Avantis Listing Details: $AVNT Launch Date and the Market Maker Impact

Avantis (AVNT) listing is generating excitement in the crypto world, sparking speculation about its potential to be the next big success. Not long ago, an early investor in Solana turned $500 into $50,000 overnight. Now, another potential game-changer is entering the market—Avantis (AVNT).

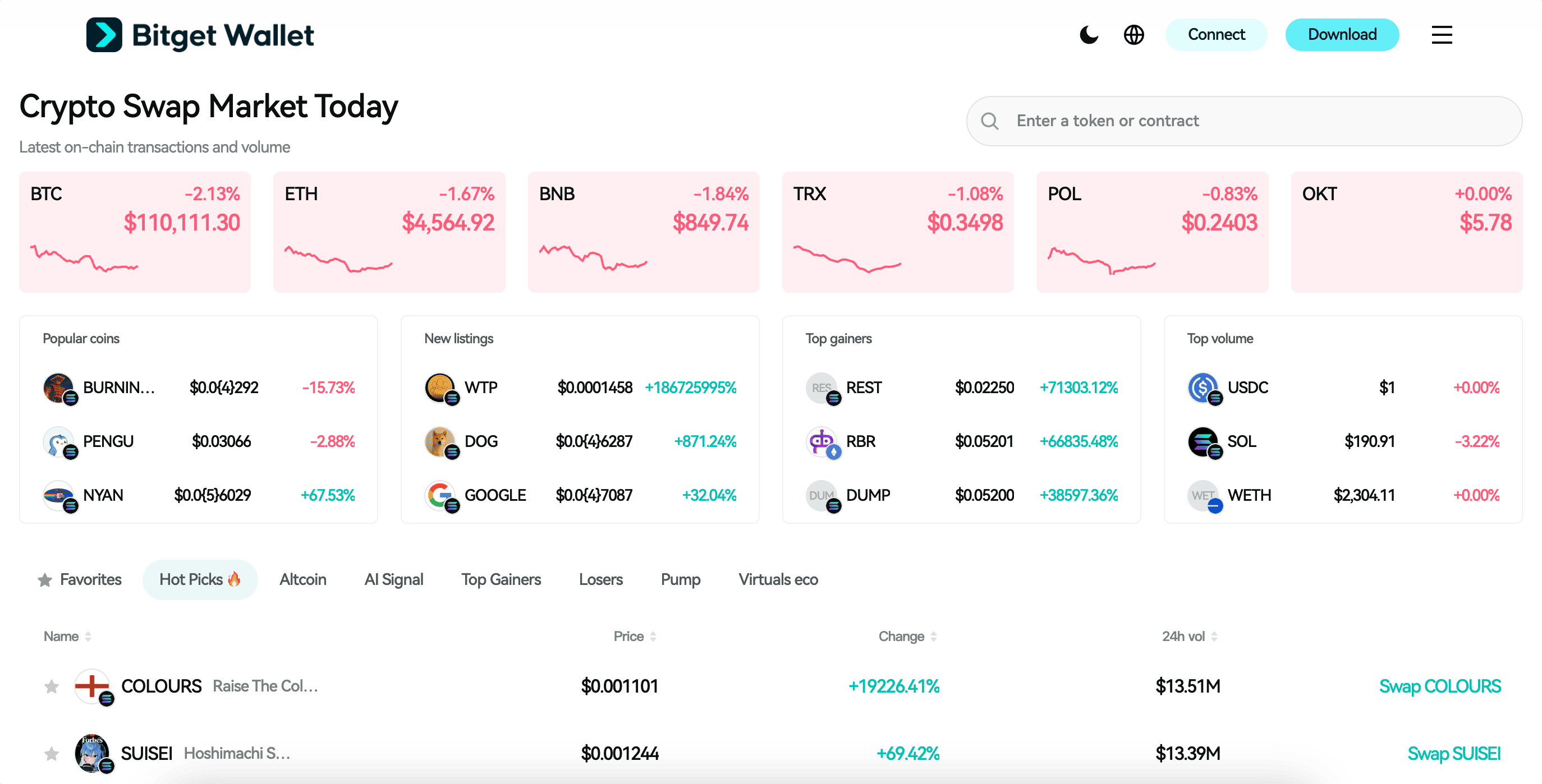

Set to list in Q3 2025, this next-generation perpetuals DEX built on Base is creating buzz among traders. Avantis isn’t just another DeFi project—it enables leveraged trading across crypto, forex, and commodities, with standout features like loss protection, zero slippage, and customizable risk tranches for liquidity providers. For those preparing to trade $AVNT, Bitget Wallet offers the perfect companion—combining secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience for managing assets with confidence.

Will this be another success story in the making? In this article, we dive deep into what makes Avantis (AVNT) stand out, how to trade it, and why investors are keeping a close eye on its launch.

Avantis (AVNT) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Avantis (AVNT) listing:

- Exchange: Bitget

- Trading Pair: AVNT/USDT

- Deposit Available: 9 September 2025, 14:00 (UTC)

- Trading Start: 9 September 2025, 14:00 (UTC)

- Withdrawal Available: 10 September 2025, 15:00 (UTC)

Don’t miss your chance to start trading Avantis (AVNT) on Bitget and be part of this groundbreaking journey.

- Please refer to the official Avantis announcement for the most accurate schedule.

Avantis (AVNT) Price Prediction: Market Maker Impact

The listing of Avantis (AVNT) on leading exchanges is not just a retail trading event—it’s also a battleground for professional market makers. If firms like Wintermute, GSR, or Amber Group provide liquidity, their historical trading patterns—ranging from aggressive short-term volatility to steadier liquidity support—could shape $AVNT’s opening months.

Key Market Maker Indicators

-

Market Maker Roster & Strategy:

