Stablecoin Earn Plus: What USDC Earn Is and How to Start Generating Yield

Stablecoin Earn Plus is a beginner-friendly way to access USDC Earn by routing USDC on Base into Aave, where borrowers pay interest that becomes your base yield. On top of that protocol yield, Bitget Wallet adds a bonus yield component based on product rules, so your total earnings can be higher than the Aave-only rate.

Rates are not fixed. The protocol portion fluctuates in real time, and the “boosted” tier depends on eligibility rules such as time limits, amount caps, and network selection. Bitget Wallet provides the product interface in a non-custodial setup, meaning you control your assets while interacting with on-chain lending.

In this article, we’ll explain how Stablecoin Earn Plus works, from how tiered APY and vouchers apply to redeeming safely, while managing stablecoins and viewing on-chain yield tools directly in Bitget Wallet before subscribing.

Key Takeaways

- Stablecoin Earn Plus enables USDC Earn on Base by supplying USDC on Base to Aave, with eligible users able to access a 10% boosted APY under specific conditions.

- Stablecoin Earn Plus APY is tiered and variable, combining Aave’s floating protocol rate with a bonus yield layer under specific time and deposit caps.

- Bitget Wallet provides a non-custodial interface for Stablecoin Earn Plus, allowing users to manage USDC on Base, subscribe, monitor yield, and redeem flexibly while retaining asset control.

What Is Stablecoin Earn Plus and How Does It Work for USDC Earn?

Stablecoin Earn Plus is an Earn product that helps beginners participate in USDC Earn on Base through Aave lending, with an additional bonus yield layer applied by product rules.

What product does “Stablecoin Earn Plus” refer to inside Bitget Wallet?

Bitget Wallet offers multiple Earn tools, but Stablecoin Earn Plus specifically refers to the USDC-Base protocol earn product. In plain terms, it’s the product path where you subscribe with USDC on the Base network, and your funds are routed into Aave to generate protocol interest, plus any eligible bonus yield from Bitget Wallet.

A simple way to remember it:

- USDC on Base is the required asset-network pair for the core Stablecoin Earn Plus flow

- Aave is the underlying lending protocol generating the variable protocol interest

- Bonus yield is added by Bitget Wallet according to eligibility rules

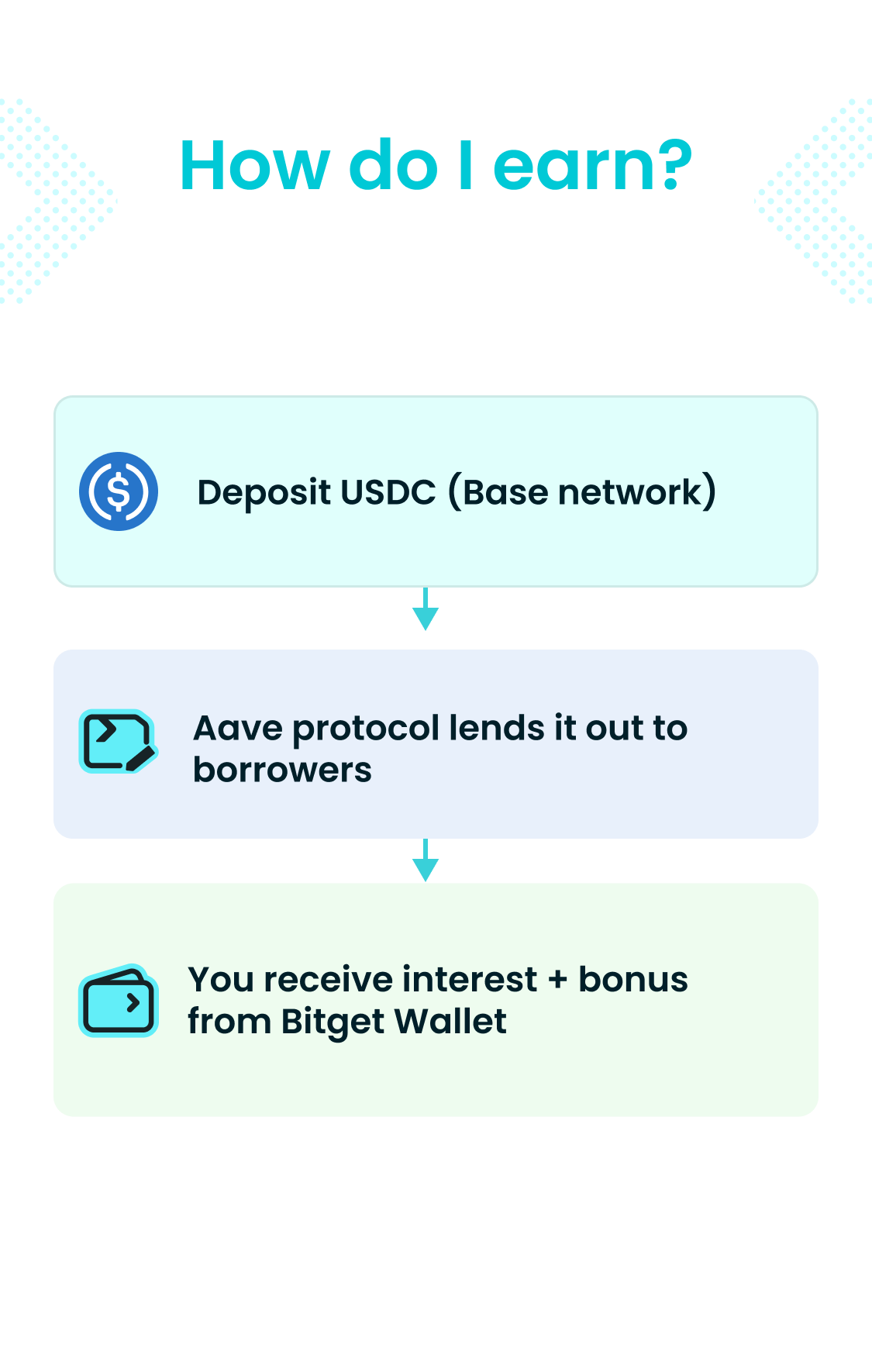

How is yield generated in Stablecoin Earn Plus?

Stablecoin Earn Plus yield typically has two components:

- Protocol yield (variable): Your USDC (Base) is supplied to Aave. Borrowers pay interest, and that interest becomes the base yield you earn.

- Bonus yield (rules-based): Bitget Wallet provides an additional yield component on top of the protocol earnings. This is not the same as “just using Aave elsewhere,” because the bonus component is tied to Stablecoin Earn Plus rules.

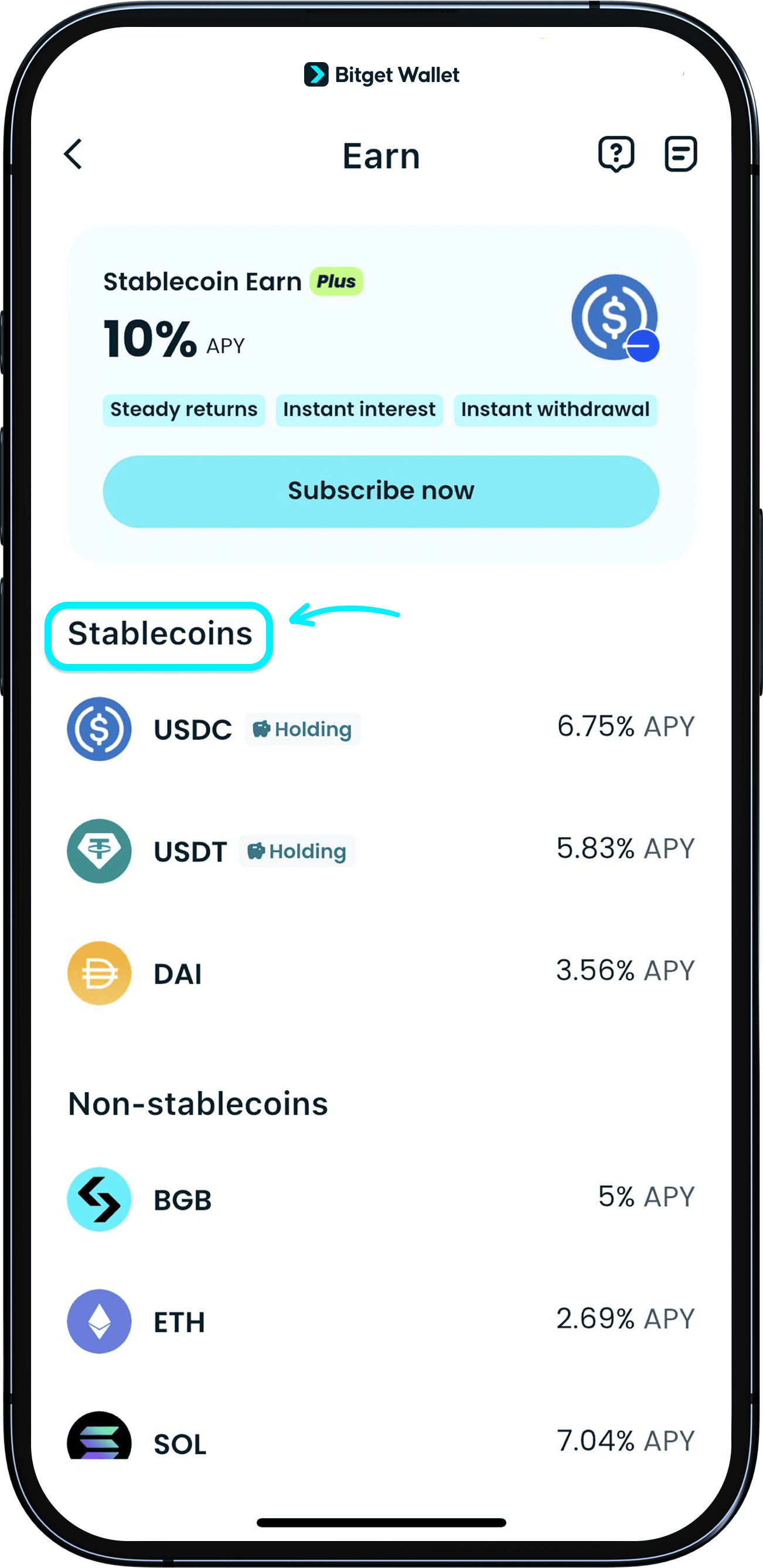

Which stablecoins are supported and what should users choose?

Stablecoin Earn Plus supports multiple stablecoins, but the boosted logic described in this guide requires choosing USDC on Base.

| Supported Stablecoins | What it means for beginners |

| USDT (Tether) | A widely used USD-pegged stablecoin; availability depends on product rules |

| USDC (USD Coin) | The key asset for the USDC (Base) boosted tier logic |

| DAI (DAI) | A USD-pegged stablecoin option; rules may differ from USDC-Base |

If your goal is specifically the Stablecoin Earn Plus boosted tier, your selection step is simple: USDC on Base.

How Do Stablecoin Earn Plus APY Tiers Work?

