What is Linear Unlock: Token Unlock Trading Strategy and Key Investor Insights

What is Linear Unlock in crypto? Linear Unlock is a token release mechanism where tokens are gradually unlocked over a set period, rather than all at once. This approach ensures a steady distribution of tokens, which can help stabilize market supply and manage investor expectations.

Unlock events matter because sudden token releases can significantly impact price volatility, liquidity, and overall investor sentiment. By understanding the timing and structure of these unlocks, investors can make smarter decisions and anticipate market movements.

Unlike Cliff Unlocks, where a large batch of tokens is released at a single point in time, Linear Unlocks distribute tokens incrementally. This gradual approach reduces abrupt market shocks and provides a predictable token flow.

With Bitget Wallet, you can track upcoming token unlocks and plan smarter, ensuring you never miss an important event that could affect your portfolio.

Key Takeaways

- Linear Unlock gradually releases tokens over a set schedule, helping stabilize market supply and reduce sudden price shocks.

- Investors can plan strategies more effectively by monitoring Linear Unlock events and understanding their impact on liquidity and market sentiment.

- Using tools like Bitget Wallet, you can track token unlock schedules, compare Linear Unlock vs Cliff Unlock, and make informed trading decisions.

What is Linear Unlock in Crypto?

Linear Unlock in crypto refers to a token release mechanism where tokens are gradually unlocked over a defined period, rather than being released all at once. This method allows projects to manage the circulation of tokens more predictably, providing a smoother supply curve and helping to reduce sudden price volatility in the market.

The main purpose of Linear Unlock in tokenomics is to control token supply and stabilize investor sentiment. By spreading token releases over time, projects can prevent large dumps that might occur with traditional Cliff Unlocks, where a big portion of tokens becomes available at a single point.

Several prominent cryptocurrencies utilize Linear Unlock schedules to maintain market balance. For example:

- Solana (SOL) distributes tokens gradually to team members and early investors to prevent sudden market fluctuations.

- Avalanche (AVAX) implements linear vesting for ecosystem participants to ensure a steady introduction of tokens into circulation.

While Cliff Unlocks release tokens abruptly, linear unlocking provides a predictable, incremental flow, setting the stage for better liquidity management and investor planning. This gradual approach reduces market shocks and allows traders to anticipate token availability more accurately, a topic we’ll explore in detail in the next section.

How Does Linear Unlock Actually Work?

How do smart contracts control linear unlocks?

Linear unlocks are typically managed through smart contracts, which automate the release of tokens according to predefined rules. These contracts are written into the project’s blockchain protocol and execute token distribution automatically, reducing the need for manual intervention. The release schedules are often detailed in the project’s whitepaper, specifying the exact timeline and percentage of tokens to be unlocked at each interval. This automation ensures consistency, transparency, and trust for investors tracking the token supply.

Is linear unlock the same as token vesting?

