What Is Lendr.fi (RWAL): A DeFi Protocol Bridging RWAs Through Tokenization and Governance Utility

What is Lendr.fi (RWAL)? Lendr.fi (RWAL) is more than a traditional digital asset—it is the intersection of real-world assets (RWAs) and decentralized finance (DeFi) that embodies the essence of tokenization, liquidity, and governance. By marrying off-chain assets with blockchain technology, it paves the way for a paradigmatic change in the world of cryptocurrency.

Supported by its liquid-staking and RWA-tokenization network, Lendr.fi (RWAL) is more than a passing trend in the blockchain space. It opens doors to diversified asset exposure, yield potential, and participatory governance. As you explore this fast-growing market, consider tools that make participation simpler — like Bitget Wallet, offering secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience.

Key Takeaways

- Lendr.fi (RWAL) bridges real-world assets (RWAs) with DeFi, bringing off-chain assets onto the blockchain.

- The protocol focuses on tokenization, liquid staking, and on-chain governance, enabling diversified exposure and active participation.

- RWAL is the platform’s governance and utility token, supporting voting, protocol upgrades, and access to yield opportunities.

What Is Lendr.fi (RWAL) and Why It Matters?

Lendr.fi (RWAL) is a governance and utility token built on the Ethereum blockchain that powers the Lendr.fi protocol — a modern approach to real-world asset (RWA) tokenization. The project embodies the following values:

- Transparency in bringing off-chain assets onto decentralized rails

- Liquidity through liquid staking and on-chain yield mechanisms

- Community governance to shape protocol growth and asset listings

Lendr.fi (RWAL) blends innovative DeFi tools with the stability of tokenized real-world assets, creating a trustworthy ecosystem for diversified exposure and participatory decision-making.

Source: X

Lendr.fi is gearing up for its public IDO / Token Generation Event (TGE) on September 23, 2025, following the close of its presale rounds. Meanwhile, the IDO via SeaFi Launchpad has opened a $1,000,000 allocation with active whitelist and reward campaigns.

Lendr.fi (RWAL) IDO: Key Details and Schedule

Below are the key details of the upcoming Lendr.fi (RWAL) IDO, covering its launchpad, schedule, pricing, and vesting terms.

- Launchpad: SeaFi

- Network: BNB Chain

- Ticker: RWAL

- Token Price: $0.03

- Allocation: $1M (soft cap $500K, hard cap $1M)

- Schedule:

- Whitelist closes: Sept 19, 2025

- IDO window: Sept 23–24, 2025

- Listing: expected after Sept 25, 2025 — exact exchange and timing to be confirmed

- Vesting: 15% at TGE → 1-month cliff → balance vests over 4 months

- Perks: Whitelist rewards and loyalty bonus (~3%)

Lendr.fi (RWAL): Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the Lendr.fi (RWAL) listing:

- Exchange: To be announced

- Trading Pair: RWAL/USDT

- Deposit Available: TBA

- Trading Start: TBA

- Withdrawal Available: TBA

Don’t miss your chance to start trading Lendr.fi (RWAL) once the official exchange announcement is released — stay tuned to Lendr.fi’s channels for the exact schedule.

- Please refer to the official announcement for the most accurate dates and times.

Lendr.fi (RWAL) Price Prediction and Outlook 2025

The value of Lendr.fi (RWAL) will depend on overall crypto-market sentiment, the strength of its real-world asset (RWA) tokenization platform, and participation from its community. As RWAL is only entering the market via its September 2025 IDO, there is no reliable historical data or analyst consensus, so forecasts should focus on the forces likely to shape its price rather than on exact figures.

Key Factors Impacting Lendr.fi (RWAL) Price

- Market Conditions: Broader trends in Bitcoin, Ethereum, and DeFi liquidity will influence RWAL’s early trading range once listed.

- Adoption & Utility: Demand for RWAL as a governance and staking token — and its use for accessing tokenized RWA pools — could support value.

- Project Expansion: Exchange listings, RWA integrations, and protocol upgrades may strengthen fundamentals and visibility.

Future Price Outlook

If Lendr.fi is able to on-board significant real-world assets on-chain and establish liquidity following its IDO, RWAL may mirror the growth pattern of other RWA tokens like Ondo (ONDO), Maple (MPL), Centrifuge (CFG), and Goldfinch (GFI) — all of which had their value dictated by the levels of adoption, TVL, and cycles in the market instead of pre-defined targets. Since RWAL is a new asset, its performance in 2025 will most probably be unstable, and investors must thoroughly evaluate risk, regulation, and total market stability before investing capital.