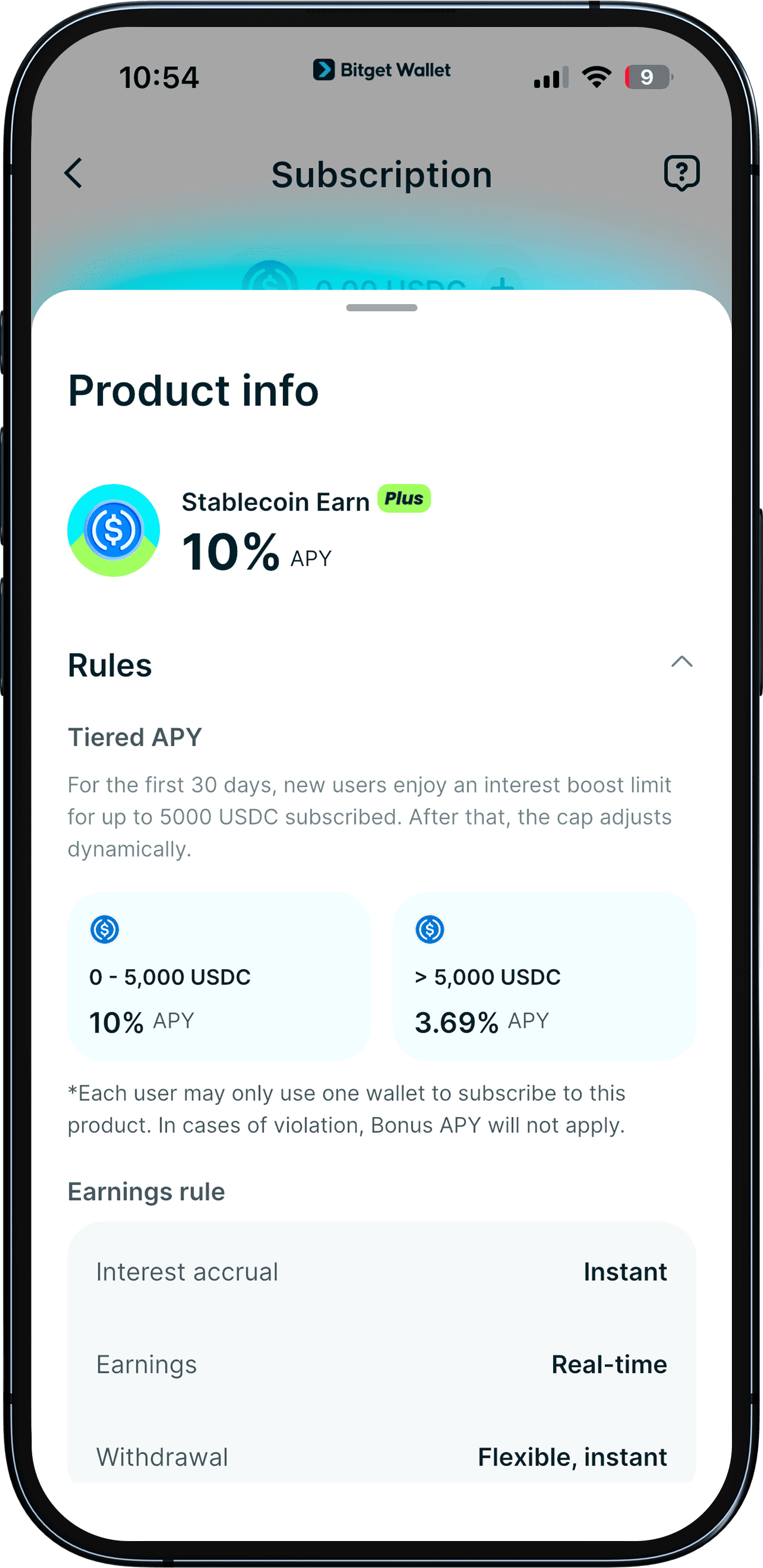

Stablecoin Earn Plus uses a tiered APY model, which means different portions of your balance (or different time periods) can earn different rates. The protocol APY is variable, and the boosted tier is capped by both time and amount.

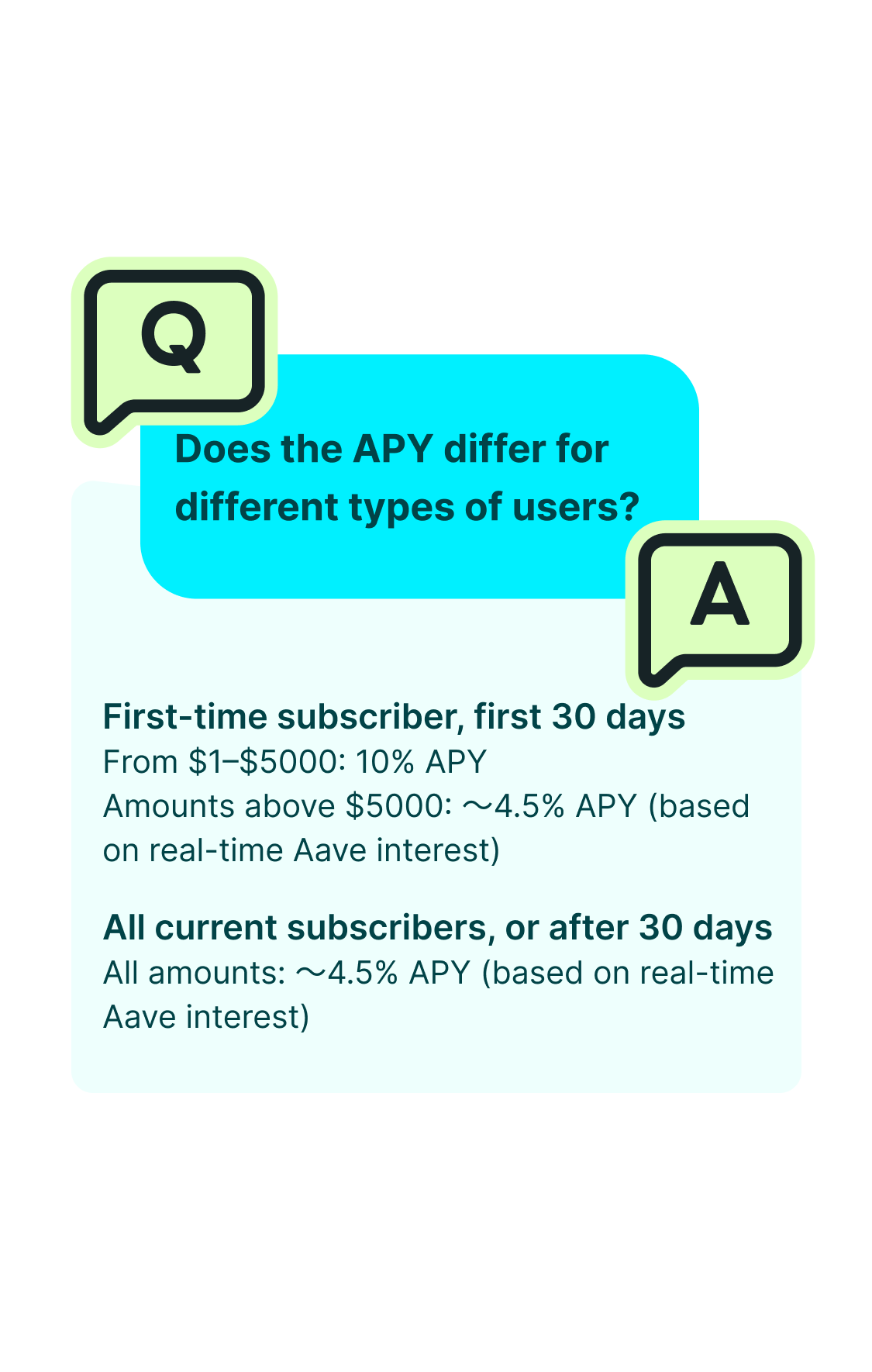

What APY tiers apply to new vs existing users?

Tiered APY is easiest to understand if you read it like a rule sheet: “This portion earns X% for this period; everything else earns the variable protocol rate.”

| User Type / Period | Investment Amount (USD) | APY Rule | Details |

| First-time subscriber (first 30 days) | $1–$5,000 | 10% | Boosted APY applies to the first $5,000 during the first 30 days. |

| First-time subscriber (first 30 days) | Amount above $5,000 | ~4.5%* | Any portion above $5,000 earns the variable protocol rate. |

| All subscribers (including after 30 days) | All amounts | ~4.5%* | After the first 30 days, all balances earn the variable protocol rate. |

However, here’s the critical detail:

The 4.5% figure shown with the “~” symbol is only an indicative reference rate. It is not fixed. In reality, the yield fluctuates continuously—hour by hour, even minute by minute—because it follows the underlying Aave protocol rate. As a protocol-based rate, it dynamically adjusts according to supply, demand, and on-chain liquidity conditions, meaning returns can rise or fall with market movements.

In short:

- The promotional rate applies only to new users, during the first 30 days, and only on the initial capped amount (e.g., 5 million VND equivalent).

- Any balance exceeding that limit—or any period beyond the 30-day window—earns a floating rate that moves with market conditions.

Always remember: a floating rate is not a guarantee. It represents opportunity, but also variable risk. Yield follows market mechanics, so disciplined monitoring and informed decision-making are essential.

How to qualify for the 10% boosted APY?

To receive the boosted tier, the requirement must be explicit:

- Eligibility requirement (must be met): Subscribe using USDC on the Base network under Stablecoin Earn Plus.

- Yield source model (beginner version):

- Protocol yield: USDC (Base) goes into Aave → borrowers pay interest → you earn the variable rate.

- Bonus yield: Bitget Wallet adds an additional yield component according to product rules.

- Why does the protocol APY change in real time? Aave rates move with borrow demand and liquidity. When more borrowers want to borrow, rates often increase; when demand drops, rates often fall.

How to Subscribe to Stablecoin Earn Plus Step by Step?

Subscribing is a simple 8-step in-app flow, but execution accuracy matters. The main beginner mistake is choosing the wrong asset/network pair—Stablecoin Earn Plus currently supports USDC on Base only, so USDC on other chains won’t work for this product.

