What is Crypto Treasury? A Complete Guide to Digital Asset Treasury Management in 2026

What is crypto treasury? A crypto treasury is a publicly traded company that holds significant portions of its assets in cryptocurrencies like Bitcoin or Ethereum. These firms raise capital through stock or debt issuance and use the proceeds to acquire and manage digital assets as a core business strategy.

Traditional treasury management focused on cash, bonds, and bank relationships. This model has evolved with the rise of cryptocurrencies as legitimate assets. Companies like Strategy now hold over 631,460 BTC worth $72.64 billion, while BitMine commands more than 2 million ETH valued at $9.1 billion.

This guide explores crypto treasury strategies, risks, benefits, and the tools that power digital asset management. Whether managing corporate assets or exploring Web3, tools like Bitget Wallet provide a secure, beginner-friendly gateway for digital asset management.

Key Takeaway

- Crypto treasuries are publicly traded companies holding significant cryptocurrency assets as core business strategy. Companies adopt this model to hedge against inflation and generate superior returns.

- There are three main crypto treasury strategies: pure treasury, hybrid mining, and yield-focused models.

- Crypto treasury companies hold $133.45 billion across multiple cryptocurrencies. Top players include Strategy, BitMine, and Forward Industries.

Why Are Companies Holding Bitcoin and Ethereum as Treasury Assets?

Companies have transformed from traditional software businesses into strategic Bitcoin and Ethereum holders. Crypto assets now serve as inflation hedges and reserves in 2026

The Strategy Playbook That Started It All

Michael Saylor pioneered the crypto treasury model in August 2020 when he converted MicroStrategy from a software company into Bitcoin's largest corporate holder. Below are the key rationales behind this strategy:

-

Inflation Protection:

Bitcoin's fixed 21 million supply cap shields corporate reserves from currency devaluation caused by unlimited fiat printing and quantitative easing programs.

-

Superior Returns:

Digital assets offer greater long-term appreciation potential than cash holdings, which lose purchasing power through negative real yields in low-interest environments.

Strategy's results validated this approach spectacularly. The company now holds 631,460 BTC worth $72.64 billion, with its stock delivering returns nearly three times Bitcoin's appreciation.

From Radical Concept to Corporate Mainstream

What seemed reckless in 2020 became standard practice by 2026 . The market has expanded dramatically with 104 Bitcoin treasury companies, 11 Ethereum firms, and 7 Solana holders collectively managing over $133 billion in digital assets.

From using ERP dashboards for cash management, Web3 teams that adopt the corporate crypto treasury model now rely on modern tools for multi-chain treasury management across Ethereum, Solana, and BNB Chain.

Source: Unchained Crypto

What Are the Different Crypto Treasury Strategies?

Crypto treasury companies employ three distinct approaches to digital asset management.

Pure Treasury Strategy (The Strategy Model)

The pure treasury approach prioritizes continuous Bitcoin accumulation through strategic capital market operations. Companies raise funds exclusively to acquire and hold digital assets without generating operational revenue. There are mainly three methods to raise capital:

-

At-the-Market (ATM) Offerings:

Companies sell shares directly into public markets at current prices, enabling flexible accumulation when stock trades at premiums to underlying Bitcoin value.

-

Convertible Bonds:

Zero-coupon debt instruments convert to equity at predetermined prices, allowing companies to raise capital without cash interest payments while minimizing shareholder dilution.

-

Private Investment in Public Equity (PIPE) Deals:

Institutional investors provide large capital commitments through negotiated transactions, offering speed and certainty for rapid treasury buildups.

Source: Crypto DNES

Hybrid Mining-Treasury Strategy

The hybrid model combines Bitcoin mining operations with strategic open-market purchases. Marathon Digital (MARA) leads this approach as the largest public Bitcoin miner, holding over 50,000 BTC accumulated through dual channels. The main advantages of this hybrid approach include:

-

Organic Production Revenue:

Mining delivers continuous Bitcoin accumulation without requiring external financing or shareholder dilution, providing baseline growth independent of capital market conditions.