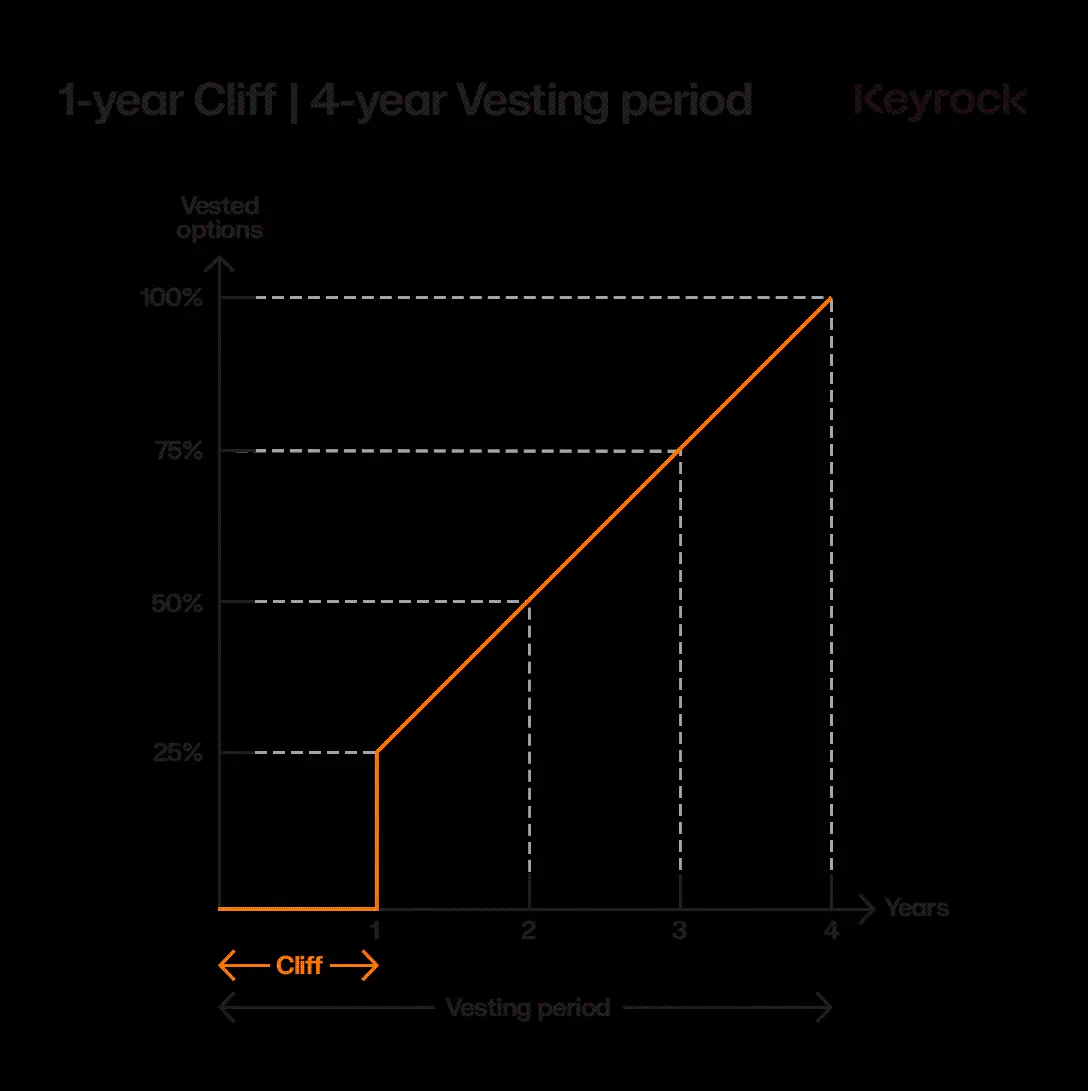

While the terms are related, linear unlock is not identical to token vesting. Token vesting provides the overall framework for how and when tokens can be accessed by team members, investors, or ecosystem participants. Linear unlock, on the other hand, refers specifically to the execution of the token release — the gradual, incremental distribution of tokens over time within the vesting framework. In short, vesting sets the rules, and linear unlock carries them out.

Source: Chaincatcher

How does linear unlock differ from cliff unlock?

The key difference lies in the release pattern. Linear unlock distributes tokens continuously over a set period, providing a predictable flow into the market. Cliff unlock, by contrast, releases a large lump sum all at once after a predefined period, which can create sudden supply spikes and market volatility. Linear unlock offers smoother market integration and better planning opportunities for traders and investors, making it a preferred strategy for many modern crypto projects.

What is the Difference Between Linear Unlock and Cliff Unlock?

What happens in a cliff unlock event?

In a cliff unlock, tokens remain locked for a fixed period and are then released all at once. This sudden surge of supply often triggers sharp market volatility, as a large number of tokens enter circulation simultaneously, creating heavy sell pressure and uncertainty among traders.

Source: Chaincatcher

Why does linear unlock reduce price shocks?

Linear unlock avoids sudden shocks by gradually releasing tokens over time. Instead of a single supply spike, the market experiences a steady flow of tokens, which helps maintain liquidity and allows investors to plan ahead. This predictable distribution supports more stable trading conditions and reduces the risk of panic-driven sell-offs.