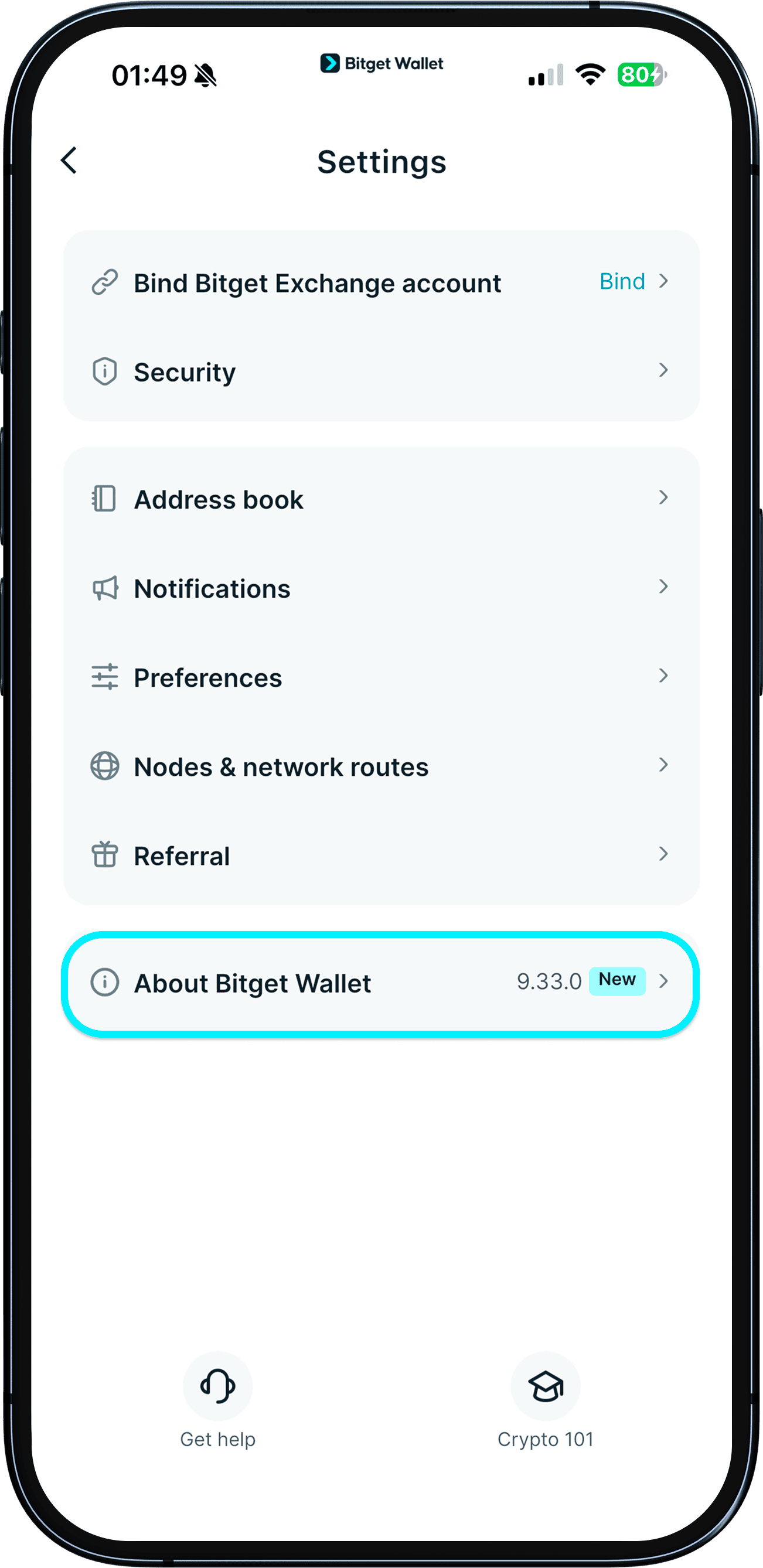

Step 1: Update Bitget Wallet app to the latest version

Go to Home → Settings → About Bitget Wallet → App version and update.

This ensures the Earn module and the Stablecoin Earn Plus entry are visible and functioning correctly, especially if you previously installed an older build.

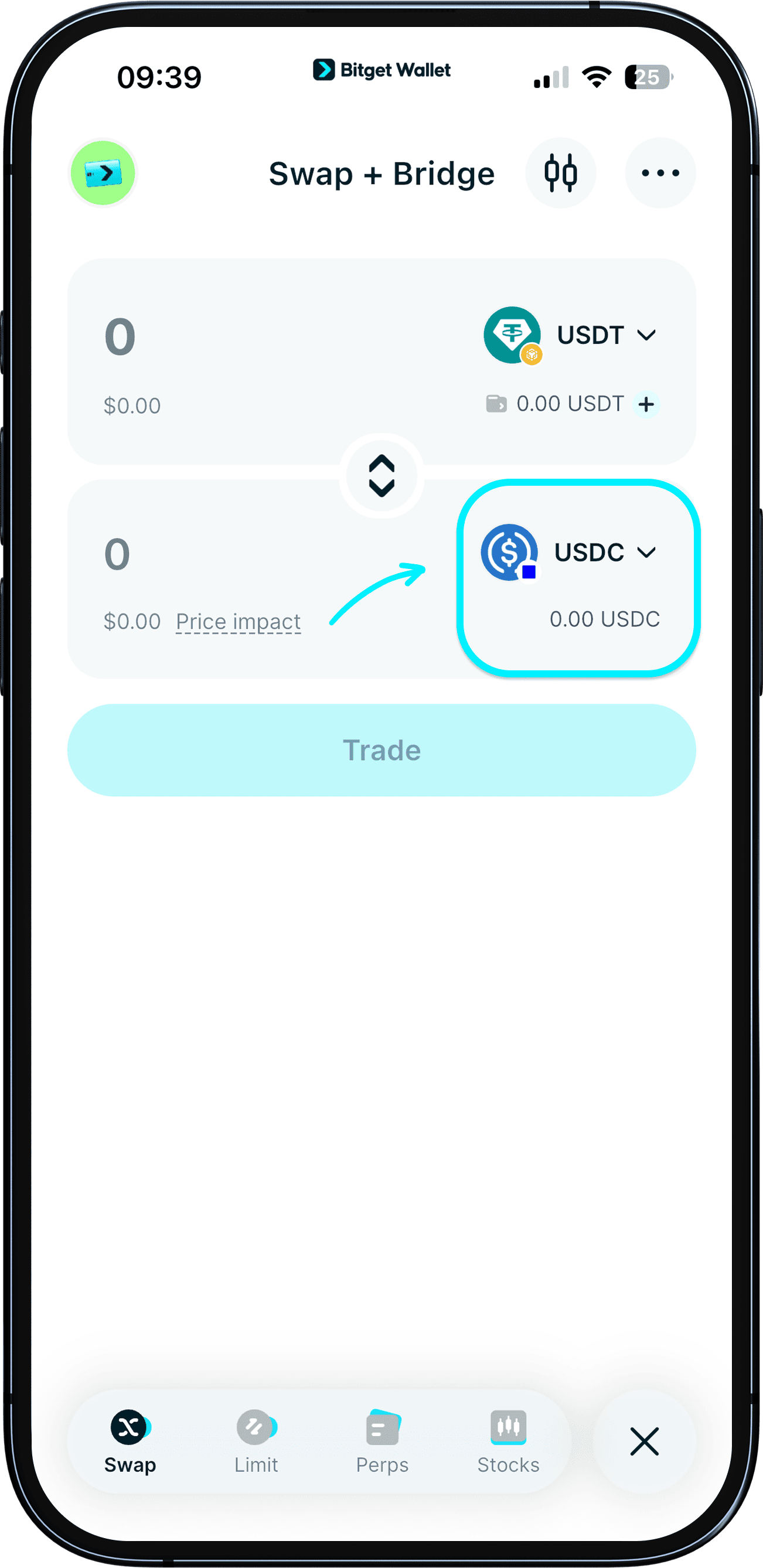

Step 2: Swap for USDC on the Base network

Open Trade and swap any token you hold into USDC (Base).

This step is critical because USDC exists across multiple chains, and the product is designed around the Base network version specifically. Always double-check the network label shows Base before confirming the swap.

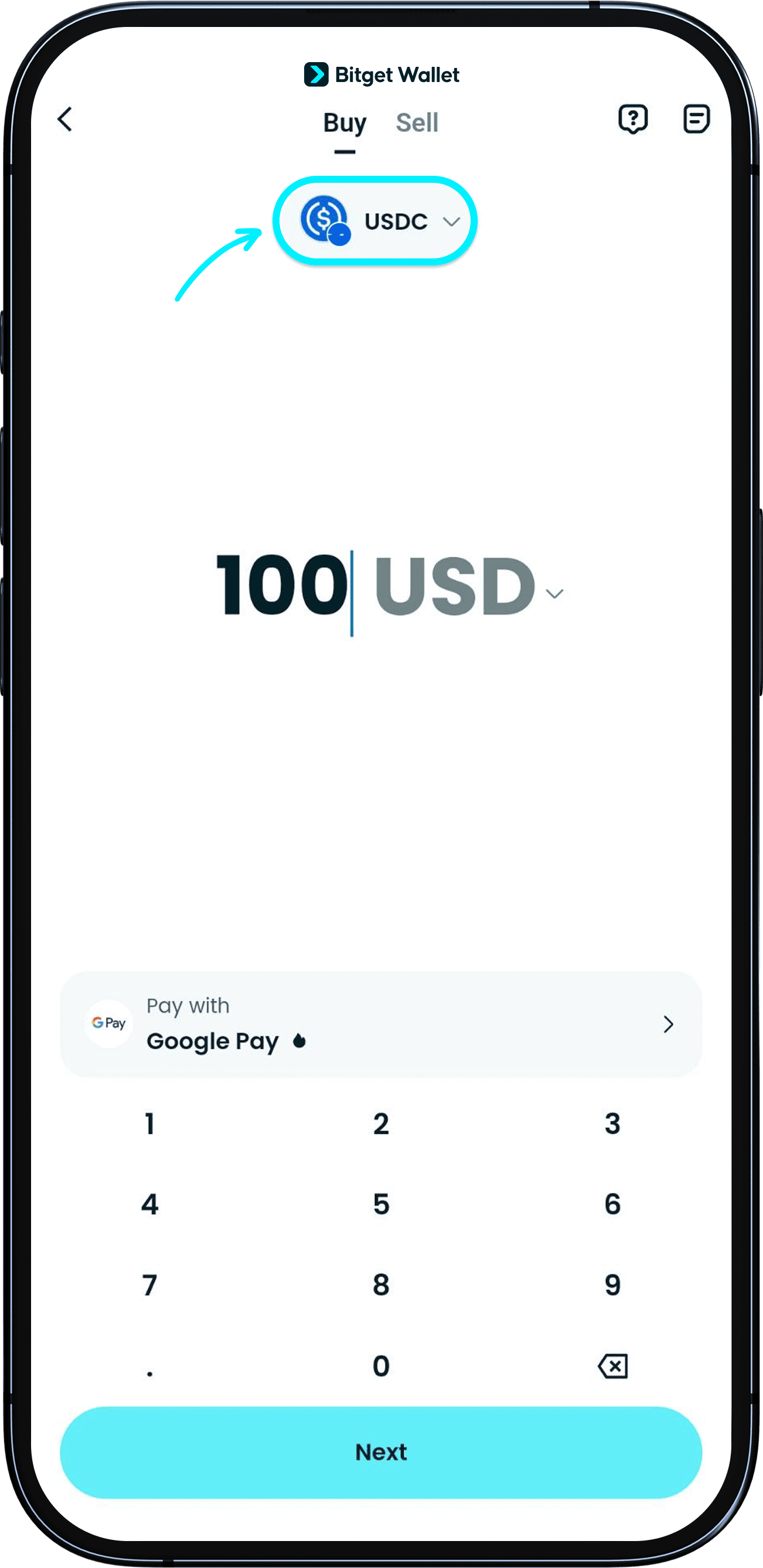

Step 3: Top up USDC on Base

If you don’t want to swap, you can top up directly via Home → Add funds, then choose:

- Transfer from an exchange

- Buy with local currency

- Buy via P2P

Key check: when depositing or buying, select USDC on Base—sending the wrong-chain USDC may require bridging or additional steps before you can subscribe.