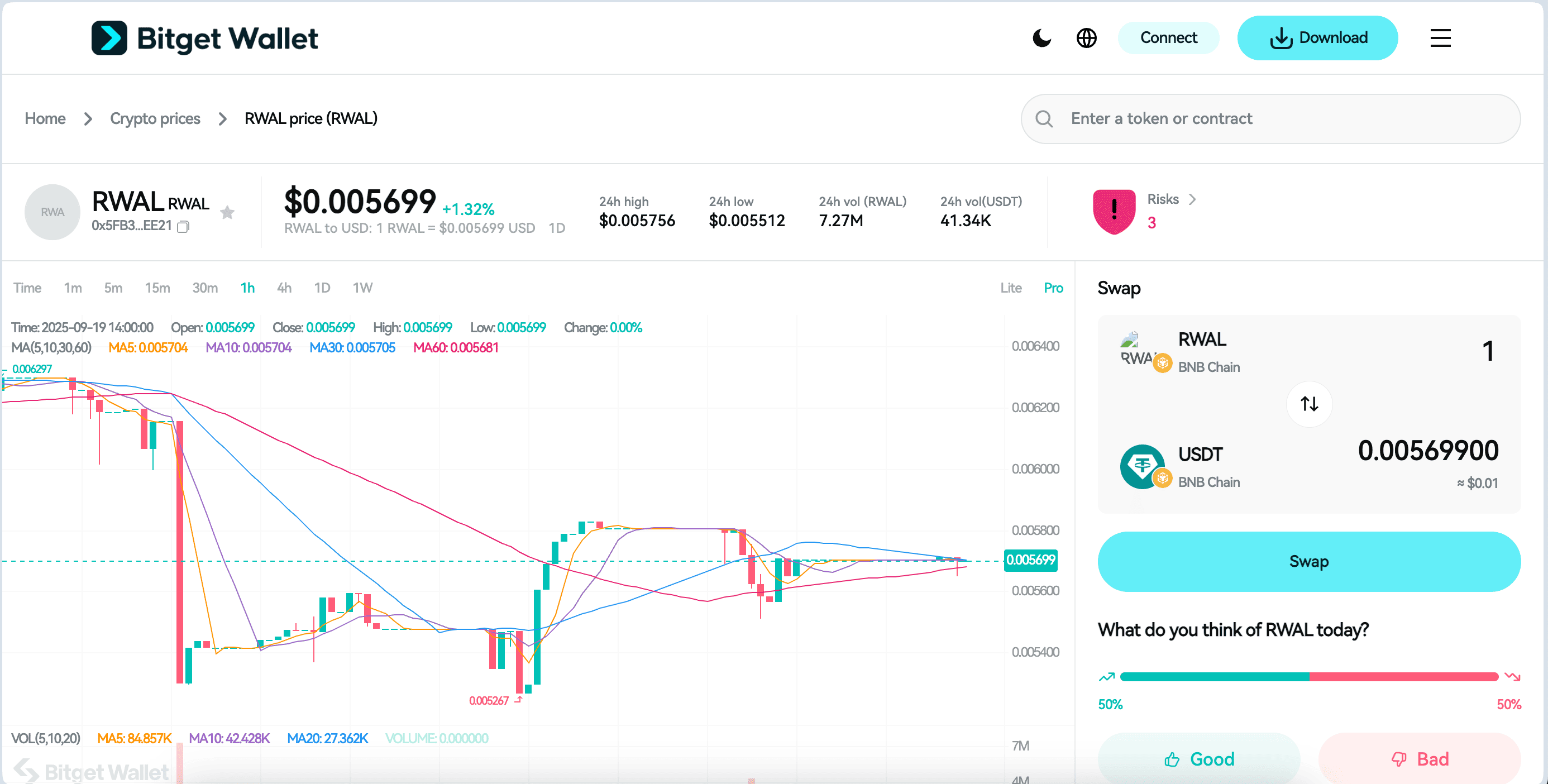

Source: Bitget Wallet

Explore Lendr.fi (RWAL) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

Lendr.fi (RWAL) Features: What Sets It Apart?