-

Strategic Purchase Flexibility:

Companies can time open-market buys during price corrections while maintaining steady mining income, optimizing capital allocation across market cycles.

Source: Coin Central

Yield-Focused Treasury Strategy (Ethereum Model)

Ethereum treasury companies capitalize on proof-of-stake networks that generate passive income through staking. This model transforms dormant holdings into yield-producing assets earning 3-5% annual returns. Typical examples of firms following this strategy include:

-

BitMine Immersion Technologies:

Holds over 2 million ETH valued at $9.1 billion, making it the world's largest Ethereum treasury.

-

SharpLink Gaming:

Stakes substantially all its 840,124 ETH with institutional validator Figment, earning continuous rewards.

Organizations seeking stable yield can use Bitget Wallet's Stablecoin Earn Plus feature to earn up to 10% APY on idle USDT or USDC.

Source: The Currency Analytics

Understanding NAV and Premium Metrics

Net Asset Value and Multiple of NAV are essential frameworks for evaluating capital raising efficiency and shareholder value creation of companies. Specifically:

-

Net Asset Value (NAV):

Total market value of cryptocurrency holdings minus liabilities, divided by outstanding shares, showing how much crypto backs each share of stock.

-

Multiple of NAV (mNAV):

Enterprise value divided by NAV, measuring how many times above underlying asset value the company trades in public markets.

High mNAV premiums enable accretive capital raising. When companies trade above 2.0x mNAV, they raise more dollars per share than Bitcoin value diluted, growing Bitcoin per share despite equity issuance.

For example, 10,000 BTC at $100,000 equals $1 billion NAV. If enterprise value reaches $1.5 billion, mNAV equals 1.5x, indicating a 50% premium. However, premiums above 2.5x may indicate overvaluation risk if Bitcoin per share growth stagnates.

What Are the Major Types of Crypto Treasury Companies?

Crypto treasury companies span multiple cryptocurrency categories with distinct strategic advantages.

1. Bitcoin Treasury Companies

Strategy pioneered the Bitcoin treasury model in 2020 and remains the undisputed leader. The company holds 631,460 BTC worth $72.64 billion, accounting for over 60% of all public company Bitcoin holdings. Its stock delivered 2,319% returns since August 2020, vastly outperforming Bitcoin's 899% gain during the same period.

Marathon Digital (MARA) ranks second with 53,250 BTC through its hybrid mining-treasury approach, combining operational mining with strategic purchases.

2. Ethereum Treasury Companies

Ethereum treasury companies capitalize on proof-of-stake networks that generate passive income. BitMine Immersion leads with 2,069,443 ETH valued at $9.1 billion, making it the world's largest Ethereum holder.

Proof-of-stake benefits enable 3-5% annual staking yields unavailable to Bitcoin holders. SharpLink Gaming stakes its 837,230 ETH with Figment, earning continuous rewards that compound holdings without shareholder dilution. Advanced strategies deploy staked ETH into DeFi lending protocols, potentially adding 1-3% extra returns.

3. Emerging Altcoin Treasuries

Forward Industries holds 6.78 million SOL worth $1.5 billion, secured through a $1.65 billion PIPE deal with Galaxy Digital. The company stakes nearly all its Solana holdings, earning 7% annual yields. BNB treasuries target Binance ecosystem exposure, while HyperLiquid, Sui, and TRON represent early-stage blockchain bets.

This diversification trend reflects institutional recognition that multiple blockchain networks will capture significant value. Companies build multi-asset portfolios optimized for different use cases rather than concentrating exclusively in Bitcoin.