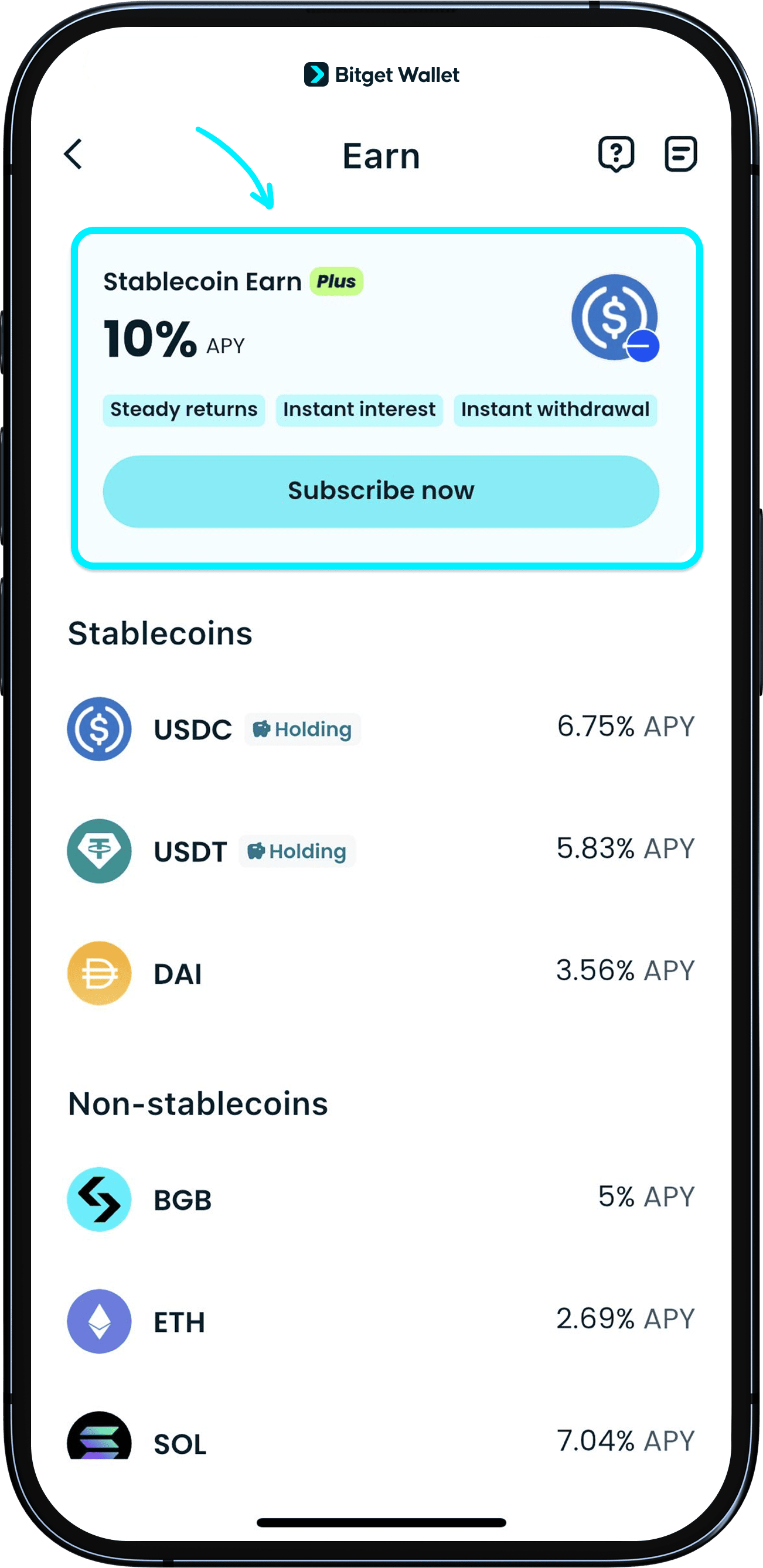

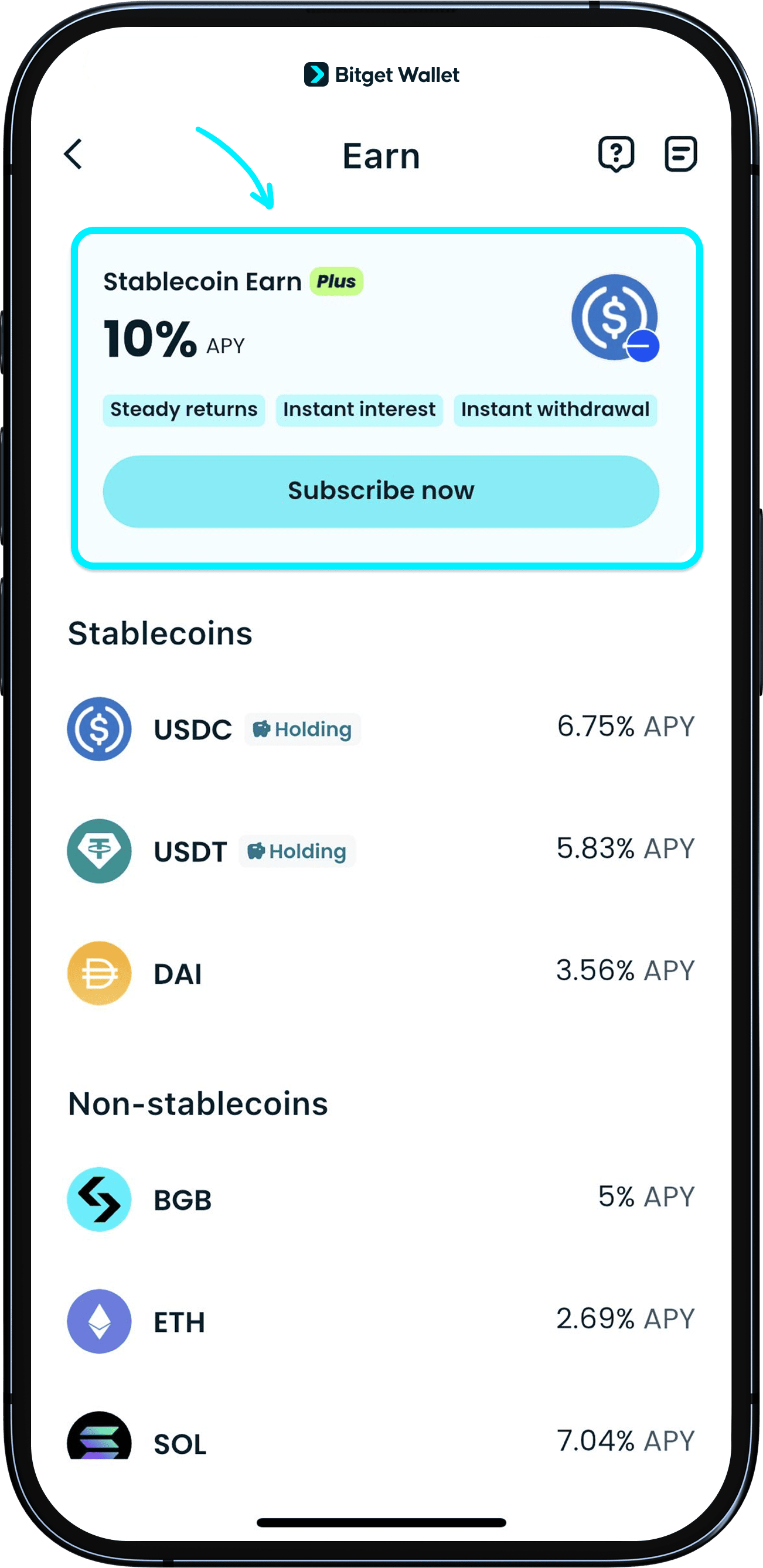

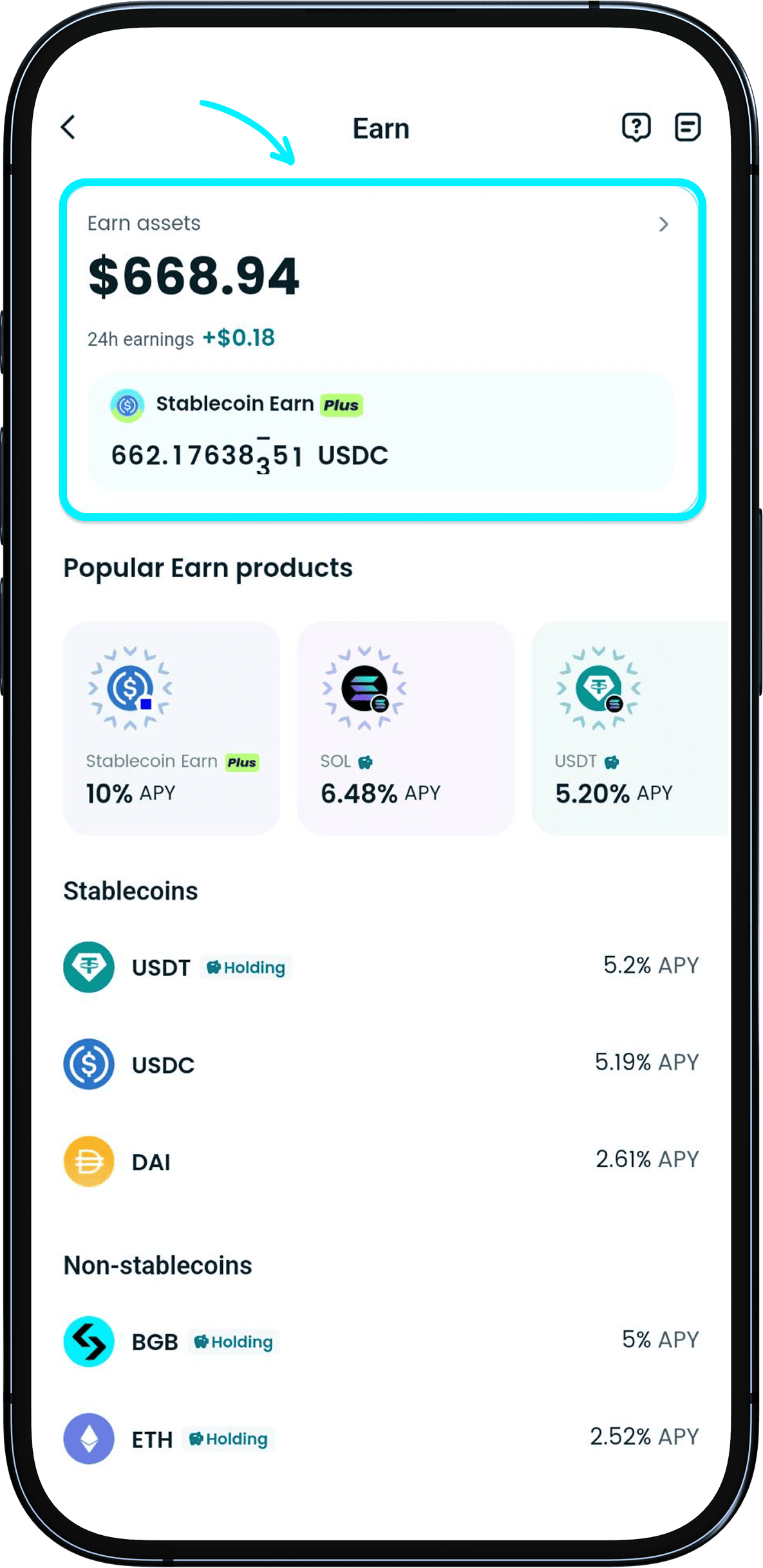

Step 4: Invest in Stablecoin Earn Plus

Navigate Wallet → Earn → Stablecoin Earn Plus → Subscribe now.