The standout features of Lendr.fi (RWAL) include:

-

Real-World Asset (RWA) Tokenization

Lendr.fi enables users to bring off-chain assets — such as real estate, commodities, or debt instruments — onto the blockchain. Through tokenization, these assets become tradable and can participate in decentralized finance, expanding liquidity and access for investors.

-

Liquid Staking Mechanism

Holders can stake RWAL or supported RWA tokens to earn yield while keeping their positions liquid. This approach lets participants stay exposed to potential asset appreciation while collecting staking rewards, combining flexibility with earning potential.

-

Governance and Protocol Utility

RWAL doubles as the governance token for Lendr.fi, allowing the community to vote on new asset pools, protocol upgrades, and fee structures. It also serves as the medium for accessing certain platform functions, aligning incentives between users and protocol growth.

How Lendr.fi (RWAL) Works and Delivers Value?

The architecture of Lendr.fi is designed with multiple elements that work together to support adoption and provide lasting value.

-

Blockchain Infrastructure

Lendr.fi is built on the BNB Chain, with bridges planned for Ethereum and other networks to ensure cross-chain compatibility. This setup optimizes transaction efficiency, keeps gas fees low, and supports scalability as real-world asset pools grow.

-

Token Utility

RWAL functions as both a governance and utility token within the ecosystem. It enables holders to propose and vote on protocol upgrades, new asset listings, and fee structures. RWAL also underpins staking programs and liquidity incentives, giving users a way to participate in platform growth while earning rewards.

Governance & Community Engagement

Holders of $RWAL can vote on key decisions — from approving new RWA pools to setting staking parameters and treasury allocations. By aligning incentives between the protocol and its community, RWAL encourages active participation and helps steer Lendr.fi’s roadmap, ensuring that the platform evolves in step with user demand and market opportunities.

The Team Behind Lendr.fi (RWAL): Experts Driving Innovation

The Team

- The Team: Lendr.fi is developed by a collective of blockchain engineers and DeFi specialists with experience in real-world asset tokenization, smart-contract security, and liquidity design.

- The Vision: To connect tangible assets — such as real estate, commodities, and credit instruments — with DeFi infrastructure, creating a transparent and efficient marketplace for investors.

- The Partnerships: The project highlights integrations with leading blockchain oracles and launchpads (e.g., Chainlink, SeaFi) to ensure secure data feeds, fair price discovery, and reliable token launches.

Experts’ Insights

Industry analysts note that the combination of RWA tokenization, liquid staking, and governance utility positions RWAL to serve as a bridge between off-chain value and decentralized finance. The team’s focus on compliance-aware design and scalable infrastructure is seen as essential for sustaining growth in a market where regulation and interoperability are key.

Key Use Cases of Lendr.fi (RWAL): How It’s Transforming DeFi and RWA Markets

Use Cases

- Tokenizing Real-World Assets: Lendr.fi enables property, commodities, or credit instruments to be represented as blockchain tokens, making them tradeable and easier to collateralize in DeFi markets.

- Staking & Yield Opportunities: Users can stake RWAL or tokenized RWAs to earn rewards, combining income generation with exposure to asset appreciation.

- Governance & Protocol Direction: RWAL holders help steer the platform by voting on asset listings, protocol upgrades, and fee structures.

- Liquidity Provision: The platform lets users supply liquidity to pools backed by tokenized assets, helping stabilize prices and earn incentives.

How Lendr.fi (RWAL) Is Transforming DeFi

By merging real-world assets with on-chain liquidity tools, Lendr.fi is expanding DeFi beyond purely digital collateral. The project gives investors a way to access yield and governance while supporting an open market for tokenized assets. This approach could help bridge traditional finance and blockchain, providing more secure and diversified opportunities for participants.

Lendr.fi (RWAL) Roadmap: Key Milestones and Future Developments

The roadmap for Lendr.fi (RWAL) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Finalized tokenomics, audited smart contracts, and began private funding for the RWAL token. |

| Q2 2025 | Announced RWAL presale and partnerships with SeaFi Launchpad and oracle providers; released whitepaper v1. |

| Q3 2025 | Conducted public IDO on SeaFi (Sept 23–24); prepared for first exchange listings and initial RWA staking pools. |

| Q4 2025 | Post-listing growth: roll out cross-chain bridge support, expand tokenized asset pools, and launch governance dashboard. |

These milestones highlight the practical value of $RWAL in bridging real-world assets and decentralized finance, positioning Lendr.fi as an emerging player in RWA tokenization and liquid staking.