Which method do top projects prefer and why?

Project teams choose unlock strategies based on their priorities. Avalanche (AVAX) and Solana (SOL) use linear unlock schedules to promote long-term stability and investor confidence. By contrast, Arbitrum (ARB) and Optimism (OP) have relied on cliff unlocks, which create dramatic one-time events. While cliff unlocks can attract short-term speculation, they also increase the risk of sudden price drops when the tokens flood the market.

Comparison Table: Linear Unlock vs Cliff Unlock

| Aspect | Linear Unlock | Cliff Unlock |

| Release Method | Gradual, continuous distribution over time | Lump-sum release after a fixed period |

| Investor Sentiment | Builds confidence with steady allocation | Creates anxiety before release, then volatility |

| Market Impact | Predictable supply, reduced price swings | High chance of sell pressure and price dips |

Why Do Token Unlocks Influence Crypto Prices?

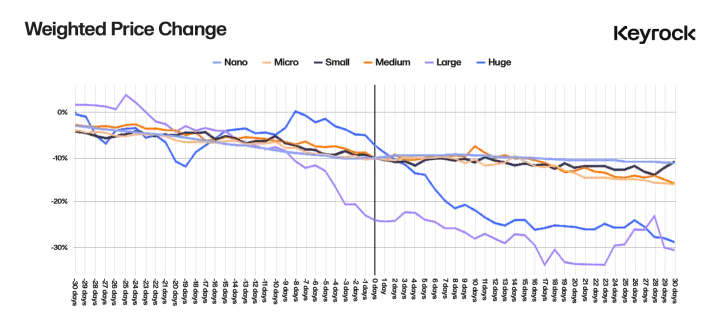

Do most unlocks create negative price pressure?

Research shows that around 90% of token unlock events are followed by negative price movements. This is largely because retail traders anticipate dilution when large amounts of tokens enter circulation. Even before the unlock occurs, sentiment often shifts bearish, leading to selling pressure.

How does unlock scale affect volatility?

The size of the unlock matters. Large unlock events introduce significant supply shocks, often triggering sharp price swings as traders hedge or exit positions. Smaller unlocks, on the other hand, tend to create less volatility since the market can more easily absorb incremental increases in circulating supply.

Source: Keyrock

Which unlock recipients have the biggest market impact?

Not all unlocks affect the market in the same way. Team unlocks typically have the worst impact, historically leading to average price drops of around 25% as insiders cash out. Investor unlocks are somewhat more controlled, as many institutional investors hedge or stagger their sales. Ecosystem unlocks, which distribute tokens for community rewards or development, can even have a slight positive effect — averaging a modest +1% — since they encourage usage and growth rather than immediate selling.

What Trading Strategies Work Around Linear Unlocks?