Device rule: only one wallet per device can subscribe to this product, so if you manage multiple wallets on the same device, choose the one you want to use before proceeding.

Step 5: Check product details before subscribing

Tap the product name to review the mechanics that impact your results, including:

- Tiered APY rules (how yield changes across different deposit sizes)

- Interest source (where returns come from)

- Market info and conditions (rates can vary)

- Voucher eligibility and caps (if you hold a boost voucher)

This is the “read before you sign” step—use it to confirm you understand how your yield is calculated.

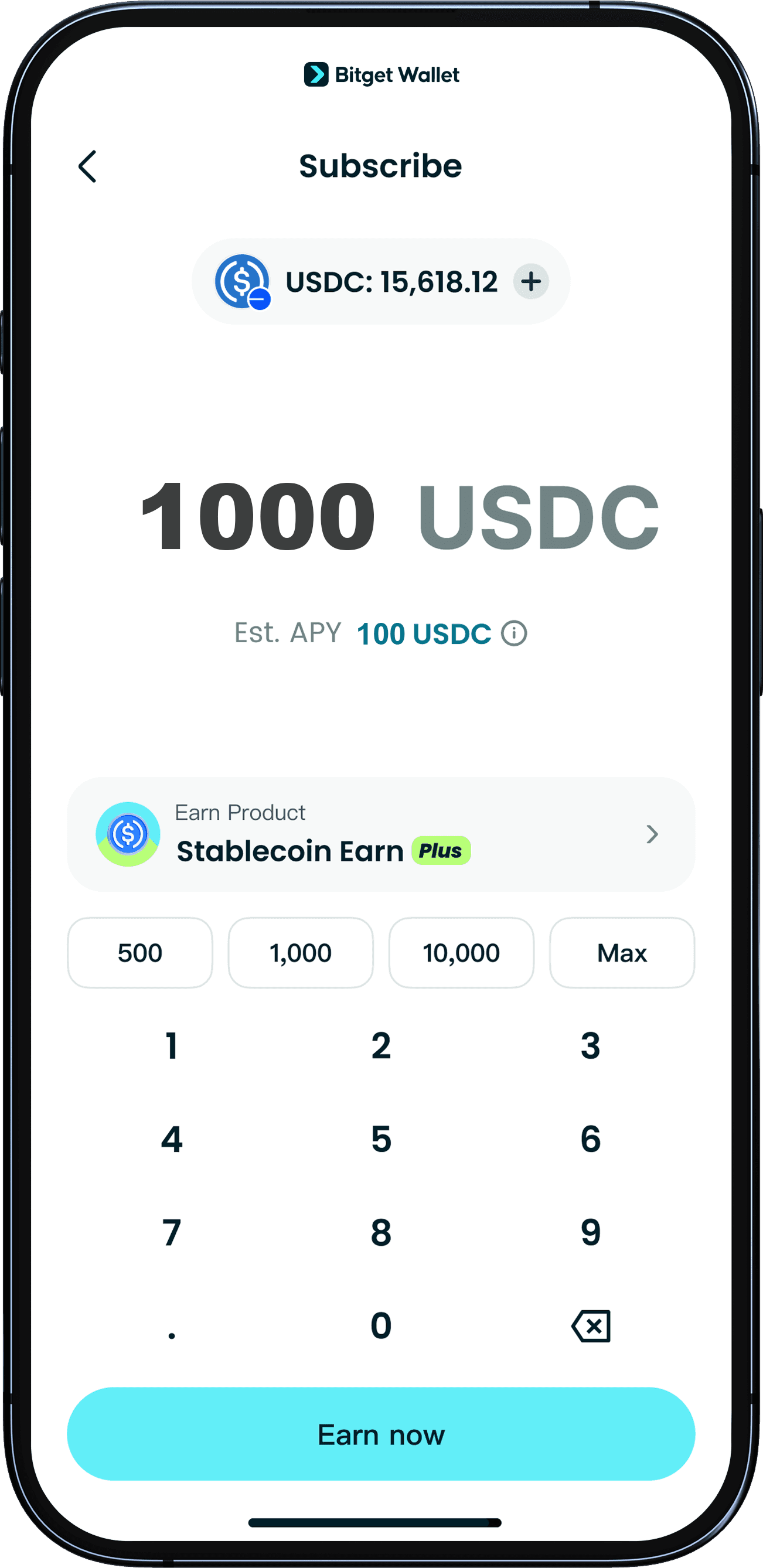

Step 6: Enter the amount to invest

Input the amount of USDC (Base) you want to invest. The app will show an estimated yearly interest figure to help you model potential returns. Treat this as a projection, not a guaranteed payout, because protocol rates and boosted rules can change over time.

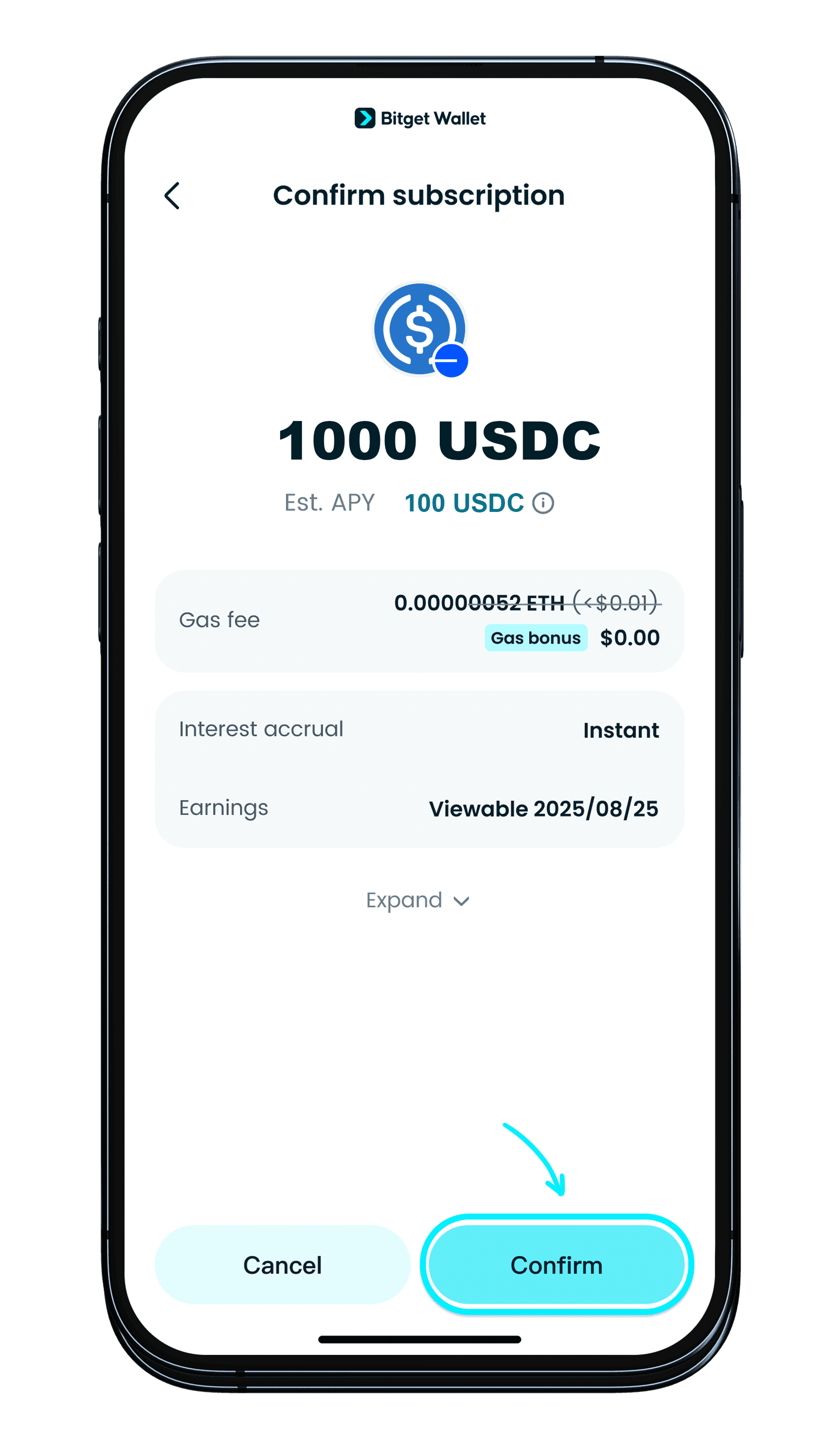

Step 7: Confirm subscription

Review the order details one more time, then tap Confirm and sign the transaction using biometrics or your wallet PIN.

Once successful, interest begins accruing immediately, and the position becomes visible in your Earn holdings.