If Wintermute is involved, expect aggressive short-term volatility plays. GSR, by contrast, is known for maintaining deeper order books, which could moderate swings.

-

Liquidity Pool Size at Launch:

A larger initial liquidity pool reduces manipulation risk, while a smaller pool could magnify volatility in $AVNT’s early days.

-

Market Maker Positioning & Contracts:

While $AVNT options are not yet live, market makers often adjust liquidity aggressively around expiries—historically aligning with 10–20% short-term volatility spikes in similar launches.

Price Projection Based on Market Maker Activity

Using Perpetual Protocol (PERP) as a comparable benchmark for decentralized perpetuals DEX tokens, here’s a forecasted range for $AVNT:

| Time Frame | Predicted Price Range | Market Maker Influence |

| Short-term (1–3 months) | $0.40 – $0.50 | High volatility expected as liquidity stabilizes |

| Medium-term (3–6 months) | $0.50 – $0.65 | Market makers likely rebalance, reducing extreme swings |

| Long-term (1 year+) | $1.00 – $2.50 | Driven by fundamentals: Avantis adoption, DEX trading volumes, and Base ecosystem growth |

Fear & Greed Narrative

🚨 “As $AVNT lists, traders should expect high short-term volatility due to market maker activity. Once liquidity pools deepen, the price could stabilize before fundamentals drive the next leg upward.”

Source: CoinCodex (PERP price forecasts), Bitget Wallet market insights

Note: This projection uses PERP’s historical and forecasted performance as a comparable proxy. It does not represent the official stance of Avantis or Bitget Wallet. Always conduct your own research and rely on official market data before investing.

Source: Bitget Wallet

Explore Avantis (AVNT) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

What Is Avantis (AVNT) Explained

Avantis (AVNT) is a next-generation perpetuals DEX (decentralized exchange) built on Base, designed to expand DeFi beyond crypto into forex, commodities, and real-world assets. Backed by leading investors such as Pantera Capital and Founders Fund, Avantis has already processed billions in trading volume during its early testnet and mainnet phases.

