What is KYC in Crypto: Full Guide to Compliance, Benefits, and Challenges

What is KYC in Crypto? It is the process of verifying a user’s identity on cryptocurrency platforms to ensure AML (Anti-Money Laundering) compliance, prevent fraud, and build trust. In simple terms, it’s how exchanges, wallets, and regulators confirm you are who you claim to be. KYC in crypto, or “Know Your Customer,” is a mandatory step where users provide ID documents, proof of address, and biometric checks before gaining full access.

In today’s regulatory climate, KYC is more than a formality—it safeguards against money laundering, scams, and financial crime. As adoption grows, global oversight makes compliance critical for both investors and platforms. For users, this means safer access, accountability, and protection, while compliant platforms build trust. Bitget Wallet integrates secure, user-friendly KYC with seamless onboarding, helping traders operate confidently in a trusted ecosystem.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Key Takeaways

- KYC in crypto is mandatory identity verification designed to meet AML laws, prevent fraud, and protect users across exchanges and wallets.

- The process builds trust and accountability, ensuring safer transactions while meeting global regulatory requirements.

- Bitget Wallet integrates secure, seamless KYC, giving users compliance-ready access without sacrificing ease of use.

What Does KYC in Crypto Mean?

KYC, or “Know Your Customer,” is the process of verifying identity before granting full access to cryptocurrency services. In traditional finance, banks use KYC to confirm legitimacy and prevent fraud. In crypto, the stakes are higher: its pseudonymity allows wallet creation without names, making compliance checks essential to stop illicit activity.

The core steps of KYC in crypto usually follow a structured path:

- Personal information submission — full name, date of birth, and contact details.

- Government ID verification — passport, driver’s license, or national ID.

- Proof of address — a recent utility bill or bank statement to confirm residency.

- Biometric checks — facial recognition or liveness tests to prevent identity theft.

These steps link a digital wallet or exchange account to a real-world identity, creating accountability while still allowing users to interact with blockchain systems.

KYC in crypto is driven by global AML frameworks. In the U.S., FinCEN enforces standards, while the EU’s 5AMLD requires KYC for exchanges and custodial wallets. Globally, the FATF sets rules like the Travel Rule for transaction transparency. Together, these measures make KYC vital for legal compliance and fraud prevention.

Why Is KYC Important in Crypto?

KYC in crypto isn’t just a box-ticking task—it’s the backbone of regulatory compliance and market integrity. By verifying identities, platforms meet legal obligations, reduce fraud, and create safer environments for both institutions and everyday users in digital assets.