How to Buy Lendr.fi (RWAL) on Bitget Wallet?

Trading Lendr.fi (RWAL) is easy on Bitget Wallet. Follow these simple steps to get started:

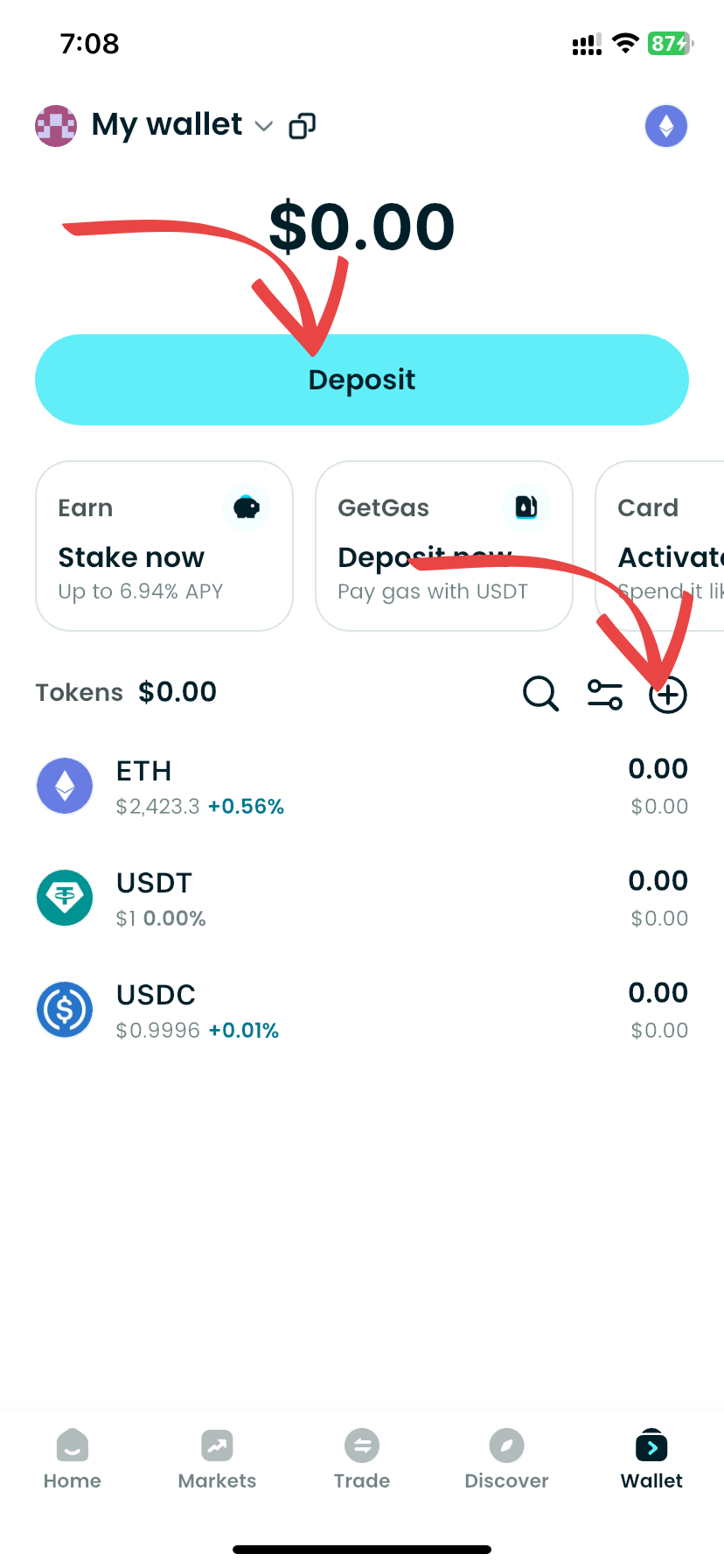

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Lendr.fi (RWAL).

