Best Stablecoin Crypto Cards for 2026: Low-Fee Options for Global Spending

Best Crypto Card for Stablecoin Users is a hot topic in 2026 as stablecoins like USDT, USDC, and DAI gain mainstream adoption. These digital assets, pegged to stable fiat currencies, provide a reliable way to store and transfer value without the wild price swings of Bitcoin or other cryptocurrencies. This makes them particularly appealing for everyday transactions and international payments.

With the emergence of stablecoin debit cards and stablecoin credit cards, crypto users can now spend their digital assets just like traditional cash at millions of merchants worldwide. The process is seamless, eliminating the need to manually convert crypto into fiat beforehand. Among the top choices, the Bitget Wallet Card stands out for its low fees, multi-stablecoin support, and advanced security.

This guide explores how stablecoin cards work, why they’re useful, how to apply for one, what fees and rewards to expect, and why the Bitget Wallet Card is considered one of the best options in 2026.

Key Takeaways

- Stablecoin cards let you spend USDT, USDC or DAI around the world in much the same way as cash. They take away the hassle of converting your crypto into fiat before you can shop or travel. Spending stablecoin allows you to spend even faster, and make everyday payments easier.

- The Bitget Wallet Card stands out because of its low fees, broad stablecoin support, and global acceptance. It combines security, ease of use, and a Web3-friendly design, making it ideal for anyone who regularly uses stablecoins.

- Applying for the right stablecoin card helps reduce fees and unlock valuable rewards. The best cards in 2026 offer global usability and long-term savings, making stablecoin spending as seamless as using traditional bank cards.

Why Do Stablecoin Users Need a Crypto Card?

Stablecoin users need crypto cards because they bridge the gap between digital asset wallets and everyday financial transactions. Instead of transferring funds to a bank and waiting days for conversion, a stablecoin card enables instant spending directly from your wallet.

Key advantages are:

- Borderless payments – Spend wherever Visa or Mastercard is accepted.

- Lower costs – Bypass bank charges and unfavorable exchange rates.

- Financial flexibility – Great for travelers, remote employees, or companies making payments worldwide.

What Are Stablecoin Crypto Cards?

Stablecoin cards are payment solutions linked to your crypto wallet, automatically converting USDT, USDC, or DAI to local currency at checkout. Here are the main types of stablecoin cards available:

- Stablecoin debit cards – Linked to your wallet balance, deducting funds instantly.

- Stablecoin credit cards – Offer credit limits backed by stablecoin deposits or staking.

- Stablecoin corporate cards – For businesses to pay contractors or vendors worldwide.

These cards typically use Visa or Mastercard networks for universal acceptance.

Read more: What is a Crypto Debit Card and How Does It Work?

Why Choose a Stablecoin Card Instead of a Traditional Bank Card?

Choosing a stablecoin card over a traditional bank card offers clear advantages for anyone holding digital assets. Stablecoins like USDT, USDC, and DAI maintain a consistent value, allowing you to spend crypto without worrying about volatility.

Here are the key reasons why stablecoin cards are gaining popularity over traditional bank cards:

- Predictable spending power – Stablecoins such as USDT, USDC, and DAI are tied to fiat currencies, meaning your balance is still valuable with no risk of crypto volatility.

- Effortlessly crypto-to-fiat exchange – Instant payments convert at checkout, eliminating the necessity for exchanges or wait times.

- Exclusive benefits and rewards – Most stablecoin cards provide cashback, token rewards, or fee discounts not covered by standard bank cards.

- Borderless and low-cost – Spend worldwide with less foreign exchange charges and less banking limitations, perfect for tourists and freelancers.

Read more: How to Use a Crypto Card for Daily Transactions

How Do Stablecoin Cards Work?

Stablecoin cards function like regular debit or credit cards but draw funds from your crypto wallet instead of a bank account. At checkout, stablecoins such as USDT, USDC, or DAI are instantly converted to local currency, making payments seamless for merchants. This gives users the convenience of traditional cards with the added benefits of crypto flexibility, lower fees, and borderless payments.