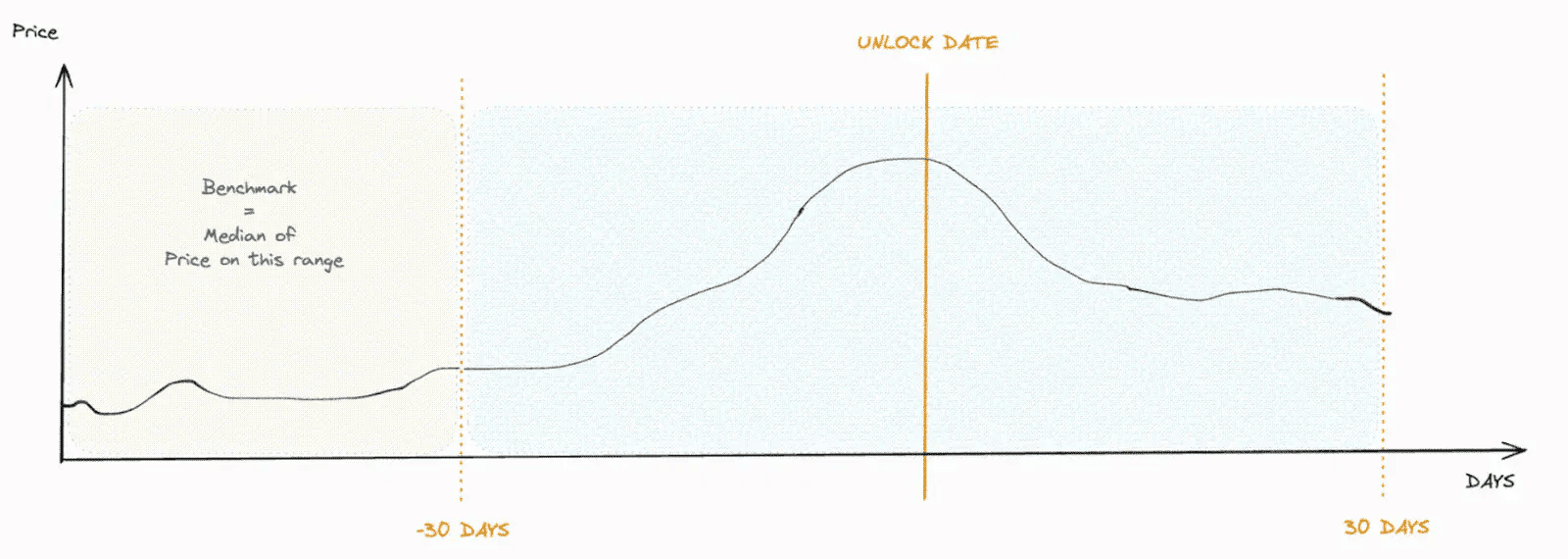

When is the best time to buy after an unlock?

Data suggests that the best entry point is usually around 14 days after a token unlock. By this time, initial volatility tends to stabilize as the market absorbs the new supply. Traders who wait for this cooling-off period often find better risk-adjusted entry opportunities compared to jumping in immediately after the unlock event.

Track upcoming unlock schedules and react instantly with Bitget Wallet’s trading tools.

When should investors exit before a large unlock?

Price declines often begin well before the actual unlock date. On average, selling pressure starts about 30 days ahead of a major unlock, as informed investors and insiders anticipate dilution. Exiting early allows traders to preserve gains and avoid being caught in the initial wave of downside volatility.

Source: Chaincatcher

How do professional investors hedge token unlock risk?

Institutional players and large investors use several methods to mitigate unlock-related risks. OTC desks allow private block trades without moving spot market prices. Algorithmic execution strategies such as TWAP (time-weighted average price) and VWAP (volume-weighted average price) help distribute sell orders more evenly. In addition, futures and derivatives markets provide hedging tools to offset downside exposure during major unlock events.

How Can Projects Use Linear Unlocks to Build Long-Term Trust?

How do linear unlocks align team and investor incentives?

Gradual token release ties team rewards directly to the project’s long-term performance. Instead of receiving a lump sum in a cliff unlock and potentially cashing out too quickly, teams under linear unlock schedules earn their allocations steadily. This creates alignment between builders and investors, as both groups are incentivized to see the project succeed over time. Predictable unlocks also strengthen investor confidence, signaling that the team is committed to sustainable growth. Avalanche (AVAX) provides a strong example, with structured linear unlocks designed to keep developers engaged and focused on the ecosystem’s future.

Can ecosystem unlocks strengthen a project’s growth?

Ecosystem unlocks allocate tokens for liquidity, grants, or user incentives, all of which feed directly into project growth. More liquidity leads to deeper markets and reduced slippage, while grants attract developers and expand dApp ecosystems. Incentive programs such as staking rewards or liquidity mining serve as flywheels that draw users in and keep them active. Solana (SOL) has effectively used ecosystem unlocks to incentivize validators and developers, helping secure the network and fuel long-term adoption.

Why does transparency in unlock planning build community confidence?

