Metaplanet Bitcoin Acquisition Strategy: Holdings, Rankings, and Asia Expansion Explained (2026 Update)

In 2026, Metaplanet’s Bitcoin acquisition took center stage, beginning with a July purchase of 797 BTC that brought total holdings to 16,352 BTC. By late 2026 and heading into 2026, Metaplanet significantly accelerated its Bitcoin accumulation, pushing total holdings to over 30,000 BTC, firmly establishing the company as Asia’s largest corporate Bitcoin holder and one of the top public BTC holders globally.

This article explores Metaplanet’s evolving Bitcoin acquisition strategy, its updated global ranking, the ambitious “555 Million Plan,” and its growing leadership role in Asia’s institutional Bitcoin adoption.

Key Takeaways

- Metaplanet acquired 797 BTC in July 2025 at an average price of ¥17.31 million (~$117,451), bringing total holdings to 16,352 BTC.

- The “555 Million Plan” targets 210,000 BTC by 2027, replacing the earlier “21 Million Plan.”

- Metaplanet ranks fifth globally among public companies for Bitcoin holdings and is the largest in Asia.

Why is Metaplanet Acquiring Bitcoin So Aggressively?

Metaplanet is making waves with its Metaplanet Bitcoin acquisition strategy, diving deep into BTC with moves that have crypto fans buzzing. It’s not just about hoarding coins—it’s a smart play to position Bitcoin as a future-proof financial asset. By prioritizing BTC as a core treasury reserve, Metaplanet is betting big on its long-term value to shield against fiat currency risks and supercharge shareholder returns.

Let’s unpack why they’re all-in on this Bitcoin treasury strategy.

Why is Bitcoin a Core Treasury Asset for Metaplanet?

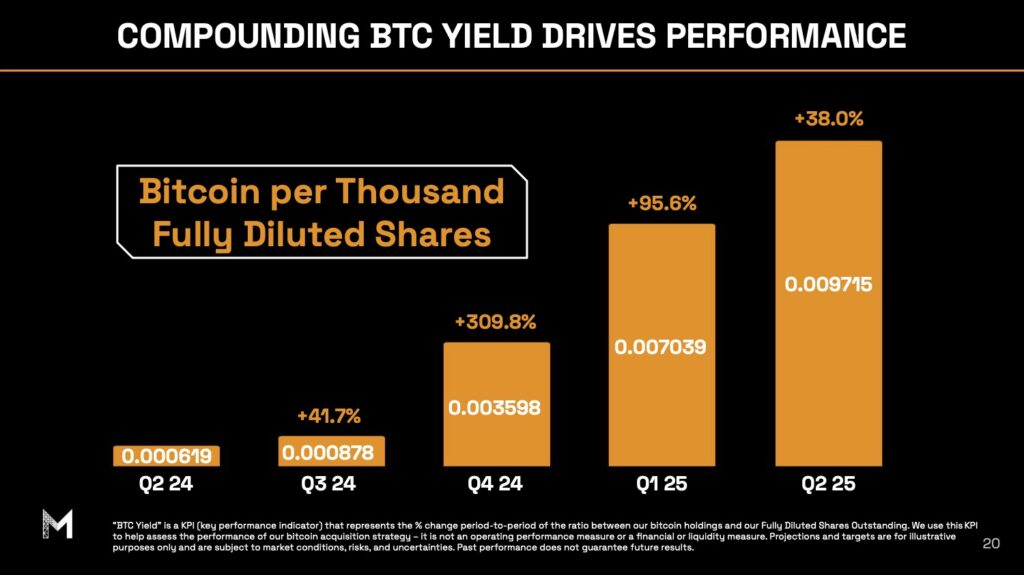

Metaplanet’s Bitcoin strategy hinges on treating BTC as a foundational treasury asset. They track success with BTC Yield, a metric measuring Bitcoin growth per fully diluted share to reflect shareholder value. From July 1–14, 2025, Metaplanet achieved a 19.4% BTC Yield, gaining 2,590 BTC and ¥45.2 billion in Bitcoin value, even with share dilution.

This underscores their belief that Metaplanet Bitcoin acquisition acts as a hedge against fiat depreciation and a driver of long-term growth.

▶️ Read more Metaplanet Stock Price Prediction 2025: What Bitcoin Investors Should Know?

What is the “555 Million Plan”?

The Metaplanet 555 Million Plan is a bold vision to amass 210,000 BTC—roughly 1% of Bitcoin’s total supply—by 2027. It replaces the earlier “21 Million Plan,” which targeted 21,000 BTC by 2026, signaling Metaplanet’s ambition to dominate corporate Bitcoin holdings through its Bitcoin acquisition strategy.

Source: X

The new plan reflects Metaplanet’s increased ambition to dominate corporate Bitcoin holdings.

| Plan Name | Target BTC | Target Date | Goal |

| 21 Million Plan | 21,000 | End-2026 | Original goal |

| 555 Million Plan | 210,000 | End-2027 | 1% of total Bitcoin supply |

What Did Metaplanet Purchase in July 2025?

Metaplanet made headlines in July 2026 with a hefty Bitcoin purchase, further cementing its reputation as a crypto powerhouse. By snapping up a significant amount of BTC, the company doubled down on its strategy to make Bitcoin a cornerstone of its treasury.

That July purchase later became the foundation for a much more aggressive accumulation phase in late 2026, as Metaplanet rapidly scaled its Bitcoin treasury beyond initial market expectations.

Let’s dive into the details of their acquisition and how it evolved on the global stage.

How Much Bitcoin Did Metaplanet Buy and at What Price?