Advantages include:

- Faster settlement than wire transfers or exchanges

- No exposure to volatile crypto assets when using stablecoins

- Global usability wherever Visa/Mastercard is accepted

Stablecoin-to-Fiat Conversion Process

Stablecoin cards function like regular debit or credit cards but draw funds from your crypto wallet instead of a bank account. At checkout, stablecoins such as USDT, USDC, or DAI are instantly converted to local currency, making payments seamless for merchants. This gives users the convenience of traditional cards with the added benefits of crypto flexibility, lower fees, and borderless payments.

- Step 1: Initiate Payment – Use your stablecoin card at checkout, just like a standard debit or credit card.

- Step 2: Instant Conversion – Your stablecoins (USDT, USDC, or DAI) are immediately converted into the merchant’s local currency.

- Step 3: Choose Custodial or Non-Custodial – Some cards hold your funds with the issuer (custodial), while others pull directly from your wallet (non-custodial) for greater control.

- Step 4: Final Settlement – The transaction is processed over trusted Visa or Mastercard networks, ensuring global reliability and acceptance.

Rewards, Fees, and Limits

Stablecoin cards usually have better rewards with cashback or crypto token payout rewards for 1% - 5% based on the account holder's daily expenditures. They also typically have lower fees than bank cards, which provides considerable opportunities for consumers to save on pricey foreign exchange fees on expenditures while traveling or sending cross-border payments. Most cards have spending caps, with daily limits commonly ranging from $2,500 to $5,000 and separate ATM withdrawal limits depending on the provider.

How to Apply for the Best Stablecoin Crypto Card?

Applying for a stablecoin card is quick and similar to applying for a bank card:

Step-by-step process:

