Trump 401(k) Crypto Investments: How the New Executive Order Opens Retirement Plans to Digital Assets

Trump 401(k) Crypto Investments has been in the spotlight thanks to a new executive order that expands access to alternative asset markets in retirement funds. The policy opens up the $9 trillion market for crypto, gold, and private equity - a booming opportunity for Americans to diversify their portfolios, turning investing into an open game for everyone. This is not only a seismic turning point that requires careful understanding of the opportunity, but also shapes how young to old investor groups accumulate retirement in the next decade.

In the context of the digital retirement era, Bitget Wallet plays an extremely necessary role in the industry - the most reliable crypto management tool, helping you balance your long-term portfolio and access the global market transparently and securely. This is a potential tool for the digital retirement era.

In this article, we will explore the details of Trump 401(k) crypto investments and explain why Bitget Wallet is the all-in-one choice for investors looking to embrace the future of digital retirement.

What Did Trump’s 401(k) Crypto Investments Announcement Include?

On July 18, 2025, President Trump signed an executive order that potentially opens the $9 trillion U.S. retirement market to a new class of alternative assets. For the first time, 401(k) plans may be able to hold crypto, gold, private equity, real estate, and infrastructure investments, breaking decades of reliance on stocks and bonds. The order immediately directs federal agencies to review outdated restrictions and pave the way for broader diversification.

This historic policy marks the first step in integrating digital assets into mainstream retirement strategies.

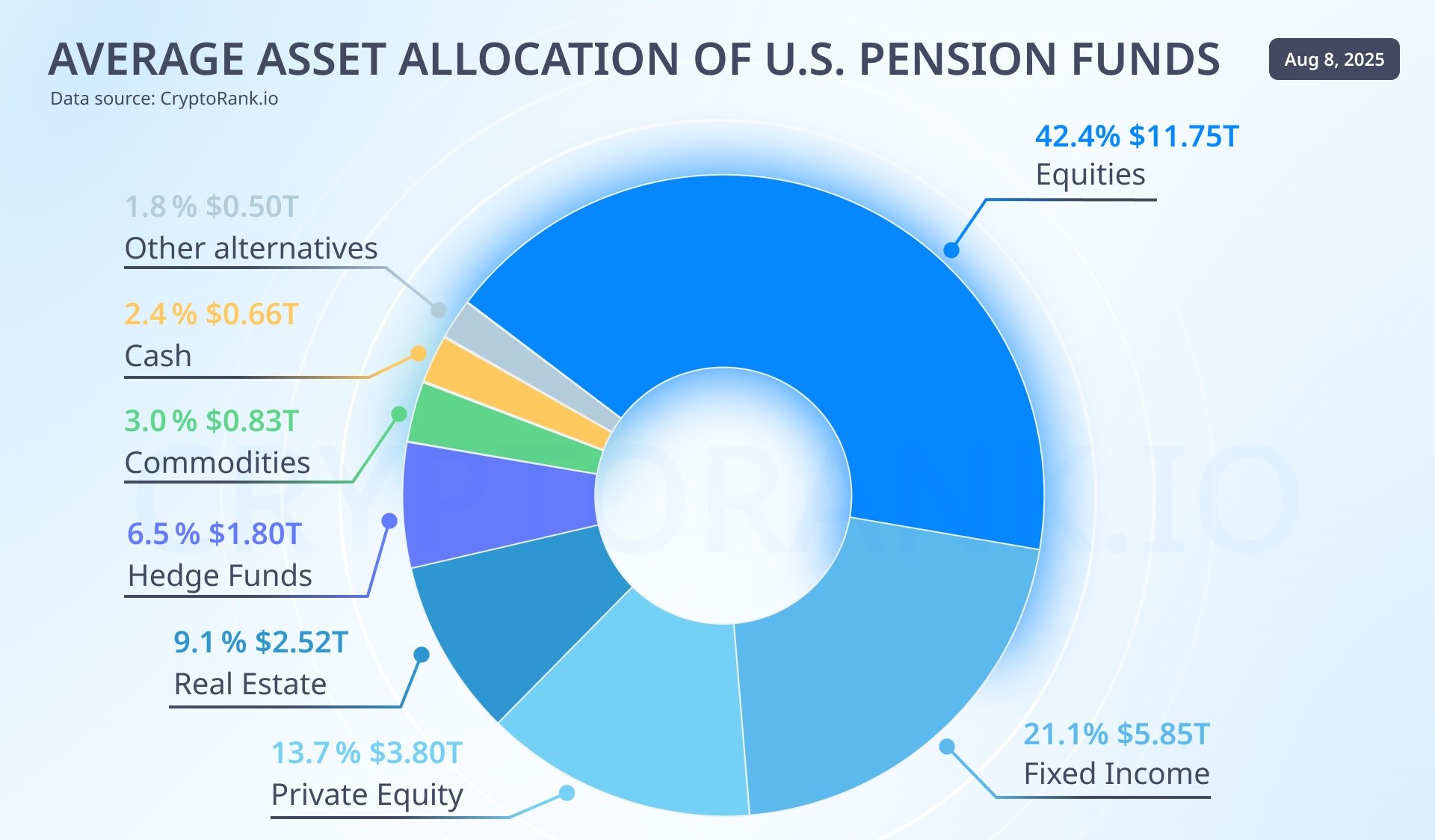

Source: CryptoRank.io on X

Why Is This Executive Order Significant for Retirement Investors?

