEXs?

Trading on Perpetual DEXs demands strategy and caution. Leverage magnifies gains and losses alike. Funding payments, often overlooked by new traders, act as rebalancing fees paid periodically between long and short positions to align perp prices with spot.

Each Perp DEX sets its own margin thresholds and liquidation logic, often enforced automatically through smart contracts. While on-chain trading ensures transparency, liquidity depth can vary — especially for smaller assets, where slippage can widen rapidly.

Smart contract vulnerabilities and oracle manipulation remain ongoing risks, alongside regulatory uncertainty as global agencies examine DeFi derivatives.

Traders should manage leverage conservatively, diversify positions, and use reputable exchanges such as Hyperliquid, Aster, and Bitget Wallet–integrated protocols.

What Are the Key Benefits of Using a Perpetual DEX?

Perpetual DEXs combine freedom, transparency, and financial innovation within a single interface.

- Self-custody: Users retain full control of funds — no exchange holds your collateral.

- Transparency: All trades, liquidations, and funding rates are visible on-chain.

- 24/7 Global Access: No KYC or geo-restrictions.

- Incentives & Tokenomics: Traders earn governance tokens, rebates, or staking rewards.

- Composability: Integrate your positions with lending, yield, and options protocols.

- Scalability: L2 chains like Arbitrum, Solana, and Base enable fast, low-fee trading.

Source: Artemis

What Are the Key Risks and Limitations of Perpetual DEXs?

Despite their growth, Perpetual DEXs carry distinct risks:

- Liquidity fragmentation: Depth varies across platforms and assets.

- Smart-contract vulnerabilities: Bugs and oracle manipulation can trigger losses.

- Funding rate volatility: Payments can swing sharply during market stress.

- High leverage risk: Overexposure leads to liquidation cascades.

- Regulatory uncertainty: Global scrutiny on crypto derivatives continues to tighten.

As noted by market analysts, “six times more volume now originates from leverage than from spot buying” — highlighting both opportunity and systemic risk.

The key takeaway: innovation doesn’t erase risk — it simply redistributes it.

How Do Perpetual DEXs Differ From Centralized Exchanges (CEXs)?

| Feature | Perp DEX | Centralized Exchange (CEX) |

| Custody | User-controlled (self-custody) | Exchange-controlled |

| Transparency | Fully on-chain, verifiable | Limited visibility |

| Accessibility | Permissionless, wallet-based | KYC-restricted |

| Execution Speed | On-chain (L2 optimized) | Centralized servers |

| Fees | Lower, transparent | Tiered and opaque |

| Regulatory Status | Decentralized, jurisdiction-agnostic | Licensed, jurisdiction-bound |

The primary distinction lies in custody and transparency: Perp DEXs allow users to own and audit their funds — while CEXs require trust.

How Do Tokenomics Strengthen Perp DEX Ecosystems?

Tokenomics power the liquidity engine behind Perpetual DEXs.

For example, Hyperliquid’s HYPE token burns 93% of trading fees and allocates 7% to liquidity rewards — a deflationary design encouraging volume and stability. Liquidity pools (HLP) generate average yields of 6–7% APY, incentivizing passive capital inflows.

By distributing rewards between liquidity providers and active traders, tokenomics align incentives and reinforce the DEX ecosystem — creating self-sustaining, growth-driven markets.

What Will the Future of Perpetual DEXs Look Like?

The next evolution is institutional on-chain trading. Funds are experimenting with compliant wallet whitelists and auditable smart contracts. Meanwhile, AI-powered analytics are emerging to optimize funding rate arbitrage, liquidation avoidance, and automated market-making.

Expect yield-bearing collateral, dark pool privacy layers, and cross-chain oracles to redefine how derivatives interact with the rest of DeFi.

Perpetual DEXs are no longer experimental — they’re becoming the backbone of decentralized financial infrastructure.

How to Trade Perpetual Contracts Safely with Bitget Wallet?

All perpetual contracts available through Bitget Wallet are Perp DEX-based, giving users true self-custody and transparency.