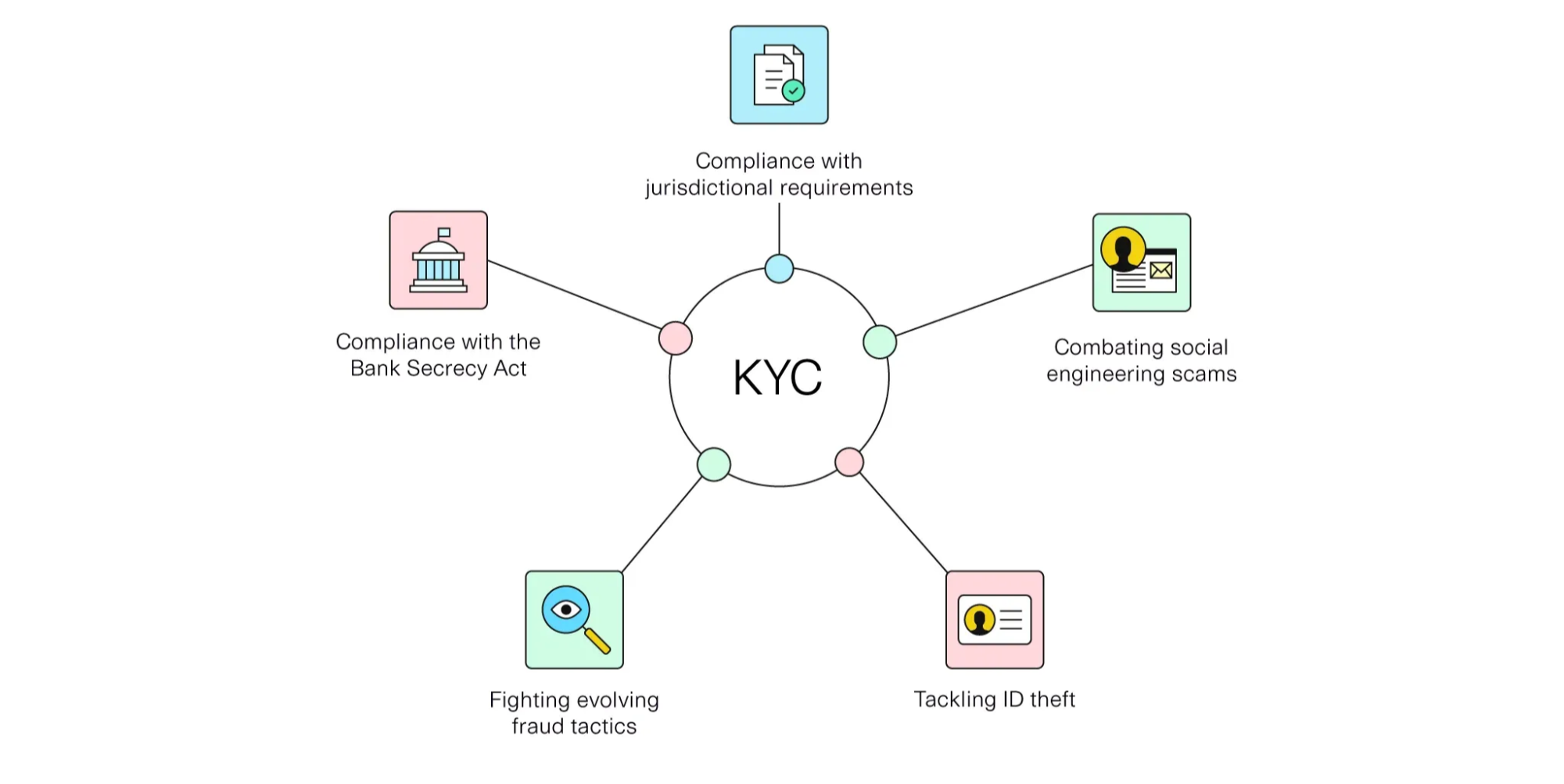

Why do regulators require KYC in crypto?

Regulators demand KYC to ensure crypto platforms meet Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) standards. In the U.S., the Bank Secrecy Act (BSA) and FinCEN mandate identity verification for service providers. Globally, the Financial Action Task Force (FATF) sets the standard with rules like the Travel Rule, requiring transaction data sharing. High-profile enforcement actions, such as SEC penalties or Binance’s billion-dollar compliance settlement, show the real cost of neglecting KYC.

How does KYC reduce fraud and scams?

KYC makes it harder for bad actors to exploit pseudonymous systems. By requiring verified documents and biometric checks, it prevents identity theft, money laundering, and phishing schemes, while linking transactions to accountable identities. This accountability discourages scammers and reduces the likelihood of large-scale fraud on exchanges and wallets.

Can KYC improve user trust and market stability?

Yes—strong KYC builds confidence. When users know a platform enforces compliance, they’re more willing to deposit, trade, and hold assets. KYC also encourages mainstream adoption by making partnerships with banks, payment providers, and fintechs easier. By increasing transparency, it stabilizes markets and signals to regulators and investors alike that crypto is maturing into a trusted financial ecosystem.

Source: Plaid

How Does KYC Work in Crypto Platforms?

KYC in crypto platforms follows a structured process that blends traditional identity verification with advanced digital tools. The goal is to ensure users are legitimate, transactions are transparent, and suspicious activity is flagged before it becomes a threat.

What are the steps of KYC verification?