Publishing unlock schedules openly is critical for trust. Transparent tokenomics give institutions confidence that there are no hidden risks, while retail communities see fairness in distribution. When projects hide or delay unlock data, investors often assume the worst. Platforms like TokenOps specialize in transparent unlock management, providing clear schedules that minimize uncertainty. With Bitget Wallet, users can track these transparent unlocks in real time, ensuring they never miss a critical event.

Where Can You Track Linear Unlock Schedules Today?

What tools help track unlock events?

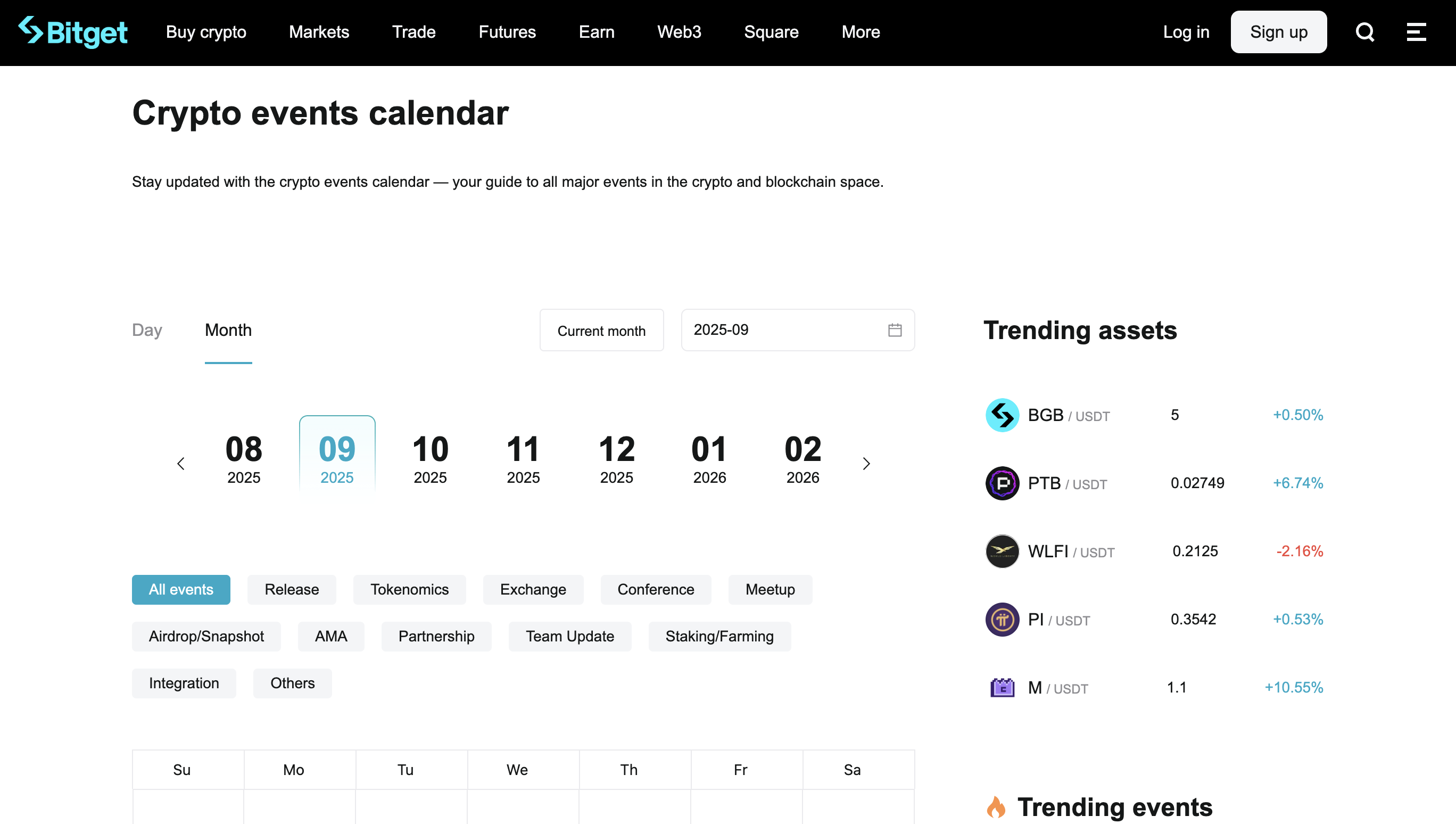

Several platforms provide reliable data on token unlocks. TokenUnlocks is widely used for its detailed calendars and real-time tracking. CryptoRank highlights upcoming unlock events alongside metrics like circulating supply and market cap. Messari integrates unlock data into its broader research dashboards, helping traders analyze supply shifts in context with other market factors. Together, these tools give investors clear visibility into how upcoming token releases might affect price action.

Can Bitget Wallet be used to monitor linear unlocks?

Yes. Bitget Wallet publishes monthly schedule updates, allowing users to track linear unlock events with ease. Beyond tracking, it stands out for its cross-chain functionality, secure stablecoin storage, and convenient access to memecoin trading. This combination of stability, flexibility, and multi-chain support makes Bitget Wallet a practical choice for investors managing their portfolios around token unlocks.

How Can You Track and Trade Linear Unlocks with Bitget Wallet?

How to Monitor Token Unlock Calendars in Bitget Wallet?

Bitget Wallet is one of the best Web3 tools to view upcoming token unlock schedules. Users can check unlock dates, token amounts, and supply changes directly through the research section, making it simple to stay ahead of major events. For broader context, resources like CoinMarketCap and TokenUnlocks also provide unlock data, but Bitget Wallet brings added convenience by combining research with portfolio management in one place. Readers are also encouraged to follow the Bitget Academy’s monthly updates for detailed insights on scheduled unlocks.

How to Trade Tokens During Linear Unlock Events with Bitget Wallet?