When you trade Futures on Bitget Wallet, you’re actually trading Perpetual Contracts — decentralized futures with no expiry date. Unlike traditional futures that expire monthly or quarterly, these contracts remain open as long as margin requirements are met. This allows traders to hold leveraged positions indefinitely, enjoy continuous funding settlements, and maintain full transparency over every trade on-chain.

By using Bitget Wallet, traders can experience the freedom of on-chain perpetual futures — no centralized custody, no hidden liquidations, and no trading restrictions. Every position, funding payment, and margin adjustment is governed by smart contracts, ensuring fairness and security. In short, buying “Futures” here means participating in a true decentralized perpetual trading ecosystem with the flexibility and benefits of DeFi.

Bitget Wallet features include:

✅ Multi-chain support across Ethereum, Solana, Base, and BNB Chain.

✅ Real-time Perp DEX integration with trending tokens.

✅ Zero-fee memecoin and stablecoin trading.

✅ Cross-chain swapping for perpetual positions.

✅ Stablecoin Earn Plus (10% APY) for idle collateral.

How to Trade Futures on Bitget Wallet?

Trading Futures on Bitget Wallet means speculating on a token’s price movement — you don’t buy or hold the token itself, but trade contracts that mirror its price. Your profit or loss depends on how the market moves.

Bitget Wallet makes this process simple and transparent. You can access decentralized perpetual futures directly on-chain, choose your preferred leverage, and open long or short positions based on your strategy. Always remember to set leverage carefully according to your risk tolerance to manage exposure effectively.

Here’s a step-by-step guide to trading futures on Bitget Wallet.

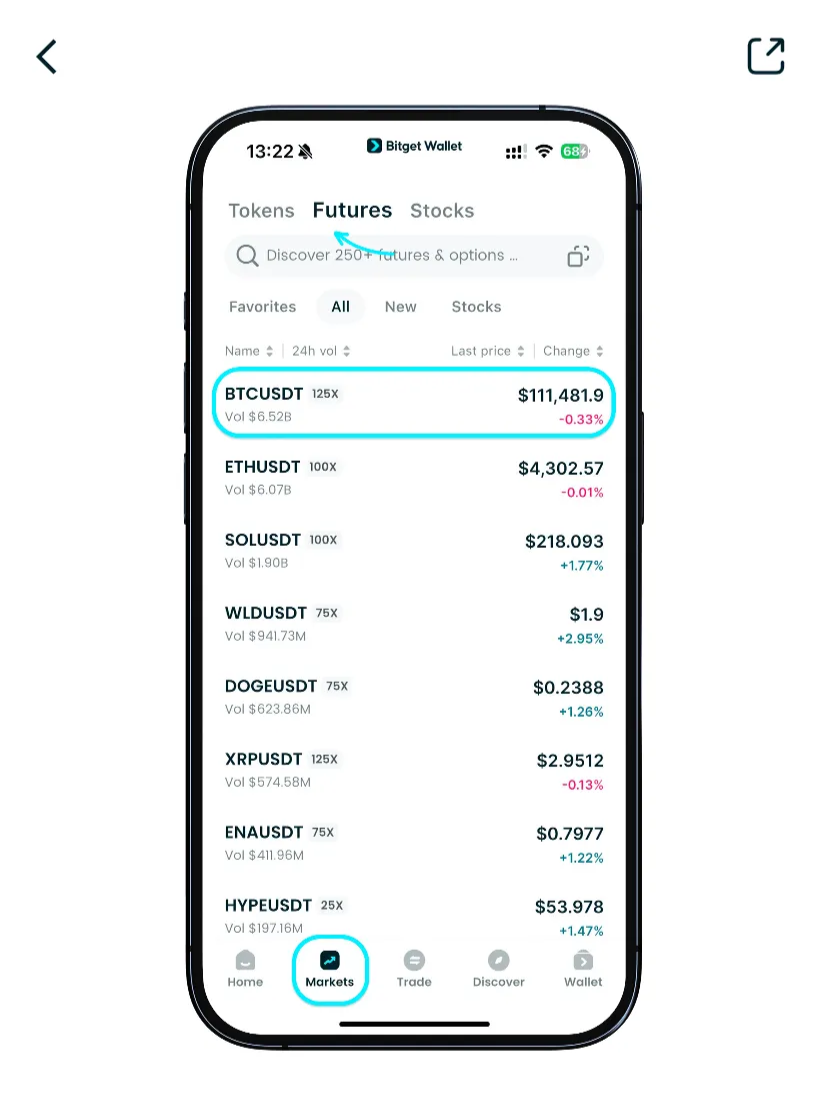

Step 1: Go to Markets, then tap Futures.