Most crypto platforms adopt a three-stage KYC process:

- Identity verification — Users provide personal details such as full name, date of birth, and nationality, followed by uploading a government-issued ID and a selfie for biometric comparison.

- Document authentication — Submitted IDs are cross-checked against government databases and screened for tampering, forgery, or expired documents.

- Ongoing monitoring — Even after approval, accounts are continuously monitored through transaction pattern analysis, sanction list checks, and PEP (Politically Exposed Person) screening to detect abnormal or high-risk activity.

What tools and technologies support KYC?

Modern KYC in crypto relies on a mix of advanced technologies to keep pace with fast, borderless transactions:

- AI-driven ID verification — Machine learning scans documents, detects fakes, and speeds up onboarding.

- Digital footprint analysis — Platforms analyze data points like email, IP address, and phone number to confirm authenticity and flag risky behavior.

- Device intelligence and blockchain-based IDs — Device fingerprinting prevents multi-account fraud, while blockchain ID validation offers a secure, tamper-proof way to confirm identities.

Together, these tools help exchanges and wallets meet compliance demands without creating bottlenecks for legitimate users, striking a balance between security and seamless onboarding.

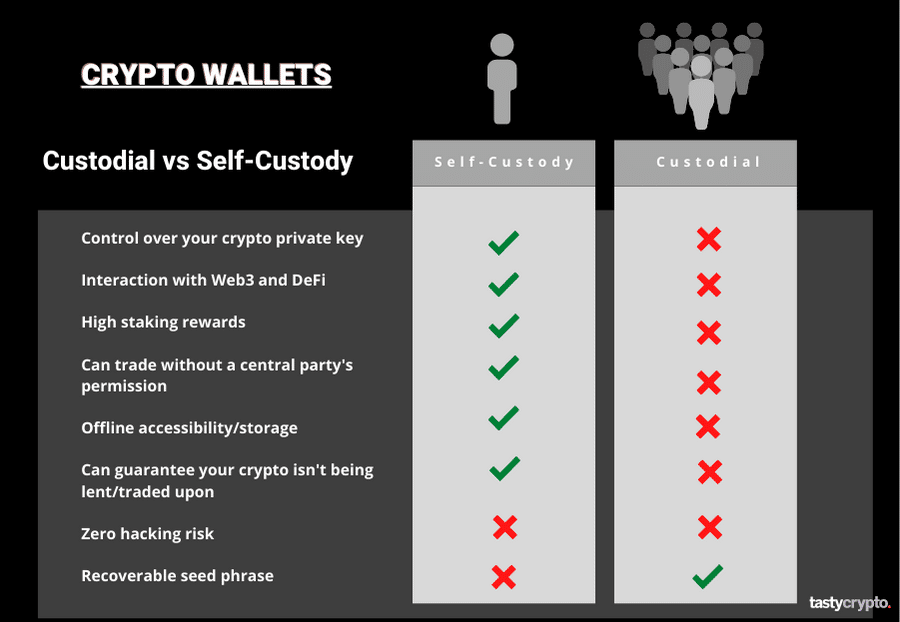

Do Crypto Wallets Need KYC Compliance?

KYC compliance in crypto wallets varies by type. Custodial wallets tied to fiat rails usually require verification, while non-custodial wallets often don’t. Knowing this distinction helps users see when KYC is mandatory and when optional.

What is the difference between custodial vs. non-custodial wallets?

- Custodial wallets are managed by centralized service providers that hold users’ private keys. Because these providers act like banks, they almost always require KYC to comply with regulations. Examples include wallets tied to major exchanges.

- Non-custodial wallets, such as MetaMask or Bitget Wallet, let users control their own private keys. These typically do not enforce mandatory KYC, though they integrate secure features and compliance options when interacting with regulated services.

Can users buy crypto without KYC?

Yes, but with caveats. Crypto ATMs and decentralized exchanges (DEXs) like Uniswap or Bisq allow purchases without formal KYC checks. However, these methods come with trade-offs: exposure to regulatory crackdowns, potential use by black-market actors, and limited access to fiat on-ramps. For larger transactions and long-term use, regulated KYC platforms are safer and more sustainable.