Until now, most 401(k) plans have been limited almost entirely to stocks, bonds, and mutual funds, restricting diversification and leaving retirement savers exposed to market volatility. By lifting barriers to alternative assets, Trump’s executive order creates new pathways for growth and protection against inflation.

As the White House emphasized in its statement, this policy is designed to “restore prosperity for everyday Americans” by giving workers the same sophisticated investment tools that institutions have long enjoyed. For many, it represents a turning point in retirement planning.

Source: Marketwatch.com

Which Alternative Assets Are Being Added Under the New Rules?

Under the new framework, investors could gain access to a diversified mix of alternative assets, including:

- Digital assets (cryptocurrencies, stablecoins, tokenized funds)

- Gold and other precious metals

- Private equity and private loans

- Infrastructure projects

- Real estate holdings

Digital assets, in particular, bring high-growth potential and serve as an inflation hedge, making them a natural fit in a diversified 401(k) portfolio. These reforms highlight the growing role of crypto in retirement plans and accelerate the shift toward digital asset 401(k) investments as a mainstream choice.

What Does the New 401(k) Policy Say About Crypto Investments?

On August 7, 2025, a follow-up executive order formally outlined how alternative assets—including cryptocurrencies—fit into the new 401(k) framework. The order defined six asset categories eligible for retirement plans:

| Asset Category | Role in Retirement Plans |

| Digital assets (cryptocurrency, tokenized products, stablecoins) | High-growth but volatile class. Allocation caps will apply to balance stability with exposure to blockchain innovation. |

| Gold and other precious metals | Acts as an inflation hedge and protection against market shocks, ensuring traditional security. |

| Private equity | Provides access to long-term growth opportunities, previously limited to institutional investors. |

| Private credit and loans | Generates steady income streams while diversifying risk beyond equities and bonds. |

| Infrastructure projects | Channels retirement savings into rebuilding U.S. systems, with potential for stable, long-term returns. |

| Real estate holdings | Serves as a proven inflation hedge and income generator, adding tangible value to retirement accounts. |

To ensure proper implementation, the order grants the Department of Labor (DOL) a 180-day review period to revise ERISA guidance. The core goals are to reduce fiduciary litigation risks, clarify plan administrators’ duties, and encourage broader access to these investments without exposing savers to unnecessary legal uncertainty.

How Will Federal Agencies Coordinate on the New Policy?

Implementation will require coordinated action from three key agencies:

| Agency | Key Responsibilities |

| Department of Labor (DOL) | Update ERISA rules, define custody requirements, and set regulatory safe harbors. |

| Department of the Treasury (Treasury) | Oversee tax policies and regulatory frameworks for alternative and non-traditional assets. |

| Securities and Exchange Commission (SEC) | Review disclosure and transparency laws, expand investor standards, and broaden access to accredited investors. |

The trio will draw the line – defining the potential of crypto markets in 401(k) plans while ensuring investor protections are tight.

What Protections Will Be in Place for Retirement Savers?

Safety is the Key! The executive order requires the DOL to create a regulatory framework that allows managers to add digital assets to their portfolios without fear of litigation, as long as they comply with rigorous standards of due diligence.

While alternative assets are often more expensive and complex, they offer greater diversification and better inflation protection. By balancing risk and access, this policy aims to help Americans build better retirement nest eggs, avoiding mismanagement risks.

How Does Fidelity’s Crypto-Enabled 401(k) Model Work?

Source: Cryptodnes.bg

Before Trump’s 2025 executive order, the most notable precedent came from Fidelity Investments, which in 2022 became the first major U.S. retirement provider to allow Bitcoin in 401(k) plans. The model was designed with strict guardrails:

-

Employer approval required:

Workers could only access crypto options if their employer opted in.

-

Allocation limit:

Bitcoin allocations were capped at 20% of an employee’s 401(k) balance.

-

Fees and trading:

Fidelity introduced a separate digital asset account with standard trading spreads and account-level fees, ensuring transparency in execution.

-

Regulatory caution:

The Department of Labor at the time warned employers about fiduciary risks, noting crypto’s volatility and the need to comply with “prudent investment” standards under ERISA.