Choose a trading pair such as BTC/USDT.

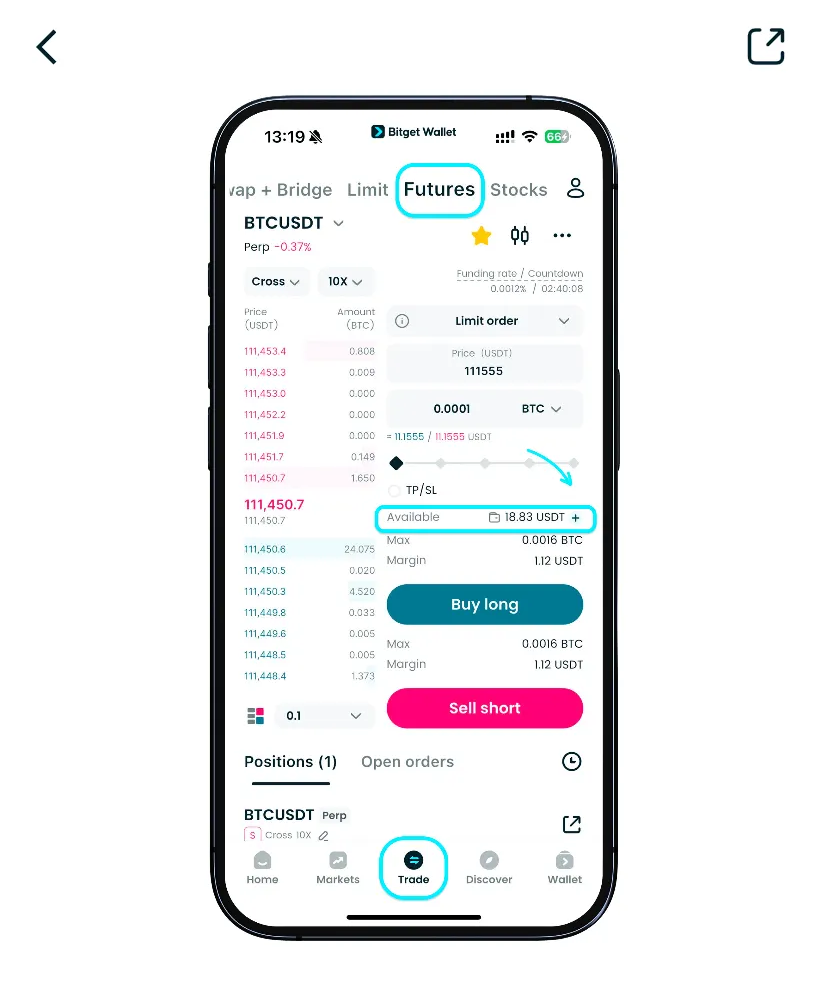

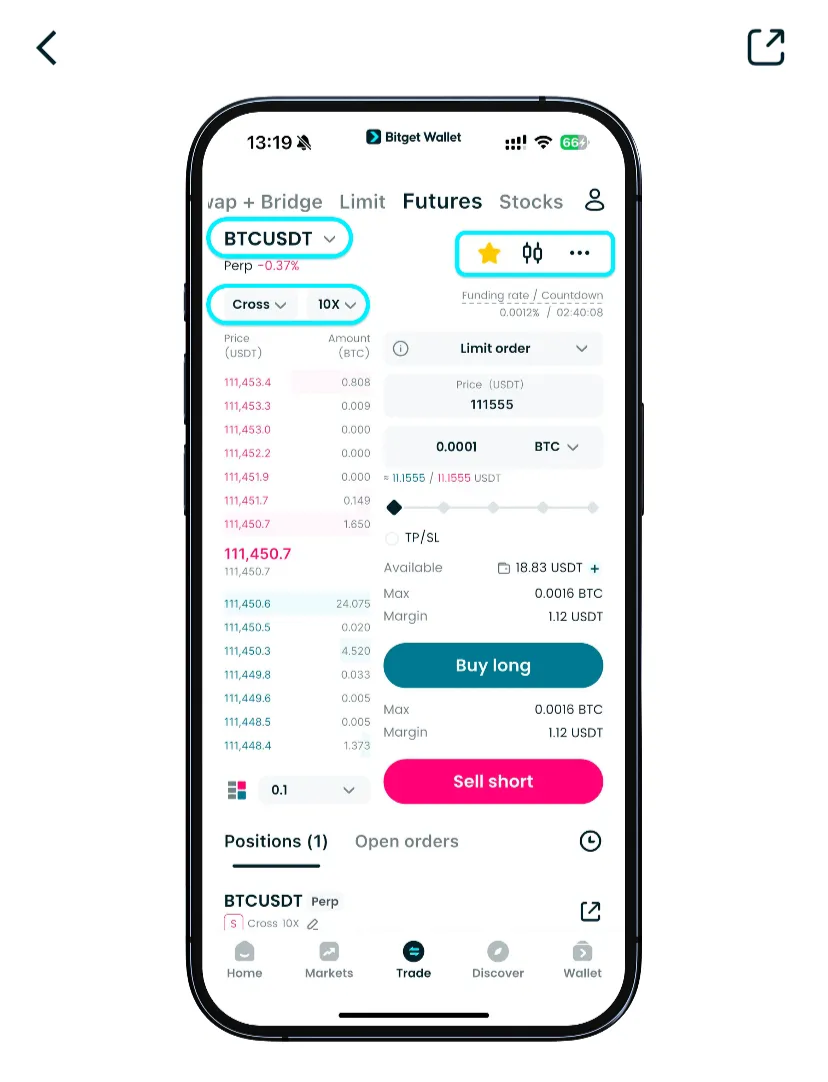

Step 2: Go to Trade → Futures.

Tap the + icon to deposit USDT into your Futures account.

Step 3: Select Cross or Isolated margin mode.

Adjust your leverage (for example, 10x).

