How to Buy Tokenized Stocks: Step-by-Step Guide for Beginners

How to buy tokenized stocks starts with understanding what they are. Tokenized stocks are blockchain-based tokens that bridge traditional company shares with decentralized finance. Each digital stock token provides direct exposure to real-world equities like Tesla, Apple, and NVIDIA without requiring traditional brokerage accounts.

These tokens maintain 1:1 backing with actual shares held in regulated custody. Investors can trade them around the clock, eliminating market hour restrictions. This structure enables fractional ownership starting from as little as $1 per transaction.

This guide helps beginners purchase tokenized Tesla, Apple, or ETF shares safely through blockchain platforms. Bitget Wallet serves as a comprehensive platform supporting cross-chain tokenized stock trading. Download Bitget Wallet to trade, store, and manage tokenized stocks across multiple chains in one place.

Key Takeaways

- Tokenized stocks are blockchain-based tokens backed 1:1 by real company shares held in regulated custody. xStocks on Solana and Ondo tokens on Ethereum track actual stock prices and enable 24/7 trading accessibility.

- Benefits include fractional ownership from $1, continuous trading without market hours, instant settlement through smart contracts, and DeFi integration.

- These blockchain-based stocks also pose certain risks, including regulatory uncertainty across jurisdictions, custodial counterparty dependencies, smart contract vulnerabilities, and limited liquidity compared to traditional markets.

What Are Tokenized Stocks and How Do They Work?

This section explores what tokenized stocks are and how this emerging asset class offers investors digital exposure to real-world equities through blockchain technology.

What Does "Tokenized Stock" Mean?

A tokenized stock is a blockchain-based token backed 1:1 by real company shares held in regulated custody. Each token provides economic exposure to stock price movements without conferring voting rights or direct ownership.

Examples include Tesla xStock (TSLAx) on Solana and Apple tokenized stocks on Ethereum. The xStocks platform by Backed Finance offers over 60 U.S. equities, while Ondo Finance provides more than 100 tokenized stocks and ETFs. These platforms use decentralized oracles, primarily Chainlink, to maintain accurate valuation.

Licensed custodians or registered broker-dealers hold the actual shares backing each token. This custody structure ensures legal claim to the underlying asset's value while maintaining transparency through blockchain verification systems.

Source: SolanaFloor

How Are They Created and Backed?

The creation of tokenized stocks follows a structured process that ensures proper backing and regulatory compliance.

-

Asset Acquisition:

Issuers purchase actual company shares or ETF units through traditional stock markets and licensed brokers.

-

Secure Custody:

Real shares are locked with regulated financial institutions, such as licensed custodians or U.S.-registered broker-dealers in segregated accounts.

-

Token Minting:

Smart contracts on Solana or Ethereum mint digital tokens equivalent to custodied shares, maintaining strict 1:1 correspondence.

-

Verification Systems:

Blockchain-based verification confirms token backing, with automated monitoring preventing over-issuance and ensuring proper collateralization.

Backed Finance integrates Chainlink Proof of Reserves for real-time verification that tokens remain fully backed by underlying assets. This system provides transparent confirmation that each digital token corresponds to actual shares held in custody.

What Makes Tokenized Stocks Different from Crypto Coins?

Understanding the distinction between tokenized stocks and cryptocurrency coins helps investors make informed decisions about these different asset classes.

| Aspect | Tokenized Stocks | Crypto Coins |

| Ownership | Economic exposure to real shares without voting rights | Native digital currency ownership on blockchain |

| Function | Track traditional stock prices and provide investment exposure | Medium of exchange, store of value, or network utility |

| Backing | 1:1 backed by real shares in regulated custody | Value from network utility, scarcity, and market demand |

| Use Case | Bridge traditional finance to DeFi ecosystems | Power blockchain networks and facilitate transactions |

| Blockchain | Built on existing chains like Ethereum or Solana | Often operate on their own native blockchain |

| Rights | No voting rights or direct company ownership | May include governance rights in blockchain protocols |

Tokenized stocks remain securities under traditional financial law and require regulatory compliance. They involve custodial counterparty risk but enable 24/7 trading of traditional securities. The tokenized stock market reached over $412 million in value as of 2025, demonstrating growing adoption of this asset class.

Read more:

- What is xStocks and How to Trade Tokenized U.S. Stocks on Bitget Wallet?

- USDY Token: What Is Ondo US Dollar Yield and How to Earn Passive Income with 4.25% APY

- What Is Chainlink (LINK): Ethereum’s Oracle Powerhouse Unlocking Web3 Connectivity

How Do Tokenized Stocks Differ from Traditional Equities?

While tokenized stocks provide exposure to the same underlying companies as traditional equities, they are fundamentally different in structure, ownership rights, and trading mechanisms.

Are Tokenized Stocks Real Shares?

Tokenized stocks are not actual shares but digital tokens providing economic exposure to underlying equities without direct ownership. A regulated custodian or broker-dealer holds the real shares while issuing equivalent blockchain tokens to investors. Each token maintains 1:1 correspondence with the underlying asset's economic value.

Traditional shareholders receive voting rights and direct company ownership. Tokenized equities holders typically receive only economic exposure to price movements. Token holders have contractual relationships with issuing platforms rather than registered shareholding status on company records.

What Advantages Do They Offer Over Brokers?

Tokenized stocks deliver several compelling benefits compared to traditional brokerage trading, particularly regarding accessibility and flexibility.

-

24/7 Trading Access:

Investors can trade tokenized stocks 24/7 without market hour restrictions. Platforms like Kraken offer nearly continuous weekday trading, while decentralized exchanges enable weekend transactions.