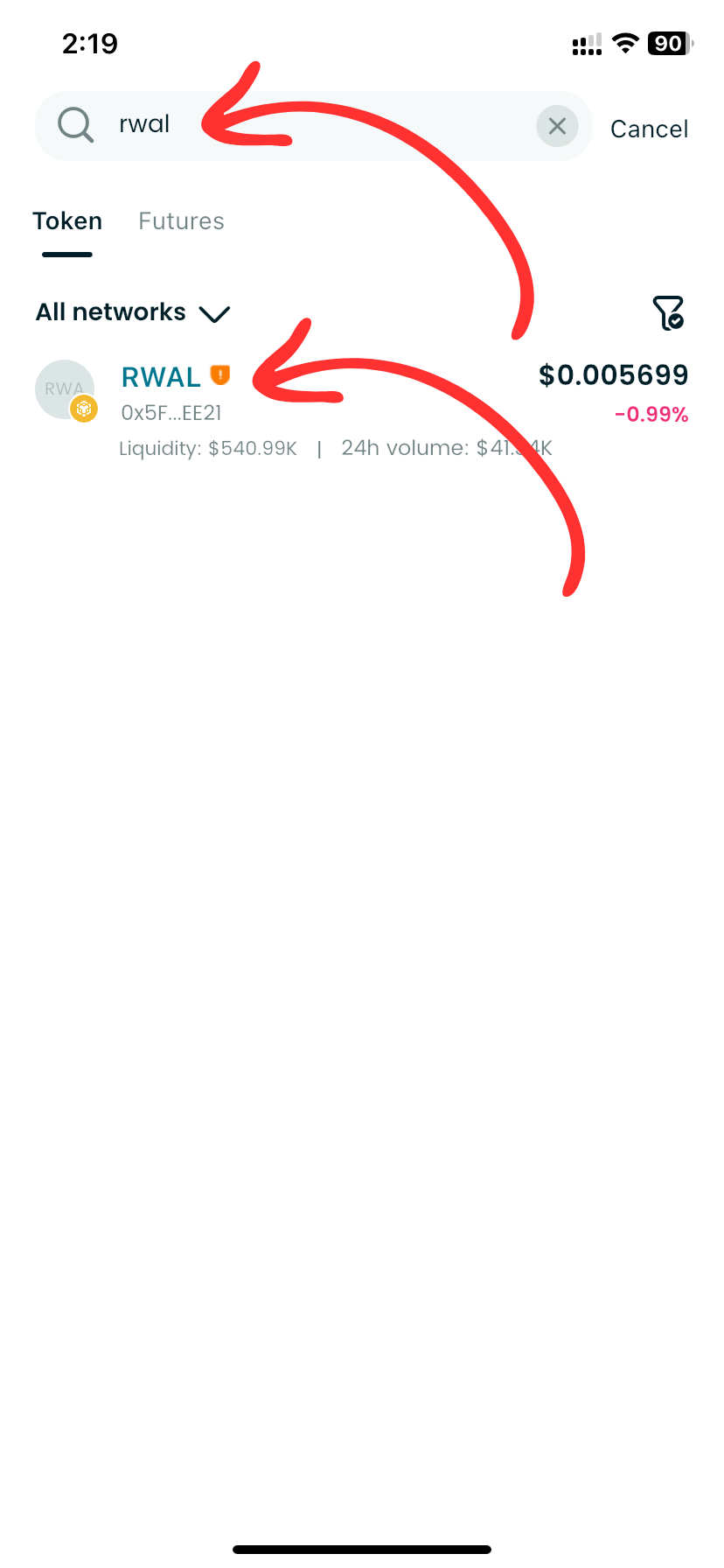

Step 3: Find Lendr.fi (RWAL)

On the Bitget Wallet platform, go to the market area. Search for Lendr.fi (RWAL) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