Crypto Treasury Companies Comparison

The table below provides a comprehensive comparison of leading crypto treasury companies across different blockchain ecosystems, highlighting their holdings, strategies, and performance metrics.

| Company Name | Total Holdings | Treasury Strategy | Unique Features | Stock Performance |

| Strategy (MSTR) | 631,460 BTC / $72.64B | Pure treasury | First mover advantage, continuous capital raising via ATM / convertible bonds | 2,319% gain since 2020 |

| Marathon Digital (MARA) | 53,250 BTC / ~$6B | Hybrid mining - treasury | Mining revenue (9,457 BTC mined in 2024) plus strategic purchases (22,065 BTC bought) | Combined operational and treasury leverage |

| BitMine Immersion (BMNR) | 2,069,443 ETH / $9.1B | Yield-focused | Ethereum staking for revenue, targeting 5% of ETH supply | Top 25 most liquid US stocks, $2.2B daily volume |

| SharpLink Gaming (SBET) | 837,230 ETH / $3.69B | Yield-focused | Staked with Figment for APY, earned 5,211 ETH in rewards | $500M unrealized gains since June 2025 |

| Forward Industries (FORD) | 6.78M SOL / $1.5B | Pure treasury | Largest Solana holder, 7% staking yield, on-chain validator operations | $1.65B PIPE from Galaxy Digital |

| MetaPlanet | 20,000 BTC | Pure treasury | "MicroStrategy of Asia", aggressive accumulation in Japanese market | Rapid Bitcoin per share growth |

| Tesla/SpaceX | Combined 19,700 BTC / $2.3B | Mixed | High-profile corporate adoption, partial holdings sold during 2022 | Mainstream validation signal |

| CEA Industries (BNC) | 480,000 BNB / $585M | Pure treasury | Largest BNB treasury, targeting 1% of supply, YZi Labs backing | Partnership with CZ family office |

Data as of October 2026 . Holdings and values subject to market fluctuations.

What Are the Benefits of Crypto Treasury Management?

Crypto treasury management offers many compelling advantages. This section covers the top seven benefits of this strategy.

1. Inflation Hedge and Store of Value

Bitcoin's fixed 21 million supply protects reserves from fiat devaluation. This programmatic scarcity functions as digital gold, shielding holdings from monetary expansion. The 2020 quantitative easing validated this thesis as what is crypto treasury adoption accelerated for long-term value preservation.

2. Enhanced Returns and Growth Potential

Crypto treasury companies deliver extraordinary returns exceeding direct cryptocurrency ownership. Strategy's stock gained 2,319% since August 2020 versus Bitcoin's 899% appreciation. This amplification stems from leveraged debt financing and premium-based capital raising enabling accretive Bitcoin-per-share growth.

3. Indirect Crypto Exposure Through Traditional Markets

Crypto treasury stocks provide regulated access through familiar equity markets. Institutional investors gain cryptocurrency exposure without custody complexity or private key management. This digital asset treasury model simplifies compliance through standard brokerage accounts subject to SEC reporting and GAAP standards.

4. Additional Revenue Streams from Staking

Ethereum treasury companies generate 3-5% annual yields through proof-of-stake validation. BitMine and SharpLink stake their ETH holdings with Figment, earning substantial passive rewards that compound automatically. Bitcoin's proof-of-work design offers no native yield generation capability.

5. Stablecoin Yield Opportunities

Organizations seeking stable yield can use Bitget Wallet's Stablecoin Earn Plus feature to earn up to 10% APY on idle USDT or USDC holdings. This provides attractive alternatives to traditional cash management yielding under 2%.

Lower volatility than Bitcoin or Ethereum makes stablecoins suitable for operational liquidity while maintaining dollar stability, complementing overall treasury strategy by optimizing returns on temporarily undeployed capital.

6. Cross-chain Liquidity and Flexibility

With Bitget Wallet's cross-chain support, companies can easily rebalance assets across chains like Ethereum, BNB Chain, and Solana without relying on custodians or centralized exchanges. This enables dynamic yield optimization as treasurers shift capital toward highest-return opportunities.

Multi-chain diversification reduces concentration risk from single-blockchain vulnerabilities. Asset rebalancing occurs seamlessly through direct swaps maintaining non-custodial control. Reduced dependence on single blockchains provides operational flexibility as crypto treasury management evolves across Web3 infrastructure.