When tokens are released into circulation, Bitget Wallet allows instant cross-chain trading so users can react quickly without relying on centralized exchanges. Its beginner-friendly swap function makes trading simple, while built-in security features protect unlocked assets. Whether holding stablecoins, trading memecoins, or managing multi-chain assets, Bitget Wallet streamlines the process from tracking to execution.

Download Bitget Wallet to track token unlocks, trade seamlessly, and manage your crypto securely – all in one app.

Conclusion

What is Linear Unlock in crypto? It is a mechanism that gradually releases tokens over time, designed to stabilize supply and reduce the price shocks often seen with cliff unlocks. By spreading token distribution, projects can build long-term trust while investors gain more predictable market conditions.

Throughout this article, we explored how linear unlocks work, why they differ from cliff unlocks, and how investors can plan trading strategies around them. From timing exits before major unlocks to buying after volatility cools, understanding unlock schedules is essential for navigating today’s token-driven markets.

Manage tokens, track unlock calendars, and trade safely with Bitget Wallet — your beginner-friendly hub for stablecoins, memecoins, and cross-chain assets.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs About Linear Unlocks in Crypto

Is linear unlock good or bad for token prices?

Linear unlocks are generally seen as more stable for token prices compared to cliff unlocks. By releasing tokens gradually, they reduce sudden sell pressure and give markets time to adjust. However, constant supply increases can still weigh on price if demand doesn’t grow in parallel.

Is linear unlock the same as vesting?

Not exactly. Vesting defines the rules and timeframe for when tokens can be accessed by teams or investors, while linear unlock refers to how those tokens are actually released. In other words, vesting is the framework, and linear unlock is the method of execution within that framework.

Which crypto projects are using linear unlock today?

Several major projects rely on linear unlock schedules. Solana (SOL) and Avalanche (AVAX) use gradual releases to keep markets stable and aligned with long-term growth. Many newer projects also prefer linear unlocks, as predictable supply builds trust among investors and reduces the volatility associated with sudden token dumps.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy LGNS in 2026: A Beginner’s Step-by-Step Guide to Longinus2026-02-04 | 5mins

- How to Buy JYPC in 2026: A Beginner’s Step-by-Step Guide to JPY Coin2026-02-02 | 5mins