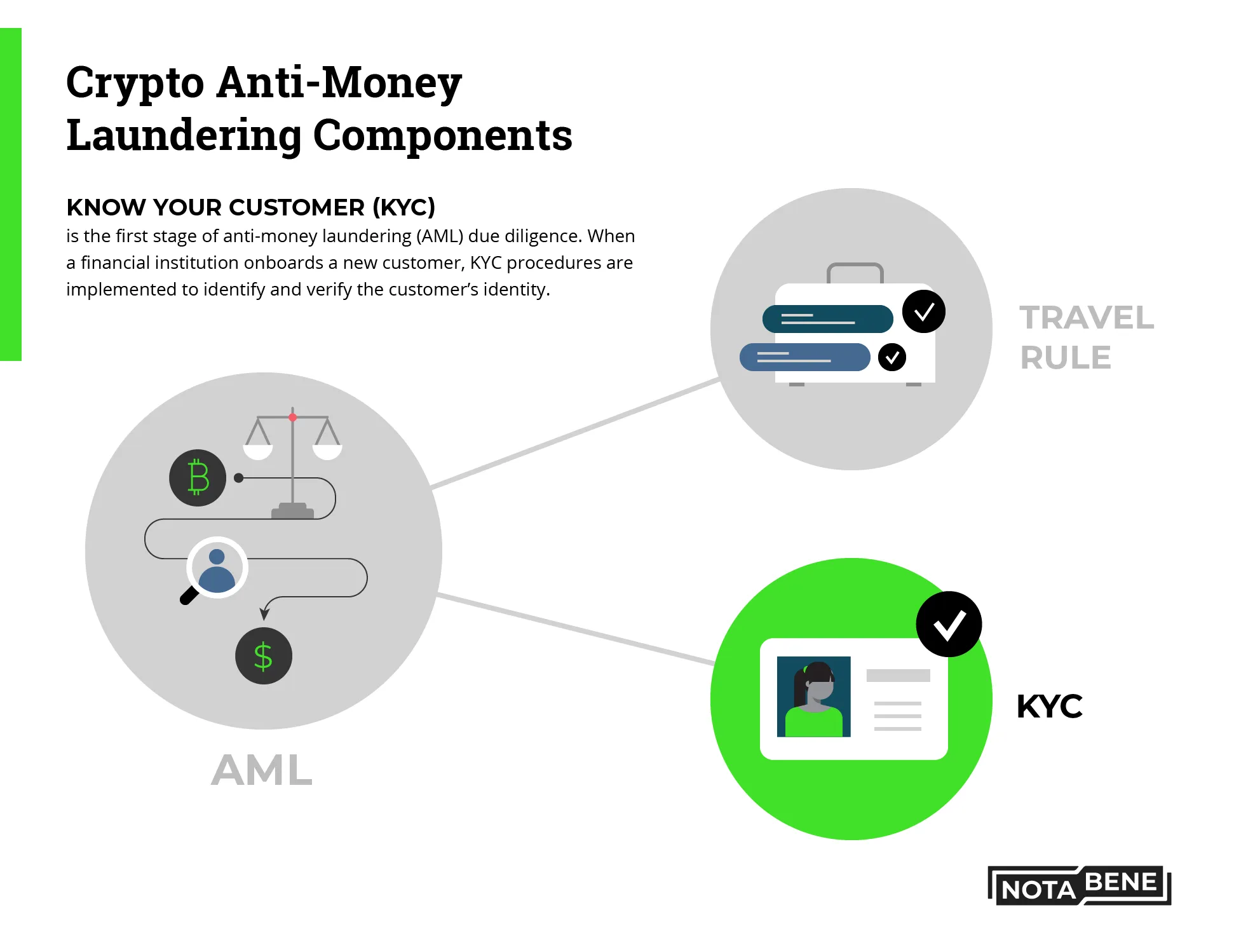

How does KYC relate to the Crypto Travel Rule?