This model served as a testing ground for crypto integration in retirement savings—balancing innovation with fiduciary caution.

Source: Insurancenewsnet.com

What Lessons Can Be Learned from Fidelity’s Approach?

Fidelity’s model proved that employer buy-in, regulatory compliance, and suitability standards are essential for crypto integration into retirement plans.

- Employer buy-in is essential — Without employer approval, employees had no access to crypto in their 401(k). Corporate HR and benefits committees became critical gatekeepers.

- Compliance is non-negotiable — Plans had to meet ERISA’s “prudent investment” test, ensuring fiduciaries acted in savers’ best interests.

- Suitability varies by retirement horizon — Younger workers might tolerate crypto volatility for growth, but older savers near retirement faced higher risks.

What Are the Pros and Cons of Adding Crypto to a 401(k)?

Integrating crypto into retirement savings presents both exciting opportunities and significant risks. Trump’s 2025 executive order amplifies this debate by broadening the eligible asset base beyond the traditional stock-and-bond framework.

| Pros | Cons |

| Diversification beyond stocks and bonds | High volatility and potential losses |

| Strong long-term growth potential | Higher fees and account complexity |

| Signals mainstream adoption of digital assets | Regulatory uncertainty and shifting guidance |

| Inflation hedge and store-of-value narrative | Employer reluctance and fiduciary liability risks |

This balance shows why Fidelity’s cautious approach—limited allocations, employer oversight, and clear disclosures—remains a valuable case study for future crypto-enabled retirement plans.

How Can Investors Participate in Trump’s 401(k) Crypto Investments Opportunity?

Trump’s 401(k) crypto investments policy may reshape retirement planning, but the new options won’t appear overnight. The executive order signed in August 2025 begins a rulemaking process, requiring coordination among federal agencies. Most retirement plans are expected to integrate alternative assets, including digital assets, starting in 2026.

For investors, the key is preparation. Here are immediate steps to take:

- Monitor updates from the Department of Labor (DOL) and the SEC on regulatory changes.

- Engage with your plan sponsor (employer or HR benefits committee) to express interest in alternative assets.

- Assess personal risk tolerance and retirement horizon to decide whether crypto or other alternatives align with long-term goals.

What Kinds of Alternative Investments Will Be Available?

The executive order establishes six alternative asset classes that could soon be part of retirement plans. In particular, they will be incorporated into Target-Date Funds (TDFs) – the default investment choice for millions of Americans.

| Asset Class | Role / Benefit | Placement in TDFs |

| Private Equity | Long-term growth opportunities | Higher allocation in early career, gradually reduced near retirement to avoid illiquidity risks |

| Real Estate | Steady income, strong inflation hedge | Peaks in mid-career stage to balance market volatility |

| Commodities (Gold & Metals) | Proven hedge against inflation and crises | Gains prominence in later career stages as a stabilizer |

| Infrastructure | Sustainable, long-term profits | Acts as a substitute for traditional bonds, adding stability + modest growth |

| Crypto Assets (Crypto, Tokenized Securities) | Innovation driver of the 4.0 era, high-growth potential | Higher allocation for young investors, scaled down automatically near retirement |

| Longevity Pools | Income insurance for older retirees | Supports withdrawal strategies in late retirement, maximizing lifetime income |

By directly embedding these assets into TDFs, the policy turns crypto and non-traditional assets into potential profit opportunities – a groundbreaking structural change for savers.

How to Prepare Your Portfolio for Alternative Assets in a 401(k)

To maximize the opportunity, investors should:

-

Research each asset class:

Understand potential returns, risks, and how they correlate with traditional stocks and bonds.

-

Account for liquidity and fees:

Many alternative assets, such as private equity or real estate, may involve higher fees and longer lock-in periods.

-

Seek professional advice:

Financial planners can help determine the right allocation mix based on age, income, and retirement timeline.

How Can Bitget Wallet Support Your Digital Asset Retirement Strategy?