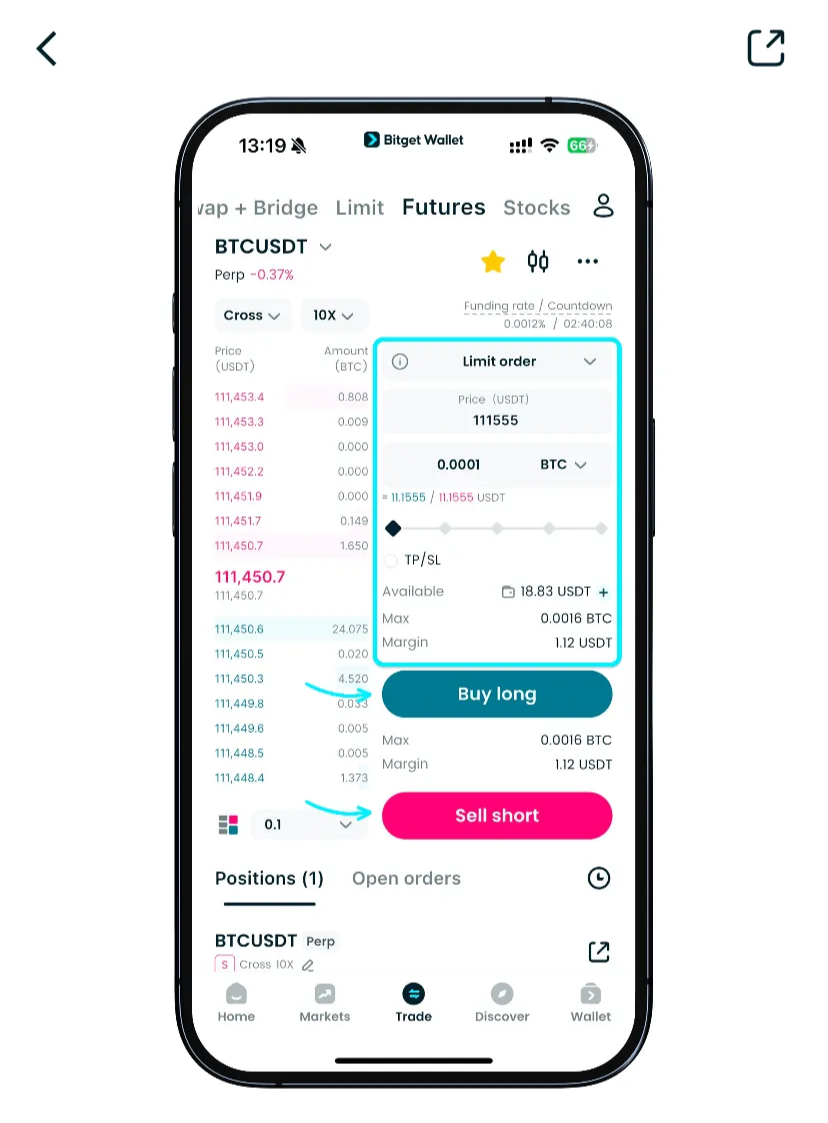

Step 4: Tap Limit order to choose Limit, Market, or Trigger order type.

Enter your desired price and amount.