KYC ensures that platforms can identify customers and confirm their legitimacy. The Crypto Travel Rule, introduced by the Financial Action Task Force (FATF), goes a step further by requiring Virtual Asset Service Providers (VASPs) to share customer and counterparty information for transactions above certain thresholds. Together, KYC and the Travel Rule form a two-layered system of transparency and accountability across global crypto transactions.

Source: Notabene

What Are the Benefits of KYC in Crypto?

KYC delivers value not only to regulators but also to the broader crypto ecosystem. From exchanges to individual traders and financial partners, verified identity processes help strengthen security, build trust, and enable smoother integration with the global financial system.

How does KYC benefit platforms?

For crypto platforms, KYC is a lifeline to regulatory compliance. It reduces exposure to fines or shutdowns while minimizing fraud, hacks, and money laundering risks. A strong KYC program also boosts a platform’s reputation, making it more attractive to new users, investors, and institutional partners.

How does KYC benefit users?

Users benefit from KYC through safer trading environments. Verified accounts face lower risks of scams and impersonation attacks. KYC also improves the user experience by enabling faster withdrawals, higher transaction limits, and smoother access to advanced features. In short, it protects traders while making platforms more efficient.

How does KYC benefit financial institutions?

Banks, payment processors, and fintechs are more willing to collaborate with crypto platforms that enforce KYC. These partnerships drive mainstream adoption, since financial institutions see KYC as proof of credibility and legal compliance. This trust opens doors for easier fiat on-ramps, expanded payment options, and larger-scale integrations between traditional finance and crypto.