The project introduces innovative features to improve trading efficiency and liquidity management, positioning itself as one of the most anticipated DeFi launches of 2025.

Why Avantis (AVNT) Stands Out?

-

Cross-Asset Trading:

Unlike most DEXs limited to crypto, Avantis enables leveraged trading across crypto, forex pairs, and commodities like gold and crude oil.

-

Loss Protection:

An industry-first feature that rebates contrarian traders, reducing downside risk and incentivizing smart risk-taking.

-

Zero Slippage Execution:

Built with dynamic risk tranching, Avantis ensures deep liquidity and minimal execution slippage, even for large orders.

-

Liquidity Provider Customization:

LPs can choose risk–return profiles, tailoring their exposure instead of relying on one-size-fits-all pools.

-

Base Ecosystem Advantage:

Built on Coinbase’s Base network, Avantis benefits from Ethereum security, low fees, and growing developer adoption.

Source: X

Avantis has rolled out its SDK, allowing both builders and traders to tap directly into real-time price feeds, execute fast trades, and manage positions from within their own apps and tools. This positions Avantis not just as a trading platform, but as a foundational “universal leverage layer” that developers can embed—further cementing its ambition to bridge DeFi with real-world assets.

The Avantis (AVNT) Ecosystem: How It Functions

How Avantis Works?

- Built on Base (an Ethereum L2), enabling fast, low-cost, and secure on-chain transactions.

- Uses Ethereum’s underlying security with Base’s rollup architecture to validate transactions efficiently.

- Supports DeFi leveraged trading across crypto, forex, and commodities, positioning itself as a universal leverage layer for on-chain finance.

Key Benefits

- Cross-Asset Trading Expansion – Avantis goes beyond typical crypto DEXs by enabling perpetual futures for FX pairs, gold, and oil, opening new markets to DeFi users.

- Loss Protection for Traders – An industry-first feature that provides rebates for contrarian positions, reducing downside risk and encouraging balanced market participation.

- Customizable Liquidity Provision – Liquidity providers can choose risk-return profiles through dynamic risk tranches, giving them flexibility in how they earn yields compared to one-size-fits-all pools.

Meet the Team Behind Avantis (AVNT): Leadership and Strategy

Leadership

The individual founders and core contributors of Avantis have not been publicly disclosed. Instead, the project’s credibility is reinforced through its backing from top-tier investors, including Pantera Capital and Founders Fund, who co-led its $8M Series A round in 2025. This level of institutional support signals strong confidence in the leadership and technical capabilities driving Avantis forward.

Strategy

Avantis’ strategy is to position itself as a “universal leverage layer” for DeFi. By expanding beyond crypto to include forex, commodities, and real-world assets (RWAs), it aims to bridge traditional financial markets with on-chain trading. The core pillars of this strategy include:

- Expanding Market Access – offering perpetuals on multiple asset classes beyond crypto.

- Liquidity Depth – enhancing liquidity through loss protection and dynamic risk tranching for LPs.

- Ecosystem Integration – leveraging Base (an Ethereum L2) for scalability, low fees, and security.

- Future Governance – moving toward community-driven decision-making to shape listings, fees, and protocol upgrades.

This approach highlights Avantis’ ambition to stand out as a long-term player in DeFi by combining institutional-grade backing with innovative features.

Avantis (AVNT): Practical Applications & Use Cases

Why Utility Matters for Avantis (AVNT)

Utility is what separates hype tokens from sustainable projects. For Avantis, the $AVNT token is expected to play a role in governance, liquidity incentives, and ecosystem growth. By aligning trader and liquidity provider incentives, $AVNT helps stabilize the exchange, attract volume, and ensure long-term sustainability in the Base ecosystem.

Key Use Cases of Avantis (AVNT)

- Trading Collateral – $AVNT can be used within the Avantis platform to open and collateralize leveraged positions.

- Liquidity Provider Rewards – LPs supplying liquidity through risk tranches may earn $AVNT as an incentive.