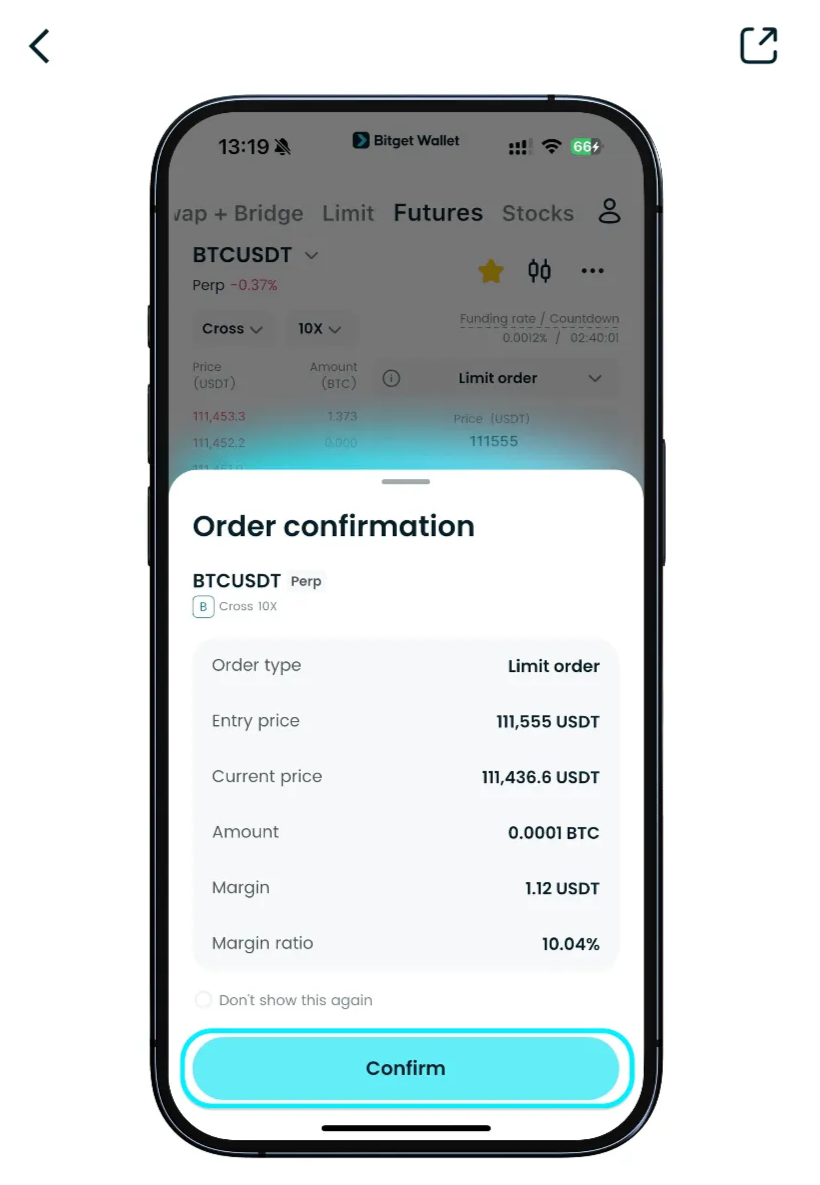

Step 5: Review your order details carefully.

Tap Confirm to place the order.