7. Real-time Transparency and On-chain Tracking

Blockchain's inherent transparency enables real-time verification of holdings and transactions. Tools like Arkham Intelligence allow investors to monitor corporate treasuries instantly, providing unprecedented accountability compared to traditional finance's quarterly disclosures with 45-90 day reporting lags.

What Are the Risks of Crypto Treasury?

Price volatility stands as the primary concern, alongside debt obligations, regulatory uncertainty, and operational complexity. However, disciplined companies employing conservative strategies can navigate these challenges successfully.

1. Price Volatility and Market Swings

Bitcoin experiences 30% daily price swings creating balance sheet uncertainty. Crypto treasury volatility amplifies through leverage as stock prices move 1.5-2x more than Bitcoin. Emotional reactions also trigger panic selling. Thus, crypto treasury companies require stakeholder preparation.

2. Debt Obligations and Forced Liquidations

Leverage risk from convertible bonds creates existential threats during downturns. Debt maturities amid depressed values force choices between default and liquidation. Selling Bitcoin to meet obligations permanently locks in losses, destroying future upside. This corporate crypto treasury challenge extends beyond capital loss to credibility damage.

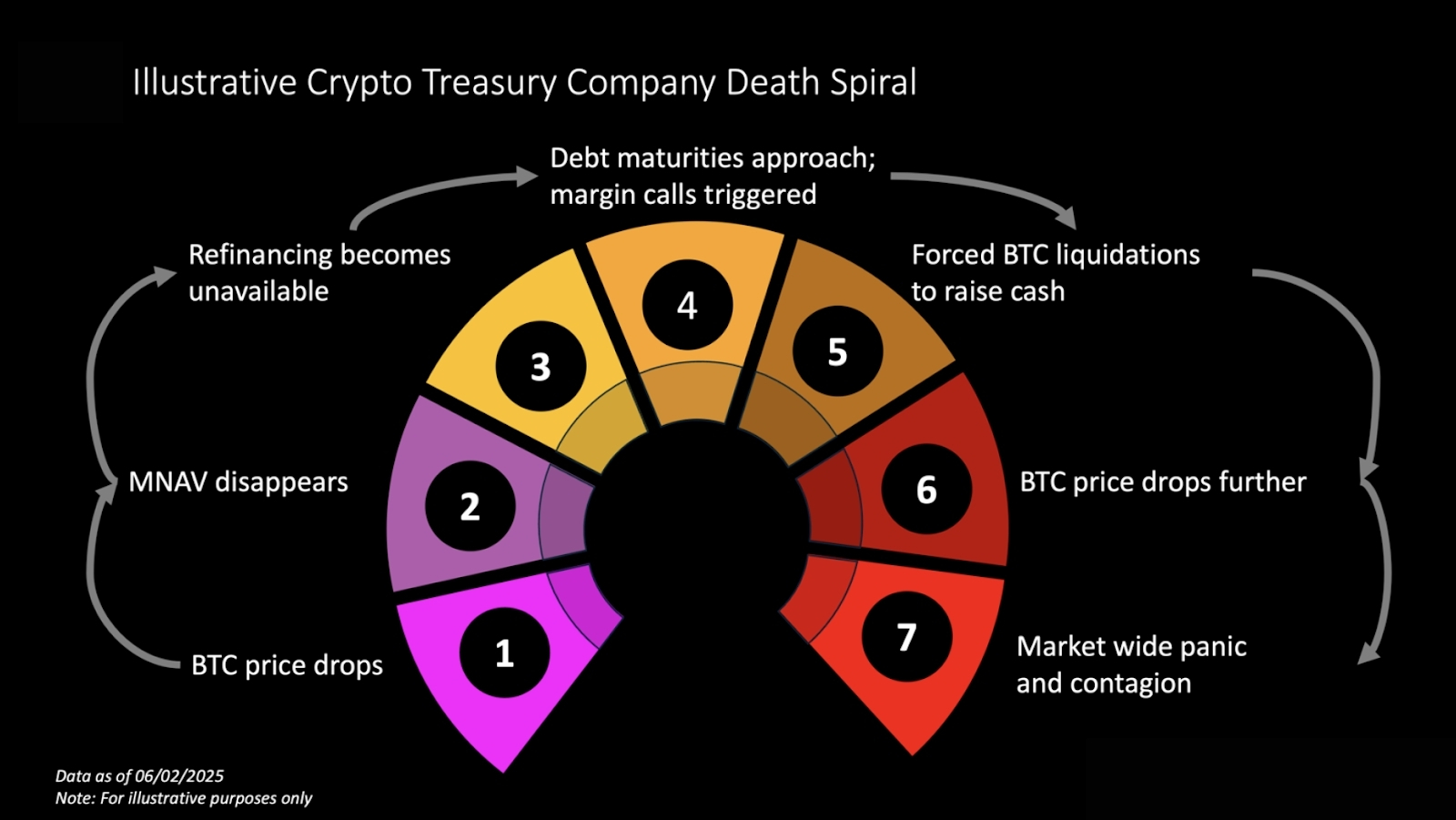

3. The Death Spiral Risk

The death spiral describes a vicious cycle where price declines trigger premium compression, eliminating capital access. Companies can avoid these risks of crypto treasury through conservative debt structures.

Source: Arkham

4. Regulatory and Legal Uncertainty

Evolving regulatory frameworks create persistent compliance challenges, such as accounting treatment, complex tax implications, and jurisdiction restrictions. Companies must invest in ongoing compliance monitoring as crypto treasury management operates in fluid legal environments.

5. Operational and Technical Complexity

Custody challenges require evaluation of multi-signature schemes and MPC implementations. Integration with accounting systems requires specialized personnel managing reconciliation and audit procedures.

Tools like Bitget Wallet simplify custody with user-friendly MPC and multi-signature solutions, reducing technical barriers for treasury operations. The platform provides enterprise-grade security and unified multi-chain dashboards for simplified management.