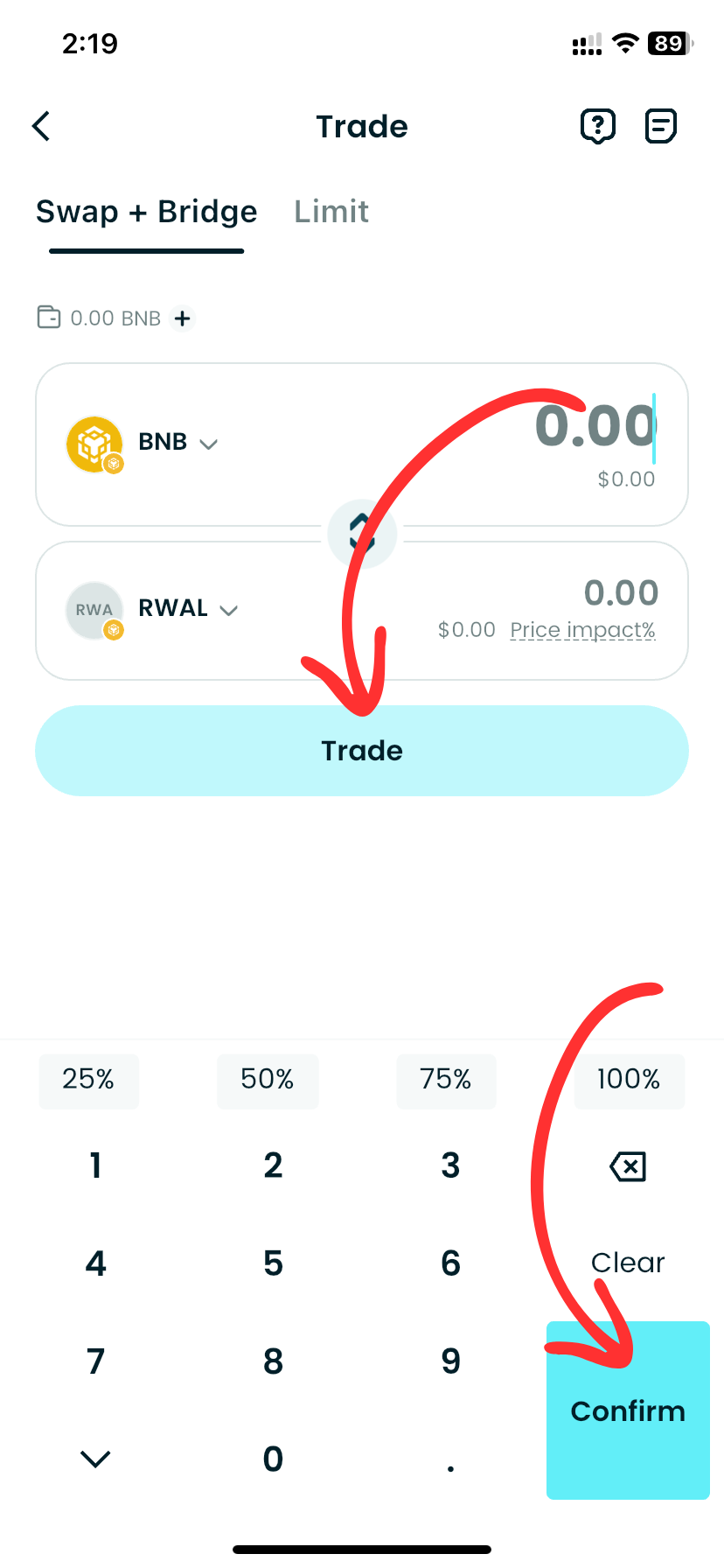

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, RWAL/USDT. By doing this, you will be able to exchange Lendr.fi (RWAL) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Lendr.fi (RWAL) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Lendr.fi (RWAL).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Lendr.fi (RWAL) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

What is Lendr.fi’s RWAL token? It introduces a fresh way to bridge real-world assets with decentralized finance. By combining RWA tokenization, liquid staking, and on-chain governance, the project offers a framework for unlocking liquidity in traditionally illiquid markets while giving holders a say in how the platform evolves. Its roadmap shows steady progress — from contract audits to its September 2025 IDO — positioning RWAL as a noteworthy entrant in the growing RWA sector.

For those looking to acquire or manage RWAL, using Bitget Wallet can simplify the process. The wallet supports seamless token purchases, clear swap interfaces, and built-in security features, helping users keep control of their assets while trading. With its cross-chain support and user-friendly design, Bitget Wallet provides an accessible way to participate in RWAL’s ecosystem without sacrificing custody or flexibility.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Lendr.fi (RWAL)?

Lendr.fi is a decentralized finance platform focused on bringing real-world assets (RWAs) onto the blockchain. Its native token, RWAL, acts as a governance and utility asset, supporting staking rewards, liquidity incentives, and protocol decision-making.

2. How can I buy RWAL?

After the September 2025 IDO, RWAL will become available on supported exchanges once listings are confirmed. Using Bitget Wallet allows you to store, swap, and manage RWAL securely while maintaining control of your private keys.

3. What makes RWAL different from other RWA tokens?

RWAL combines RWA tokenization with liquid staking and on-chain governance, giving users a way to earn yield, participate in protocol votes, and gain exposure to off-chain assets through a single ecosystem. This blend of utility and governance sets it apart from projects that focus on only one of these elements.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.