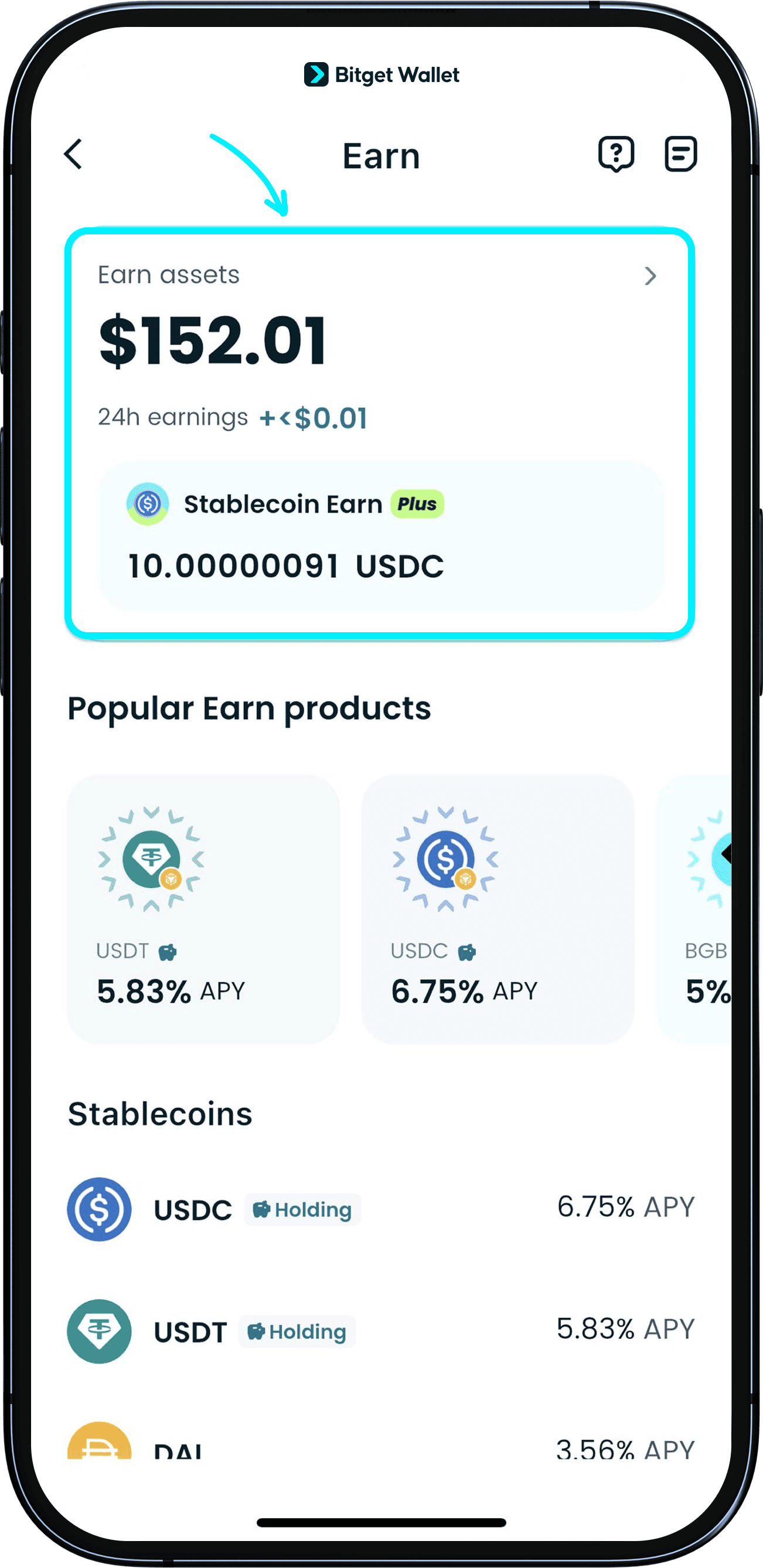

Step 8: View your positions

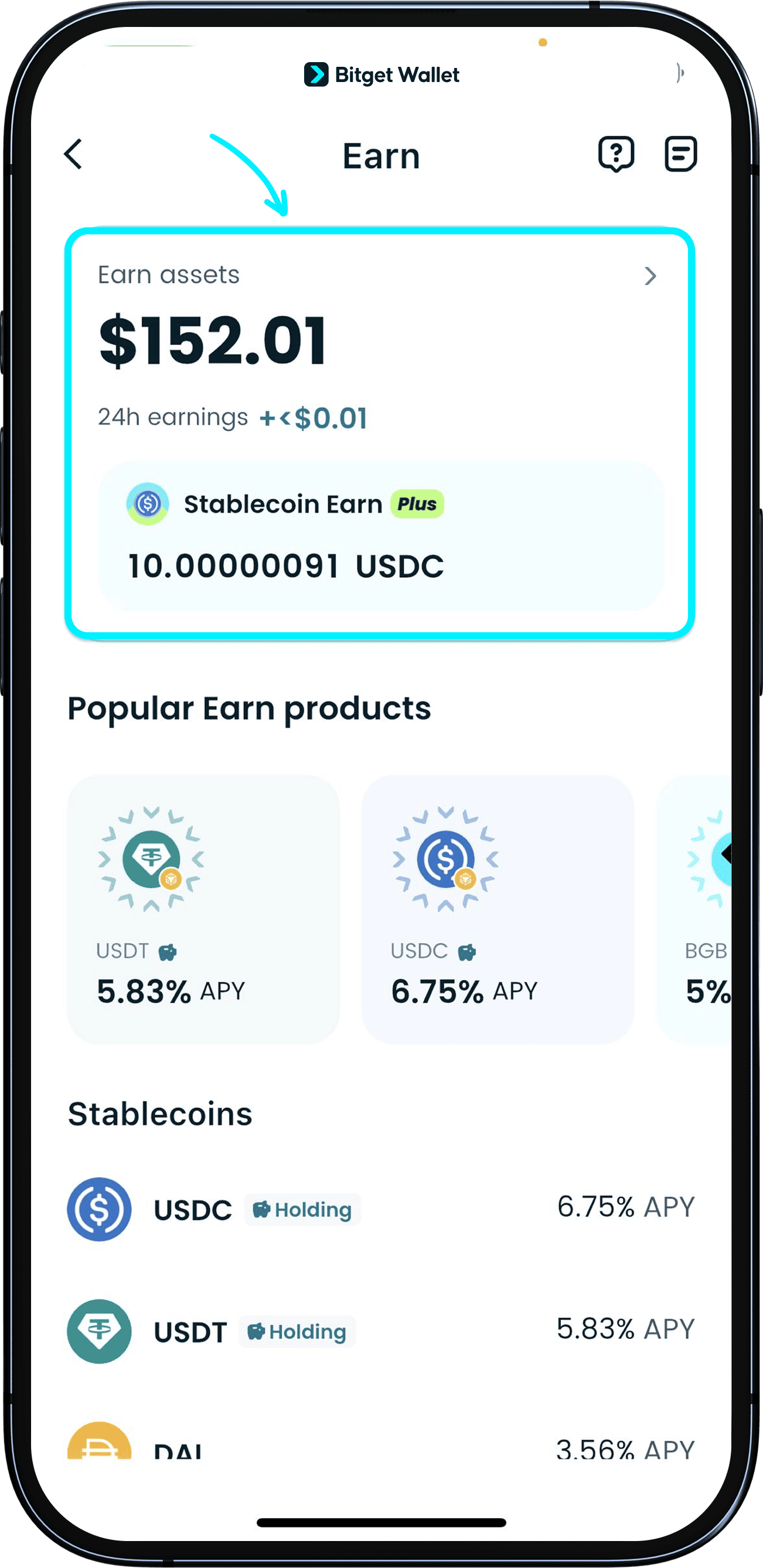

Go to Earn home → Earn Assets to track your holdings.

Your Stablecoin Earn Plus position is shown separately, making it easier to monitor principal, earnings, and product-specific performance without mixing it with other Earn assets.

How to View My Stablecoin Earn Plus Earnings in the App?

You can track earnings directly inside the Earn module. For clarity, check both the Earn Assets overview (high-level totals) and the Stablecoin Earn Plus holdings view (product-level details), so you understand daily earnings versus cumulative earnings.

Step 1: Check Total Earn Assets and Total Earnings

Open Earn → Earn Assets to view a dashboard-style summary of your overall Earn portfolio. This view helps you quickly see:

- Total Earn holdings

- Total earnings across Earn products

It’s the fastest way to confirm your account-level performance at a glance.

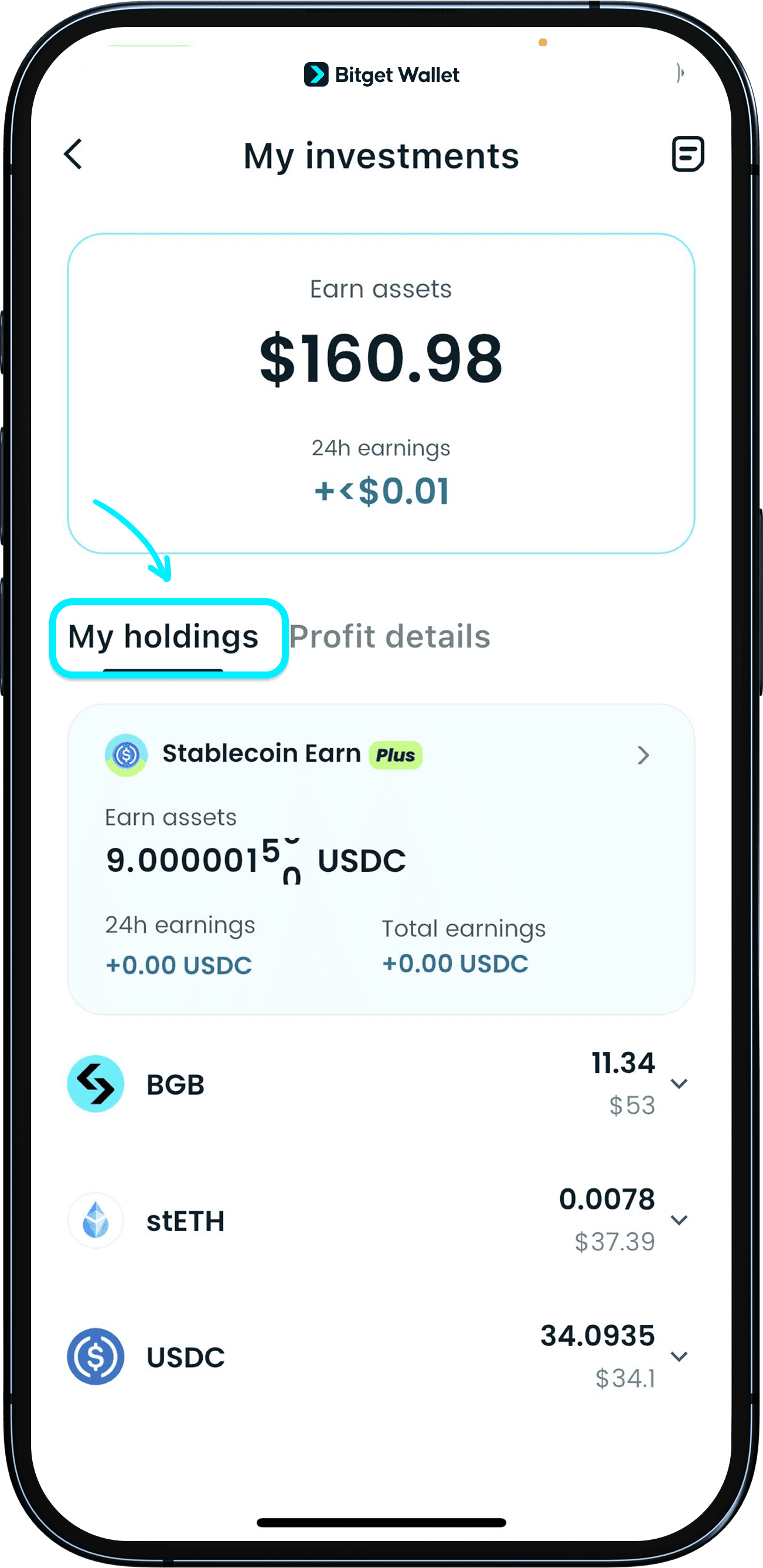

Step 2: View Stablecoin Earn Plus holdings and detailed earnings

Tap My holdings to open your Stablecoin Earn Plus details. Here you can review:

- Total holdings

- Daily earnings (typically the previous day)

- Cumulative earnings since you subscribed

A useful habit is checking at a consistent time each day so daily comparisons stay clean and more meaningful.