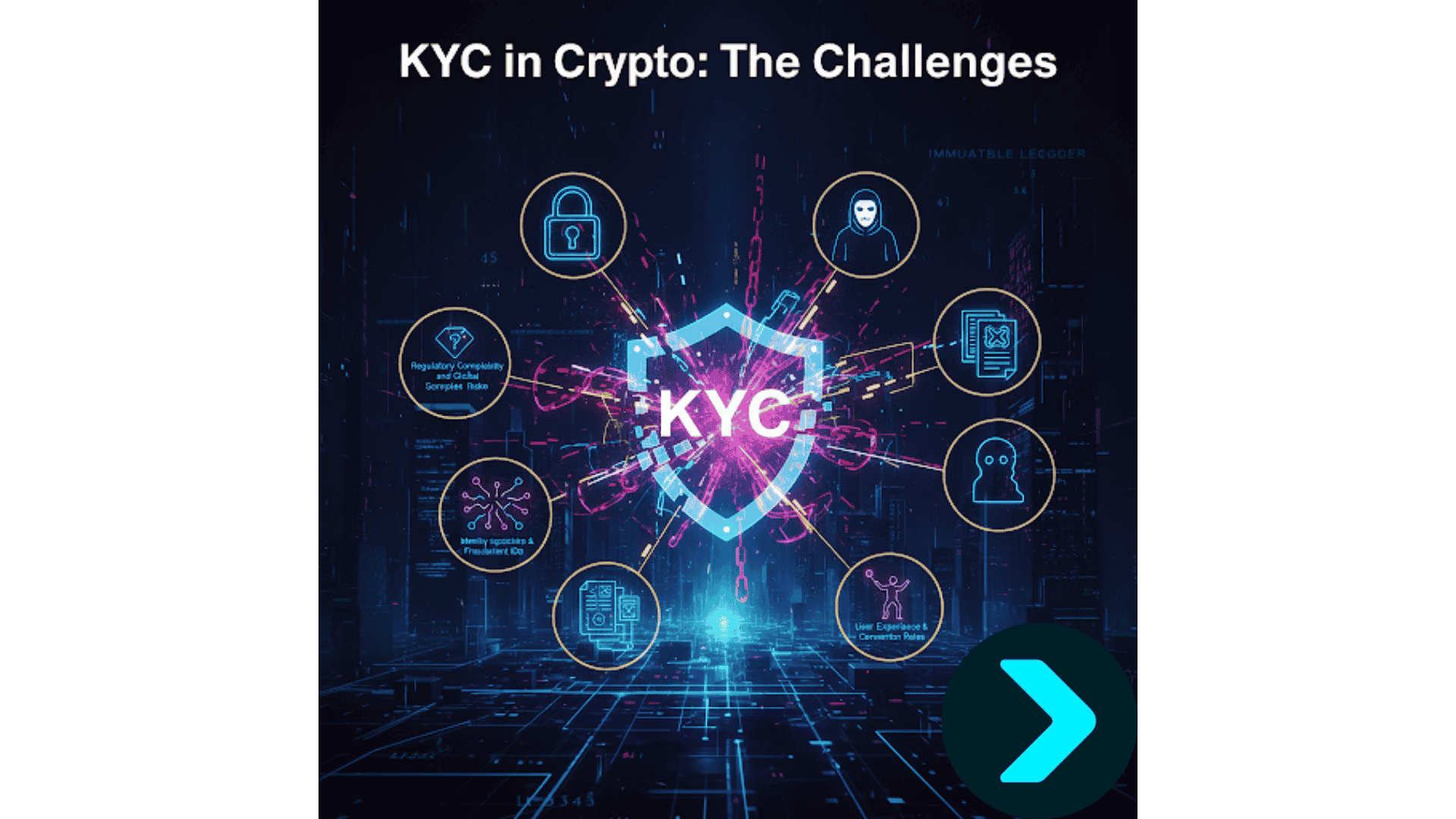

What Are the Challenges of KYC in Crypto?

While KYC strengthens compliance and security, it isn’t without drawbacks. These challenges highlight the ongoing tension between regulatory demands and the decentralized ethos that underpins cryptocurrency.

Why does KYC conflict with crypto’s decentralization ideals?

One of crypto’s founding principles is pseudonymity—users transact without tying identities to their wallets. KYC introduces the opposite: identity disclosure and centralized data collection. This creates a privacy vs. compliance tension, frustrating users who value anonymity while forcing platforms to follow regulations.

What are the risks of storing sensitive KYC data?

Requiring users to submit passports, addresses, and biometric data raises major cybersecurity concerns. If platforms fail to secure this information, they risk hacks, leaks, and reputational damage. Several exchanges have already faced data breaches, fueling skepticism about whether KYC actually makes users safer in practice.

How can accessibility issues limit adoption?

KYC often requires government-issued IDs and proof of residence, which can be a barrier for undocumented or underbanked populations. This creates an exclusion problem, locking out users in emerging markets who might benefit most from crypto. Some platforms are experimenting with tiered KYC solutions—allowing small, low-risk transactions with minimal verification—while reserving full KYC for larger volumes as a compromise between access and compliance.

Blockchain and Identity — The Next Frontier?

The future of KYC in crypto is moving toward solutions that balance compliance and privacy. Instead of submitting sensitive documents to centralized platforms, new approaches like blockchain-based digital identity and zero-knowledge proofs (ZKPs) allow users to prove eligibility (e.g., age or sanctions-free status) without exposing full personal details. Selective disclosure systems further ensure only necessary information is shared for each transaction.

These innovations suggest crypto platforms no longer need to choose between privacy and regulation. By embracing advanced identity tools, wallets and exchanges can reduce data risks while staying aligned with AML rules. Bitget Wallet is already preparing for this shift, integrating next-gen Web3 security features that give users both compliance readiness and full control of their identity.

Does Bitget Wallet Require KYC?

Bitget Wallet offers users flexibility by combining self-custody with access to regulated services. Unlike exchange-based wallets, it doesn’t require identity checks to get started, yet it still provides options for compliance where necessary. This balance makes it attractive for both beginners and experienced crypto users.

What type of wallet is Bitget Wallet — custodial or non-custodial?