-

Fractional Ownership:

Investors can start with as little as $1 instead of purchasing full shares costing hundreds or thousands of dollars. This dramatically lowers entry barriers for retail participants.

-

Global Accessibility:

Tokenized stocks provide borderless market access without complex international brokerage relationships. Investors worldwide can access U.S. equities without extensive documentation requirements.

-

Instant Settlement:

Blockchain transactions settle almost immediately rather than the standard two-day settlement period. This eliminates waiting periods between trade execution and ownership transfer.

-

DeFi Integration:

Tokenized stocks can work within decentralized finance protocols. This creates novel options like using stock positions as backing for borrowed funds.

HSBC forecasts that tokenized markets may reach $24 trillion by 2027. This figure would account for 10% of global GDP as large institutions increase adoption.

What Limitations or Regulations Should Beginners Know?

Tokenized stocks face serious regulatory barriers across major markets. Retail investors cannot access them in the United States, United Kingdom, Canada, and Australia due to compliance obstacles.

Beginners should understand several key risk categories before investing.

-

Regulatory Risk:

Laws around tokenized stocks shift rapidly in different countries and regions. Abrupt regulatory changes might force platforms to halt trading or require investors to sell.

-

Liquidity Risk:

Tokenized stocks trade nonstop but usually have less market depth than regular equities. Buyers face wider price gaps and pay more in fees during off-peak hours.

-

Smart Contract Risk:

These assets run on blockchain technology that can have weak spots and flaws. They might break or get hacked, causing losses that cannot be reversed.

What Are the Benefits and Risks of Tokenized Stocks?

Tokenized stocks offer transformative potential but they also introduce novel risks that investors must carefully evaluate.

Benefits

-

24/7 Trading Access:

Tokenized stocks enable continuous trading across all time zones without market hour restrictions. Investors can respond immediately to global events and news.

-

Fractional Ownership:

Digital stocks allow purchases starting from $1 instead of requiring full share prices. This democratizes access to high-value equities like Apple or Tesla.

-

Global Accessibility:

Blockchain-based stocks provide borderless market access without complex international brokerage accounts. Investors worldwide can trade U.S. equities without geographic restrictions.

-

Instant Settlement:

Smart contracts enable near-instantaneous transaction settlement compared to the standard two-day waiting period. This reduces counterparty risk and improves capital efficiency.

-

DeFi Integration:

Platforms like Raydium and Kamino allow using tokenized stocks as loan collateral or liquidity pool assets. This creates novel use cases impossible with traditional stock ownership.

Risks

-

Regulatory Uncertainty:

The legal framework for tokenized stocks remains unclear and rapidly evolving across jurisdictions. Major markets like the U.S., U.K., Canada, and Australia currently restrict retail access.

-

Custodial Risk:

Investors depend on custodians to properly hold underlying shares and honor redemption requests. Platform failures or custodial mismanagement could result in asset loss.

-

Smart Contract Vulnerabilities:

These tokens rely on blockchain code that may contain bugs or face security breaches. The immutable nature of blockchain means errors may be irreversible.

-

Limited Liquidity:

Despite continuous trading availability, tokenized stocks often experience low trading volumes and wide bid-ask spreads. Large trades can face significant slippage and price impact.

Always review issuer documentation from platforms like Backed Finance and Ondo Finance before investing in any tokenized stock products.

Which Is the Best Platform to Buy Tokenized Stocks in 2025?

The best platform to buy tokenized stocks in 2025 is Bitget Wallet, offering cross-chain trading capabilities and multi-asset management for both beginners and experienced investors. Below are certain features that users can expect from this application:

-

Multi-Chain Support:

Bitget Wallet supports Solana, Ethereum, BNB Chain, Polygon, and Base networks. This enables access to diverse tokenized stocks across multiple blockchain ecosystems.

-

Non-Custodial Security:

Users maintain complete control over private keys and assets without relying on third-party custodians. This ensures true ownership and eliminates counterparty risk.

-

Cross-Chain Swaps:

The platform enables seamless trading and bridging between USDC, USDT, and tokenized equities. Users can easily move assets across different blockchain networks.

-

Stablecoin Earn Plus:

Investors can earn up to 10% APY on idle stablecoin holdings through integrated yield programs. This maximizes capital efficiency while awaiting trading opportunities.

-

Zero-Fee Trading:

Trade tokenized stocks and memecoins without transaction fees, reducing overall trading costs. This makes frequent trading strategies more economically viable.

Different platforms serve varying user needs and regional requirements. Bitget Wallet delivers superior cross-chain flexibility and cost-effective access to tokenized stocks for investors seeking comprehensive blockchain integration.

How to Buy Tokenized Stocks on Bitget Wallet?

How to buy tokenized stocks on Bitget Wallet involves a straightforward process accessible to beginners seeking exposure to xStocks and other tokenized equities.