How to Redeem Funds From Stablecoin Earn Plus?

Redemption is designed to be flexible, but there are two beginner details to understand before you redeem: (1) you’ll pay standard gas fees, and (2) protocol interest and bonus interest can follow different timing rules.

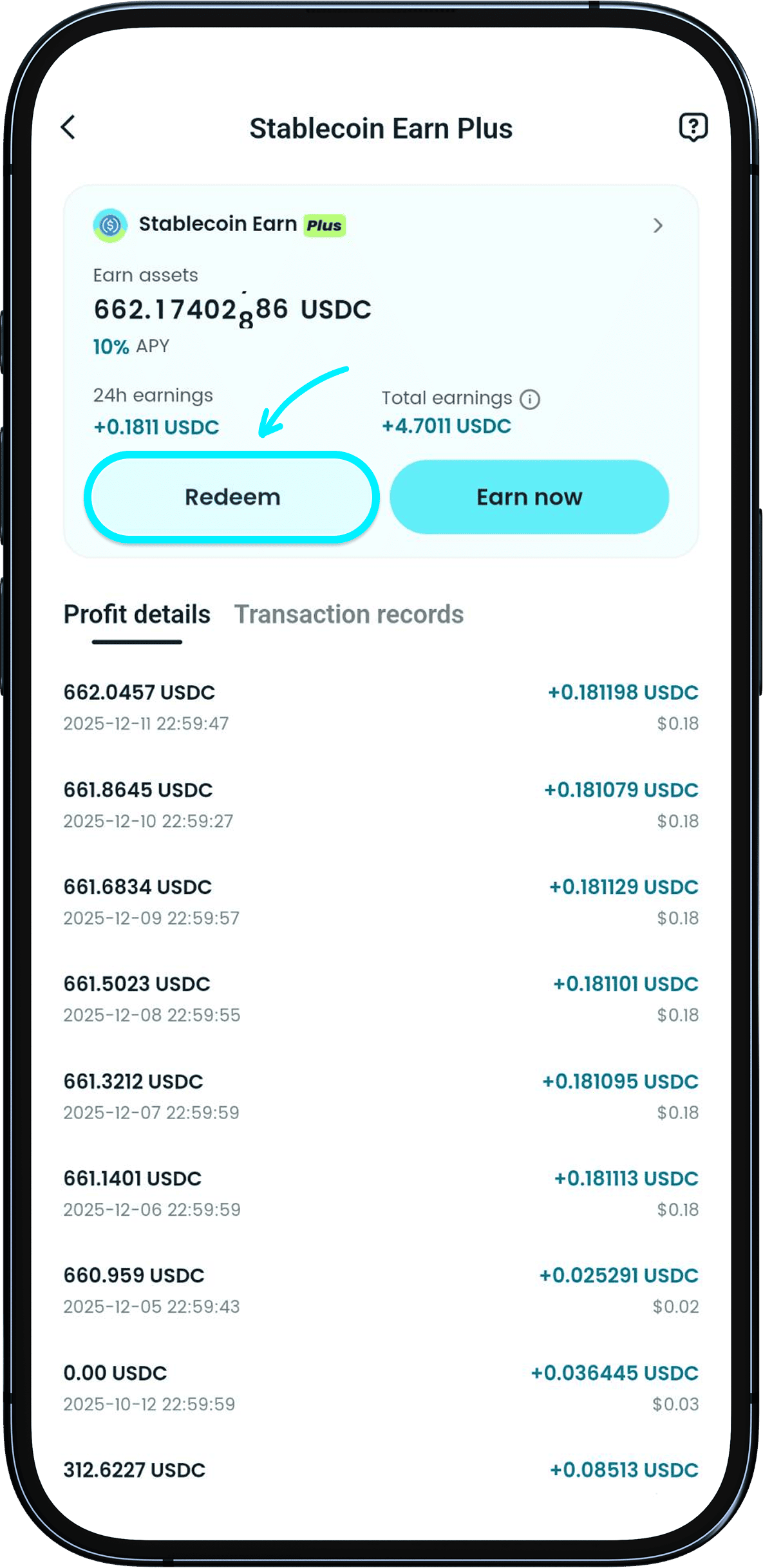

Step 1: View Your Position

On the Earn home, tap Stablecoin Earn Plus to enter the product page and open your position details.

Step 2: Redeem and Confirm the Transaction

Tap Redeem, enter the amount you want to withdraw, then tap Next → Confirm.

Redemption requires a small gas fee. There are no extra platform fees added beyond standard network costs.

Step 3: Understand Redemption Timing and Bonus Interest

- Protocol interest is calculated in real time.

- Bonus interest may be distributed by the hour.

Example: if you redeem at 12:45, you receive protocol earnings up to 12:45, but bonus earnings may only be credited up to 12:00, depending on the hourly payout rule shown in the product.

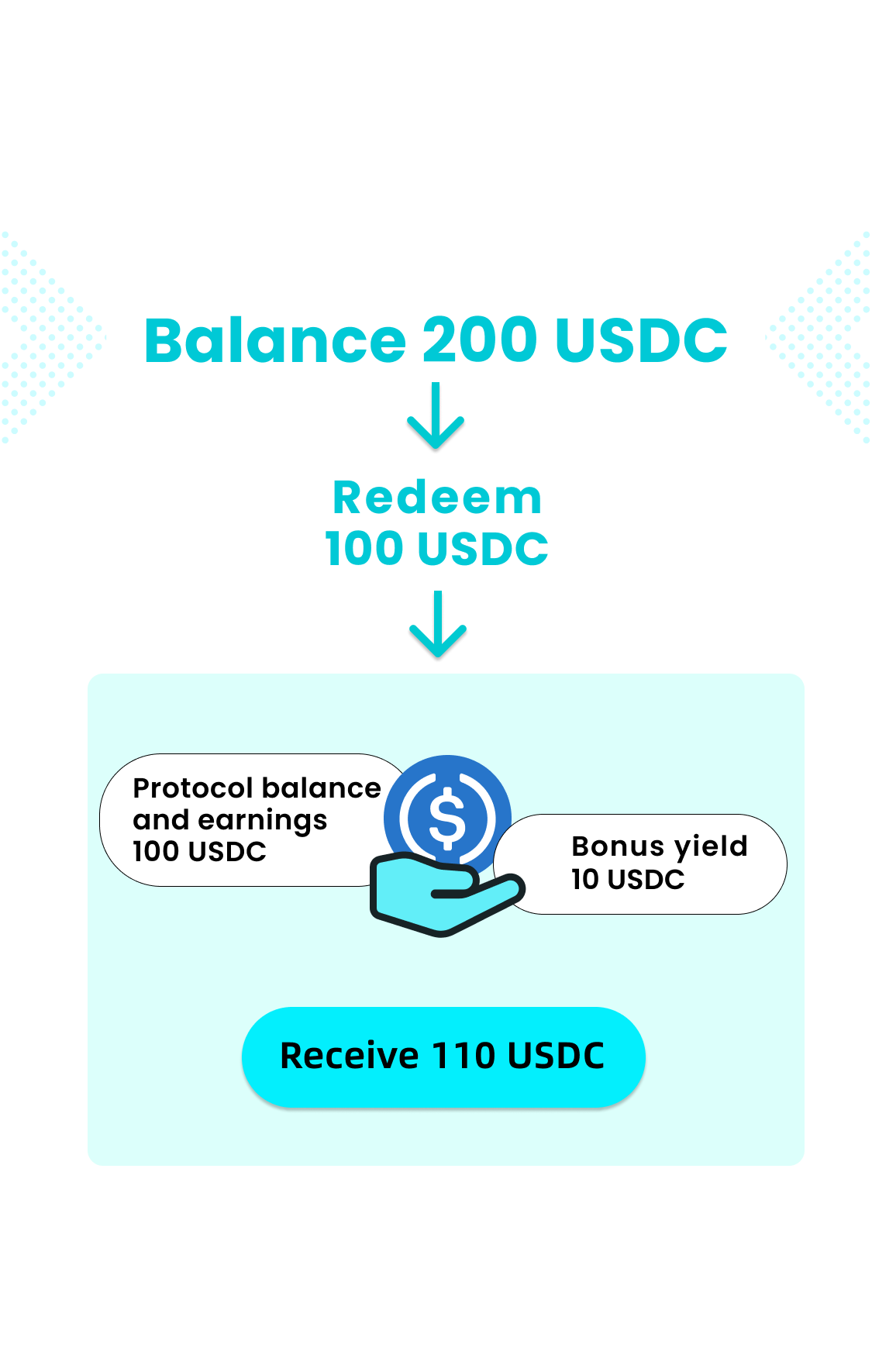

Step 4-1: Partial Redemption

If you redeem only part of your position:

- The redeemed principal + protocol interest are returned via the protocol flow.

- Any bonus yield provided by Bitget Wallet may arrive separately, often as an airdrop-style transfer within minutes.

This is why you may see two incoming transfers, and the combined amount can be higher than the number you typed in (because bonus yield is additional).