- Governance & Protocol Upgrades – Token holders may gain voting power over fee models, new asset listings (crypto, forex, commodities), and protocol parameters.

- Ecosystem Incentives – Traders and early adopters can be rewarded in $AVNT for providing volume, referrals, or contrarian trades under the loss protection mechanism.

What’s Next for Avantis (AVNT)?

Avantis is positioning itself as a “universal leverage layer” for DeFi, with plans to expand supported markets, deepen liquidity, and integrate with other protocols on Base and Ethereum L2s. Upcoming milestones likely include:

- Official $AVNT token launch and exchange listings.

- Broader asset integrations (beyond crypto into real-world assets).

- Institutional partnerships with market makers to expand liquidity depth.

- Potential DAO governance to decentralize protocol decision-making.

As the Base ecosystem grows, Avantis aims to be its flagship leveraged trading platform—bridging crypto-native traders with real-world asset exposure.

Avantis (AVNT) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for Avantis (AVNT) outlines a clear path for growth and innovation as it evolves into a universal leverage layer for DeFi:

| Quarter | Roadmap |

| Q1 2025 | Continued scaling of Avantis DEX on Base; expansion of cross-asset trading pairs (crypto, FX, commodities). Testing of dynamic risk tranches with wider LP onboarding. |

| Q2 2025 | Series A funding announced ($8M led by Pantera Capital & Founders Fund). Platform improvements for loss protection and liquidity depth; preparing infrastructure for token launch. |

| Q3 2025 | Token Generation Event (TGE) and exchange listings for $AVNT. Liquidity mining incentives launched to bootstrap trading volume and reward early adopters. |

| Q4 2025 and beyond | Expansion into real-world assets (RWAs) and institutional partnerships. Governance mechanisms introduced for token holders to shape fee models, listings, and protocol direction. |

These milestones highlight the practical value of $AVNT in the DeFi leveraged trading industry, bringing institutional-grade tools like loss protection, customizable risk for LPs, and multi-asset exposure into the Base ecosystem.

How to Buy Avantis (AVNT) on Bitget Wallet?

Trading Avantis (AVNT) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Avantis (AVNT).

Step 3: Find Avantis (AVNT)

On the Bitget Wallet platform, go to the market area. Search for Avantis (AVNT) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, AVNT/USDT. By doing this, you will be able to exchange Avantis (AVNT) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Avantis (AVNT) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Avantis (AVNT).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Avantis (AVNT) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

The Avantis ($AVNT) listing on leading exchanges isn’t just about short-term gains—it signals a move toward building a stronger, decentralized future for leveraged trading. With a mission to deliver seamless cross-asset access, robust security, and innovative incentives in the DeFi space, Avantis is set to capture growing attention from both retail traders and institutions.

As momentum builds, getting involved early—through trading, liquidity provision, or joining the governance community—can help users stay ahead in this rapidly evolving ecosystem.

For secure and effortless asset management, Bitget Wallet offers the perfect solution. With self-custody security, cross-chain support, and a beginner-friendly interface, it ensures you can trade and store digital assets confidently.

👉 Step into the future of finance—download Bitget Wallet today and unlock new opportunities in Web3.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Avantis (AVNT)?

Avantis is a next-generation perpetuals DEX built on Base, designed to offer leveraged trading across crypto, forex, and commodities. It introduces innovative features like loss protection, customizable liquidity tranches, and minimized slippage to improve the trading experience.

2. When will $AVNT be listed?

The Token Generation Event (TGE) and official exchange listings for $AVNT are expected in Q3 2025. Exact dates and trading pairs will be announced by Avantis and participating exchanges.

3. What makes Avantis different from other DEXs?

Unlike most perpetuals DEXs that focus solely on crypto, Avantis aims to be a universal leverage layer, supporting multiple asset classes. It also stands out with loss protection rebates for contrarian traders, zero-slippage design, and dynamic risk options for liquidity providers, making it more versatile than traditional models.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.