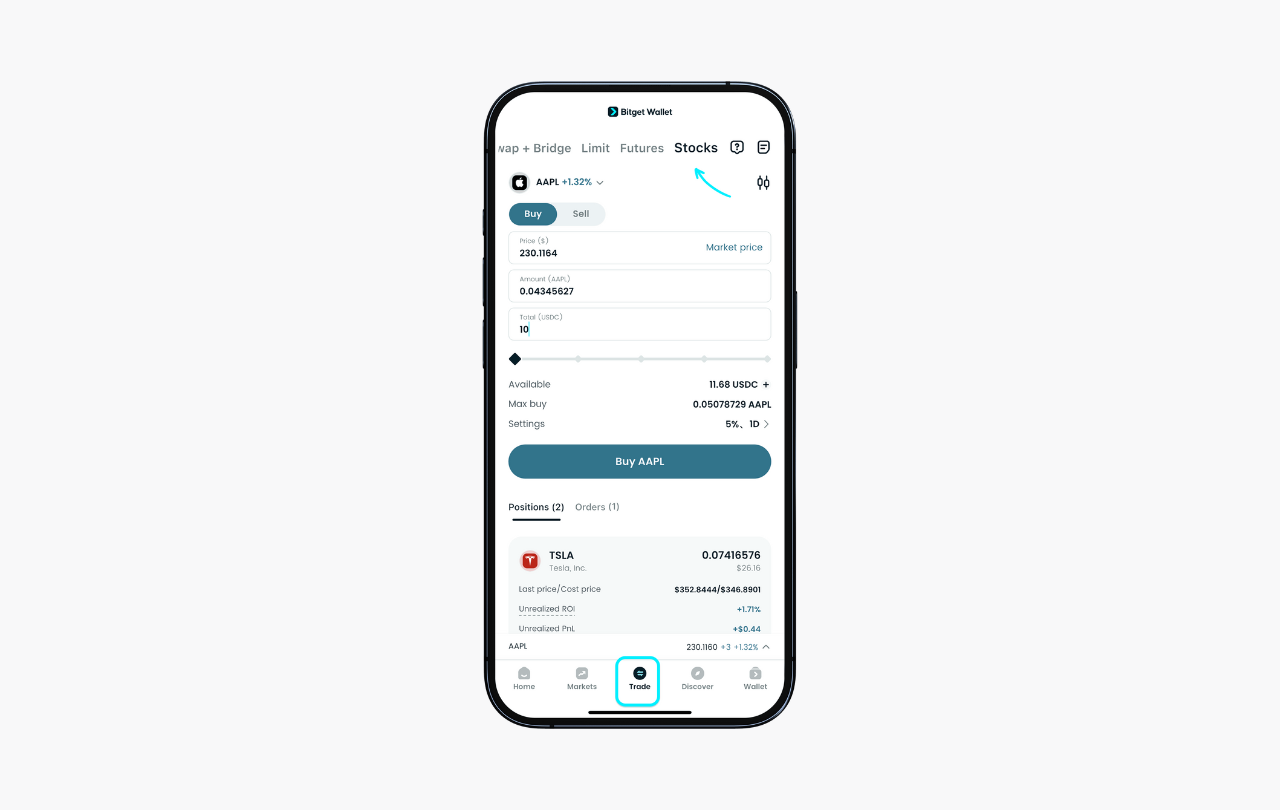

Step 1/8: Buy tokenized stocks

First, update the app to the latest version. Open it and go to "Trade" > "Stocks". Trading uses limit orders.

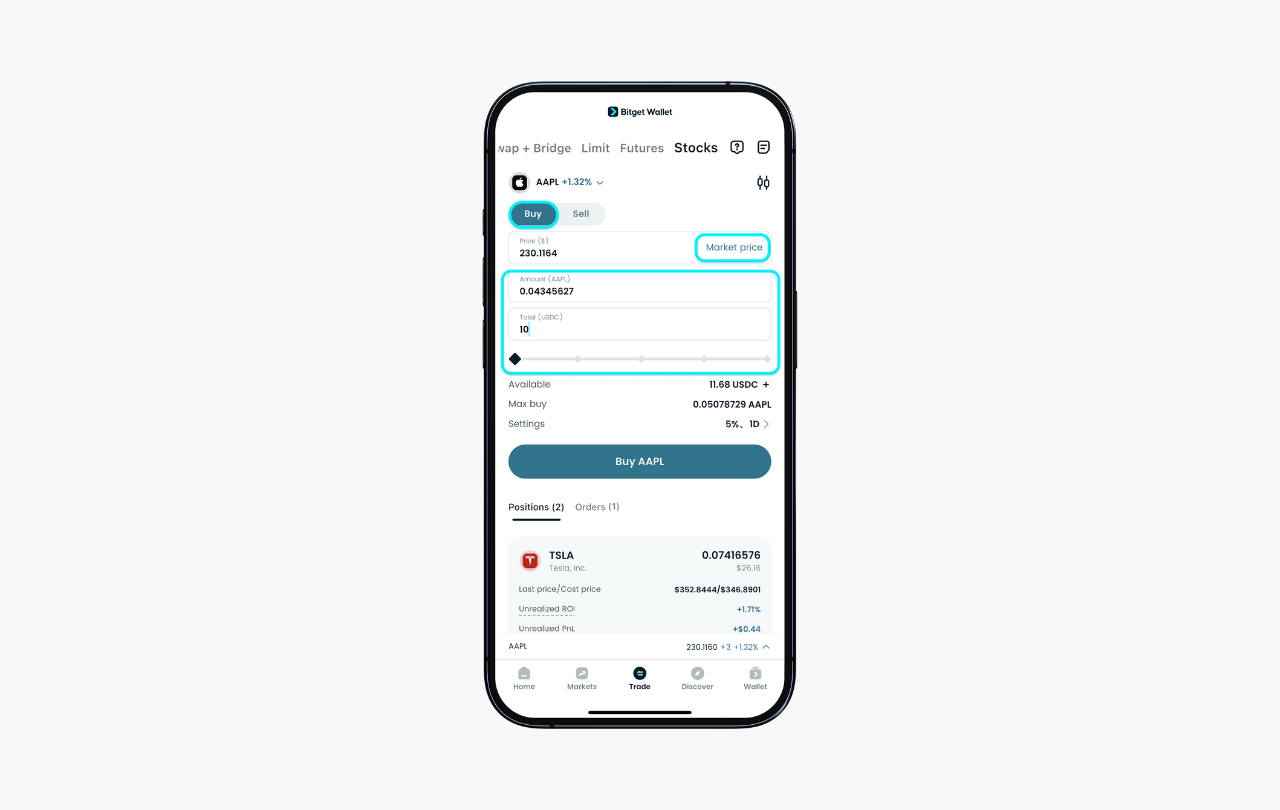

Step 2/8: Choose the stock to buy

At the top of the page, select the tokenized stock you want and set the order type to "Buy". Enter your buy price; tap "Market price" to auto-fill the current price. Then enter the quantity or the total amount you want to spend. You can also adjust the quantity using the slider below.

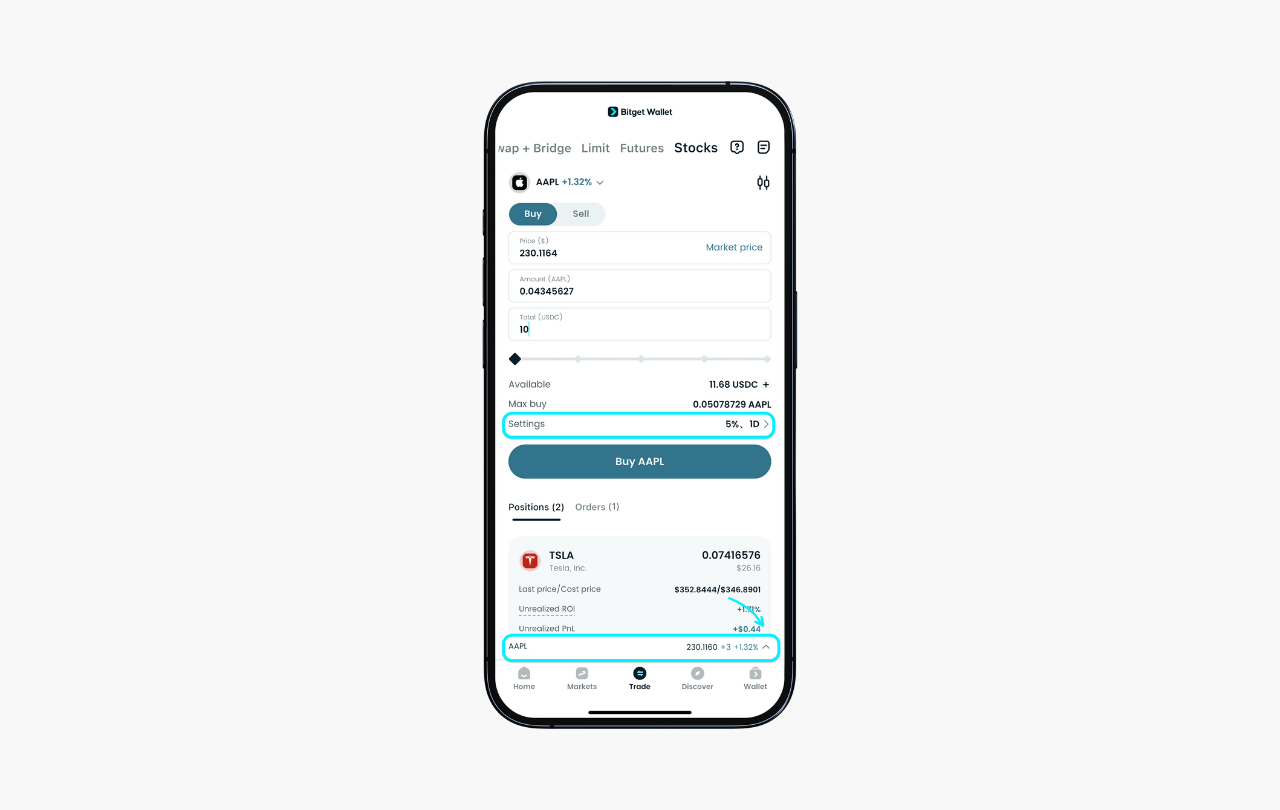

Step 3/8: Set slippage and expiry

After confirming the amount, open "Settings" to adjust slippage tolerance and the order expiry time.

Slippage is the maximum price deviation you're willing to accept. Expiry means the order will automatically cancel if it isn't filled within the set time.

To view the stock's candlestick chart info, tap the info bar at the bottom.

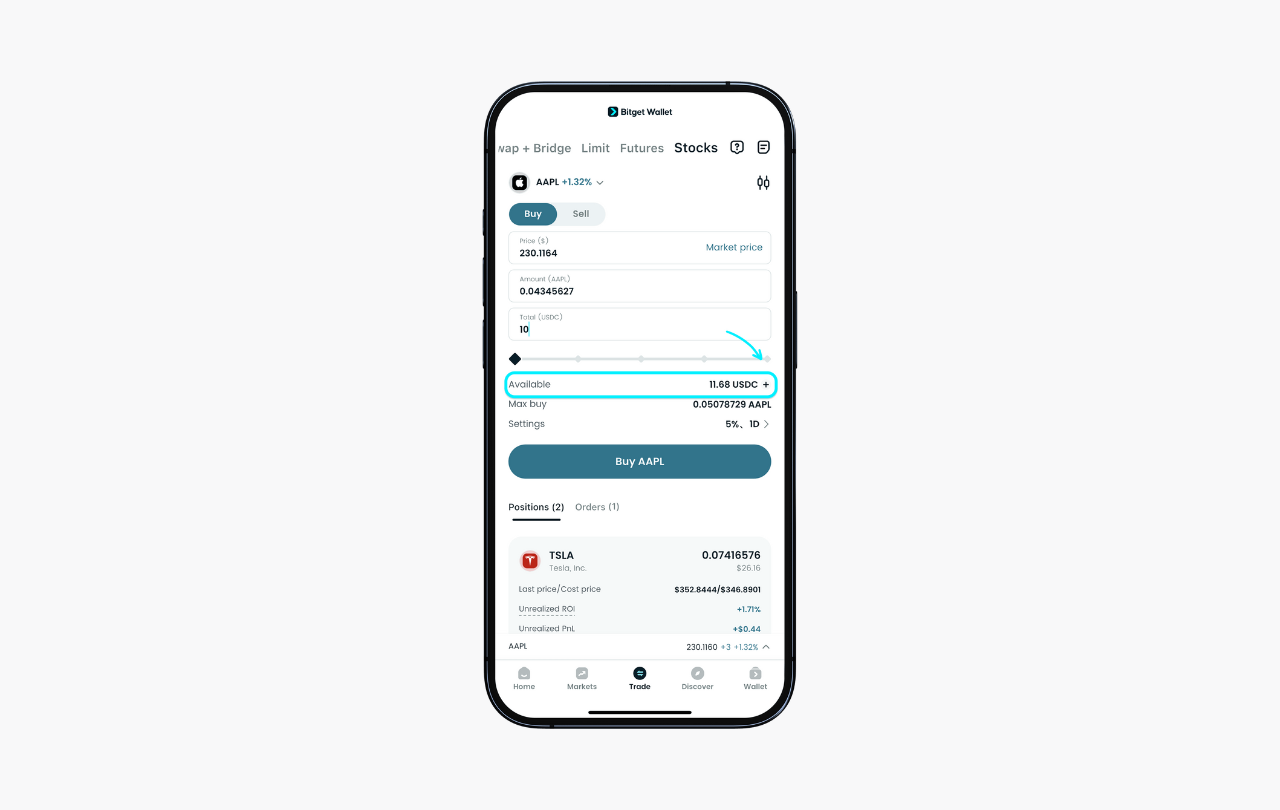

Step 4/8: Verify supported token

Right now, you can only buy with USDC on the Ethereum network. Your "Available balance" is shown on the screen; tap "+" to add funds.

More networks will be supported in the future.

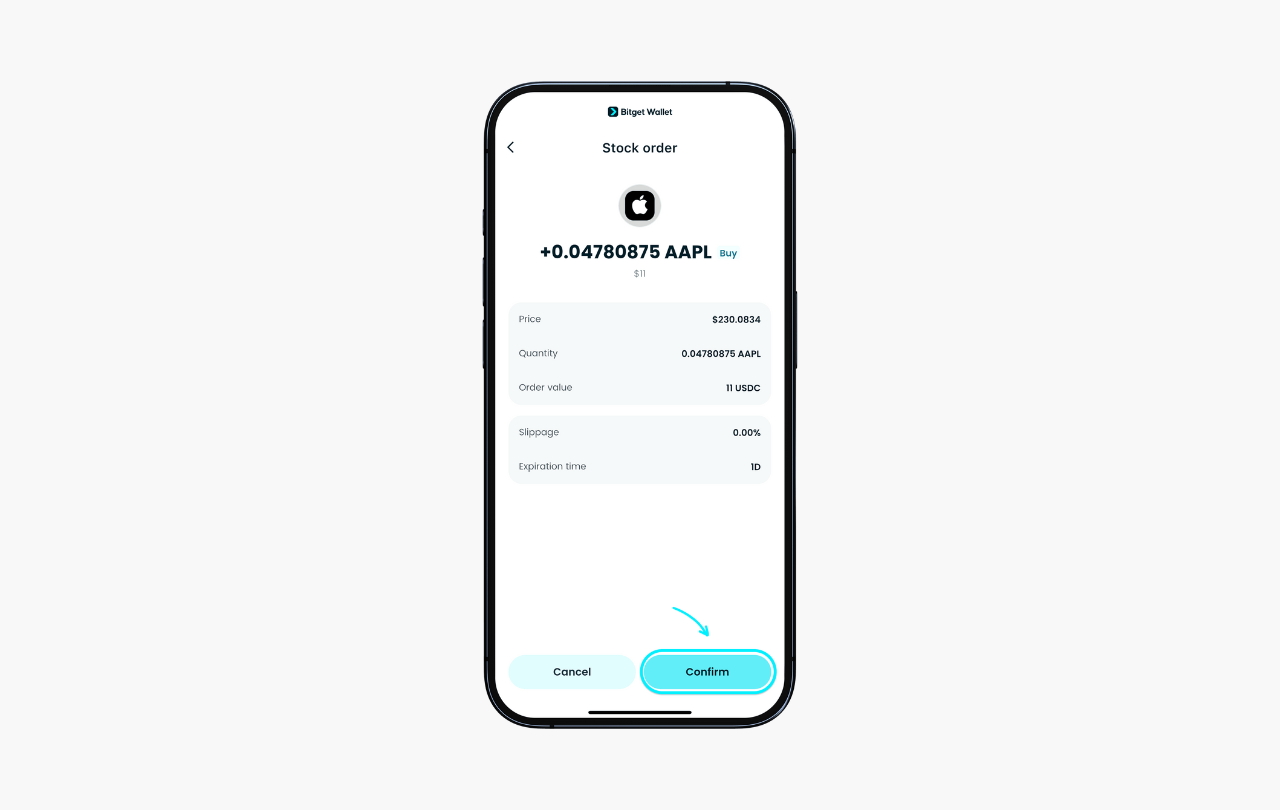

Step 5/8: Review and submit

Tap "Buy" to see the order details. If everything looks correct, tap "Confirm" to place your order.

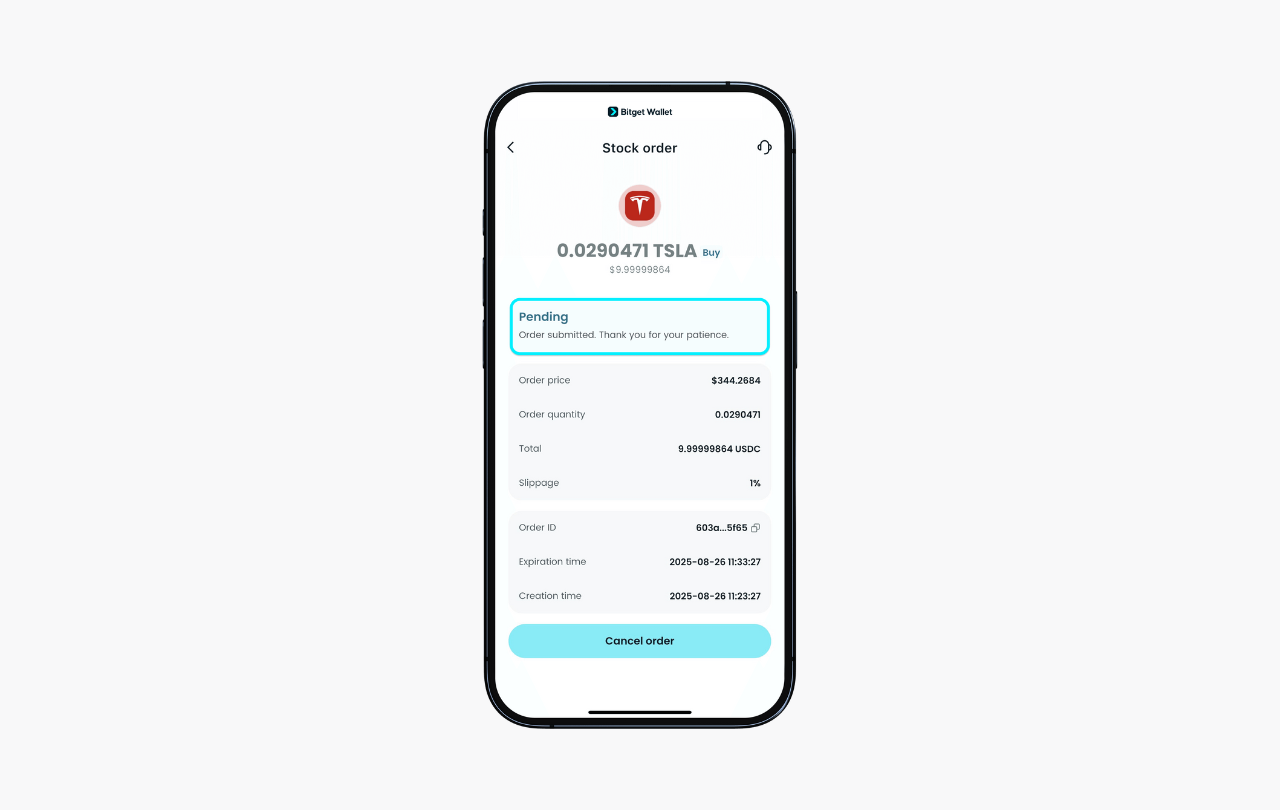

Step 6/8: Monitor order status

The order status will show "Pending". You'll get a notification when your price condition is met and the order fills, and the status will update. You can also view your positions at the bottom portion of the "Stocks" page.

Note: if liquidity is low, the order might not fill even if the price condition is met.

Step 7/8: Understand where your funds go

Your assets stay in your wallet until the order executes. Make sure you have enough balance, or the order won't fill.

Step 8/8: Fee Structure

There's no trading fee for buying or selling tokenized stocks. You don't pay gas to submit an order, but when the order executes you will pay gas in ETH.

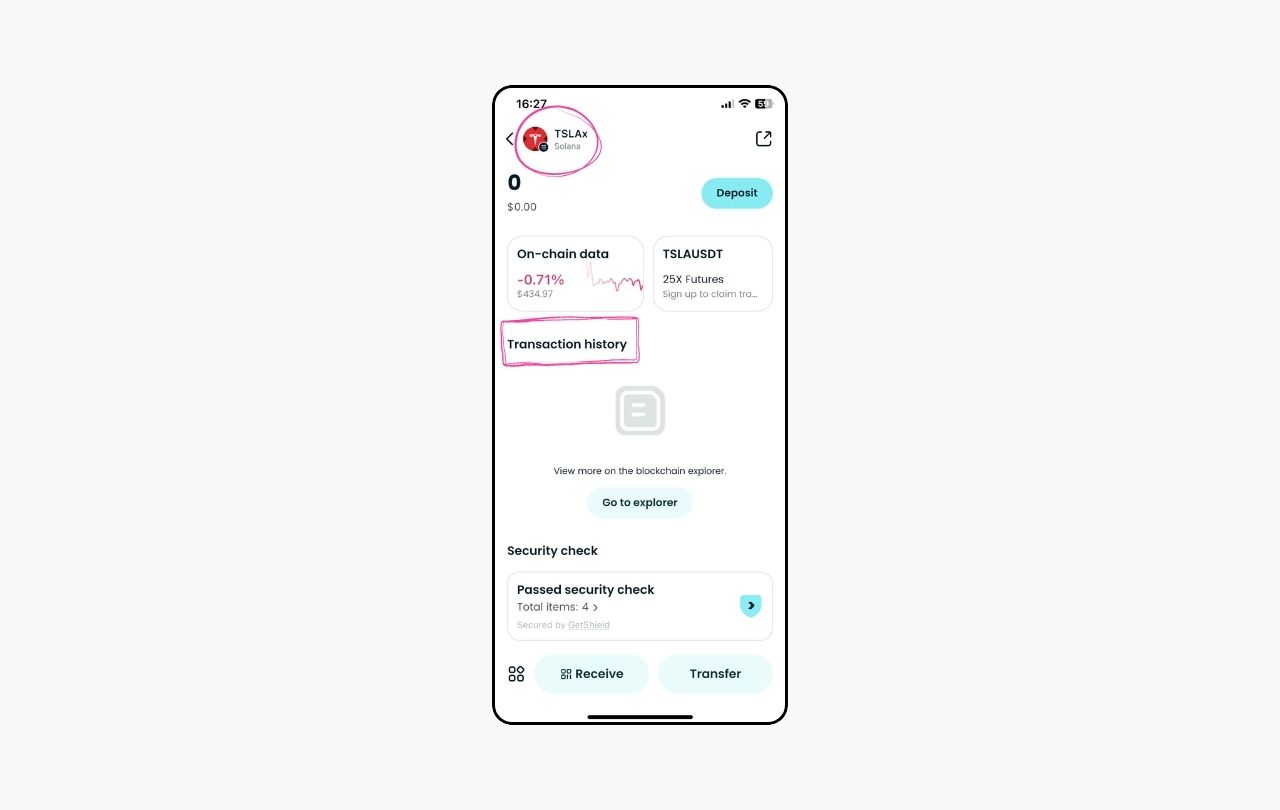

How to Store and Manage Tokenized Stocks with Bitget Wallet?

Bitget Wallet serves as a multi-chain gateway for storing and managing tokenized stocks across Solana, Ethereum, BNB Chain, Polygon, and Base. The app consolidates all digital assets into a single interface with full non-custodial control. Download Bitget Wallet to trade, store, and track tokenized stocks across multiple chains in one place.

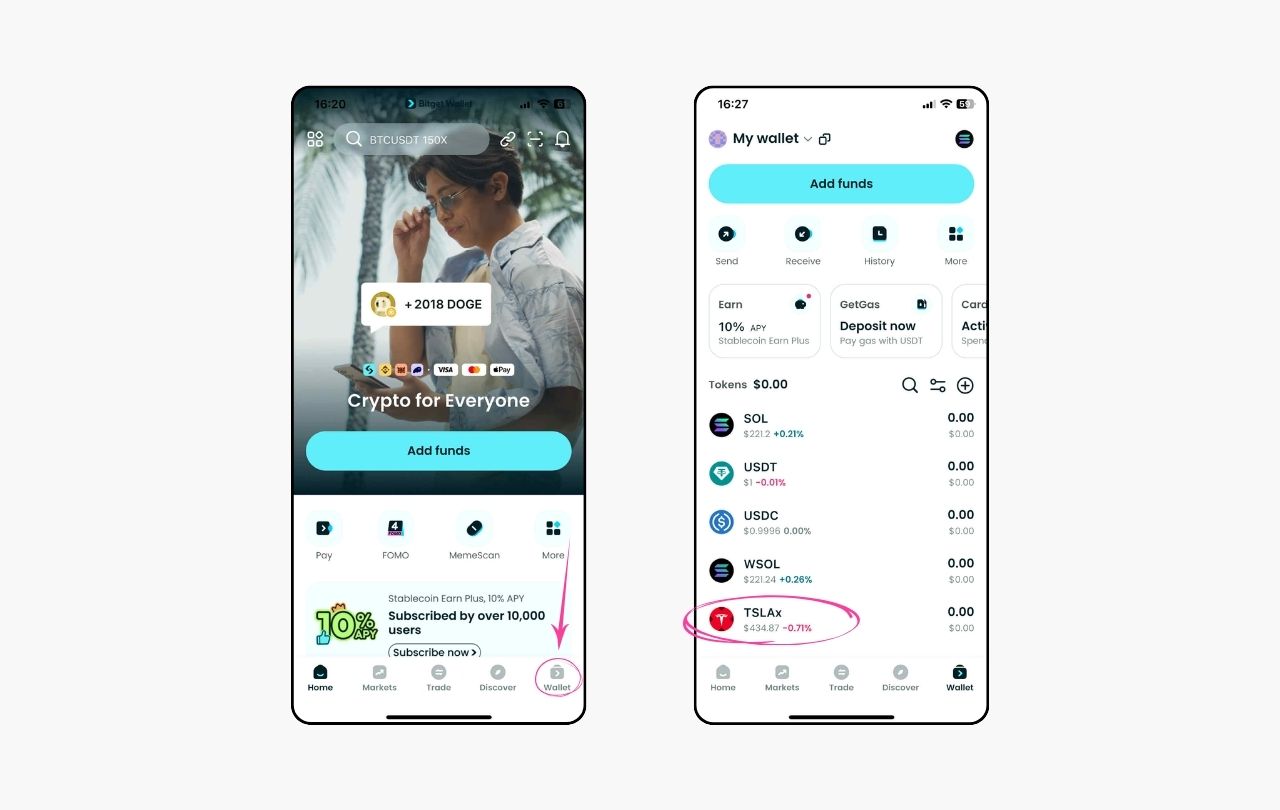

Portfolio tracking happens through these simple steps:

-

Access Your Portfolio:

Open Bitget Wallet and navigate to the "Wallet" tab to view all tokenized stocks holdings.