What Tools Support Crypto Treasury Operations?

Crypto treasury operations require infrastructure with secure custody, cross-chain control, real-time analytics, governance systems, and yield optimization.

1. Custody and Security Solutions

Multi-signature wallets require M-of-N approvals for transactions, distributing custodial responsibility across multiple key-holders. This threshold scheme enhances security by eliminating single points of failure.

Advanced solutions like Bitget Wallet combine MPC and multi-sig for enhanced security. Qualified custodians provide insurance coverage, hardware security modules, and compliance frameworks.

2. Multi-chain Asset Management Platforms

Modern treasuries diversify across Ethereum, Solana, BNB Chain, Base, and Polygon. Unified platforms aggregate wallet balances and transaction histories across multiple blockchains through single dashboards.

In addition, these platforms provide active management capabilities, including fund allocation, automated cross-chain swaps, native connectors to DeFi protocols like Aave and Curve, and policy engines enforce multi-sig consent before executing large rebalances.

3. Analytics and Transparency Tools

Real-time tracking provides minute-by-minute visibility into treasury performance and holdings. Arkham Intelligence exemplifies comprehensive analytics by deanonymizing wallet addresses and tracking corporate treasury activity. On-chain transaction monitoring generates automated alerts for large or suspicious movements.

Portfolio reporting generates compliance-ready documents with immutable on-chain proof of reserves. Audit trail capabilities enable independent verification without third-party attestations. Dashboard widgets track mNAV movements, staking yields, and debt maturities.

4. DAO Coordination and Multi-sig Platforms

Decentralized organizations require governance frameworks combining on-chain voting with secure treasury control. Certain key coordination capabilities include:

-

Multi-signature Workflows:

M-of-N vault transactions require governance proposal approval and quorum achievement before execution.

-

Governance Integration:

Platforms like Snapshot and Tally enable token-holder voting with transparent on-chain tallies recorded.

-

Automated Fund Allocation:

Smart contracts triggered by governance outcomes automate grant disbursements and liquidity incentives systematically.

-

Stakeholder Transparency:

Public dashboards display pending proposals, voting status, and transaction history for real-time treasury monitoring.

5. Yield and Liquidity Solutions

Stablecoin earning platforms channel deposits into DeFi protocols generating 3-10% yields on idle treasury funds. Aave and Compound enable lending across chains while maintaining principal security. Concentrated liquidity strategies through Uniswap V3 maximize fee income within specific price ranges.

Beyond stablecoin strategies, proof-of-stake networks offer additional yield opportunities, such as institutional staking services, liquid staking protocols, cross-chain swap capabilities, and treasury management.

How Does Bitget Wallet Support Crypto Treasury Management?

Bitget Wallet serves as a comprehensive Web3 treasury solution combining enterprise security with DeFi flexibility. The platform offers multi-chain management, advanced custody, yield optimization, and DAO coordination for institutional and individual users.

Core Treasury Functions

Bitget Wallet delivers essential infrastructure for modern crypto treasury operations through three foundational capabilities:

-

Multi-chain Asset Management:

For teams managing digital assets, Bitget Wallet simplifies multi-chain fund allocation, on-chain approvals, and real-time tracking across Ethereum, Solana, BNB Chain, Base, and Polygon networks.

-

Secure Custody Protection:

Unlike single-key wallets, Bitget Wallet adopts advanced MPC and multi-signature solutions to secure corporate treasuries through cryptographic key shares requiring threshold approvals for transactions.

-

Cross-chain Liquidity Access:

Companies can easily rebalance assets across chains without relying on third-party custodians, enabling instant portfolio adjustments through integrated swap engines and automated gas fee management.

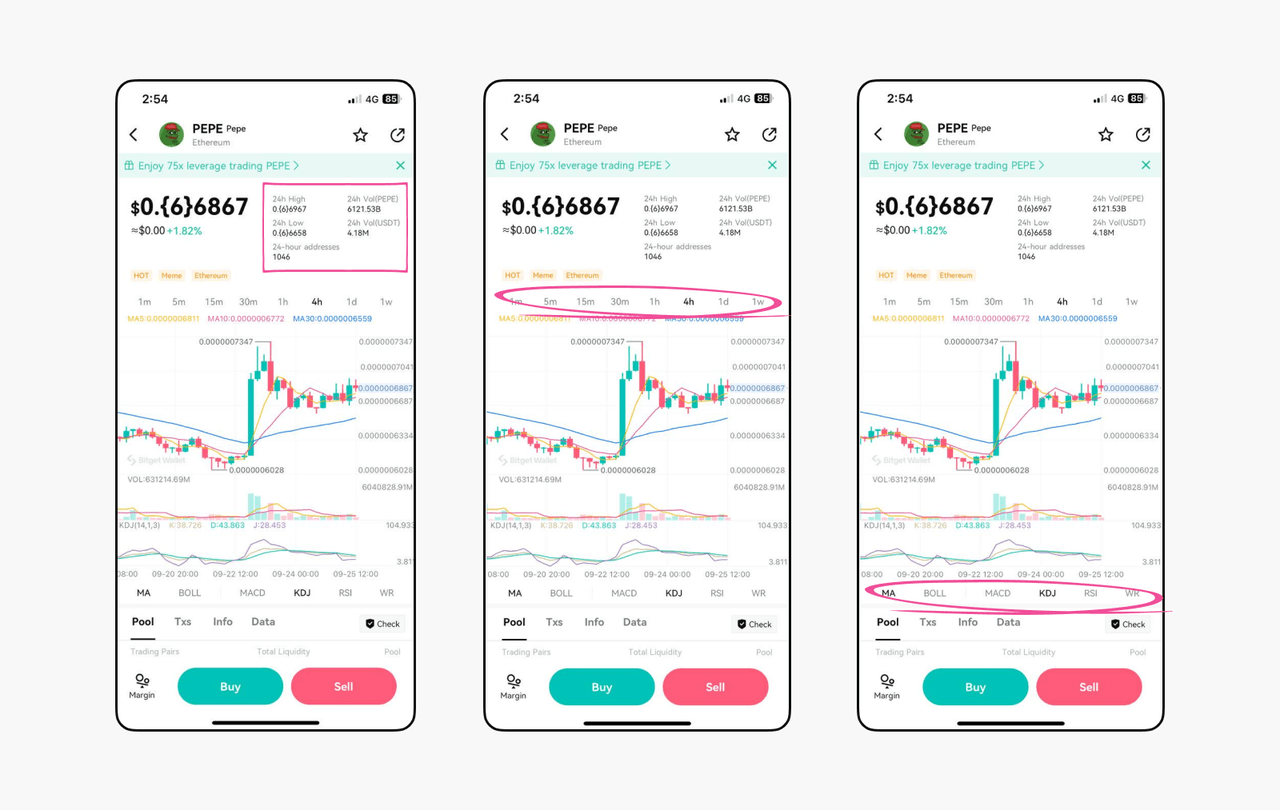

How to Use Bitget Wallet for Treasury Operations?

Organizations can implement treasury strategies with Bitget Wallet via the following six steps.

STEP 1 - Store & Secure:

Download Bitget Wallet to store thousands of tokens securely with non-custodial control and MPC-backed key management.

STEP 2 - Trade & Swap:

Access instant cross-chain swaps with low fees directly in the app for efficient rebalancing.

STEP 3 - Earn Yield:

Use Stablecoin Earn Plus to generate up to 10% APY on USDT or USDC holdings.

STEP 4 - Track in Real-time:

Monitor wallet balances and transaction history with integrated analytics providing comprehensive portfolio visibility.

STEP 5 - Access DeFi & Web3:

Connect to decentralized applications through the built-in browser for protocol integration.

STEP 6 - Coordinate DAO Operations:

Manage multi-sig approvals and fund allocations for team treasuries with on-chain governance workflows.

Conclusion

What is crypto treasury? It has evolved from a radical experiment into legitimate corporate strategy for digital asset management in 2026 . Companies like Strategy, BitMine, and Forward Industries demonstrate how businesses successfully manage billions in Bitcoin, Ethereum, and Solana through disciplined treasury operations.

Whether managing corporate treasuries or exploring on-chain yield opportunities, Bitget Wallet provides a secure, beginner-friendly gateway for Web3 asset management. The platform combines institutional-grade security with accessible crypto treasury management tools for enterprises and individuals.

Download Bitget Wallet today to manage stablecoins, trade trending tokens, and access seamless multi-chain operations across Ethereum, Solana, BNB Chain, Base, and Polygon. Secure your digital assets, earn competitive yields, and explore DeFi opportunities through one comprehensive platform.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is crypto treasury?

Crypto treasury refers to a corporate strategy of holding cryptocurrencies like Bitcoin or Ethereum on the balance sheet as reserve assets. It involves active management of digital asset allocations, leveraging both price appreciation and yield opportunities under a structured crypto treasury management framework.

2. How is crypto treasury different from traditional treasury?

Unlike traditional treasury, crypto treasury allocates funds to digital assets with higher volatility, scarcity-driven appreciation, and staking yield. It uses blockchain-based custody, multi-chain rebalancing, and DeFi integration rather than bank deposits, bonds, or money market funds.

3. Which companies lead the crypto treasury space?

The top crypto treasury companies include Strategy (formerly MicroStrategy) with 638,460 BTC, Marathon Digital (MARA) employing hybrid mining-treasury, and BitMine Immersion (BMNR) as the largest Ethereum staker, followed by SharpLink Gaming, Forward Industries, and Metaplanet.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy LGNS in 2026: A Beginner’s Step-by-Step Guide to Longinus2026-02-04 | 5mins

- How to Buy JYPC in 2026: A Beginner’s Step-by-Step Guide to JPY Coin2026-02-02 | 5mins