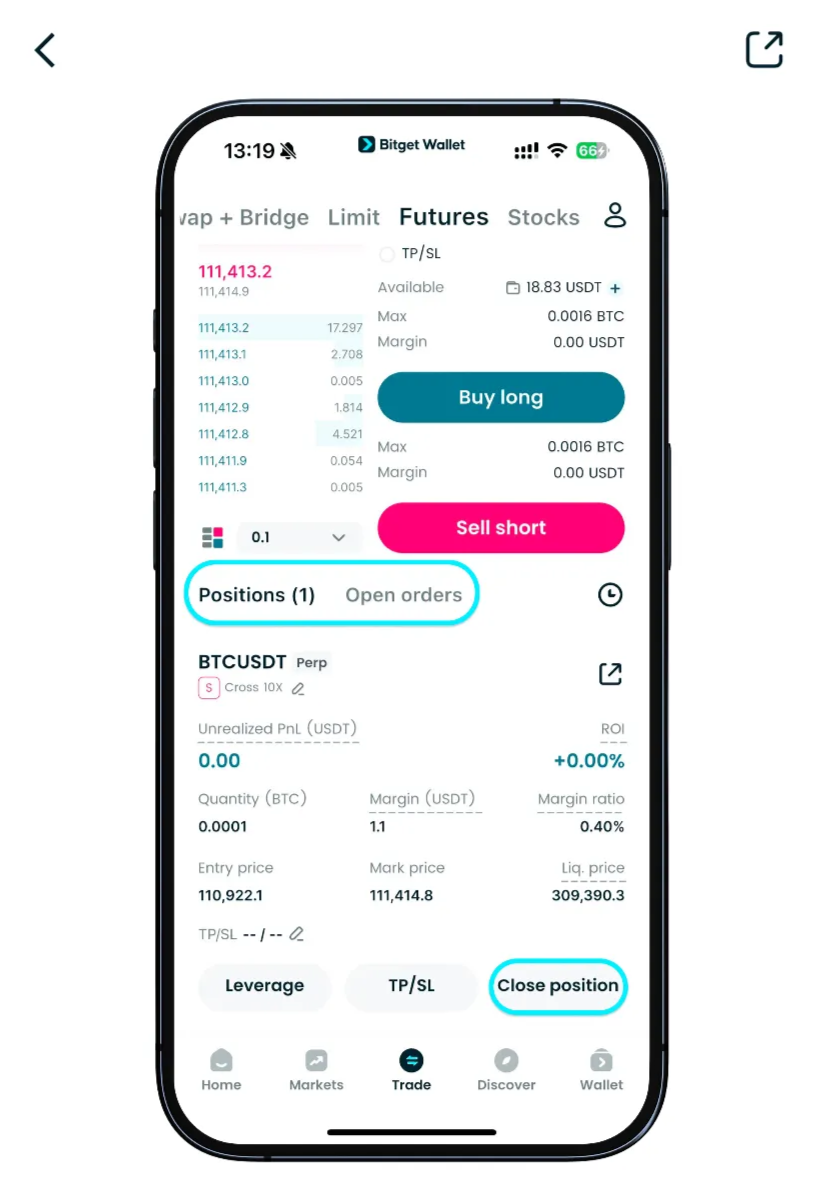

Step 6: Check your open position under Positions.

To close a trade, tap Close position.