In July 2025, Metaplanet’s Bitcoin acquisition included 797 BTC for ¥13.798 billion, at an average price of ¥17.31 million per BTC ($117,451). This pushed their total holdings to 16,352 BTC, with an average purchase price of ¥14.65 million per BTC ($100,191) and a cumulative investment of ¥239.6 billion (~$1.64 billion).July 2025 Purchase

Source from The market Periodical

Where Does Metaplanet Rank Globally in BTC Holdings?

Metaplanet ranks fifth globally among public companies for Bitcoin holdings, according to Bitcoin Treasuries data, trailing Strategy (formerly MicroStrategy), Marathon, Twenty One Capital, and Riot Platforms. It remains the largest corporate Bitcoin holder in Asia, solidifying its leadership in the region.Global Bitcoin Holdings Ranking

What is Metaplanet’s Strategy in the Asian Market?

Metaplanet is positioning itself as Asia’s leading advocate for Bitcoin adoption, leveraging its growing BTC treasury to reshape corporate finance in the region. With a bold vision to integrate Bitcoin into mainstream business practices, the company is not just stacking coins but actively pushing for institutional acceptance across Asia.

Why Does Metaplanet Sponsor Bitcoin Asia 2025?

Metaplanet is the title sponsor of Bitcoin Asia 2025, happening August 28–29, 2025, in Hong Kong. CEO Simon Gerovich calls it a chance to pitch a Bitcoin-first capital allocation framework to Asia’s top institutional investors. “We’re excited to gather in Hong Kong at what we believe is the inflection point of the Bitcoin decade,” Gerovich said, emphasizing Asia’s rising role in the global Bitcoin economy. With over 10,000 attendees expected, this sponsorship highlights Metaplanet’s mission to drive Bitcoin acquisition across the region.

How is Metaplanet Funding These Acquisitions?

Metaplanet’s Bitcoin treasury strategy in Asia is funded through stock acquisition rights, share issuances, and bond redemptions. The company employs flexible capital tools, such as moving-strike warrants tied to market prices, to minimize shareholder dilution while maximizing BTC per share.

What Kind of Companies Are Acquiring Large Amounts of Bitcoin?

The landscape of Bitcoin acquisition by companies has evolved significantly over the past few years. Initially driven by technology firms and crypto-native companies, the trend has expanded to include a diverse range of industries such as financial services, manufacturing, retail, and even entertainment.

Is Metaplanet an Outlier or Part of a Global Trend?

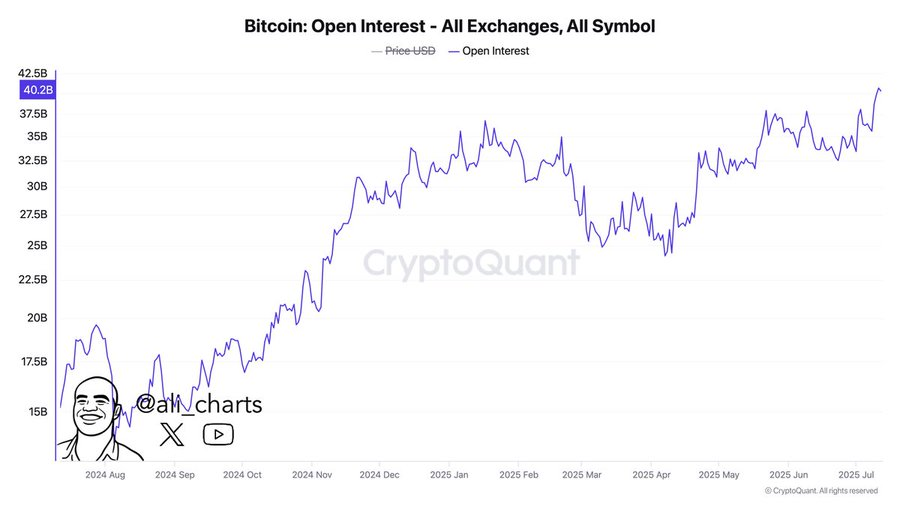

Metaplanet’s Bitcoin acquisition aligns with a global trend of public companies adopting BTC as a treasury asset, inspired by Strategy (formerly MicroStrategy). Around 80–130 listed firms hold Bitcoin, accounting for 3–3.4% of the total supply. Analysts predict institutional investments in corporate BTC holdings will hit hundreds of billions by 2029, as companies embrace Bitcoin treasury strategies for balance-sheet exposure.

Conclusion

Metaplanet’s Bitcoin acquisition strategy has positioned it as a trailblazer in 2025, with 16,352 BTC in holdings and a fifth-place global ranking. The “555 Million Plan” sets an ambitious target of 210,000 BTC by 2027, while its sponsorship of Bitcoin Asia 2025 underscores its leadership in driving institutional adoption in Asia. For investors or companies managing Bitcoin treasuries, Bitget Wallet offers multi-chain support, staking features, and real-time portfolio tracking, making it an ideal tool for secure and efficient BTC management.

Download Bitget Wallet

FAQs

Why is Metaplanet investing so heavily in Bitcoin?

Metaplanet sees Bitcoin as a hedge against fiat currency depreciation and a long-term value driver. By using BTC Yield to measure Bitcoin growth per share, the company ties its financial success to BTC’s performance, aiming to maximize shareholder value while protecting against economic uncertainties.

What is the significance of the “555 Million Plan”?

The “555 Million Plan” is Metaplanet’s bold goal to accumulate 210,000 BTC (1% of Bitcoin’s total supply) by 2027. It replaces the earlier “21 Million Plan” and reflects the company’s ambition to become a global leader in corporate Bitcoin holdings.

How does Metaplanet fund its Bitcoin purchases?

Metaplanet uses a mix of stock acquisition rights, share issuances, and bond redemptions to raise capital. Tools like moving-strike warrants help minimize shareholder dilution, ensuring more Bitcoin per share for investors.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.