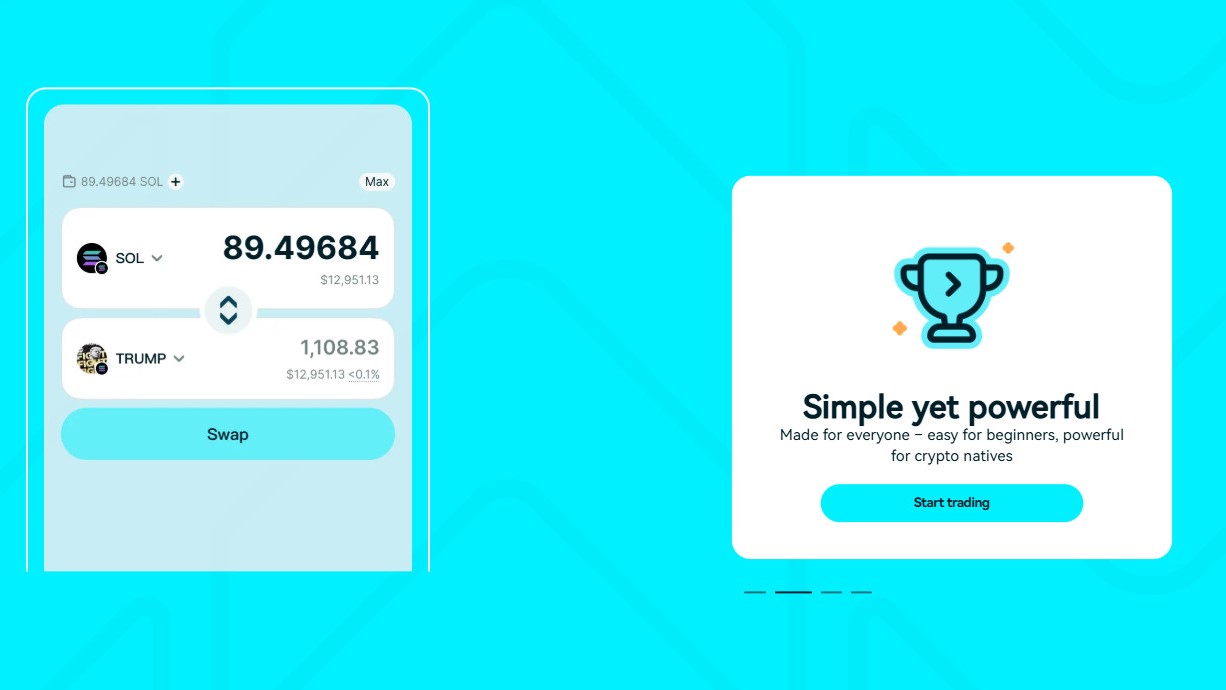

Trump’s 401(k) policy opens the door to crypto in retirement accounts—but choosing the right tool to manage those assets is the real game-changer. This is where Bitget Wallet steps in as your trusted partner for the digital retirement era.

See the future, today

Track 250,000+ tokens across 100+ blockchains with real-time analytics, giving you the clarity to navigate market cycles with confidence.

Security that lasts a lifetime

With MPC encryption and true self-custody, your retirement assets stay under your control, safe from centralized risks and market shocks.

-

Diversify without limits

Swap, stake, and bridge seamlessly across ecosystems, building a retirement portfolio as global and dynamic as the digital economy itself.

-

Turn savings into freedom

From DeFi yield opportunities to the Bitget Wallet Mastercard, your retirement plan isn’t just locked away—it’s working for you, and ready when you need it.

Bitget Wallet doesn’t just store your crypto—it transforms it into a resilient, retirement-ready strategy. By merging long-term planning with cutting-edge Web3 access, it ensures your 401(k) isn’t stuck in the past, but boldly positioned for the future.

Conclusion

Trump's crypto 401(k) initiative could be a game-changer for how Americans plan for retirement. The August 2025 executive order paves the way for new asset classes like private equity, real estate, and especially crypto, while also planning for federal coordination and investor protection. While a smooth rollout may not happen until 2026, you should get in on the action now by staying up to date on the latest regulations, engaging with plan sponsors, and reassessing their risk tolerance.

The future of retirement will be a hybrid of traditional finance and blockchain technology, making a truly secure crypto management tool a must. Bitget Wallet is the number one choice, helping you store securely, trade smoothly, and have a full multi-chain crypto portfolio - all in one app. With strict security and powerful multi-chain support, Bitget Wallet is a worthy companion to help you diversify and digitize your retirement plan in the best way.

👉 Don't miss the golden opportunity - Download Bitget Wallet now to manage, store and invest crypto smoothly and intelligently!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What are Trump’s 401(k) crypto investments?

Trump’s 2025 executive order allows retirement plans like 401(k)s to include alternative assets such as cryptocurrencies, gold, real estate, and private equity. For the first time, everyday Americans can diversify their retirement savings beyond traditional stocks and bonds.

2. When will crypto actually be available in 401(k) plans?

Although the executive order was signed in August 2025, implementation requires a rulemaking process led by the Department of Labor (DOL), Treasury, and SEC. Most experts expect crypto and other alternatives to appear in 401(k) plans by 2026.

3. How can Bitget Wallet help with retirement crypto investing?

Bitget Wallet is a self-custody crypto wallet that supports 250,000+ tokens across 100+ blockchains. It provides security, diversification, and global market access, making it the perfect tool to manage, stake, and grow digital assets within a long-term retirement strategy.

- What Is a Multi-Chain Wallet?2026-02-13 | 5 mins