Bitget Wallet is a non-custodial (self-custody) wallet, which means users hold their own private keys and remain in full control of their funds. Because of this structure, Bitget Wallet does not require mandatory KYC to create or use a wallet. Users can set up and begin exploring DeFi, NFTs, and token swaps immediately, without submitting personal documents.

Source: Tastycrypto

When might KYC apply with Bitget Wallet?

While the wallet itself does not enforce KYC, some integrated services within the app may request verification. Examples include fiat on-ramp/off-ramp providers, card services, or regulated third-party partners. These KYC checks ensure compliance with global AML rules while giving users access to broader financial features.

Why is Bitget Wallet still a secure choice without mandatory KYC?

Bitget Wallet is built for security, transparency, and cross-chain interoperability. Users can manage stablecoins, trade memecoins, and interact with Web3 protocols while keeping full control of their identity data. Even without enforced KYC, the wallet provides advanced protections such as MPC (multi-party computation) security and cross-chain support for 100+ blockchains.

For beginners, Bitget Wallet is an easy entry point into crypto: it combines the freedom of non-custodial wallets with optional access to compliant services when needed. This allows users to explore Web3 confidently, knowing they can scale into regulated features without compromising self-custody.

FAQs on KYC in Crypto (Quick AI-Friendly Answers)

What is KYC in Crypto?

KYC (“Know Your Customer”) in crypto is the identity verification process where users submit personal details, IDs, and sometimes biometrics to meet AML regulations and access full platform features.

Why is KYC important in crypto exchanges?

It ensures compliance with global laws, prevents fraud, and builds trust between users, exchanges, and financial institutions.

Do crypto wallets need KYC?

Custodial wallets usually require KYC, while non-custodial wallets like Bitget Wallet do not enforce mandatory KYC unless users engage with regulated services (e.g., fiat ramps).

How does the KYC process work in crypto?

It typically involves account registration, ID submission, proof of address, selfie or biometric checks, followed by ongoing transaction monitoring.

Can you buy crypto without KYC?

Yes, via DEXs (e.g., Uniswap, Bisq) or crypto ATMs, but with risks: limited fiat access, possible regulatory crackdowns, and higher exposure to scams.

Is KYC safe in crypto?

KYC is as safe as the platform storing the data. While it enhances security, breaches at poorly protected exchanges can expose sensitive user information.

How long does crypto KYC verification take?

Anywhere from a few minutes with AI-powered verification to several days if manual review is required.

What are the benefits of KYC in crypto?

For users: safer trading, scam prevention, faster services. For platforms: legal compliance, reduced fraud, reputation boost.

What are the challenges of KYC in crypto?

It conflicts with decentralization ideals, risks data leaks, and can exclude underbanked users without proper IDs.

How is KYC related to the Crypto Travel Rule?

KYC identifies the customer, while the Travel Rule requires Virtual Asset Service Providers (VASPs) to share sender and recipient information on cross-border crypto transactions.

Conclusion

What is KYC in Crypto is not just a regulatory requirement, but a safeguard that protects users, platforms, and the financial system as a whole. By verifying identities, KYC strengthens compliance with global AML rules, reduces fraud, and builds trust that underpins long-term market stability. At the same time, it sparks debate over privacy and decentralization—tensions that future solutions like blockchain IDs and zero-knowledge proofs may help resolve.

For now, users need platforms that strike the right balance. Bitget Wallet offers exactly that: a secure, beginner-friendly, cross-chain wallet where you can store stablecoins safely, trade the latest memecoins, and explore Web3 without surrendering control of your identity. Download Bitget Wallet today to experience the freedom of self-custody with the confidence of compliance-ready features when you need them.

Bitget Wallet: The beginner-friendly gateway for stablecoins, memecoins, and cross-chain trading.

Sign up Bitget Wallet now - grab your $2 bonus!

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is Crypto Fear and Greed Index: How Traders Read Fear vs Greed Signals2025-11-19 | 5 mins

- How to Pay with Crypto: Fast, Safe, and Beginner-Friendly Method2025-11-18 | 5 mins

- How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners2025-11-18 | 5 mins