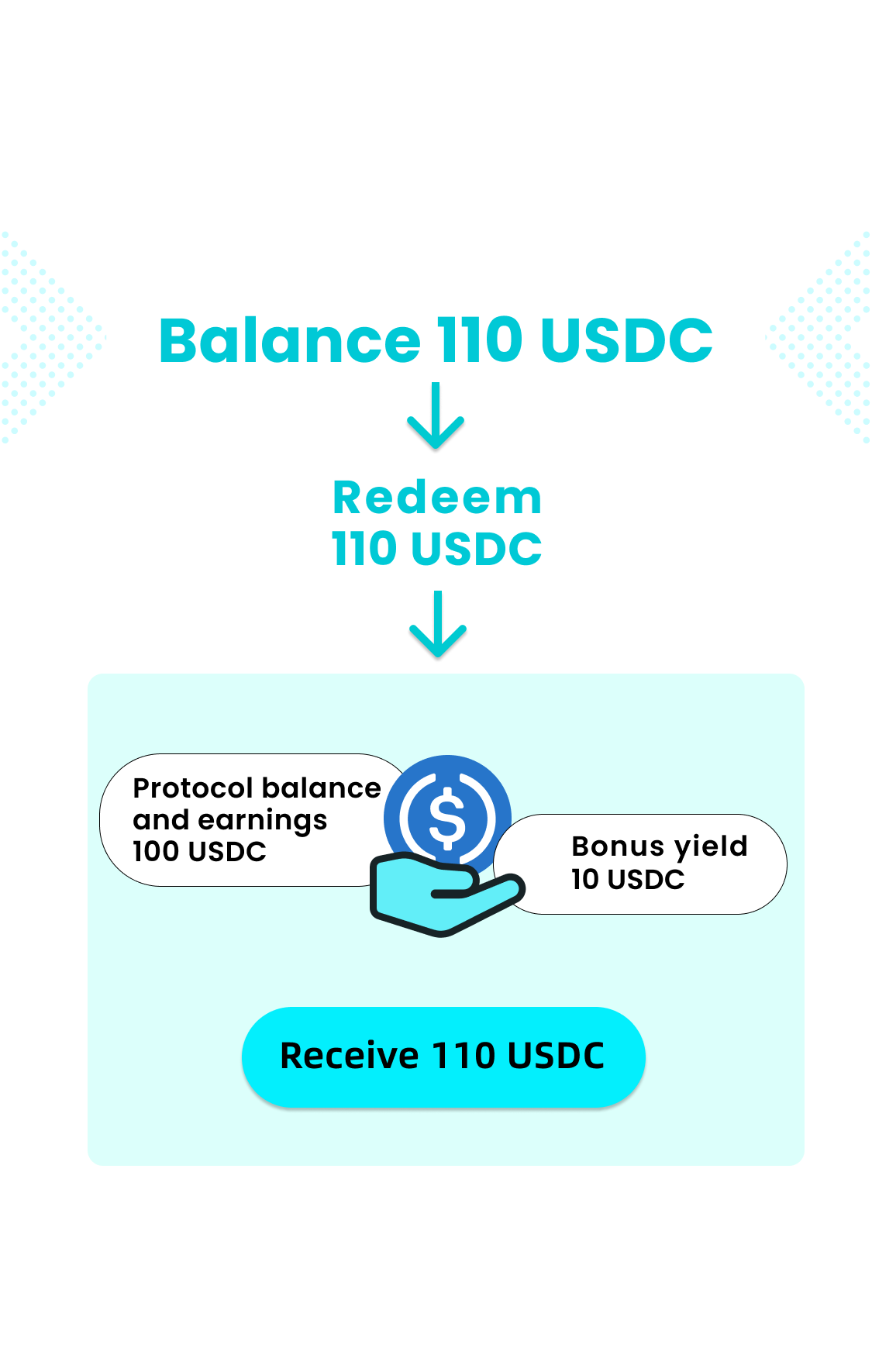

Step 4-2: Full Redemption

If you redeem all assets:

- Principal + protocol interest are returned directly to your wallet.

- Bonus yield is still distributed separately.

You may again see two incoming transfers, and the combined total reflects the full redeemed assets plus any applicable bonus distribution.

How Does Stablecoin Earn Plus Vouchers Work?

Stablecoin Earn Plus occasionally distributes APY boost vouchers via campaigns or airdrops. A voucher can increase your APY within a defined cap, which means it boosts returns only for part of your subscribed amount.

How vouchers apply at subscription?

When you subscribe, the system automatically checks if you hold a valid voucher. If you meet the conditions, the subscription page will show the final boosted APY without you needing to manually apply anything.

How returns are calculated with caps?

Most vouchers include a cap. The boosted APY applies only up to the capped amount, and any amount above that earns the standard APY.

Example (cap logic):

If you subscribe with 8,000 USDC, and your voucher gives +2% APY with a 5,000 USDC cap:

- First 5,000 USDC earns Base APY + 2%

- Remaining 3,000 USDC earns the standard APY

Important voucher rules

- No stacking: only one voucher can be used per subscription.

- New subscription only: vouchers apply only to newly subscribed amounts.

- Validity period: vouchers expire automatically after their end date.

- Account restriction: campaign rules typically limit claim/use to one wallet address per user; multiple-wallet attempts may invalidate eligibility.

Fees

APY boost vouchers themselves do not charge any fees.

Additional returns earned from the voucher will be distributed together with your principal and other earnings upon redemption. Please refer to the Redemption & Earnings Rules for detailed payout policies.

You only pay standard gas fees. No extra platform fees.

What if I can’t use the voucher?

If your APY boost voucher does not apply at subscription, please check the following:

| Issues | Possible Reasons |

| Can't find the voucher | - Check whether you claimed it using another wallet address. - Confirm whether the voucher has already been used (used vouchers disappear automatically). - If you believe it is unused but cannot find it, please contact customer support and provide your wallet address. |

| Voucher not applicable at subscription |

|

If none of the above applies, please contact Bitget Wallet customer support and provide your wallet address and relevant screenshots for further assistance.

How Does Stablecoin Earn Plus Compare With Traditional Bank Financial Products?

Stablecoin Earn Plus generates yield through on-chain lending, while banks generate interest through centralized balance-sheet mechanisms. The trade-off is typically higher transparency and flexibility, but also on-chain and smart contract risks.

| Factor | Stablecoin Earn Plus | Traditional Bank Financial Products |

| Yield & Access | Competitive stablecoin yield with flexible subscribe/redeem; earnings accrue in real time. | Often lower rates; may have lock-ups or early-withdrawal penalties. |

| Asset Stability | Uses stablecoins pegged 1:1 to USD, reducing price volatility vs non-stable crypto. | Fiat stability depends on local monetary policy and banking conditions. |

| USDC Reserve Model | USDC follows a fully reserved model backed 1:1 by cash and short-term U.S. Treasuries, with independent attestations. | Deposits rely on bank balance sheets + deposit insurance (varies by jurisdiction). |

| Asset Custody | Non-custodial: users control assets; platform cannot move funds unilaterally. | Custodial: bank controls deposited funds. |

| Transparency | On-chain flows are trackable; collateral and transactions are visible on public networks. | Limited transparency into internal asset allocation and balance-sheet operations. |

| Governance | Smart contracts enforce rules automatically and are verifiable on-chain. | Centralized execution governed by bank processes and internal controls. |

| Protection | $700 million Bitget Wallet Protection Fund for eligible platform-related incidents. | Deposit insurance varies widely by country and coverage limits. |

| Risk Profile | Smart contract risk, on-chain security risk, and variable yield conditions. | Typically lower volatility, but exposed to inflation and systemic banking risks. |

This comparison reveals a fundamental shift in financial thinking: Stablecoin Earn Plus is not merely an alternative product; it is a step forward in financial self-sovereignty.

While traditional banks often operate like a "black box" with complex internal processes and modest yields, Stablecoin Earn Plus offers unparalleled transparency and safe access to the crypto market through stablecoins. Therefore, if you are seeking a transparent and efficient yield-generating channel while wanting to regain full control over your assets, Stablecoin Earn Plus represents the leading choice for the future of finance.

Read more: What is Stablecoin Earn Plus?

How Can Beginners Use Bitget Wallet to Manage Stablecoins More Safely?

Before focusing on yield, build a repeatable safety routine. Bitget Wallet is your self-custody home base on that journey. It is more than a multi-chain wallet supporting 100+ blockchains and millions of tokens, with built-in Swap, cross-chain bridges, and an in-app Earn section. Added peace of mind comes from its $700 million Protection Fund for eligible platform-related incidents. But even the strongest tools are only armor — the core protection lies in how you use them.

A practical safety framework:

- Network verification first: confirm you hold USDC on Base. Sending USDC on the wrong chain is a common beginner error and may require bridging.

- Rule awareness: review tier caps, time limits (e.g., 30-day boosted period), and remember the protocol APY is variable.

- Gas planning: keep sufficient ETH on Base for redemptions and follow-up transactions.

- Size control: start with a smaller allocation when testing new DeFi flows.

- Ongoing monitoring: check Earn Assets, product-level holdings, voucher cap status, and redemption details (including two-transfer logic).

Download Bitget Wallet now to monitor USDC on Base, review Earn rules, and manage subscriptions and redemptions in one interface.

Related Reading on USDC Earn

If you're exploring USDC earn opportunities — from understanding APY mechanics to evaluating liquidity and smart contract exposure — these guides will help you assess yield potential and risks more clearly.

🔹 Understanding USDC & Stablecoin Basics

🔹 USDC Earn Explained

- USDC Earn Explained: A Complete Guide to Yield, APY, and Risk

- USDC Earn Returns: How to Evaluate APY, Liquidity, and Smart Contract Exposure

- USDC Yield: How to Earn Yield on USDC Safely in 2026?

- Best USDC Yield Strategies: How to Earn Stablecoin Interest?

- USDC Yield and Passive Income: How Much Capital Do You Need?

🔹 Stablecoin Earn Plus & Yield Options

- Stablecoin Earn Plus: What USDC Earn Is and How to Start Generating Yield

- Stablecoin Earn Plus: Earn Up to 10% APY with Flexible Withdrawals

Conclusion

Stablecoin Earn Plus is a structured way to access USDC Earn by supplying USDC on Base into Aave for variable lending interest, while also receiving an additional bonus yield component based on product rules. For beginners, the most important concepts are the tiered APY structure (time and amount caps), the reality that protocol yield is variable, and the practical steps to subscribe, monitor earnings, and redeem.

To use Stablecoin Earn Plus responsibly, verify your network selection, understand why redemptions can create two transfers, and treat vouchers as capped, rules-based boosts rather than permanent rate changes.

Download Bitget Wallet to manage USDC on Base, review Stablecoin Earn Plus rules, and track subscriptions and redemptions securely in a non-custodial setup.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Stablecoin Earn Plus?

Stablecoin Earn Plus is a yield product within Bitget Wallet that allows users to earn returns on USDC on the Base network. Your USDC is supplied to the Aave lending protocol to generate variable lending interest, and eligible users may also receive additional promotional yield rewards provided by Bitget Wallet.

2. How is the yield calculated in Stablecoin Earn Plus?

The total yield consists of two components: a variable base yield generated from supplying USDC to Aave, which fluctuates based on market supply and demand, and a conditional bonus yield offered by Bitget Wallet during promotional periods. Your actual return depends on eligibility criteria and applicable deposit caps.

3. How can I qualify for the 10% APY offer?

To qualify for the 10% APY promotion, you typically need to deposit USDC on the Base network and be a first-time participant. The boosted rate usually applies for the first 30 days and only up to a specified deposit limit; any amount above the cap earns the standard protocol yield.

4. What are the steps to subscribe to Stablecoin Earn Plus?

First, update Bitget Wallet to the latest version and ensure you hold USDC on the Base network. Then navigate to Wallet → Earn → Stablecoin Earn Plus, review the yield terms and limits, enter your deposit amount, and confirm the transaction on the Base network.

5. Can I redeem my funds at any time?

Yes, you can redeem at any time by selecting your Stablecoin Earn Plus position and confirming the redemption transaction. You will pay Base network gas fees, and while protocol yield is typically credited immediately, bonus rewards may be distributed separately according to program terms.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Download Bitget Wallet APK Safely: Step-by-Step Beginner Guide2026-02-03 | 5mins

- How to Invest in Cryptocurrency: A Beginner's Guide for 20262025-11-03 | 5 mins