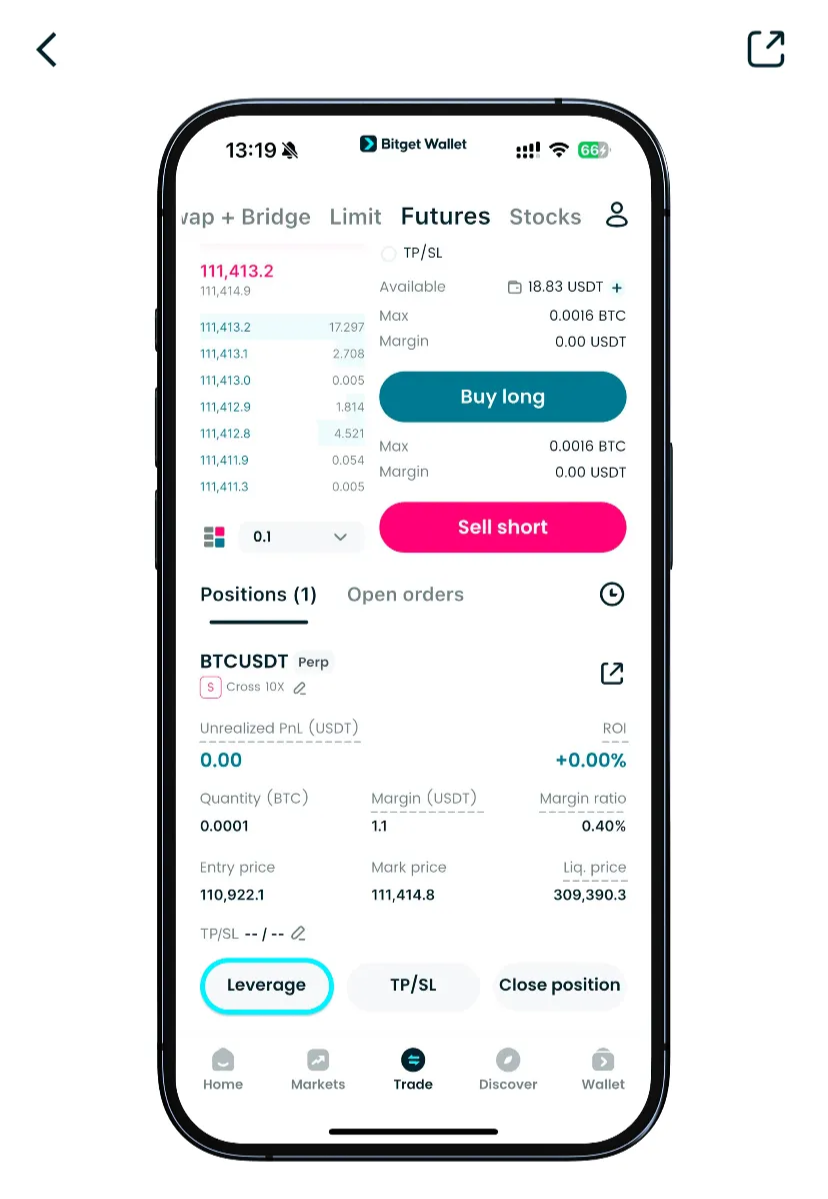

Step 7: To change leverage before an order fills, tap Leverage.