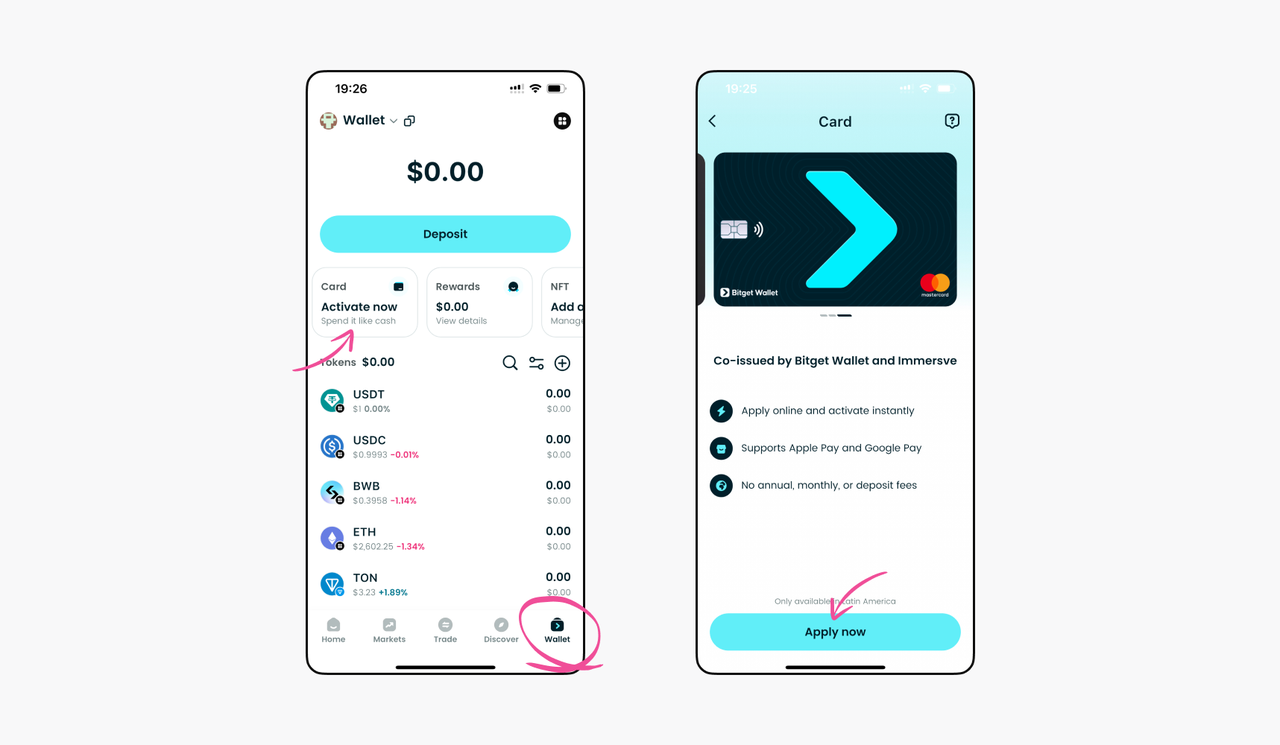

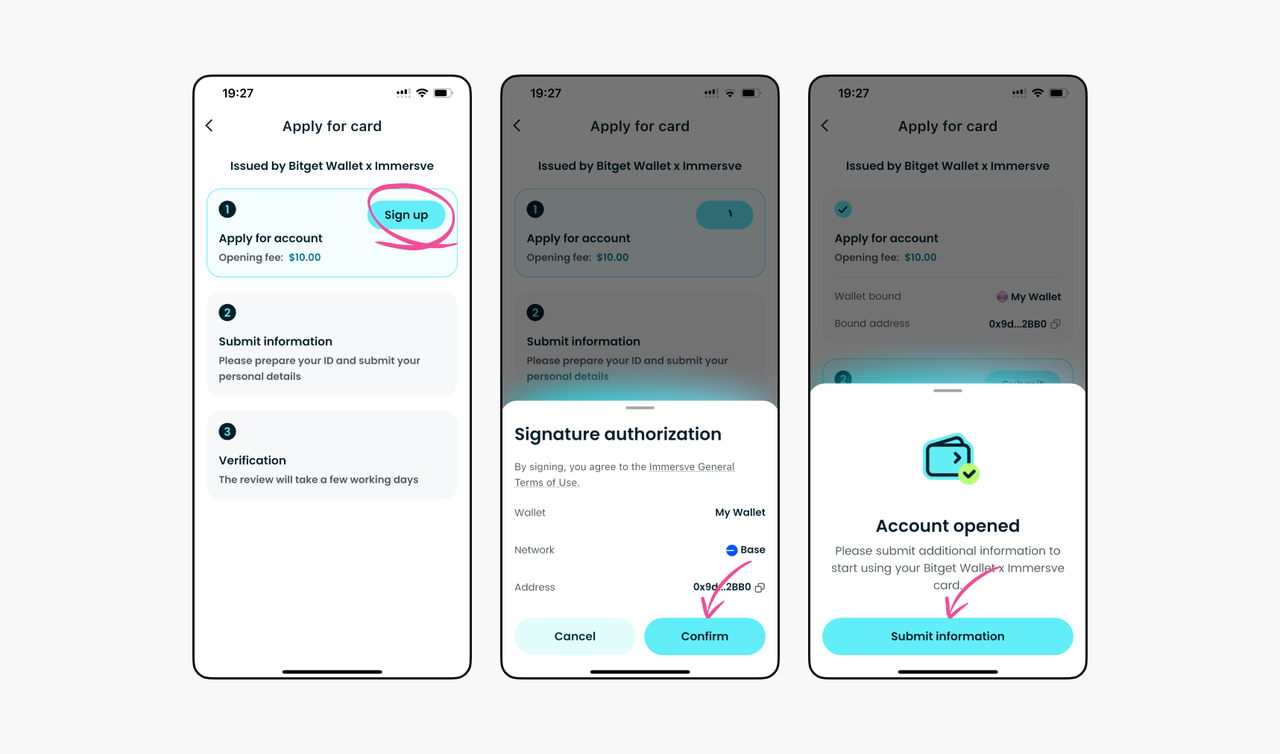

- Step 1: Download and Sign Up – Install the Bitget Wallet, create an account using your email or social login, and secure it with a password.

- Step 2: Complete KYC Verification – Submit identity documents (passport, driver’s license, or national ID) and proof of address. This verification step is required for compliance and card issuance.

- Step 3: Fund Your Wallet – Deposit or connect your existing wallet with USDT, USDC, or DAI to fund your card balance.

- Step 4: Apply for the Card – Choose between a virtual card for immediate online spending or a physical card for in-store purchases and ATM withdrawals.

- Step 5: Activate and Start Spending – Activate your card in the Bitget Wallet app and begin making payments anywhere Visa and Mastercard are accepted.

Tip: The Bitget Wallet Card offers instant top-ups, no monthly fees, and support for 130+ chains, making it one of the most user-friendly crypto card options available in 2025.