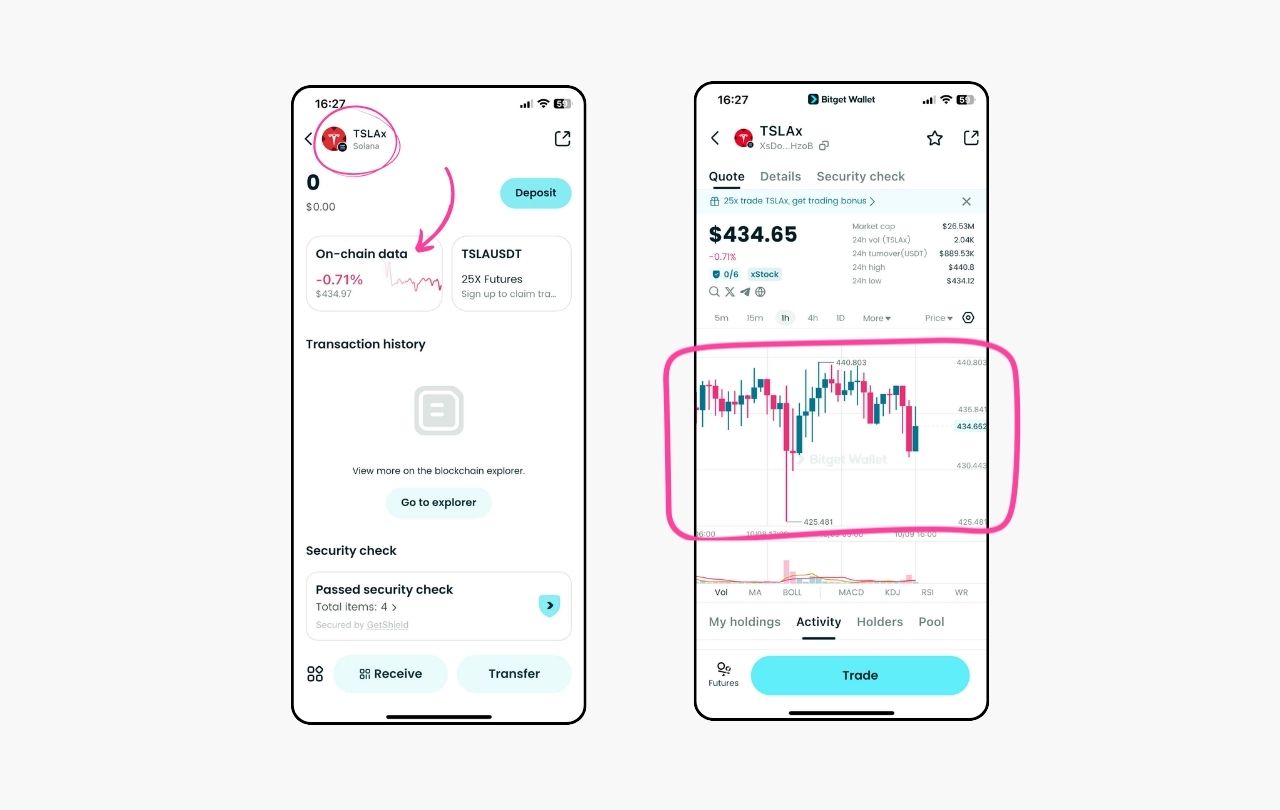

-

Check Real-Time Balances:

Review current holdings with live market values updated automatically across all supported blockchain networks. -

Monitor Performance:

Select any tokenized stock to access detailed metrics including price charts, 24-hour changes, and total profit/loss calculations.

-

Review Transaction History:

View complete transaction records for each position, including purchases, swaps, transfers, and associated gas fees for full portfolio transparency.

Conclusion

How to buy tokenized stocks involves understanding what they are, selecting a suitable platform, executing purchases, and managing holdings through secure wallets. Bitget Wallet simplifies this process by providing multi-chain support, non-custodial storage, and integrated trading features for beginners seeking exposure to digital equities.

Tokenized stocks democratize access to traditional markets through fractional ownership starting from $1, 24/7 trading availability, and cross-chain DeFi integration. These blockchain-based stocks serve as an accessible gateway for investors exploring real-world asset trading without brokerage barriers or geographic restrictions.

Download Bitget Wallet to manage tokenized stocks and stablecoins across multiple chains with zero fees. Trade trending tokenized equities seamlessly while earning yield on idle assets in one beginner-friendly platform.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What steps are required to purchase tokenized stocks on a decentralized exchange?

Connect a Web3 wallet to the platform, bridge USDC or USDT to your target blockchain, select your desired tokenized stock like xStocks, approve the swap transaction, and confirm execution.

2. Which wallets support tokenized stock storage and trading?

Multi-chain wallets including Bitget Wallet, Phantom, and MetaMask support tokenized stocks across Solana, Ethereum, BNB Chain, Polygon, and Base. They provide non-custodial control, ensuring users maintain ownership of private keys and assets.

3. How can I fund my wallet to buy tokenized stocks?

Purchase USDC or USDT from a centralized exchange, withdraw funds to your multi-chain wallet address, then bridge or swap directly into tokenized stocks on your chosen blockchain network. This process typically completes within minutes.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is Crypto Fear and Greed Index: How Traders Read Fear vs Greed Signals2025-11-19 | 5 mins

- How to Pay with Crypto: Fast, Safe, and Beginner-Friendly Method2025-11-18 | 5 mins

- How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners2025-11-18 | 5 mins