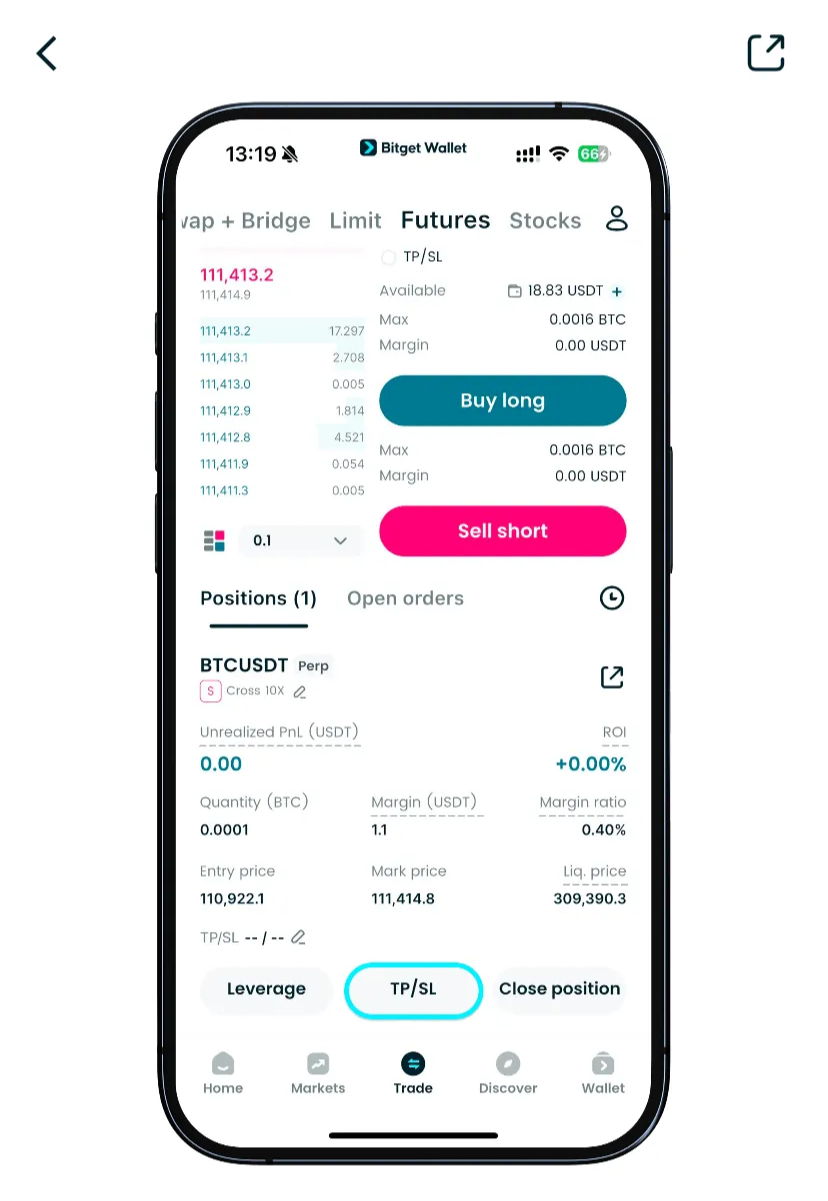

Step 8: Tap TP/SL to set your take-profit and stop-loss targets.

Enter your trigger prices and confirm.

*Download Bitget Wallet to trade Perp DEX contracts, manage stablecoins securely, and join the next wave of decentralized derivatives.*

Conclusion

What is Perpetual DEXs is more than a definition — it represents a revolution in how traders engage with on-chain finance. By removing intermediaries, perpetual DEXs empower users with transparency, self-custody, and composability.

Platforms like Hyperliquid, Aster, and Bitget Wallet are leading the shift toward secure, decentralized perpetual trading — bringing institutional-grade tools to retail hands.

Start trading decentralized perpetual futures today — download Bitget Wallet and experience seamless Perp DEX trading.

FAQs

1. What does “Perpetual” mean in crypto?

Perpetual contracts have no expiry date. They use funding payments to keep prices aligned with the spot market.

2. Are Perp DEXs safer than centralized exchanges?

Yes, because users hold their own keys — but smart contract risks still exist.

3. What leverage can traders use on Perpetual DEXs?

Depending on the platform, anywhere from 20× to 1000× — though conservative use is recommended.

4. Which wallets support Perp DEX trading?

**Bitget Wallet** provides seamless access to decentralized perpetual exchanges, enabling cross-chain trading, stablecoin management, and full self-custody.

5. Can I earn yield on collateral while trading?

Yes. Some Perp DEXs allow yield-bearing collateral so traders can earn passive income while keeping positions open.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- About the funding rate2025-04-17 | 2 mins

- How to open a position?2022-11-25 | 5 minutes