Read more: How to Spend USDT with a Crypto Card: Step-by-Step for Beginners

How Do the Top Stablecoin Cards Compare in 2026?

Stablecoin card providers compete by offering different fee structures, rewards programs, and supported assets. Comparing these features helps users select the best option based on their spending needs, preferred rewards, and travel habits.

| Card | Rewards | Fees Supported | Assets & Features |

| Bitget Wallet Card | No monthly fees, instant top-ups, and occasional token bonuses on spend. Ideal for stablecoin users wanting predictable costs. | Free to hold, pay only when you spend; competitive conversion rates | Supports USDT, USDC, DAI with 130+ blockchain integrations, MPC wallet security, and global ATM withdrawals |

| Crypto.com Card | 1–5% CRO cashback (staking) | Free card; 1% top-up fee; ATM limits | 100+ cryptos; Visa-backed tiers |

| Binance Card | Up to 8% BNB cashback (tiered) | 0.9% transaction fee | ~15 cryptos; wide global reach |

| Wirex Card | 0.5–8% WXT cashback (tiered) | No monthly fee; ATM up to $400 free | 35+ cryptos; multi-fiat support |

Read more: Best 10 Crypto Cards for 2025

Why Bitget Wallet Card Is the Best Option for Stablecoin Users?

The Bitget Wallet Card is built for stablecoin users seeking a low-cost, global way to spend USDT, USDC, and DAI. It removes conversion hassles, offers instant funding, and supports 130+ blockchains with Web3-ready security. With low fees and predictable spending power, it’s ideal for travelers, freelancers, and long-term crypto holders.

Key Benefits of Bitget Wallet Card

- Instant stablecoin top-ups – Simply add USDT, USDC, or DAI to your card immediately, perfect for quick, impulse spending on-the-go.

- No monthly fees – You pay only when you spend, which keeps your costs lower than bank cards with regular charges.

- MPC wallet security & Web3 integration – State-of-the-art multi-party computation (MPC) wallet technology provides market-leading security whilst maintaining the card as a perfect companion for decentralized applications.

Is Bitget Wallet Card Easy to Use?

Yes, it’s built for simplicity. You can activate your card in minutes, link it to mobile payment apps like Apple Pay or Google Pay, and start spending immediately. The Bitget Wallet Card works at millions of Visa-supported merchants worldwide and supports both virtual and physical cards, making it ideal for both online shopping and in-store transactions. Combined with secure wallet integration and simple account management, it’s one of the easiest ways to spend stablecoins globally without complicated setup or maintenance.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Conclusion

Best Crypto Card for Stablecoin Users is essential for anyone looking to unlock borderless payments, lower fees, and crypto-powered rewards. With stablecoin cards, you can spend USDT, USDC, and DAI as easily as traditional currency, avoiding manual conversions and high banking charges. These cards make it simple to bridge your crypto wallet and the real world, whether you are shopping online, traveling abroad, or withdrawing cash from an ATM.

For 2026, the Bitget Wallet Card stands out as the best crypto card with low fees, offering no monthly charges, instant top‑ups, multi-stablecoin support, and global acceptance, all backed by Web3-ready security and 130+ chain integrations. Whether you are a traveler, freelancer, or crypto enthusiast, this card provides predictable spending power without the volatility risks of other crypto-based payment solutions.

Apply Now to start spending your stablecoins effortlessly. Spend stablecoins anywhere – the beginner‑friendly Bitget Wallet Card is here.

FAQs

1. Which stablecoins can I spend with a crypto card?

Most cards support USDT, USDC, and DAI, while some add extra options like BUSD or regional stablecoins. This allows flexibility for different user needs and trading preferences.

2. What are the lowest fee stablecoin cards?

The Bitget Wallet Card is known for no monthly fees and low conversion rates, saving users money compared to bank cards with high forex charges. For frequent travelers, this translates to significant yearly savings.

3. How do stablecoin cards compare with regular bank cards?

Stablecoin cards offer instant crypto-to-fiat conversion, borderless payments, and often crypto cashback rewards. Unlike bank cards, they don’t require holding funds in a traditional bank, giving users more control and flexibility.

4. Do I need KYC to apply for a stablecoin card?

Yes. The majority of issuers of cards require verification under KYC for compliance with regulations. The process is swift, normally only a few minutes with ID and address proof.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins